Retail is brutal. Honestly, if you looked at Marks & Spencer five years ago, you might have thought they were headed for the same graveyard as Debenhams or BHS. But something shifted. The Marks & Spencer share price isn't just a number on a ticker tape anymore; it’s become a barometer for whether a legacy British brand can actually figure out the 21st century.

Investors are obsessed.

People used to joke that M&S was where you went for your grandmother’s birthday card and maybe some high-quality socks. Now? It’s a different beast. We are seeing a massive transformation in how the market values "MKS"—the London Stock Exchange ticker for the retail giant—and it’s driven by a weirdly successful pivot into premium food and a long-overdue overhaul of their clothing line.

The Resurgence of MKS on the FTSE 100

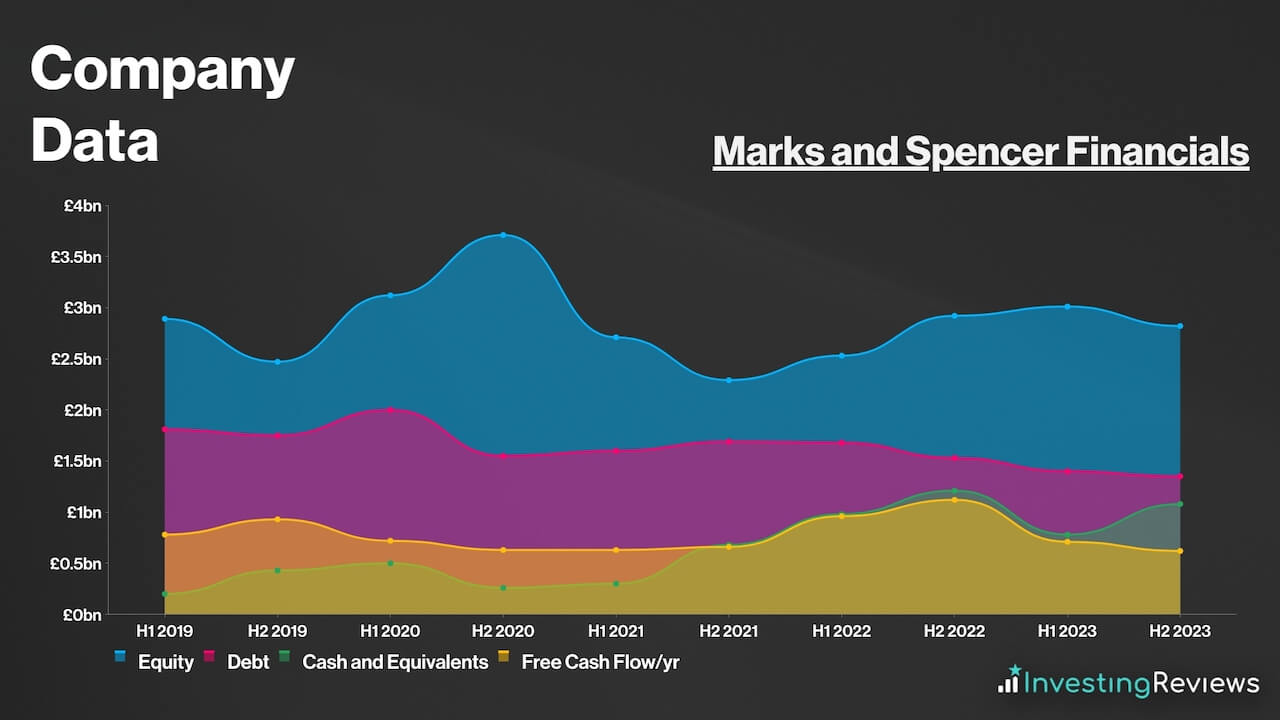

For a long time, the Marks & Spencer share price felt like it was stuck in a basement. It was relegated from the FTSE 100 in 2019, a move that felt like a final insult to a British institution. However, the comeback story began in earnest around 2023. By the time 2024 and 2025 rolled around, M&S wasn't just surviving; it was outperforming almost everyone in the retail space.

Why? Because they stopped trying to be everything to everyone.

Stuart Machin, the CEO, has been pretty vocal about "reshaping" the business. This isn't just corporate speak. It meant closing down the massive, drafty old stores that cost a fortune to heat and maintain and moving into sleeker, more efficient "Store of the Future" formats. When you look at the Marks & Spencer share price trends over the last 24 months, you can see the exact moments the market started believing in this strategy. The dividends came back. The profit margins widened.

It’s about the "Food Hall" effect.

M&S Food has a cult following. It’s weird, right? People will complain about the price of milk but then happily drop £10 on a "Dine In" deal. This segment of the business provides a massive cushion. Even when the "General Merchandise" (clothes and home) side of the business struggles, people still need to eat. And apparently, they want to eat M&S sourdough.

What’s Actually Moving the Marks & Spencer Share Price?

You can't talk about MKS without talking about Ocado. The joint venture with Ocado Retail has been a bit of a rollercoaster. Initially, it was seen as the genius move that would save M&S from its lack of a delivery infrastructure. Then, the post-pandemic slump hit online grocery shopping hard.

📖 Related: George Soros Net Worth: Why the 7.5 Billion Figure is Only Half the Story

Lately, the tension between M&S and Ocado Group has been headline news. There have been disputes over performance payments, and this friction often causes ripples in the Marks & Spencer share price. If you’re trading this stock, you have to watch the relationship between these two companies like a hawk.

- Cost of Living: High interest rates in the UK generally hurt retailers. But M&S has a "middle-class" buffer. Their customers tend to be slightly more insulated from the harshest economic winds.

- The Clothing Pivot: They finally stopped making "frumpy" clothes. By focusing on "staples" and high-quality denim, they’ve managed to snag a younger demographic that wouldn't have been caught dead in an M&S fitting room ten years ago.

- Operational Efficiency: They are cutting £500 million in costs. That goes straight to the bottom line.

Analysts at firms like Shore Capital and Goldman Sachs have been revising their price targets upward because M&S is finally showing "operating leverage." Basically, they are making more money on every pound spent than they used to.

The Perils of the "Middle Ground"

There is a huge risk, though. The middle ground is a dangerous place to be in retail. You have Aldi and Lidl screaming at you from the bottom on price. You have Waitrose and Selfridges at the top. M&S sits right in the crosshairs.

If the Marks & Spencer share price is going to hit new highs, they have to prove that they can maintain their "premium" status without alienating people who are feeling the pinch. Some investors worry that the current valuation is "priced to perfection." This means that if they have one bad Christmas season, or if a supply chain issue hits their Per Una line, the stock could take a massive hit.

I’ve seen this happen before.

In the early 2010s, every time M&S looked like it was recovering, it stumbled. The difference now is the leadership. They seem less interested in "brand heritage" and more interested in logistics, data, and what people actually want to wear in 2026.

Technical Analysis vs. Reality

If you look at the charts, the Marks & Spencer share price has shown some pretty classic "cup and handle" patterns over the last year. For the folks who spend their days staring at candles and moving averages, the support levels have been remarkably consistent.

But charts don't tell the whole story.

✨ Don't miss: Finding a Farewell Present for Boss That Doesn’t Feel Awkward or Cheap

The real story is in the footfall. Go into a revamped M&S on a Tuesday morning. It’s packed. That’s the kind of "boots on the ground" research that often beats a spreadsheet. The market is currently valuing MKS at a price-to-earnings (P/E) ratio that suggests they are a growth company again, not just a decaying utility. That’s a massive psychological shift for the City of London.

Navigating the Volatility

Is it a "buy"? That depends on your stomach for retail. Retail is cyclical. It’s moody. It’s sensitive to the weather (literally—if it’s too warm in October, nobody buys coats, and the Marks & Spencer share price dips).

If you're looking at MKS, you need to consider:

- The Dividend Yield: M&S reinstated its dividend, which is a huge signal of confidence. If you're an income investor, this makes the stock way more attractive.

- The Estate Transformation: Keep an eye on the news regarding store closures. It sounds bad, but in the long run, closing a failing high street shop and opening a food-only site in a retail park is usually great for the share price.

- Market Sentiment: Right now, the sentiment is "bullish." But sentiment can flip in a heartbeat if inflation spikes again or if the UK economy enters a prolonged recession.

The days of M&S being a "boring" stock are over. It’s a dynamic, aggressive retailer now.

Actionable Steps for Investors

If you are tracking or trading MKS, don't just look at the daily price. Start by downloading their latest half-year results. Look specifically at "Food LFL" (Like-for-Like) sales. If that number is growing, the company is healthy.

✨ Don't miss: Trump Steel and Aluminum Tariffs: What Really Happened to Your Costs

Check the "General Merchandise" margins. It’s one thing to sell a lot of dresses; it’s another thing to sell them without having to discount them by 50% in a January sale. High full-price sales percentages are the secret sauce for M&S.

Lastly, watch the UK consumer confidence index. M&S is a "confidence" stock. When Brits feel good about their wallets, they buy the expensive Percy Pigs and the Italian leather boots. When they don't, MKS feels the heat.

Stay skeptical. Retail turnarounds are legendary for failing just when they look the most promising. But for now, M&S is proving the doubters wrong.

To get a real handle on where things are going, keep an eye on the quarterly trading updates—usually released in January, April, July, and October. These are the "market movers." Also, follow retail analysts like Clive Black; his insights into the UK grocery sector are usually spot on and provide a layer of context you won't get from just looking at a price chart. Set up a Google Alert for "M&S Ocado dispute"—resolution there could provide a significant catalyst for the next leg of movement in the Marks & Spencer share price.