Wait, I need to pay how much?

That’s the question thousands of people are asking as they stare at checkout screens or, worse, receive "postage due" notices for a $15 phone case. If you’ve been buying from China for years, you probably never thought twice about taxes. You click buy, a silver bag shows up three weeks later, and life goes on.

That era ended on May 2.

The may 2 aliexpress tariffs aren't just a small price hike. They represent a fundamental shift in how the U.S. government views every single cardboard box crossing the border. For years, the "de minimis" rule was the secret sauce of the internet. It basically said that if your package was worth less than $800, the government didn't want to deal with the paperwork. You paid $0 in duty.

Now? The gate has slammed shut.

Why May 2 Changed Everything for Your Shopping Cart

Honestly, the logic behind this is pretty intense. On May 2, 2025, the U.S. government officially stripped China and Hong Kong of their "de minimis" privileges. This wasn't some quiet bureaucratic shift. It was a targeted strike.

What does that actually mean for you?

Previously, a $20 order for LED strips on AliExpress was just $20. After May 2, that same order is technically subject to a flat fee or a massive percentage-based duty. Because the "de minimis" exemption is gone for Chinese goods, every single parcel is now treated like a commercial import.

✨ Don't miss: Fifth Third Bank Fraud Phone Number: How to Call the Right People When Your Account Is Under Attack

It’s a logistical nightmare.

Customs and Border Protection (CBP) used to wave these through. Now, they have to account for them. During the initial rollout in May, the duty was set at a staggering $100 per item or 120% ad valorem (the value of the item), whichever was higher.

Yeah, you read that right.

Imagine buying a $5 pair of socks and being told the import fee is $100. It sounds like a joke, but for the first month of these may 2 aliexpress tariffs, it was the cold, hard reality of the "reciprocal tariff" logic being applied to small-parcel e-commerce.

The Breakdown: What You're Actually Paying

It’s not a flat tax. It's more like a moving target.

- The Ad Valorem Rate: For most of May, the government experimented with rates as high as 120-125% on the declared value.

- The Flat Fee Trap: For postal shipments, carriers often have to choose a method for the whole month. This could be a $100 fee per item (which increased to $200 in June).

- Brokerage Fees: This is the one that sneaks up on you. Since these are no longer "informal entries," someone has to file the paperwork. If FedEx or UPS does it for you, they aren't doing it for free.

The Death of the $800 Loophole

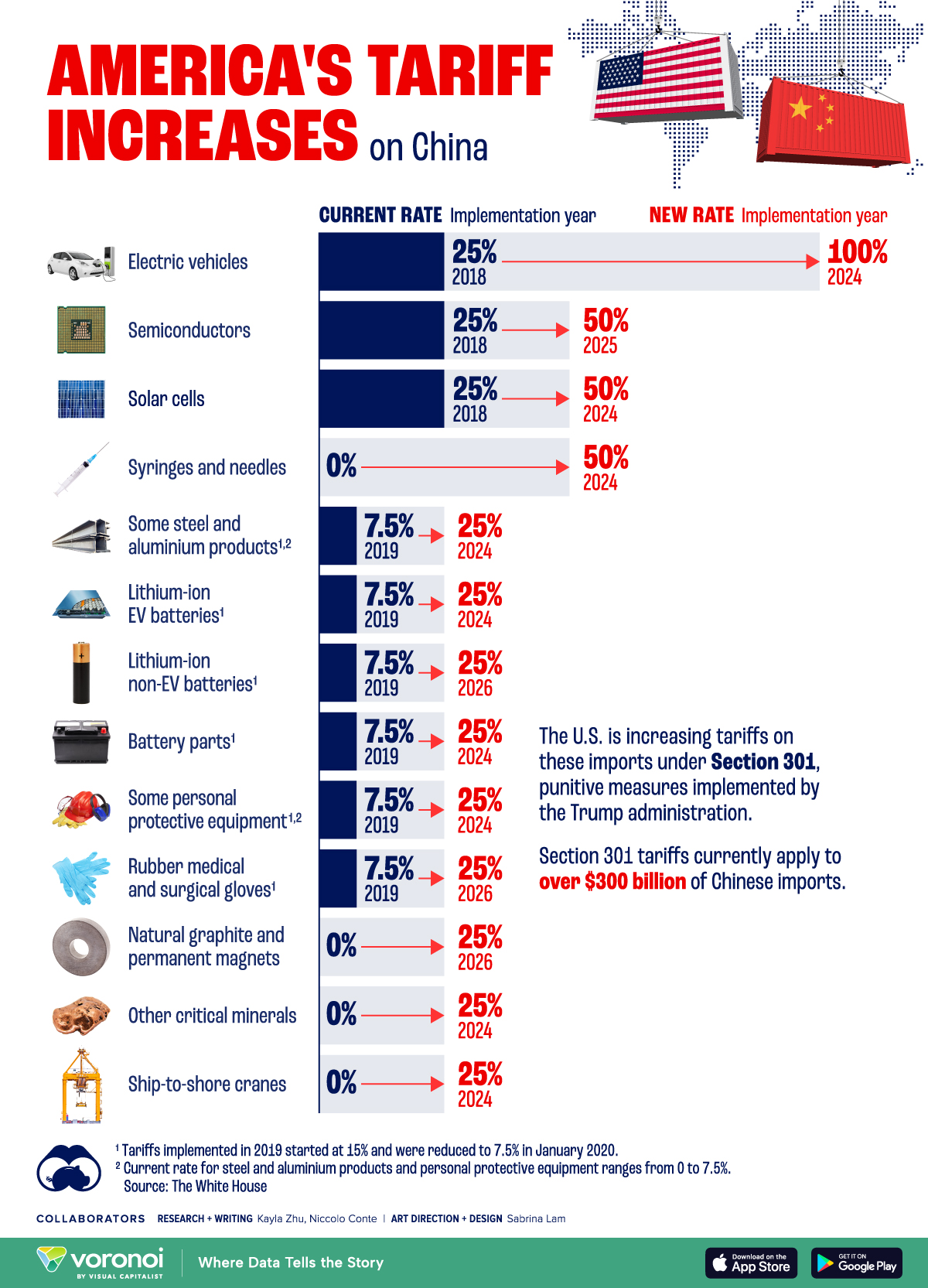

You might have heard people talking about Section 301 or the "One Big Beautiful Act." These are the legal engines driving the may 2 aliexpress tariffs.

The U.S. used to have the most generous import threshold in the world. At $800, we were outliers. Most of Europe was at €150 (and they're killing that, too). The argument from the White House was that companies like Temu and AliExpress were "gaming the system" by breaking large shipments into millions of tiny individual boxes to dodge taxes that big retailers like Walmart have to pay.

It worked.

In 2024, over 1.3 billion of these tiny packages hit U.S. soil.

But as of May 2, the "Section 301" tariffs—the ones usually reserved for industrial steel or high-tech components—started being applied to that $12 spatula you bought while doom-scrolling at 2:00 AM.

Why Sellers Are Acting Weird

Have you noticed AliExpress sellers being strangely vague lately?

"Friend, please check local customs," they’ll say.

They’re terrified. Many sellers have no idea how to price their goods anymore. If they include the tariff in the price, the item looks 3x more expensive than the competition. If they don't, the buyer gets hit at the door, refuses the package, and the seller loses the product and the shipping cost.

Some sellers are trying to route things through "Third Country" warehouses. You might see items shipping from Mexico or Vietnam. But be careful. CBP is wise to "transshipment." If the goods were made in China, the may 2 aliexpress tariffs usually still apply based on the "Country of Origin," regardless of where the last plane took off from.

Is This Just a US Problem?

Short answer: No.

While the May 2 date is specific to the U.S. crackdown on China, the whole world is basically following suit. Brazil started their "Remessa Conforme" program, which added a 20% federal tax on top of local taxes for small purchases. The EU is fast-tracking the end of their own duty-free threshold for 2026.

The "Global Village" of cheap, untaxed plastic is being partitioned by trade wars.

How to Shop on AliExpress Without Getting Destroyed

You can still use the site. You just have to be smarter than the algorithm.

First, look for "Choice" items that explicitly state "VAT Included" or "Taxes Included." These are usually handled by AliExpress’s own logistics arm, Cainiao. They’ve been working feverishly to set up bulk-clearing systems where they pay the duty in one big lump sum so you don't get a $100 bill for a $10 item.

Second, avoid "Postal" shipping if you can.

Standard international mail is getting hit the hardest because it's the easiest for customs to flag for the flat-fee tariffs. Private couriers (though more expensive) often have better-integrated systems for handling these new costs upfront.

Third, keep your order values low, but not for the reason you think.

The $800 limit is gone. There is no "safe" number anymore. However, smaller, lighter packages are still more likely to slip through the cracks of a stressed-out customs system than a giant 20lb box that screams "Commercial Goods."

The Future of Dropshipping

If you're running a Shopify store and sourcing from China, May 2 was likely your "Black Friday" in a very bad way.

The margins are essentially gone.

If you're still trying to ship 1-by-1 from a warehouse in Shenzhen to a customer in Ohio, you're playing a losing game. Successful sellers are moving toward "Onshore Fulfillment." They buy 500 units, pay the bulk commercial tariff (which is often lower than the individual "item fee"), and ship from a 3PL in the States.

It’s more expensive to start, but it’s the only way to avoid the may 2 aliexpress tariffs death spiral.

Actionable Steps for the "Post-May 2" World

Stop thinking of AliExpress as a tax-free zone. It’s a global marketplace subject to local laws.

- Check the "Ship From" Location: If it’s not China or Hong Kong, you might be safe for now, but double-check the fine print.

- Use Credit Cards with Good Protection: If a package arrives with a massive, unexpected tax bill, you might want to refuse delivery. Having a credit card that supports easy chargebacks for "not as described" or "unforeseen costs" is a lifesaver.

- Calculate the "True Cost": Before you click buy, add 30% to the price in your head. If it’s still a good deal, go for it. If not, check Amazon or eBay. Often, those sellers have already dealt with the tariffs, and the price you see is the price you pay.

- Watch the News: These rates change monthly. What was a $100 fee in May might be a 25% rate in August. The "reciprocal" nature of these laws means they are used as bargaining chips in trade talks.

The "golden age" of $1 gadgets with free shipping is effectively on life support. The may 2 aliexpress tariffs are the first real sign that the bill has finally come due.

Stay informed, keep your receipts, and don't be surprised if your mailman starts asking for a check.