You probably saw the flyers. Maybe you saw the frantic TV spots or the grainy social media ads. When Measure E Los Angeles hit the ballot, the messaging was, frankly, all over the place. One side promised a safer city with better-equipped paramedics; the other warned of a never-ending tax burden that would squeeze middle-class homeowners until they couldn't breathe.

Now that the dust has settled, we need to talk about what’s actually on the books.

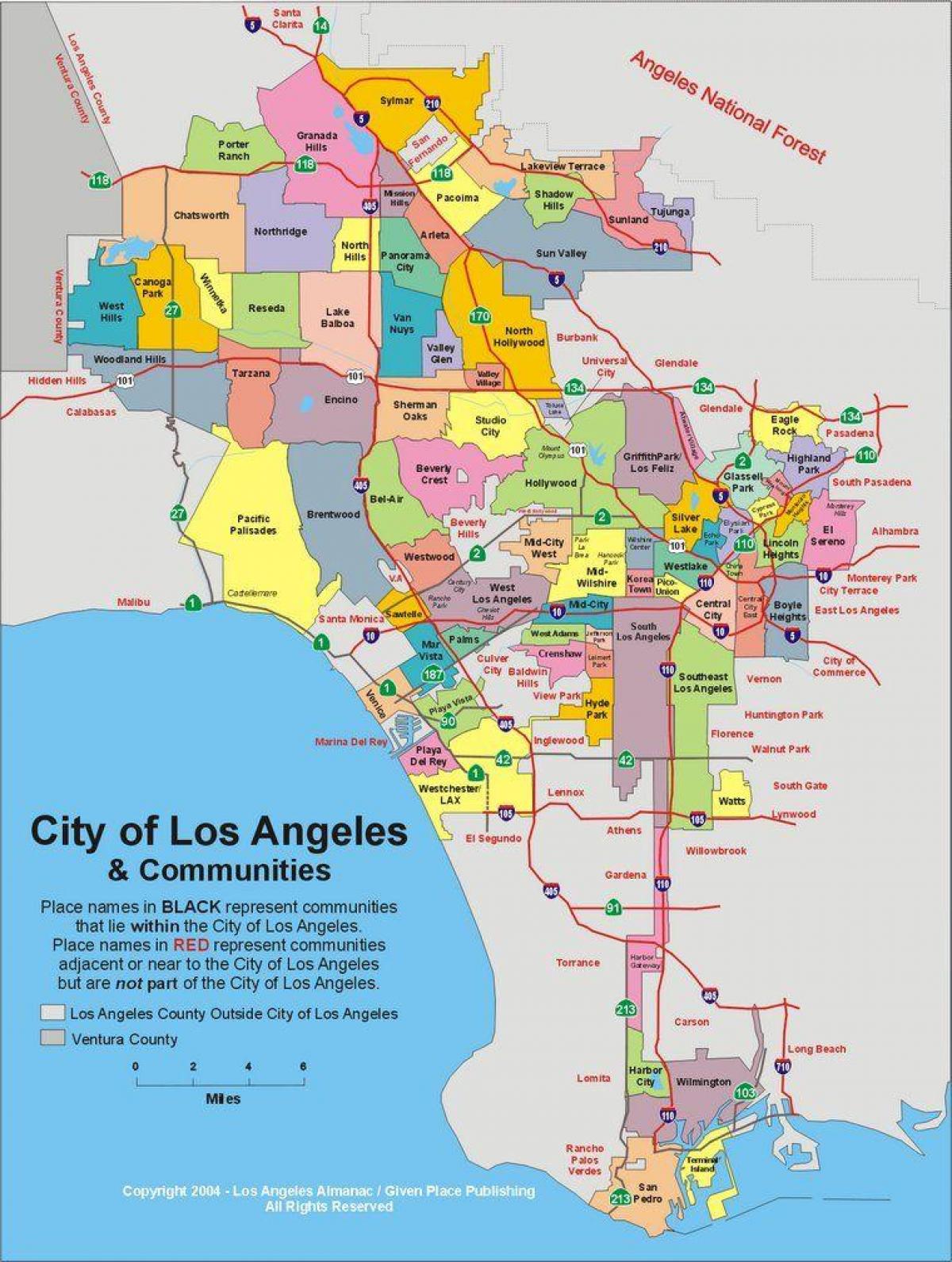

Politics in LA is messy. It’s expensive. And when it comes to local parcel taxes, it's often confusing as hell. Measure E wasn't just some abstract "good idea" floating in the ether. It was a very specific, very localized attempt to overhaul how the Los Angeles County Consolidated Fire Protection District—which covers a massive chunk of the county but not the City of Los Angeles itself—gets its funding.

The $0.06 Difference: Breaking Down the Math

Let’s get the numbers out of the way because they’re the bone of contention. Measure E Los Angeles proposed a special parcel tax. Specifically, it asked for 6 cents per square foot of "improved" property.

If you own a 1,500-square-foot home, we're talking about roughly $90 a year. It sounds small. But for a massive warehouse or a sprawling commercial complex in Santa Clarita or Lancaster, that bill climbs into the thousands or even tens of thousands of dollars very quickly. That's why the opposition wasn't just grumpy neighbors; it was fueled by major business groups and the Howard Jarvis Taxpayers Association.

Why 6 cents? Because the District's infrastructure is, quite honestly, falling apart.

We are talking about communication systems from the 1980s. Some fire stations have roofs that leak every time we get a "pineapple express" storm. More importantly, the volume of 911 calls has skyrocketed over the last decade, particularly medical emergency calls. The District argued that without this cash infusion, response times would continue to lag. And in a cardiac arrest or a fast-moving brush fire, three minutes is the difference between a save and a tragedy.

Who actually pays?

This is where people get tripped up. If you live in the City of Los Angeles (covered by LAFD), you don't pay this. This measure targets the Consolidated Fire Protection District. This includes 60 contract cities like West Hollywood, Santa Clarita, Palmdale, and unincorporated areas of the county.

💡 You might also like: Percentage of Women That Voted for Trump: What Really Happened

It’s a massive footprint.

The tax also has a built-in "escalator." It’s not just 6 cents forever. The rate can increase annually based on the Consumer Price Index (CPI), though it’s capped at 2% per year. This is a common feature in modern California tax measures, designed to keep up with inflation, but it's also a major sticking point for people who feel like they're being "nickeled and dimed" by the government.

Why the Pushback Was So Intense

You can't talk about Measure E without talking about the "tax fatigue" currently rotting the soul of many Angelenos. Between Measure ULA (the so-called mansion tax) and various school bonds, property owners are feeling defensive.

Opponents of Measure E Los Angeles pointed to one specific fact: the Fire District already gets a portion of the 1% ad valorem property tax. They argued that the county should manage its existing multi-billion dollar budget better instead of coming back to the voters for more. "Mismanagement" is the keyword you’ll hear at every town hall.

But there's a nuance here.

The District is a "special district." It’s a separate legal entity from the County’s general fund. It can't just dip into the money meant for social services or jail reform. It relies on its own dedicated revenue streams. When those streams don't keep up with the cost of modern fire engines—which now cost over $1 million a piece—the math stops working.

The Exemptions (The Fine Print)

To make the pill easier to swallow, the architects of Measure E included exemptions. Low-income seniors can apply to opt-out. So can certain non-profits.

📖 Related: What Category Was Harvey? The Surprising Truth Behind the Number

But here is the catch: you usually have to apply for these. The county doesn't just know you're a low-income senior and automatically waive the fee. This creates an administrative hurdle that many people simply miss, leading to "accidental" payments that they legally shouldn't have to make.

Paramedics, Peeking at the Future, and 911 Calls

If you’ve ever had to call 911 in a crowded part of LA County, you know the anxiety of the wait. The primary goal of Measure E Los Angeles was to hire more paramedics.

Currently, many stations are understaffed, leading to "brownouts" where certain units are temporarily taken out of service because there aren't enough bodies to man them. By adding roughly $150 million to $170 million to the annual budget, the District claims it can finally fill those gaps.

- Modernizing 911 dispatch: Replacing tech that belongs in a museum.

- Life-saving equipment: Getting advanced monitors and defibrillators into more trucks.

- Infrastructure: Fixing the literal holes in the ceilings of stations built in the 1950s.

Is it a "forever tax"? Basically, yes.

Unlike bonds that have an expiration date once the debt is paid, this is a parcel tax for "essential services." It stays until the voters decide to repeal it, which, let’s be honest, almost never happens in California.

The Reality of Living with Measure E

For the average renter, the impact is indirect but inevitable. Landlords rarely eat a $200 or $500 increase in annual costs; they pass it down through rent hikes or by reduced maintenance. For homeowners, it's another line item on a tax bill that already feels like a mortgage payment of its own.

But then there's the other side of the coin.

👉 See also: When Does Joe Biden's Term End: What Actually Happened

If you live in a high-fire-danger zone—think the foothills of the San Gabriel Mountains or the canyons of Malibu—the Fire District is your lifeline. Insurance companies are already fleeing California or spiking premiums to $10,000 a year. If the local fire department isn't well-funded, those insurance companies have even more reason to drop your coverage. In a weird, circular way, paying a $100 parcel tax might actually be cheaper than the alternative of losing your home insurance entirely because your "protection class" rating dropped.

Actionable Steps for Property Owners

Don't just grumble about the bill when it arrives in October. There are things you can and should do to manage the impact of Measure E Los Angeles.

1. Check Your Property Square Footage

The tax is based on "improved" square footage. Sometimes the County Assessor's records are wrong. If they think your house is 2,200 square feet but it’s actually 1,800, you are overpaying. Check your latest property tax portal login and verify the data. If it's wrong, file for a correction.

2. Apply for the Senior Exemption Early

If you are 65 or older and meet the "low-income" threshold (which varies by year), you are likely eligible for an exemption. Do not wait for the bill to arrive. Visit the LA County Assessor’s website or the Fire District’s specific Measure E portal to download the application. You usually have to provide proof of age and income.

3. Monitor the Oversight Committee

Measure E mandates a Citizens' Oversight Committee. This isn't just a group of people eating donuts in a basement. They are supposed to review every dollar spent. If you’re worried about "mission creep" or the money being used for administrative bonuses instead of fire trucks, read their annual reports. They are public record.

4. Understand Your "City" Status

Confirm if you are actually in the Consolidated District. If you live in the City of Los Angeles, Long Beach, or Pasadena, your fire services are funded differently. You shouldn't see this specific line item. If you do, it’s an error that needs an immediate appeal.

The reality of Measure E Los Angeles is that it’s a trade-off. It’s a gamble that more money will actually translate into faster response times and better survival rates. For some, that’s a price worth paying. For others, it’s just another sign that California is becoming unaffordable. Regardless of where you sit, the tax is here, and knowing the mechanics of it is the only way to ensure you aren't paying more than your fair share.