Maryland taxes are a bit of a maze. If you’ve ever sat down with a Maryland tax rate calculator and ended up with a number that looks nothing like your neighbor’s bill, you aren't alone. Most people assume there is just one "Maryland tax," but that is basically never the case.

Honestly, the state has one of the most unique—and frankly, sometimes confusing—tax structures in the country because of the "piggyback" system. You aren't just paying the state; you are paying your county (or Baltimore City) at the exact same time. It’s all bundled together on one return, but the rates vary wildly depending on whether you're living in a high-cost area like Bethesda or a quieter spot like Garrett County.

Why Your Maryland Tax Rate Calculator Might Be Lying to You

Most generic online calculators are built for simple states. Maryland isn't simple.

The biggest mistake folks make is ignoring the local tax rate. In Maryland, every single county (plus Baltimore City) sets its own local income tax rate. These range from a low of around 2.25% to a high of 3.30%. If your calculator doesn't ask for your specific zip code or county, the final number it spits out is probably garbage.

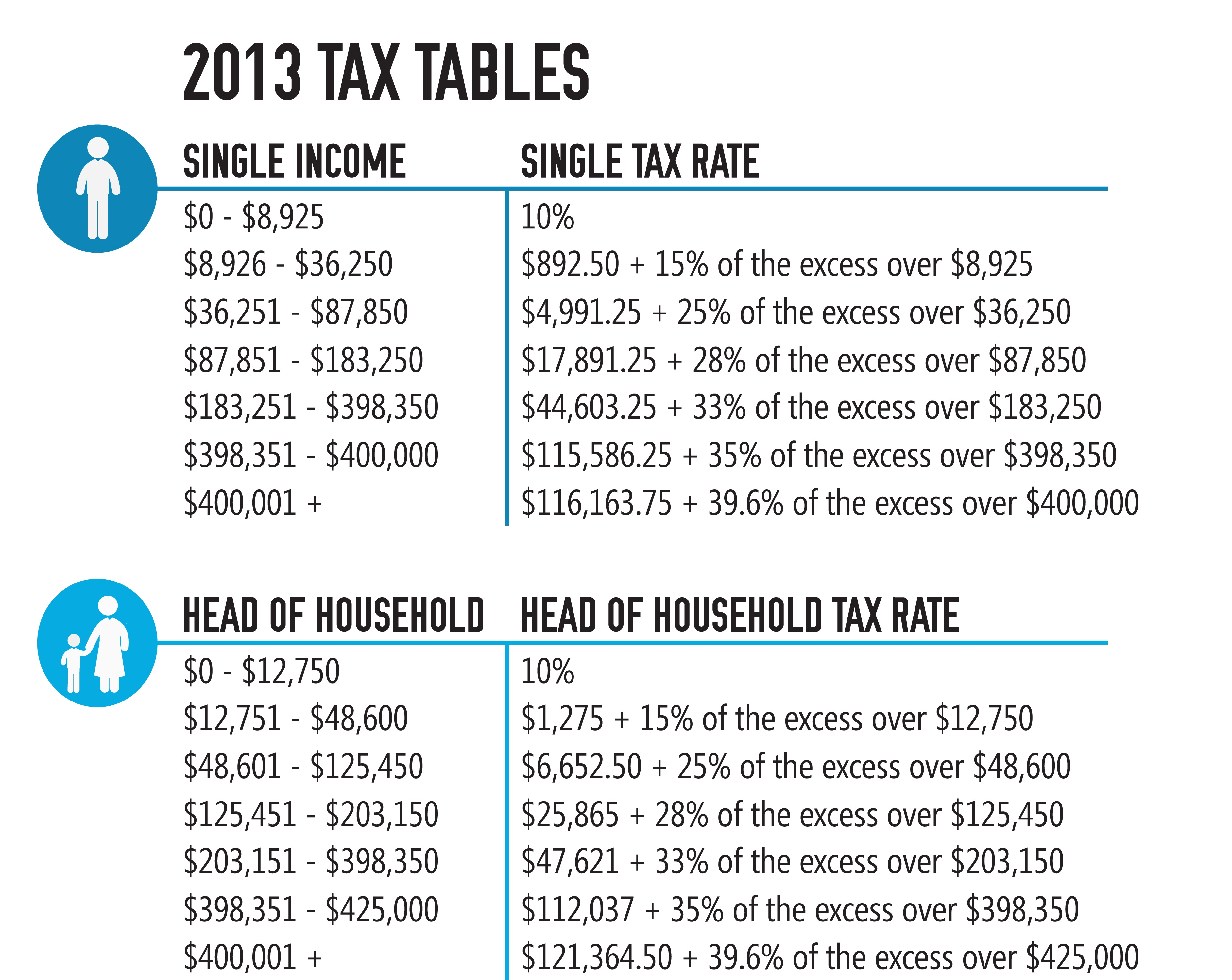

The state portion is progressive. This means you don't just pay one flat percentage. You pay a little bit at 2%, then a chunk at 3%, and it keeps climbing until you hit the top brackets. For the 2025 tax year (the ones you are filing in 2026), things got even more interesting. The state added two brand-new high-income brackets.

If you're a single filer making over $500,000, or a joint filer over $600,000, you’re looking at a 6.25% rate on that top slice. Cross the million-dollar mark? That jumps to 6.5%. These are the highest rates Maryland has seen in quite a while.

The Real Math Behind the Brackets

You've got to look at the state and local pieces as two separate puzzles that eventually snap together.

The State Piece:

Maryland’s state rates start at 2% for the first $1,000 of taxable income. It sounds low, but it scales fast. Most middle-class families find the bulk of their income taxed at 4.75%.

💡 You might also like: Billing Zip Code Explained: Why Banks Keep Asking for It

The Local Piece:

This is where the surprises happen. Some counties, like Anne Arundel, have actually moved toward a graduated local tax system. Instead of one flat rate for the whole county, they might charge you 2.70% on your first $50,000 and 3.20% on everything over $400,000.

Most other spots, like Montgomery County or Baltimore City, just stick to a flat 3.20% or 3.30%. When you add that local 3.30% to the state's top 6.5%, some Marylanders are effectively paying nearly 10% in state and local income taxes. That is a heavy lift.

The 2% Capital Gains Surtax No One Saw Coming

If you are checking a Maryland tax rate calculator because you just sold some stock or a second home, pay attention.

Starting in 2025, there is a new 2% surtax on net capital gains. This isn't for everyone, though. It only kicks in if your Federal Adjusted Gross Income (AGI) is over $350,000. It doesn't matter if you file single or joint; that $350k threshold is the line in the sand.

💡 You might also like: State Bank of Vietnam News Today: Why the 15% Credit Cap Matters More Than You Think

There are a few "outs." If you sold your primary residence and the price was under $1.5 million, you're usually safe from this specific surtax. But for investors, this is a massive change that many people are going to miss until they see their 2026 tax bill.

Standard Deductions vs. The Maryland Itemized Trap

Maryland used to be pretty generous with deductions, but the rules are getting tighter.

For 2025, the standard deduction for a single person is $3,350. For married couples, it’s $6,700. These numbers usually go up a tiny bit every year with inflation.

But here’s the kicker: if you choose to itemize, Maryland now "phases out" those deductions for high earners. If your AGI is over $200,000 (or $100,000 if you're married filing separately), the state starts shaving 7.5% off your total itemized deductions. It’s a "hidden" tax increase that basically penalizes people for having a lot of mortgage interest or charitable donations.

How Local Rates Shift Your Take-Home Pay

Let's look at how the county you choose to live in changes the math.

🔗 Read more: Solar Module Manufacturers India: Why the High-Quality Stuff is Getting Harder to Find

Imagine two people, both making $100,000 in taxable income. One lives in Worcester County, where the local rate has historically been one of the lowest at 2.25%. The other lives in Howard County, which sits at 3.20%.

The Howard County resident is paying nearly $1,000 more per year just because of their zip code.

2026 Local Tax Rates at a Glance

- Low Range (2.25% - 2.75%): Places like Worcester, Talbot, and Cecil (which dropped its rate recently to 2.74%).

- Mid Range (2.80% - 3.10%): Washington County and Carroll County usually hover here.

- High Range (3.20% - 3.30%): This is the "heavy hitter" group. Baltimore City, Montgomery, Prince George’s, and Howard.

Note that Dorchester County made waves recently by retroactively bumping their rate to the new state-allowed maximum of 3.30%. This suggests other counties might follow suit as they look to plug budget holes.

Avoiding the Maryland Tax Trap

Kinda crazy, right? The key to getting an accurate estimate out of any Maryland tax rate calculator is knowing your "Maryland Taxable Net Income." This is not the same as your salary.

You start with your federal AGI. Then you add back certain things (like interest from out-of-state municipal bonds) and subtract others (like Social Security benefits or a portion of your pension if you're over 65).

Maryland's pension exclusion is actually pretty decent. For the 2025 tax year, qualifying seniors can subtract up to $41,200 of their retirement income from their state taxes. If you don't account for that in your calculator, your estimate will be way too high.

Actionable Steps for Tax Planning

- Check your withholding: If you live in a county that recently raised its rate (like Dorchester or St. Mary’s), make sure your employer is actually withholding enough. Most payroll software lags behind local law changes.

- Verify your county: If you moved mid-year, you usually owe tax based on where you lived on the last day of the year. Don't let a calculator assume you were in one spot for all 12 months if you weren't.

- Track Capital Gains: If you’re near that $350,000 AGI mark, be careful with year-end stock sales. Triggering that extra 2% surtax could cost you thousands.

- Max out the 529: Maryland offers a $2,500 deduction per beneficiary for contributions to the Maryland College Investment Plan. It’s one of the few ways to directly lower your state taxable income.

Maryland's tax landscape is shifting. Between the new top-tier brackets, the capital gains surtax, and the local rate hikes, the "old" math just doesn't work anymore. Using a tool that accounts for the 2026 filing realities is the only way to avoid a nasty surprise when April rolls around.