Ever stared at a stack of cash and felt like a millionaire, only to realize it barely covers a decent dinner? That is the current reality of the Malawi Kwacha. If you are looking at the Malawi currency to US dollar exchange rate today, you're seeing a number that tells a story of survival, massive devaluations, and an economy trying to catch its breath. Honestly, it’s a lot to wrap your head around if you aren't living it.

Right now, in early 2026, the official rate is hovering around 1,750 MWK per US Dollar. But if you step onto the streets of Lilongwe or Blantyre, the conversation changes. The "bureau cash rate" or the informal market is where the real action happens, often pushing closer to 1,950 MWK or more. Why the gap? Because in Malawi, the dollar isn't just money. It is a rare commodity.

The 44% Hit That Changed Everything

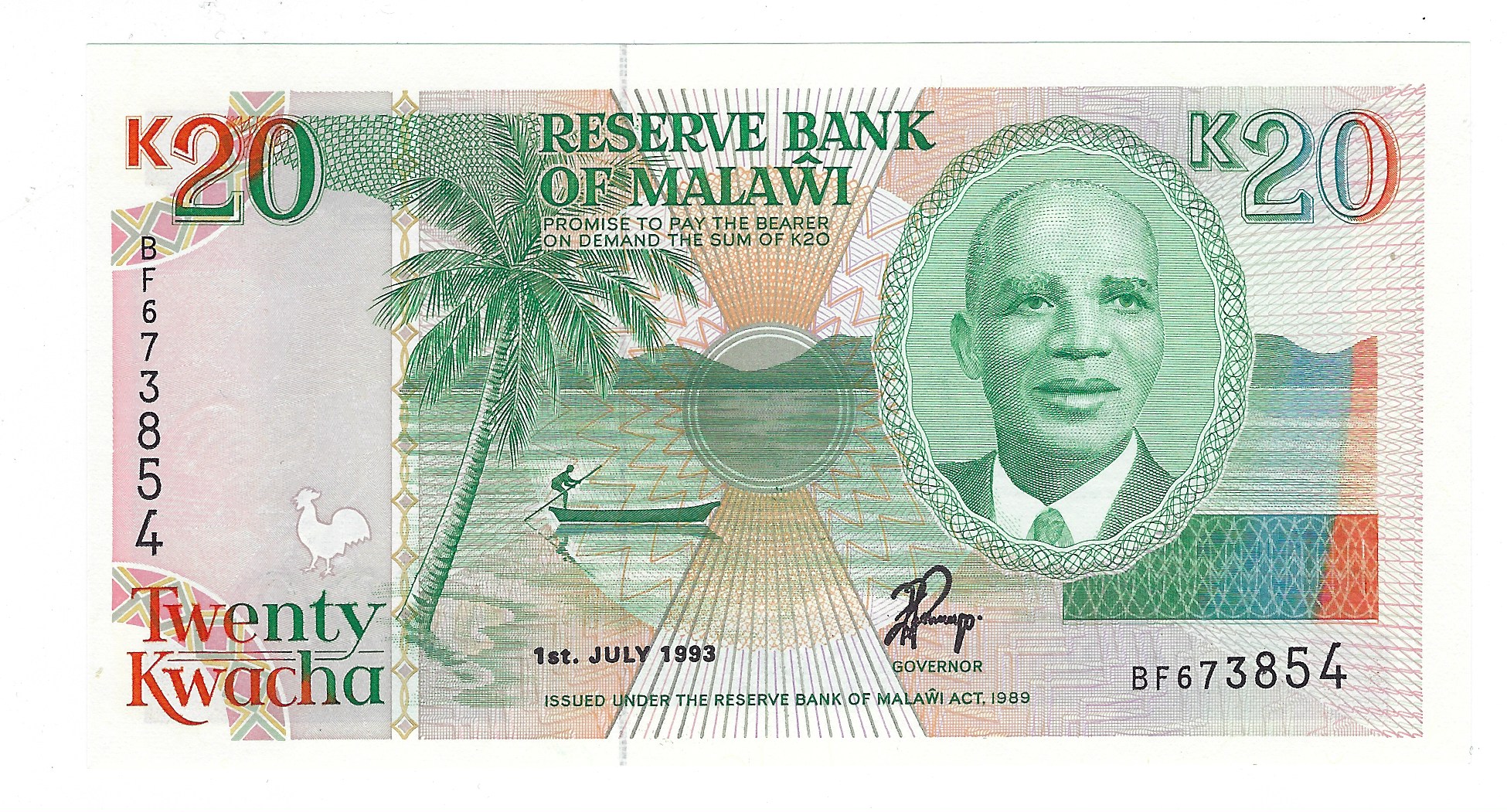

You've probably heard about the "Big Devaluation." Back in November 2023, the Reserve Bank of Malawi (RBM) dropped a bombshell by devaluing the Kwacha by a staggering 44%. People woke up and their savings were basically halved in terms of global purchasing power.

It wasn't just a random choice. The government was desperate to fix a massive trade imbalance. Malawi imports way more than it exports—think fuel, fertilizer, and medicine. When the foreign reserves ran dry, they had to "realign" the currency. Since then, the Malawi currency to US dollar relationship has been a tightrope walk.

Growth has been sluggish, around 1.8% to 2.7%. When you factor in the 2024 El Niño drought that hammered the maize crops, you see why the Kwacha is struggling. If there’s no corn to sell, there are no dollars coming in.

Why the Malawi Currency to US Dollar Rate Stays So Volatile

There is a specific "Malawian rhythm" to the currency. Usually, the Kwacha gets a little stronger during the tobacco auction season. Tobacco is Malawi's "Gold Leaf," accounting for the vast majority of its foreign exchange. But lately, even the tobacco season hasn't been enough to plug the holes.

💡 You might also like: GoPro CEO Nick Woodman: What Most People Get Wrong About His 2026 Strategy

The "Twin Deficits" Problem

Basically, Malawi is dealing with two massive leaks:

- Trade Deficit: The country buys expensive petrol and sells relatively cheap agricultural goods.

- Budget Deficit: The government often spends more than it collects in taxes, leading to a public debt that hit roughly 88% of GDP recently.

When the IMF (International Monetary Fund) paused some of its support programs in 2025, it put even more pressure on the Malawi currency to US dollar rate. Without those "donor dollars" flowing into the central bank, the Kwacha had nowhere to go but down.

Fuel Shortages and the Dollar Crunch

You might see headlines about fuel queues in Malawi. Those aren't because there’s no gas in the world. It’s because the private importers literally don't have enough US dollars to pay the suppliers. By late 2025, the state-owned National Oil Company of Malawi (NOCMA) had to take over about 60% of fuel imports just to keep the lights on. They’re trying to centralize the few dollars they have to ensure the country doesn't grind to a halt.

Realities for Travelers and Business Owners

If you're visiting Malawi in 2026, the rules have changed. It’s not just about the exchange rate anymore; it’s about where you spend it.

The government recently started ordering tourists to pay for hotel stays and services in "hard currency" like US Dollars or Euros. They’re trying to "save every dollar" to rebuild those shrinking reserves. It’s a bit of a headache for travelers who expected to use local cash for everything.

Wait, what about the black market?

Kinda everyone talks about it, but it’s risky. While you might get a better rate for your Malawi currency to US dollar exchange on a street corner, the authorities have been cracking down. There’s a new "National Anti-Forex Crime Unit" specifically designed to hunt down parallel market activities. If you get caught, you could face months of detention. Stick to the authorized bureaus or use a travel card like Wise, which uses the mid-market rate without the shady back-alley vibes.

💡 You might also like: Zomato Share Price NSE: What Most People Get Wrong

Current Costs (The "Vibe" Check)

- A mid-range dinner: Around 15,000 to 20,000 MWK (roughly $10-$12 USD).

- A liter of petrol: Expect to pay heavily, as prices are adjusted frequently to match the global dollar cost.

- The Visa Fee: As of January 3, 2026, Malawi brought back visa requirements for Americans, Brits, and many others. It’s $50 for a single entry, and you usually have to pay this in—you guessed it—US Dollars.

What to Expect Next for the Kwacha

The Reserve Bank has kept the "Policy Rate" at 26%. That is incredibly high. For context, it means borrowing money in Malawi is wildly expensive, which is a move meant to kill inflation (which is still sitting near 28%).

Will the Kwacha stabilize? Maybe. The government is betting big on "Mining, Monasteries, and Money" (well, actually Mining, Agriculture, and Tourism). There are new projects in the works to export minerals, which would provide a new stream of dollars that doesn't depend on the weather.

But for now, the Malawi currency to US dollar rate remains a reflection of a country in transition. It’s a beautiful place with some of the kindest people you’ll ever meet, but their wallet is taking a beating.

Actionable Insights for 2026

If you are managing money involving Malawi, here is the "cheat sheet":

- Carry Small Bills: If you're a tourist, keep a stash of $1, $5, and $10 USD. Since many places now require payment in dollars, they often "run out" of change in USD and will try to give you Kwacha back at a terrible rate.

- Declare Your Cash: When you land at Kamuzu International Airport, declare every cent of foreign currency. If you don't, and you try to leave with more than $5,000, they can and will confiscate it.

- Watch the Tobacco Calendar: If you're doing business, the months of April through August (tobacco season) usually see slightly better liquidity in the banks.

- Use Digital When Possible: Major hotels in Lilongwe take Visa and Mastercard. Use them to lock in the official bank rate rather than guessing with cash.

- Stay Flexible: The 2026 budget is still being tweaked. Regulations on who can hold dollars and how they can be spent change almost monthly. Check the RBM (Reserve Bank of Malawi) official website for the "TT Rate" before any major transaction.

The Kwacha's journey against the dollar is a wild ride, but understanding the "why" behind the numbers makes it a lot easier to navigate.

Next Steps for Your Trip or Business:

- Verify if your specific nationality requires the new 2026 e-Visa before booking flights.

- Set up a multi-currency account to avoid carrying large amounts of physical cash.

- Monitor the RBM official daily mid-rates to ensure you aren't being overcharged at local bureaus.