You're staring at a chart. It’s red. Not just a little red, but a "my portfolio is hemorrhaging" kind of red. Most people see that and panic. But if you’re looking for a market checkout option for short, you aren't most people. You’re looking for the exit sign that also happens to be a profit center.

Shorting isn't just "betting against" something. It’s a mechanical process. You borrow a stock you don't own, sell it at current prices, and pray—or calculate—that you can buy it back cheaper later. The "checkout" part? That’s your exit strategy. It’s the difference between a genius trade and a margin call that ruins your week. Honestly, most retail traders mess this up because they treat the exit like an afterthought. They focus so much on the entry that they forget the market doesn't care about their feelings when the price starts bouncing back.

Why the Market Checkout Option for Short is Different

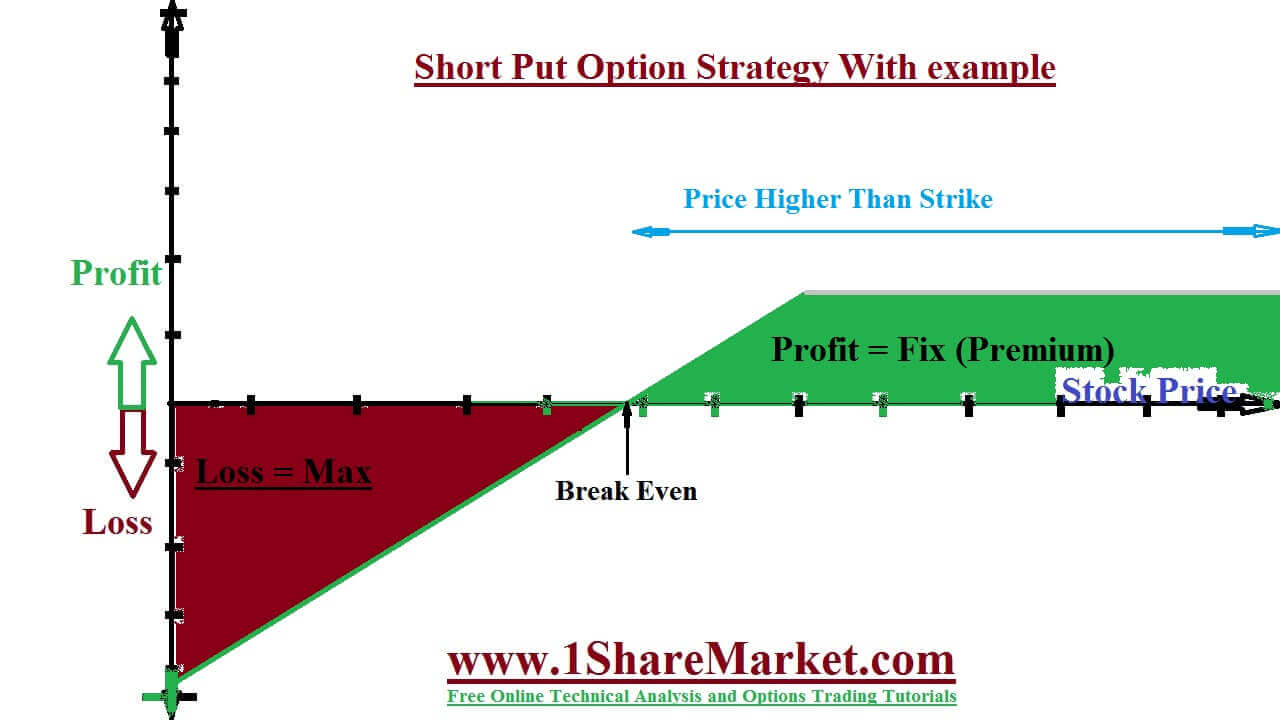

When you buy a stock (going long), your risk is capped at zero. You can only lose what you put in. When you short, your risk is theoretically infinite. If a stock goes from $10 to $1,000, you're on the hook for that spread. This makes your market checkout option for short positions infinitely more stressful than a standard sell order.

👉 See also: Price of Oil Today Per Barrel: Why Markets are Spiking Despite a Global Glut

You need to understand the "Buy to Cover" order. This is your primary checkout tool. It’s the mechanical inverse of selling a long position. You’re entering the market to purchase shares to return to the lender. If you’re using a platform like Charles Schwab or Interactive Brokers, this button is usually labeled clearly, but the timing is where the expertise comes in.

There’s a concept in psychology called "loss aversion." Humans feel the pain of a loss twice as strongly as the joy of a gain. In shorting, this is amplified. Because prices can spike faster than they fall—thanks to the "short squeeze"—your checkout window is often measured in seconds, not days. Look at what happened with GameStop (GME) in 2021. Short sellers who didn't have a pre-defined checkout option were literally wiped out. They weren't just wrong; they were trapped.

The Nuance of Liquidity

Liquidity is everything. If you're shorting a small-cap biotech firm with low daily volume, your "checkout" might not even exist when you need it. You try to buy back 5,000 shares to close your position, but there are only 200 shares available at the current price. Suddenly, you're the one driving the price up against yourself. It’s a self-inflicted wound.

Experts look at the "Days to Cover" metric. If a stock has a high short interest and a high days-to-cover ratio, the market checkout option for short sellers becomes a crowded hallway during a fire drill. Everyone is running for the same door. You want to be the one who already has their hand on the knob.

Mechanics of the Exit: Orders That Actually Work

Forget basic market orders. If you use a standard market order to check out of a short during high volatility, you're going to get "slipped." Slippage is the gap between the price you see and the price you actually get. In a fast-moving market, that gap can be 5% or 10%.

- Buy Stop Orders: This is your insurance. You set a price above the current market value. If the stock hits that price, it triggers a market order to buy and close your position. It stops the bleeding.

- Trailing Buy Stops: These are cooler. As the stock price drops (making you money), the stop price follows it down at a set distance. If the stock suddenly reverses, you "check out" with most of your profits intact.

- Limit Orders: You specify the exact price you're willing to pay to close the short. Great for precision, dangerous if the stock never quite reaches your price and then moons.

Think of it like this: A market order is "get me out now at any cost." A limit order is "I’ll leave when the price is right." In shorting, being too picky with a limit order often leads to disaster.

The Role of Margin Interest

Shorting isn't free. You're borrowing. You're paying interest on those borrowed shares every single day. This "cost to borrow" can vary wildly. If you’re shorting a "hard-to-borrow" stock, the interest rate might be 20%, 50%, or even 100% annually.

Your market checkout option for short isn't just about the stock price; it's about the clock. Every day you stay in the trade, your "break-even" point moves against you. You’re basically paying rent on a house you’re hoping collapses. If the house stays standing too long, the rent kills you even if the house eventually falls down.

💡 You might also like: Tribal installment loans direct lenders no credit check: What you actually need to know before signing

Real World Example: The 2008 Volkswagen Squeeze

In 2008, Volkswagen briefly became the most valuable company in the world. Why? Because Porsche secretly hoovered up almost all the floating shares. Short sellers thought the stock was overvalued and piled in. When they realized there were almost no shares left to buy to close their positions, the market checkout option for short players vanished.

The price went from €200 to over €1,000 in days. This wasn't because Volkswagen got better at making cars. It was because the "checkout" was physically impossible for everyone at once.

You've got to watch the "Float." If the percentage of the float that is shorted exceeds 20%, you're in "dangerous territory." If it hits 40% or 50%, you aren't trading; you're playing Russian Roulette with a fully loaded cylinder.

Psychology: The "Vulture" Stigma

There’s a weird social aspect to this. Short sellers are often seen as the villains. CEOs like Elon Musk have famously railed against them. But short sellers provide a vital service: they sniff out fraud.

Think of Enron or Wirecard. Short sellers were the ones who saw the rot before anyone else. Their "market checkout" was their reward for doing the deep forensic accounting that regulators missed. But being right doesn't mean you'll make money. You can be right about a company being a fraud and still get liquidated if the market stays irrational longer than you stay solvent. As the saying goes, the market can stay irrational a lot longer than you can stay liquid.

💡 You might also like: Trump’s Net Worth: What Most People Get Wrong

Specific Strategies for Short Exits

- Scaling Out: Don't close the whole position at once. If you're short 1,000 shares, buy back 250 at your first profit target. Buy another 250 at the next. This lowers your stress and locks in gains.

- The "V" Recovery Guard: If you see a sharp "V" shape on a 5-minute chart, that’s often short-covering. It’s not new buyers; it’s people like you panicking and hitting the checkout button. When you see that spike, you usually want to be part of it, not waiting for it to "settle down."

- Using Options as a Hedge: Sometimes the best way to manage a short is to buy a "Call" option. This gives you the right to buy the stock at a fixed price, effectively capping your risk. It’s like a secondary, guaranteed checkout option.

You've also got to consider taxes. Short-term capital gains are taxed heavily. But with shorting, you almost never have long-term gains because holding a short for over a year is incredibly expensive and risky. You're almost always playing the short-term game.

Technical Indicators to Watch

Standard indicators like the Relative Strength Index (RSI) work differently here. In a long position, an RSI over 70 means "overbought." In a short position, you're looking for an RSI under 30 (oversold) to trigger your market checkout option for short.

When a stock is "oversold," it’s like a stretched rubber band. It wants to snap back. That snap-back is your cue to leave. Don't be greedy. The last 10% of a move is usually where the most traders get wrecked.

The Hard Truths

Let's be real for a second. Shorting is hard. It is fundamentally harder than buying stocks. The math is against you (stocks tend to go up over long periods), the costs are against you (interest and fees), and the physics are against you (unlimited risk).

If you don't have a hard-coded exit plan, you're not a trader. You're a gambler. And the house loves gamblers who don't know where the exit is. Your market checkout option for short needs to be written down before you ever click "Sell to Open."

Actionable Steps for Your Short Strategy

- Check the Borrow Rate Daily: Use tools like Fintel or your broker’s internal scanner. If the rate spikes, your checkout clock just started ticking faster.

- Set Hard Stops: Never enter a short without a "Buy Stop" order already in the system. "Mental stops" are lies we tell ourselves to feel brave.

- Monitor the News Cycle: Short positions are hyper-sensitive to "good news" surprises. A surprise buyout offer can gap a stock up 40% overnight, bypassing your stop-loss entirely.

- Size Appropriately: Because of the infinite risk, short positions should generally be smaller than your long positions. If a long position goes to zero, you lose 100%. If a short position "goes to the moon," you can lose 500% or more.

- Identify the "Support" Levels: Look at historical charts. Where has the stock stopped falling before? That’s your natural checkout point. Don't expect the stock to go to zero. Very few companies actually go to zero. Most just get "cheap" and then bounce.

Shorting is a tool, not a religion. Use it when the macro environment is ugly—like during high inflation or earnings recessions—but always keep your finger on the "Buy to Cover" trigger. The best short sellers aren't the ones who catch the bottom; they're the ones who get out with their capital intact.

Focus on the mechanics. Respect the margin. Know your exit. That is how you survive the downside.