Honestly, nobody wakes up excited to deal with the Comptroller of Maryland. But if you're self-employed, a small business owner, or just someone with a side hustle that’s actually making money, the maryland estimate tax payment is something you can't really ignore without getting slapped with a bill later. Maryland is a bit unique. Unlike some states that just have one flat rate, we have a progressive state tax plus a local tax that varies depending on which county you call home.

It gets confusing. Fast.

The biggest mistake people make is thinking they only have to care about taxes in April. If you're bringing in income that doesn't have taxes taken out automatically—think 1099 work, rental income, or capital gains—the state expects their cut throughout the year. Basically, if you wait until April 15th to pay everything you owe for the previous year, Maryland is going to charge you "interest" for the "privilege" of holding onto their money.

Who actually needs to make a Maryland estimate tax payment?

You've got to pay if you expect to owe more than $500 in tax when you file your return. That’s the threshold. It’s pretty low. If you’re a freelancer in Silver Spring or running a shop in Annapolis, you’re likely hitting that.

The state law, specifically Section 10-815 of the Tax-General Article, is pretty clear: if your income isn't subject to withholding, or if the withholding isn't enough, you’re on the hook for estimated payments. This includes:

- Self-employment income: The most common reason.

- Prizes and awards: If you hit it big at a casino or win a raffle and they didn't take out state tax, you have 60 days to file a declaration.

- Investment income: Dividends and capital gains can sneak up on you.

- Pension or IRA distributions: Sometimes the withholding on these isn't high enough to cover the combined state and local rates.

Speaking of rates, Maryland’s state tax tops out at 5.75% for most, but as of 2025/2026, there are new brackets for high earners. If you're clearing over $500,000 (single) or $600,000 (joint), you might be looking at rates up to 6.5%. Plus, you have to add your county rate, which is usually between 2.25% and 3.2%—though some counties can now go up to 3.3%. Basically, you should be setting aside roughly 8% to 9% of your net income just for the state and local guys.

📖 Related: The Income Tax Calculator NYC Mistake That Costs Thousands

The deadlines you can't miss

Maryland follows the standard quarterly schedule, but don't let the word "quarterly" fool you. The periods aren't actually three months long.

- April 15: Covers January through March.

- June 15: Covers April and May. (Yes, only two months!)

- September 15: Covers June through August.

- January 15: Covers the final four months of the previous year.

If the 15th falls on a weekend or a holiday, you get until the next business day. But really, don't cut it that close. If you're a farmer or fisherman, you have a bit of a break; you can usually skip these if you file and pay your whole bill by March 1. For everyone else, missing a date starts the interest clock ticking.

How to actually pay without losing your mind

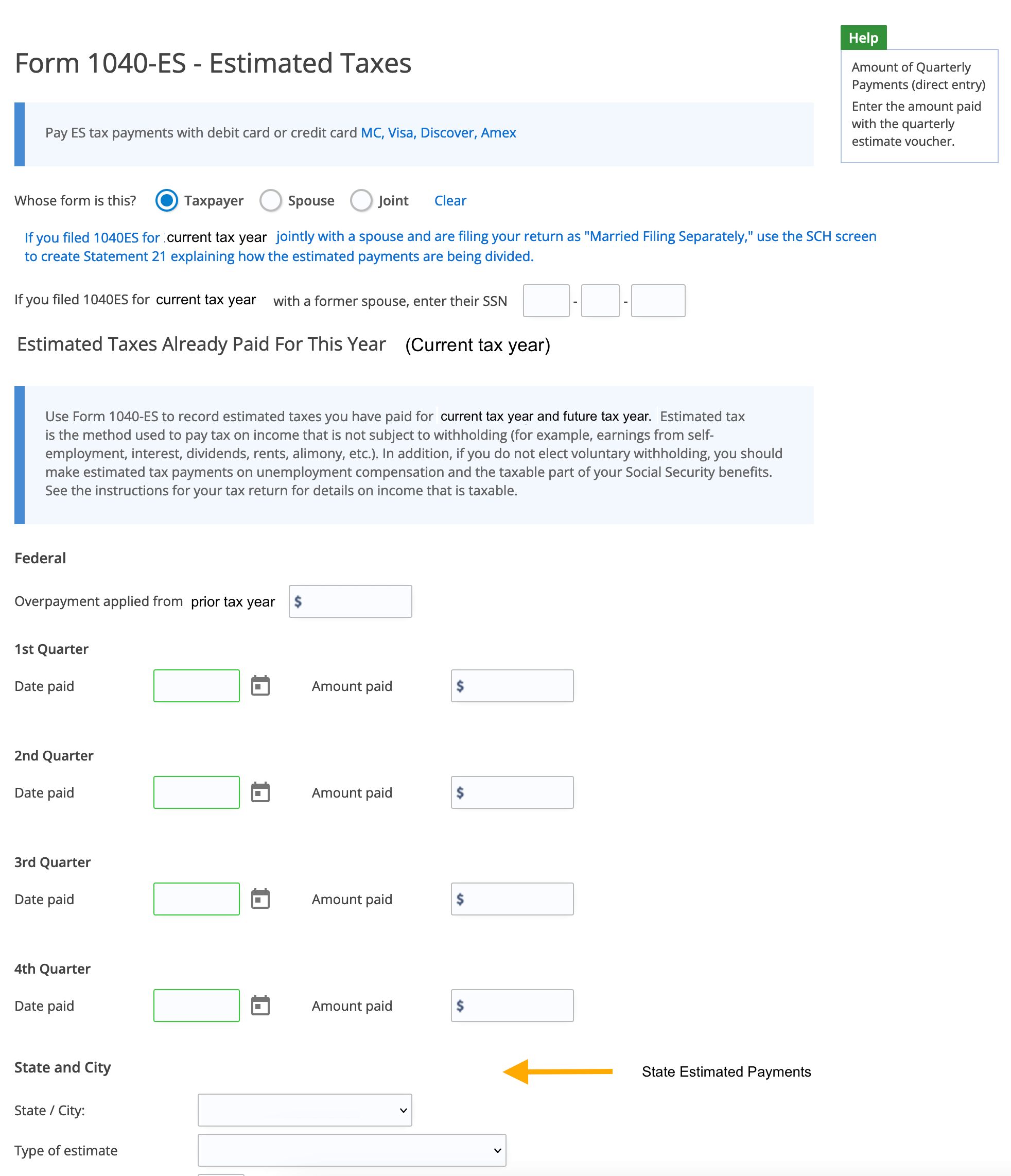

You have options. You don't have to mail a paper check like it’s 1995, though you can if you really want to.

If you go the paper route, you need Form PV. This is the Personal Tax Payment Voucher. You fill it out, attach your check, and mail it to the Comptroller in Annapolis. Pro tip: make sure your Social Security number is on the check. They get a lot of mail, and you don't want your money sitting in a "mystery pile."

Most people now use the Maryland Tax Connect portal or the iFile system. It’s faster. You can set up a direct debit from your bank account. If you want to use a credit card, you can, but be warned: there’s a "convenience fee." Honestly, that fee usually eats up any points or rewards you’d earn on the card, so use a bank transfer if you can.

Calculating the right amount

This is where people get "analysis paralysis." How do you know what to pay when your income fluctuates?

The "Safe Harbor" rule is your best friend here. To avoid penalties, you generally need to pay either:

- 90% of the tax you’ll owe for the current year.

- 110% of what you paid last year (if your income was over $150,000).

If you pay the 110% amount based on last year’s return, Maryland can’t penalize you even if you make way more money this year. It's a "set it and forget it" strategy.

The penalty for getting it wrong

If you underpay, Maryland doesn't just ask for the difference. They charge interest. Currently, that rate is around 9% or higher annually, calculated monthly. If you missed the April payment and didn't catch up until September, they'll charge you interest on that specific underpayment for those months.

There is a form called 502UP (Underpayment of Estimated Income Tax by Individuals). You use this to calculate if you owe interest or if you qualify for an exception—like if your income was seasonal and you didn't actually earn anything until the third quarter.

Actionable Next Steps

Don't let the paperwork pile up. It’s better to pay a little something now than to face a massive bill and interest charges next spring.

- Check your last tax return: Look at the "Total Tax" line. Divide that by four. That’s your baseline for this year's payments.

- Set up a Maryland Tax Connect account: It takes 10 minutes and makes the actual payment process a one-click affair later on.

- Mark June 15 on your calendar: It’s the one everyone forgets because it's only two months after the April deadline.

- Keep a "tax bucket": Put 30% of every 1099 check into a separate savings account. This covers both your Federal and Maryland estimate tax payment needs so you aren't scrambling when the 15th rolls around.

Managing state taxes isn't fun, but being "square" with the Comptroller means one less thing to worry about when you're trying to run your business or enjoy your life in the Free State.