You've probably seen the glossy ads for the "premium" travel cards. The ones with the heavy metal construction, the $600 annual fees, and the promises of airport lounges that are usually overcrowded anyway. But honestly, most of us just want a way to stay at a decent hotel for free without having to pay a "membership fee" for the privilege of spending our own money.

That’s where the Marriott Bonvoy Bold Credit Card comes in.

It’s often ignored because it doesn’t have the flashy "Free Night Award" every year like its older brother, the Boundless. But for a $0 annual fee card, the Bold has actually become a bit of a powerhouse lately. Chase and Marriott quietly revamped it in mid-2024, and in 2026, it remains one of the few ways to keep your foot in the door of the world's largest hotel loyalty program without it costing you a dime.

The Welcome Offer is Kinda Ridiculous Right Now

Most no-fee cards give you a tiny splash of points—maybe enough for a Tuesday night at a suburban courtyard. But the current offer on the Marriott Bonvoy Bold Credit Card is a massive outlier.

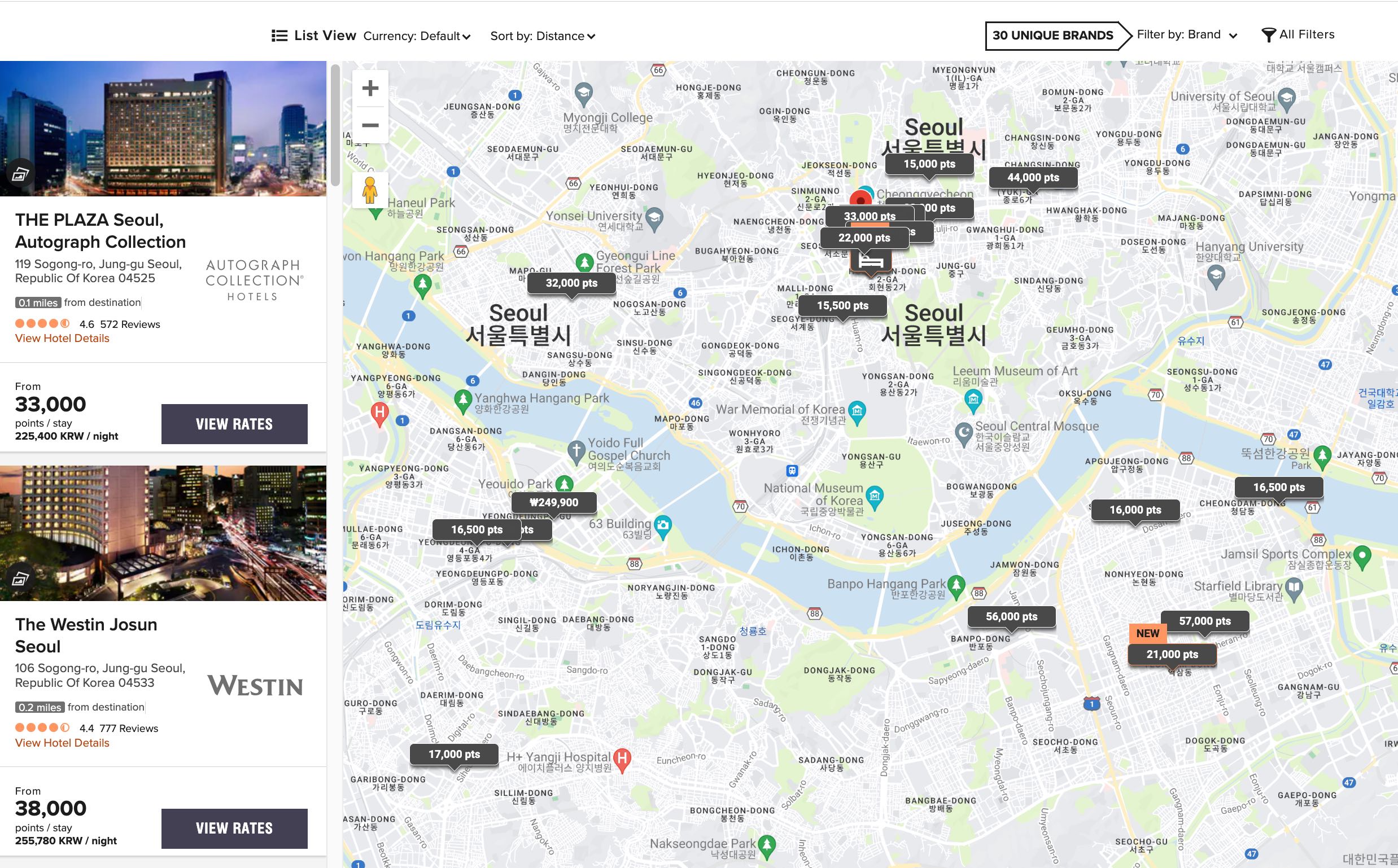

Right now, you can earn 2 Free Night Awards after spending just $1,000 on purchases in the first 3 months. Here is the part people miss: these aren't the "cheap hotel" certificates. These are valid for properties up to 50,000 points per night.

Think about that. You could potentially book two nights at the The Westin Tokyo or a high-end Autograph Collection property just for hitting a $1,000 spend. If you tried to buy those 100,000 points outright, it would cost you over $1,200. Getting that for free on a $0 annual fee card is, frankly, a steal.

📖 Related: Seeing Universal Studios Orlando from Above: What the Maps Don't Tell You

And if you find a dream hotel that costs 60,000 points? You can "top off" your certificates. Marriott allows you to add up to 15,000 of your own points to these certificates to bridge the gap. It's a level of flexibility that used to be reserved for the "fancy" cards.

Breaking Down the Math: Is it Actually Worth It?

Let's be real. You aren't going to get rich off the earning rates here.

The Marriott Bonvoy Bold Credit Card is designed for the casual traveler, not the road warrior. You get 3X points for every $1 spent at hotels participating in Marriott Bonvoy. When you add the Silver Elite status bonus and the base points you get as a member, Marriott likes to say you earn "up to 14X total points," but that's a bit of marketing math.

Here is what you actually earn on daily life:

- 2X points on grocery stores (a huge addition from the old version of the card).

- 2X points on rideshare and food delivery (Uber Eats, DoorDash, etc.).

- 2X points on streaming, internet, and phone bills.

- 1X points on everything else.

Is 2X points on groceries impressive? Not compared to a dedicated grocery card. But if you’re trying to keep all your points in one "bucket" to fund a big honeymoon or a family vacation, it’s a steady trickle that adds up.

👉 See also: How Long Ago Did the Titanic Sink? The Real Timeline of History's Most Famous Shipwreck

The Stealth Benefit: Elite Night Credits

This is the real reason people keep this card in their sock drawer. Every year, you get 5 Elite Night Credits.

No, that doesn't mean you get 5 free nights. It means Marriott "credits" your account as if you had stayed 5 nights. Why does this matter? Because it gives you a head start on the next status tier.

Silver Elite is automatic with this card, but Silver doesn't get you much—maybe a late checkout if the hotel is feeling generous and a 10% points bonus. The "real" benefits like free breakfast and lounge access start at Platinum Elite (50 nights).

If you already stay at Marriotts 45 nights a year for work, this $0 card pushes you over the edge to Platinum. It’s a permanent +5 boost to your status journey that costs you zero dollars a year to maintain.

Travel Protections That Shouldn't Be Free

Usually, when you pay $0 for a card, the bank laughs at you if your luggage goes missing. But the Marriott Bonvoy Bold Credit Card actually carries some decent insurance.

✨ Don't miss: Why the Newport Back Bay Science Center is the Best Kept Secret in Orange County

- Baggage Delay: If your bags are late by more than 6 hours, you can get reimbursed up to $100 a day (for 5 days) to buy essentials.

- Trip Delay: If your flight is delayed over 12 hours or requires an overnight stay, you’re covered for up to $500 in expenses like meals and lodging.

- No Foreign Transaction Fees: This is the big one. Most no-fee cards charge you 3% every time you buy a coffee in London or Paris. This card doesn't.

What You Give Up (The Catch)

I’m not going to sit here and tell you this card is perfect. It’s not.

The biggest downside is the lack of an Anniversary Free Night. The $95 Boundless card gives you a free night every year (up to 35,000 points). For most people, that one night is worth way more than the $95 fee. If you go with the Bold, you lose that.

Also, the "Pay Yourself Back" feature is a bit of a trap. It lets you redeem points for statement credits on travel purchases, but the value is often around 0.8 cents per point. You’re almost always better off saving those points for an actual hotel stay where you can easily get 1.0 to 1.2 cents of value.

Actionable Steps for Your Next Move

If you’re looking at the Marriott Bonvoy Bold Credit Card, don't just hit apply without a plan.

First, check your "Chase 5/24" status. Chase generally won't approve you if you've opened 5 or more personal credit cards from any bank in the last 24 months.

Second, look at your upcoming travel. If you have a $1,000 trip coming up, that is the perfect time to open this card. You’ll hit the spending requirement instantly, earn those 2 Free Night Awards (worth up to 100,000 points), and you can use the "Travel Now, Pay Later" feature if you want to split the cost of your booking into monthly installments with no interest or plan fees.

Finally, remember that you can always upgrade later. If you find yourself staying at Marriotts more often, you can usually "product change" this card to the Boundless after a year, though you might miss out on a new sign-up bonus if you do it that way. For a $0 entry point into the world of travel rewards, it's a solid, low-risk way to start sleeping for free.