You might be looking for a ticker symbol that doesn’t exist anymore. Honestly, it’s a bit of a trip. For decades, Magellan Midstream Partners LP was the "boring" gold standard for income investors, a reliable cash cow that specialized in moving refined petroleum products and crude oil across the heart of America. If you owned it, you probably loved those quarterly distributions. But then, things got messy.

In late 2023, the Tulsa-based giant was swallowed up. ONEOK, Inc. (OKE) stepped in with a massive $18.8 billion deal that effectively ended the reign of Magellan as a standalone entity. It wasn't just a simple name change on your brokerage statement, though. The deal sparked a legitimate civil war among unit holders. Some people were thrilled about the premium; others were absolutely livid about the tax bill.

Why the Magellan Midstream Partners LP Merger Felt Like a Betrayal

To understand why people are still talking about this, you have to understand what made Magellan Midstream Partners LP special. It was a Master Limited Partnership (MLP). For the uninitiated, that's basically a business structure that doesn't pay corporate taxes but passes its income directly to "unit holders."

Investors didn't just buy MMP for the growth. They bought it for the K-1 tax forms and the yield.

When the ONEOK deal was announced, it triggered a "recapture" of all those tax-deferred distributions investors had been enjoying for years. Basically, the IRS came knocking. For long-term holders, this meant a massive, unexpected tax hit that often wiped out the immediate gains from the sale price. It’s one of those instances where a "good" business move on paper felt like a slap in the face to the people who had funded the company for twenty years.

Aaron Milford, the CEO at the time, argued the move was necessary for "diversification." He wasn't entirely wrong. The energy landscape is shifting. Having a massive footprint in refined products (like gasoline and diesel) is great, but the future looks a lot more like natural gas and renewables. By joining ONEOK, the assets of the former Magellan Midstream Partners LP became part of a much more diversified energy powerhouse.

The Infrastructure Nobody Sees

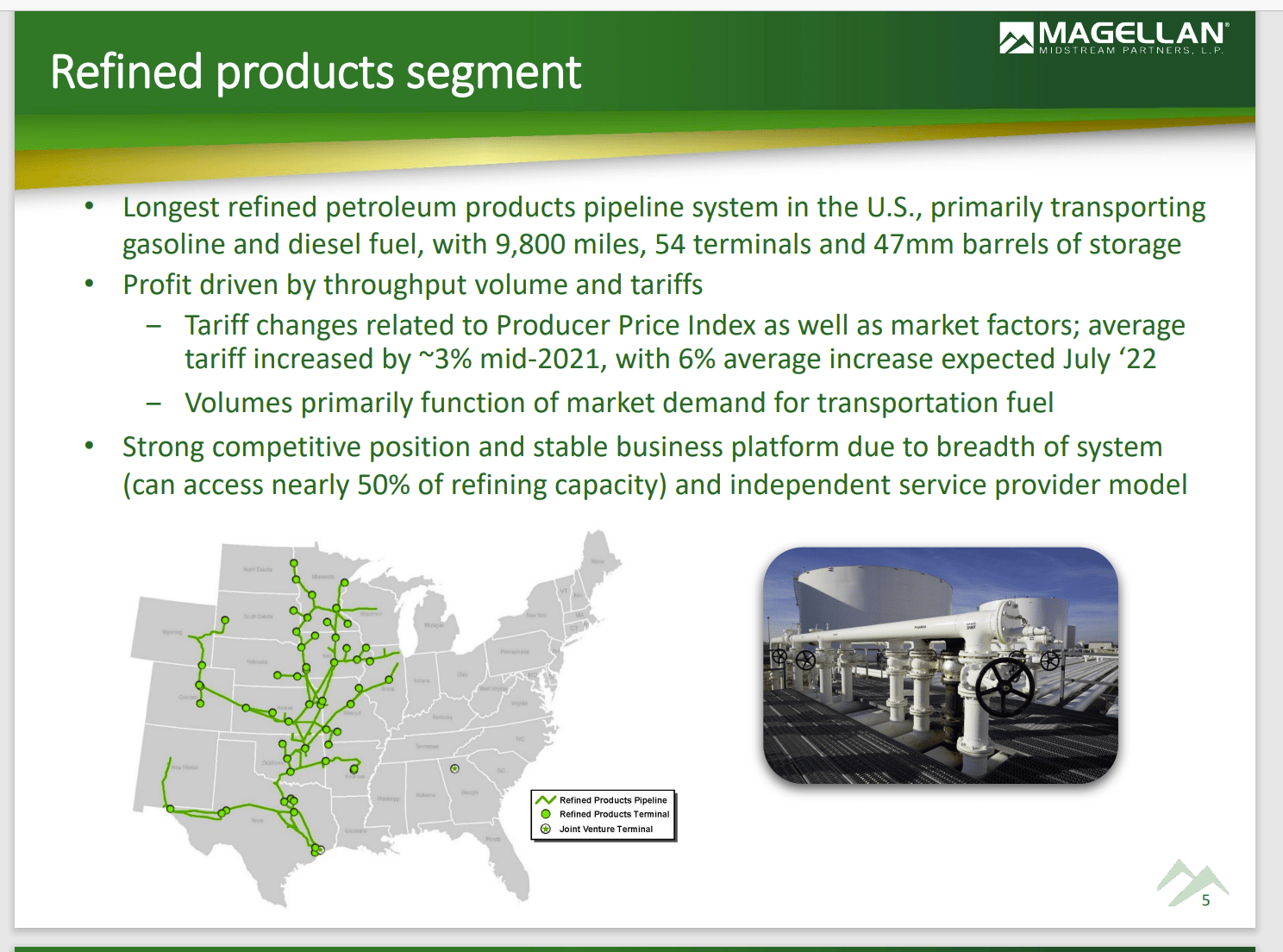

We’re talking about a 9,800-mile refined products pipeline system. That is an insane amount of pipe. It connects nearly half of the refining capacity in the continental United States. If you live in the Midwest, there is a very high probability that the gas you put in your car this morning flowed through a pipe once owned by Magellan.

They also controlled about 54 terminal facilities.

📖 Related: The Truth About the Earth City MO UPS Hub and Your Missing Package

These aren't just storage tanks. They are the nervous system of the American economy. While everyone was obsessed with tech stocks and AI, Magellan was quietly charging a fee for every barrel of oil that moved from point A to point B. It was a toll-booth model. It worked. It worked so well that the company maintained one of the highest credit ratings in the midstream sector for a long time.

The Tax Nightmare: Recapture and the K-1

Most people don't realize that when you sell an MLP—or when it’s bought out—you don't just pay capital gains. You deal with "ordinary income" rates on the depreciation you've claimed over the years. This is the "recapture."

Let’s say you bought Magellan Midstream Partners LP at $40 and sold it (via the merger) for $67. You might think your profit is $27. But if you’ve received $15 in distributions over the years, the IRS might view your "basis" as $25. Suddenly, you're paying taxes on a much larger chunk of money than you actually "made" in the final sale.

This is why the 2023 vote was so contentious.

📖 Related: Alexandra Fuente: What Most People Get Wrong About the Woxer Founder

A significant group of investors, led by firms like Energy Income Partners (EIP), actually tried to block the deal. They argued that the tax burden on individual investors was so high that the "premium" offered by ONEOK was basically an illusion. They lost. The deal closed in September 2023.

Is the Legacy Still Alive?

If you were a fan of the Magellan business model, you're now a ONEOK shareholder (unless you sold).

Is it the same? Not really.

ONEOK is a C-Corp. You get a 1099 now, not a K-1. For a lot of people, that’s actually a relief. No more waiting until late March to file your taxes because the MLP paperwork was lagging. But you also lose that specific tax-shielded income structure that made Magellan Midstream Partners LP a staple in retirement accounts.

🔗 Read more: Exchange Rate Dollar to Naira in Black Market Today: What You Need to Know

The assets are still there, though. The Longhorn and BridgeTex pipelines are still moving crude. The refined system is still the backbone of the central U.S.

What You Should Do Now

If you are still holding the OKE shares you received from the Magellan Midstream Partners LP buyout, you need to be looking at your portfolio's balance. ONEOK is much more sensitive to natural gas prices than Magellan ever was. Magellan was a "volume" play; ONEOK is a bit more complex.

- Check your cost basis. Many brokerages struggled to calculate the exact basis after the merger because of the complex MLP rules. Don't trust the automated number blindly.

- Look at the midstream sector broadly. If you miss the MLP structure, there are still players like Enterprise Products Partners (EPD) or Western Midstream (WES).

- Consult a tax professional who actually knows what "Section 751 gain" means. If you just take your 1099/K-1 to a generic tax prep chain, they will likely mess it up.

The era of Magellan Midstream Partners LP as an independent entity is over, but it serves as a massive case study in why the "structure" of an investment often matters just as much as the "business." It was a great company that ended in a way that left a sour taste in many mouths. That’s the reality of the energy business—it’s never as simple as a ticker symbol and a price graph.

If you're still tracking the old Magellan assets, keep a close eye on ONEOK’s quarterly earnings reports, specifically the "Refined Products" segment. That is where the ghost of Magellan lives. Watch the volume throughput. If those numbers dip, it tells you more about the health of the American consumer than almost any other economic indicator.

The transition from MMP to OKE was a turning point for the midstream industry. It signaled that the days of small, focused MLPs might be numbered, giving way to massive, diversified corporations that can weather the energy transition. Whether that's good for your wallet depends entirely on your tax bracket and how long you plan to hold.

Check your 2023 and 2024 tax filings for any carryover losses from the merger. Often, the "passive losses" you accumulated while owning Magellan can be used to offset the gain from the sale, but you have to actively claim them. Most people leave money on the table because they don't realize those old losses are "unlocked" once the entity is fully liquidated or sold.