You’re scrolling through a site, find a pair of boots from a brand in Italy or maybe a new tech gadget from Shenzhen, and the price looks great. Then you hit the checkout button. Suddenly, there’s a "duty" or a "customs fee" that makes your stomach drop. That, in its simplest form, is the ripple effect of a tariff.

But what exactly is the meaning of tariff in the grand scheme of global power?

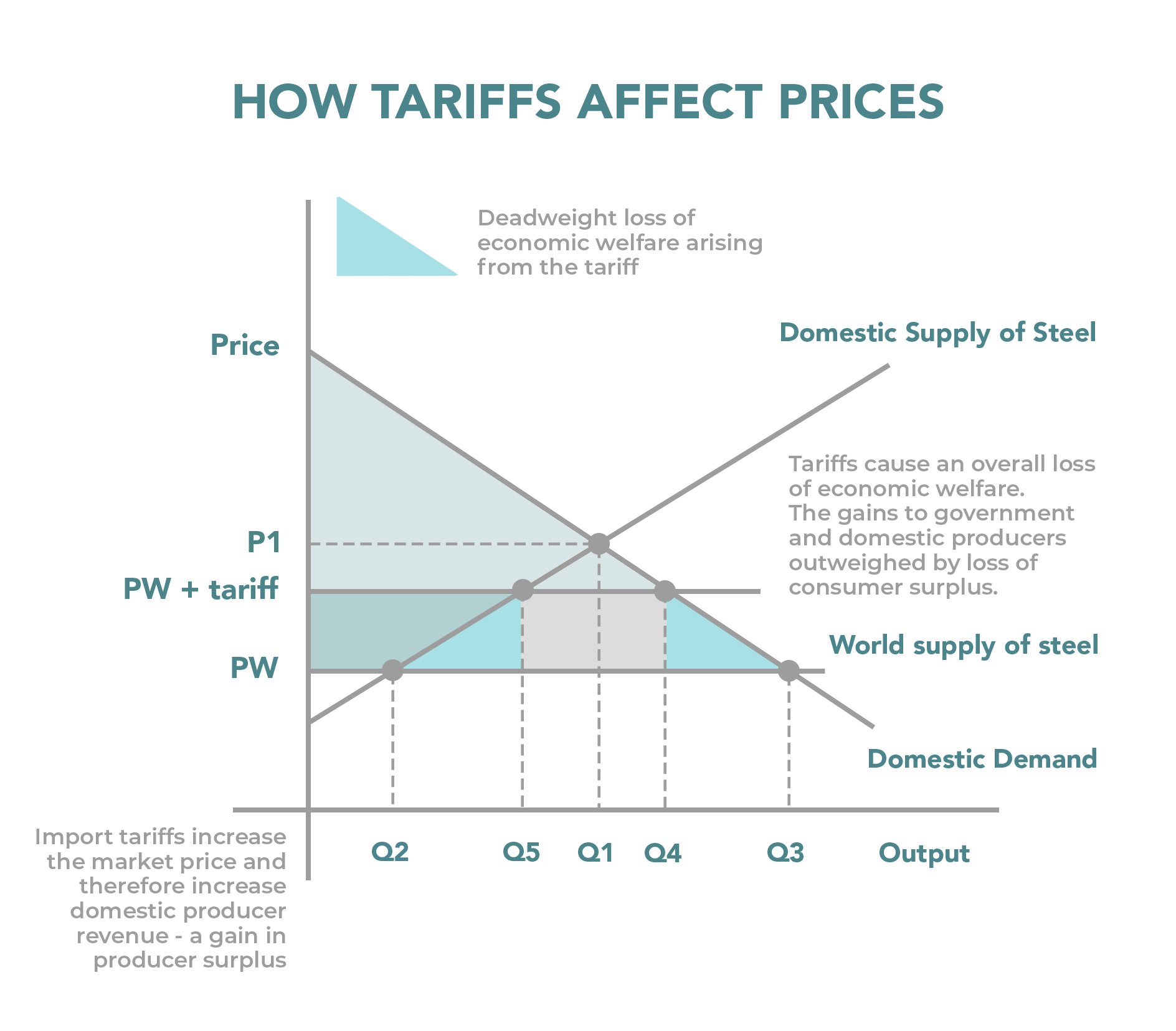

Most people think it’s just a tax. It’s not. Well, it is a tax, but it’s a tax with an agenda. Governments don't just collect this money to fill their coffers; they use it as a blunt force instrument to shape how you spend your money and how companies run their factories. If the U.S. government wants you to buy a Ford instead of a BYD electric vehicle, they might slap a 100% tariff on the Chinese car. Now, that "affordable" import costs double. You buy the Ford. The government wins its policy goal, but your wallet feels the sting.

The gritty reality of how tariffs actually function

When we talk about the meaning of tariff, we have to look at the paperwork. A tariff is a tax imposed by a government on goods imported from other countries. It’s paid by the domestic importer—the company bringing the stuff in—not by the country exporting the goods. This is a huge point of confusion. If the U.S. puts a tariff on French wine, the French government doesn't write a check to Washington. Instead, the wine shop in New York pays the tax to U.S. Customs. To keep their profit margins from disappearing, that shop raises the price of your favorite Bordeaux.

You pay the tariff.

There are two main flavors here. First, you have "ad valorem" tariffs. This is a percentage of the value. If there's a 10% tariff on a $1,000 laptop, the tax is $100. Then there are "specific" tariffs. This is a flat fee based on quantity, like $2 for every ton of steel, regardless of what that steel is worth that day. Sometimes, governments get fancy and combine them into a "compound tariff." It’s a mess of math that keeps customs brokers in business.

📖 Related: TCPA Shadow Creek Ranch: What Homeowners and Marketers Keep Missing

Why do leaders love them so much?

Protecting "infant industries" is the classic excuse. Imagine a country trying to start its own solar panel industry. They can't compete with massive Chinese factories that have been doing it for decades. By placing a heavy tariff on foreign panels, the government gives the local startup a fighting chance. It’s training wheels for the economy.

But it’s also about national security.

If a country relies entirely on an adversary for semiconductors or steel, they’re vulnerable. Tariffs can be used to force companies to build factories at home. It’s about leverage. You'll often hear politicians talk about "leveling the playing field." They argue that if another country subsidizes its businesses or has lower environmental standards, a tariff acts as a balancer. It’s an economic equalizer, or at least, that’s the sales pitch.

The 1930s lesson: When tariffs go horribly wrong

History is littered with tariff horror stories. The big one everyone mentions is the Smoot-Hawley Tariff Act of 1930. The U.S. wanted to protect farmers during the Great Depression. They hiked tariffs on over 20,000 imported goods. It was a disaster.

Other countries didn't just sit there and take it; they retaliated.

👉 See also: Starting Pay for Target: What Most People Get Wrong

Canada got mad. Europe got mad. They raised their own tariffs on American goods. Global trade plummeted by about 66% in a few years. Instead of saving the economy, it arguably made the Great Depression "Greater." It’s a cautionary tale that economists like Adam Smith or David Ricardo would have seen coming a mile away. They championed "comparative advantage," the idea that everyone wins when countries trade what they’re best at making. Tariffs throw a wrench in that machine.

The ripple effect on your grocery bill

Let's look at something mundane: aluminum. If there's a tariff on imported aluminum, the price of soda cans goes up. The brewery that makes your favorite craft beer now has to pay more for packaging. They aren't going to eat that cost. They’ll pass it to the bar, and the bar passes it to you. You’re paying an extra 50 cents for a pint because of a trade war over raw metal.

It’s often the "invisible tax." You don't see it on your receipt like a sales tax, but it’s baked into the price of the bread, the car, and the smartphone.

Who actually wins in this scenario?

Honestly, it’s a mixed bag. The domestic producers—the guys making the stuff locally—are the big winners. They can raise their prices to just below the tariff-inflated price of the imports and rake in more cash.

- Domestic workers: Sometimes tariffs save jobs in specific sectors, like steel or textiles.

- The Treasury: The government gets a nice influx of cash.

- Strategic autonomy: The country becomes less dependent on foreign supply chains.

But the losers? Consumers, mostly. And manufacturers who use imported parts. If you make washing machines in Ohio but use imported Swedish steel, your costs just went up. Your "Made in America" product is now more expensive to produce because of the very tariffs meant to help American industry. It's a weird, self-defeating loop sometimes.

✨ Don't miss: Why the Old Spice Deodorant Advert Still Wins Over a Decade Later

The modern trade war: Beyond the meaning of tariff

In 2026, the meaning of tariff has evolved. It’s no longer just about protecting a local shoe factory. It’s a high-stakes chess game involving tech, data, and green energy. We see "carbon tariffs" now, where countries tax imports based on how much pollution was created during manufacturing. This is a massive shift. It’s not just about trade; it’s about climate policy.

The European Union’s Carbon Border Adjustment Mechanism (CBAM) is the blueprint here. If you want to sell "dirty" steel in Europe, you’re going to pay a premium. It’s a tariff disguised as environmentalism, and it’s changing how global shipping works.

Retaliation and the "Tit-for-Tat" cycle

When Country A hits Country B with a tariff, Country B rarely says "okay, fair enough." They look for Country A's most sensitive exports. If the U.S. taxes French planes, France might tax American bourbon or Harley-Davidson motorcycles. Why? Because those industries are politically sensitive. They want to cause enough pain to force the other side back to the negotiating table. It’s economic chicken.

Navigating the costs as a business or consumer

If you’re running a small business, you can't just ignore these shifts. Supply chains are brittle. A sudden 25% tariff on a key component can wipe out your yearly profit in a week. This is why many companies are moving toward "friend-shoring"—moving production to countries with stable trade agreements (like the USMCA between the US, Mexico, and Canada) to avoid the tariff minefield.

For the average person, it’s about being an informed shopper.

- Check the origin: Goods from countries with "Free Trade Agreements" usually won't have these extra hidden costs.

- Watch the news: Trade policy changes fast. If you’re planning a big purchase like a car or major appliance, knowing if a trade dispute is brewing can save you thousands.

- Understand "De Minimis": In many countries, like the U.S., there’s a threshold (often $800) where you don't pay duties on personal imports. If your order is over that, expect a bill.

Tariffs are essentially a tug-of-war between the desire for cheap goods and the need for national industrial strength. There is no easy answer, and there is no free lunch. Every time a government "protects" an industry with a tariff, someone, somewhere, is picking up the tab. Usually, it's the person staring at the price tag in the store.

The best way to handle this is to diversify. Businesses should never rely on a single country for 100% of their parts. Consumers should look for local alternatives when the math on imports stops making sense. Understanding the meaning of tariff isn't just for economists; it's a survival skill for anyone living in a globalized world that's starting to put up walls again. Keep an eye on trade representative reports and watch for shifts in "Most Favored Nation" (MFN) statuses, as these are the early warning signs that prices are about to climb. Efficiency is great, but in a world of trade wars, resilience is what actually pays the bills.