You look at your pay stub. It's Friday. You’re ready to celebrate the weekend, but then you see it—that pesky line item cutting into your take-home pay. It’s the medicare deduction. Most people just shrug and assume it’s a generic tax, but there is actually a lot more moving parts here than just a flat percentage disappearing into the ether.

Honestly, it’s a bit of a shock the first time you really crunch the numbers.

Basically, the Medicare tax is a mandatory payroll deduction established by the Federal Insurance Contributions Act (FICA). It’s how the government funds the Medicare program, which provides health insurance for folks 65 and older and people with specific disabilities. If you’re working a standard W-2 job, you aren’t the only one paying. Your employer is chipping in too. They match whatever is taken out of your check, dollar for dollar. It’s one of those rare moments where the company is legally forced to pay for your future healthcare alongside you.

📖 Related: Palm Beach Gardens Medical Center: What You Actually Need to Know Before Checking In

Understanding the Medicare Deduction Math (It's Not Just One Number)

The standard rate for the medicare deduction is 1.45% of your gross wages. If you earn $1,000 this week, the government takes $14.50. Simple, right? Well, sort of.

There is no "cap" on Medicare taxes. Unlike Social Security—where you stop paying once you hit a certain income threshold ($168,600 in 2024)—Medicare takes its cut from every single dollar you earn. If you make five million dollars, you’re paying 1.45% on all of it. Except, for high earners, it actually gets more expensive.

The Affordable Care Act introduced something called the Additional Medicare Tax. Once you cross a specific income threshold—$200,000 for individuals or $250,000 for married couples filing jointly—the rate jumps. An extra 0.9% gets tacked on. This means on every dollar earned above that limit, your medicare deduction effectively becomes 2.35%.

Employers don’t match that extra 0.9%. That’s all on you.

Why Self-Employed People Get Hit Harder

If you’re a freelancer or a small business owner, the "employer match" doesn't exist. You are the employer. This means you’re on the hook for the full 2.9% (the 1.45% employee share plus the 1.45% employer share). It’s often called the Self-Employment Contributions Act (SECA) tax.

It feels heavy. It feels unfair sometimes when you’re trying to grow a business and the IRS comes knocking for nearly 3% of your gross just for one specific insurance fund. But there is a silver lining: you can deduct half of your self-employment tax on your income tax return, which lowers your overall taxable income. It’s a bit of a wash, but it helps.

The Paycheck vs. The Social Security Check

When people ask "what is a medicare deduction," they are usually looking at a paycheck. But there is a second type of deduction that happens much later in life.

Once you actually retire and start collecting Social Security, the term "deduction" takes on a whole new meaning. Instead of paying into the system, you’re now paying for the service. Most people don’t realize that Medicare Part B (which covers doctor visits and outpatient care) isn't free.

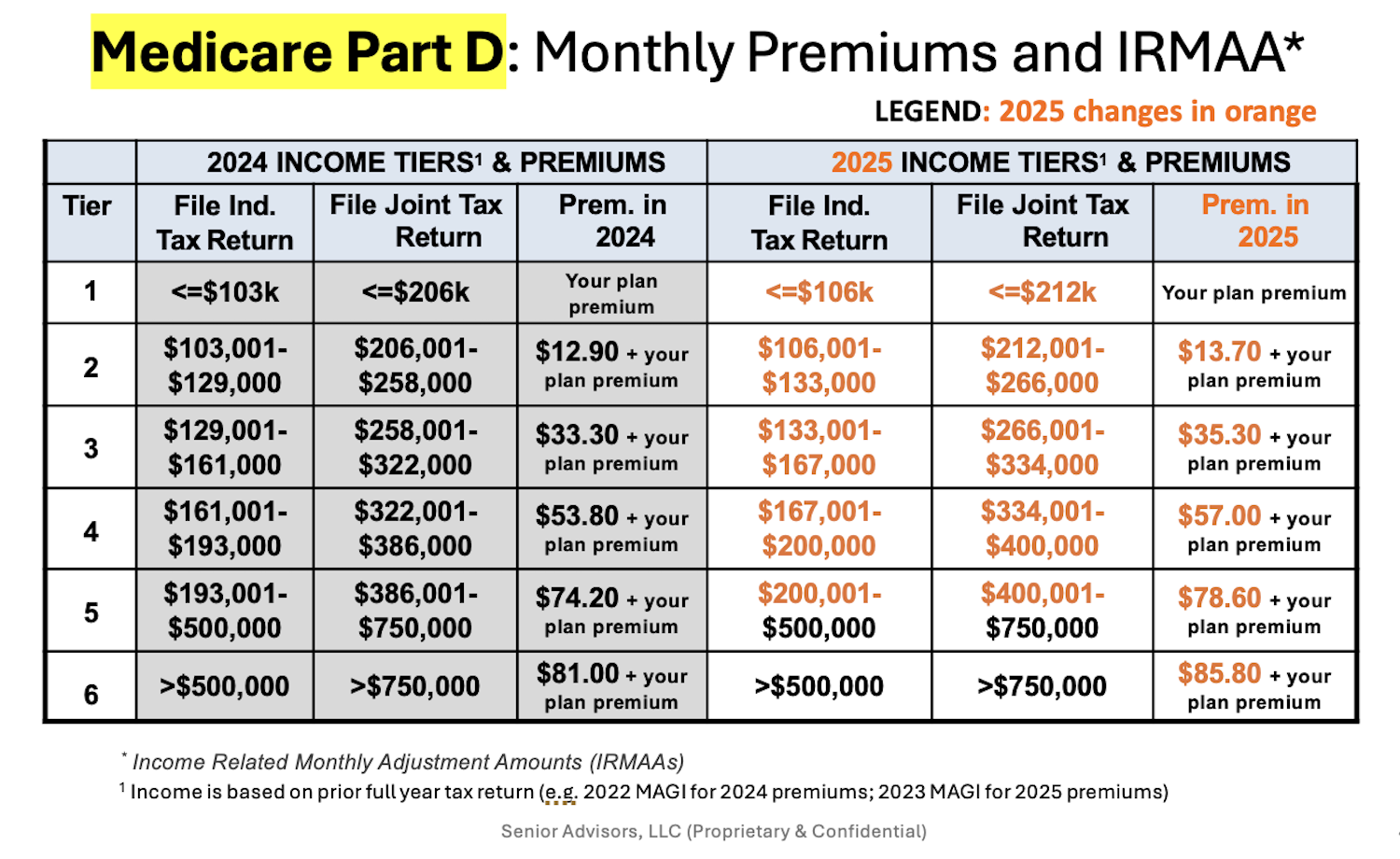

If you’re receiving Social Security benefits, the monthly premium for Part B is automatically deducted from your check. In 2024, the standard premium is $174.70. For most, this is a "set it and forget it" situation, but for those with higher retirement incomes, a thing called IRMAA kicks in.

IRMAA stands for Income Related Monthly Adjustment Amount. It’s basically a surcharge. If your modified adjusted gross income from two years ago was high, your medicare deduction from your Social Security check could skyrocket to over $500 a month. It catches people off guard. You plan your retirement budget based on a certain Social Security amount, then the Medicare premium takes a massive bite out of it because you sold some stock or had a good year two years prior.

Where Does That Money Actually Go?

It’s easy to feel like this money is just falling into a black hole. It isn't. The medicare deduction funds the Medicare Hospital Insurance (HI) Trust Fund.

This specific fund pays for:

- Medicare Part A: Inpatient hospital stays, hospice, and some home health services.

- Administrative costs for the program.

- Skilled nursing facility care.

The trust fund is a hot topic in Washington. You’ve probably seen the headlines. "Medicare is going broke!" is a favorite for news outlets. According to the 2024 Trustees Report, the HI Trust Fund is projected to be able to pay 100% of total scheduled benefits until 2036. After that, it might only be able to pay 89%.

It’s a math problem that politicians are currently kicking down the road, but the deductions you see on your check today are what keep the system solvent for current seniors.

Common Misconceptions About These Deductions

One of the biggest myths is that paying the medicare deduction means your healthcare will be "free" when you turn 65.

👉 See also: When she took off the condom: Consent, health risks, and the law

That is a total fabrication. Medicare has deductibles, co-pays, and coinsurance.

Part A is usually premium-free if you’ve worked and paid those payroll deductions for at least 10 years (40 quarters). But Part B has a monthly cost. Part D (drugs) has a monthly cost. And Medicare Supplement (Medigap) or Medicare Advantage plans usually have additional costs.

Essentially, your current payroll tax is just buying you "admission" into the program. You’re paying for the right to buy subsidized insurance later.

Another weird quirk? Not all income is subject to the medicare deduction.

If you have a 401(k) or a 403(b), your contributions are usually exempt from income tax, but they are NOT exempt from FICA tax. You still pay that 1.45% on the money you put into your retirement account. On the flip side, some "Section 125" cafeteria plans—like Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs) through an employer—actually reduce your Medicare tax. If you put $3,000 into an HSA via payroll deduction, that $3,000 is never taxed for Medicare. It’s one of the few legal ways to avoid the deduction entirely.

How to Audit Your Own Deductions

Errors happen. Payroll software is good, but it’s not perfect, especially if you have multiple jobs or change employers mid-year.

If you work two jobs and your combined income exceeds the $200,000 threshold, your employers might not know to take out the Additional Medicare Tax. They only look at what they pay you individually. Come tax time, you might find yourself owing the IRS a few thousand dollars because you didn't have enough withheld.

Check your W-2. Box 4 is Social Security tax, and Box 6 is Medicare tax.

If you’re an employee, Box 6 should be exactly 1.45% of your "Medicare wages" (Box 5). If it’s not, someone messed up the math.

💡 You might also like: Can You Be Allergic to Liquor? What’s Actually Making You Sick

Practical Steps to Manage Your Medicare Costs

Understanding the medicare deduction is the first step toward long-term financial planning. It’s not just a line item; it’s a variable in your wealth.

For the currently employed:

Look into your employer's HSA or FSA options. These are some of the only ways to legally lower the amount of Medicare tax you pay. Every dollar you put in there is a dollar the government can't touch at a 1.45% or 2.35% clip.

For those nearing 65:

Start tracking your income now. Remember that IRMAA (the surcharge on Part B) is based on a two-year look-back. If you plan to retire at 65, the income you make at age 63 will determine how much is deducted from your Social Security check for Medicare. If you’re planning on selling a house or taking a massive capital gain, try to do it before that look-back window starts or consult a tax pro to spread it out.

For the self-employed:

Don't wait until April 15th to think about this. You should be setting aside at least 15.3% of your net income for self-employment taxes (which includes both Social Security and Medicare). Quarterly estimated payments are your best friend to avoid a massive "sticker shock" and underpayment penalties.

The medicare deduction is a constant. It’s a cornerstone of the American social contract. While it might sting to see your paycheck shrink, it’s the mechanism that ensures healthcare access for the elderly and disabled. By knowing the rates, the thresholds, and the exemptions, you can stop guessing and start planning.

Keep an eye on those paycheck stubs. Verify the percentages. Adjust your withholdings if you're a high earner or have multiple income streams. Taking twenty minutes today to review your Box 5 and Box 6 figures can save you a massive headache during tax season.