You’re sitting there with a great business idea, maybe it’s a craft brewery in Portland or a tech startup in Bangor, and suddenly you hit the wall: the Maine Secretary of State website. It looks like it hasn’t been updated since the late nineties. Honestly, navigating the Maine Secretary of State corporations portal can feel like trying to find a specific lobster trap in a thick fog.

But here’s the thing. If you don't get this right, the state doesn't care how good your business plan is. They’ll shut you down or hit you with fees that eat your lunch.

The Search Tool Trap

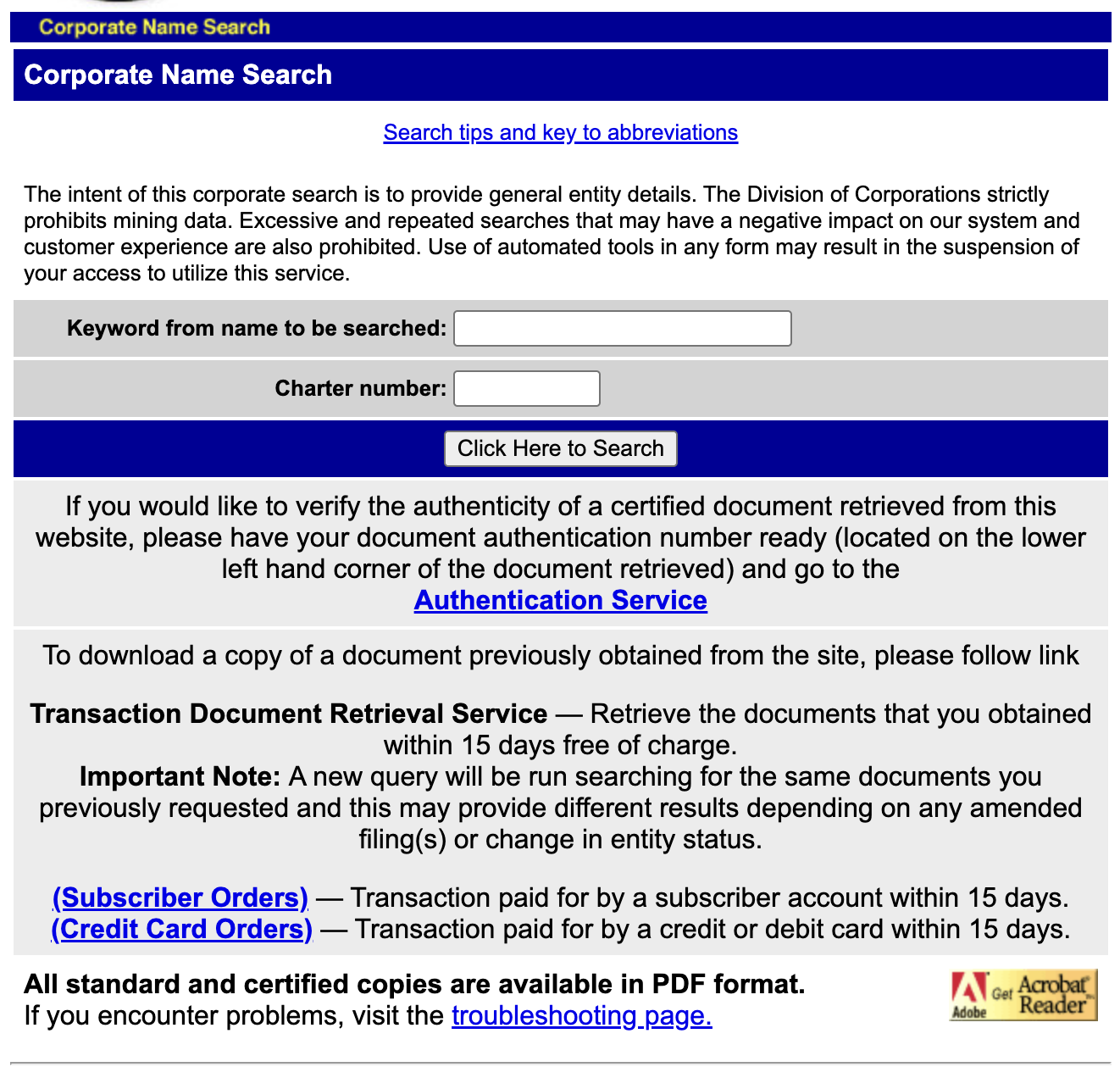

Most people go to the Interactive Corporate Services (ICRS) page and just type in their dream name. Big mistake. Maine’s search engine is... well, it’s quirky.

If you search "The Pine Tree Coffee Shop," and someone already has "Pine Tree Coffee, LLC," the system might not flag it as an exact match depending on how you type it, but the human clerk who reviews your filing sure will. They are sticklers for "distinguishability." Basically, if your name is too close to someone else's, they’ll reject your Articles of Incorporation faster than a bad clam.

You've gotta search fragments. Instead of the whole name, just search "Pine Tree." You’ll probably get 100 results (which is the limit the system shows you, by the way), but you’ll see everything that could possibly conflict.

✨ Don't miss: Starting Pay for Target: What Most People Get Wrong

Forming a Maine Corporation vs. LLC

A lot of folks get confused about which forms to grab. If you’re going for a standard business corporation, you’re looking at Title 13-C. For an LLC, it’s Title 31.

- Articles of Incorporation (Corporations): This will run you $145.

- Certificate of Formation (LLCs): This is $175.

Wait, why is the LLC more expensive? Nobody really knows, it's just the Maine way. Also, heads up: Maine is one of those rare places where you still have to mail in your initial formation documents or hand-deliver them in Augusta. You can't just do the initial setup online like you can in Delaware or Wyoming. It’s old school. You need original "inked" signatures. No DocuSign here for the state filings.

The June 1st Cliff

This is where they get you. Every single year, every business entity in Maine has to file an Annual Report.

The deadline is June 1st. Not June 15th. Not the end of the fiscal year. June 1st.

🔗 Read more: Why the Old Spice Deodorant Advert Still Wins Over a Decade Later

If you miss it? The penalty is a flat $50 late fee. That might not sound like a lot, but if you ignore it for 65 days, the Secretary of State will "administratively dissolve" your company. Your business basically ceases to exist in the eyes of the law. You lose your "Good Standing," and if you try to get a bank loan or a lease, you’re going to have a very bad day.

To fix it, you have to file a Certificate of Revival, which costs way more and involves a lot of paperwork. Just set a calendar alert for January 1st when the filing window opens.

The "Clerk" vs. "Registered Agent" Nuance

In most states, you just have a Registered Agent. In Maine, if you are a domestic corporation, you have a Clerk. If you are a foreign corporation (one formed outside of Maine but doing business there) or an LLC, you have a Registered Agent.

They do the same thing—they’re the person who gets served if you get sued—but the terminology matters on the forms. If you put "Registered Agent" on a domestic corporation form, the clerk in Augusta might send it back to you with a polite but firm rejection notice.

💡 You might also like: Palantir Alex Karp Stock Sale: Why the CEO is Actually Selling Now

Real Talk on Processing Times

As of right now, expect to wait about 15 to 20 business days for standard processing. If you’re in a rush because you need an EIN to open a bank account, you can pay for expedited service.

- 24-hour processing: Extra $50.

- Immediate (while you wait): Extra $100.

If you’re driving to Augusta to do this in person, the Bureau of Corporations, Elections and Commissions is located at the Burton M. Cross Building. Their customer service phone hours are a bit weird too—usually 10:00 a.m. to 5:00 p.m., even though the office opens at 8:00 a.m.

Don't Forget the "Assumed Name"

If you incorporate as "Portland Ventures Inc." but you want to put "The Holy Grail of Sandwiches" on your sign, you have to file a Statement of Intention to do Business under an Assumed Name.

In Maine, you actually have to file this at the municipal level (with the town clerk) and sometimes with the Secretary of State depending on the entity type. It costs about $10-$20. If you don't do this, you're technically in violation of state law, and it can make opening a business bank account a total nightmare.

What to Do Next

If you're ready to get moving, here is your checklist:

- Do a deep search: Don't just search your full name on the Maine SOS site. Use keywords and fragments to find similar-sounding businesses.

- Download the right PDF: Go to the "Business Corporations" or "Limited Liability Companies" section of the SOS website. Make sure the form says "2024" or later at the bottom.

- Get a checkbook: Since you have to mail these in, you'll need a physical check or money order. They don't take credit cards over the phone for initial filings.

- Find a Clerk/Agent: Make sure you have someone with a physical Maine address (not a P.O. Box) to serve as your registered agent.

- File your Annual Report early: If you already have a business, go to the online portal on January 1st and get it over with. The $85 fee for domestic entities is much cheaper than the $135 you'll pay if you're even one day late.