When someone mentions madison square garden stock, they usually think they’re buying a piece of a basketball team or a concert venue. Honestly, it’s way more complicated than that. You aren't just buying "The Garden." You’re actually stepping into a complex web of corporate spin-offs, real estate plays, and sports team valuations that would make a Wall Street analyst’s head spin.

James Dolan, the man everyone loves to talk about, basically chopped his empire into three distinct pieces over the last few years. If you buy the wrong ticker, you might end up owning a giant LED ball in Las Vegas instead of the New York Knicks.

Let's break down what's actually happening with these stocks in early 2026.

The Three-Headed Monster: Which Stock is Which?

You can't just search for "MSG" on your broker app and call it a day. There are three primary ways to play this, and they behave very differently.

1. Madison Square Garden Sports Corp. (MSGS)

This is the "pure play" sports stock. When you buy MSGS, you are essentially buying the New York Knicks and the New York Rangers. Period. You don't own the building they play in—you own the teams.

As of January 16, 2026, MSGS has been on an absolute tear, hitting all-time highs around $289.61. Why? Because professional sports teams are basically "trophy assets." There are only 30 NBA teams and 32 NHL teams. They don't make more of them.

2. Madison Square Garden Entertainment Corp. (MSGE)

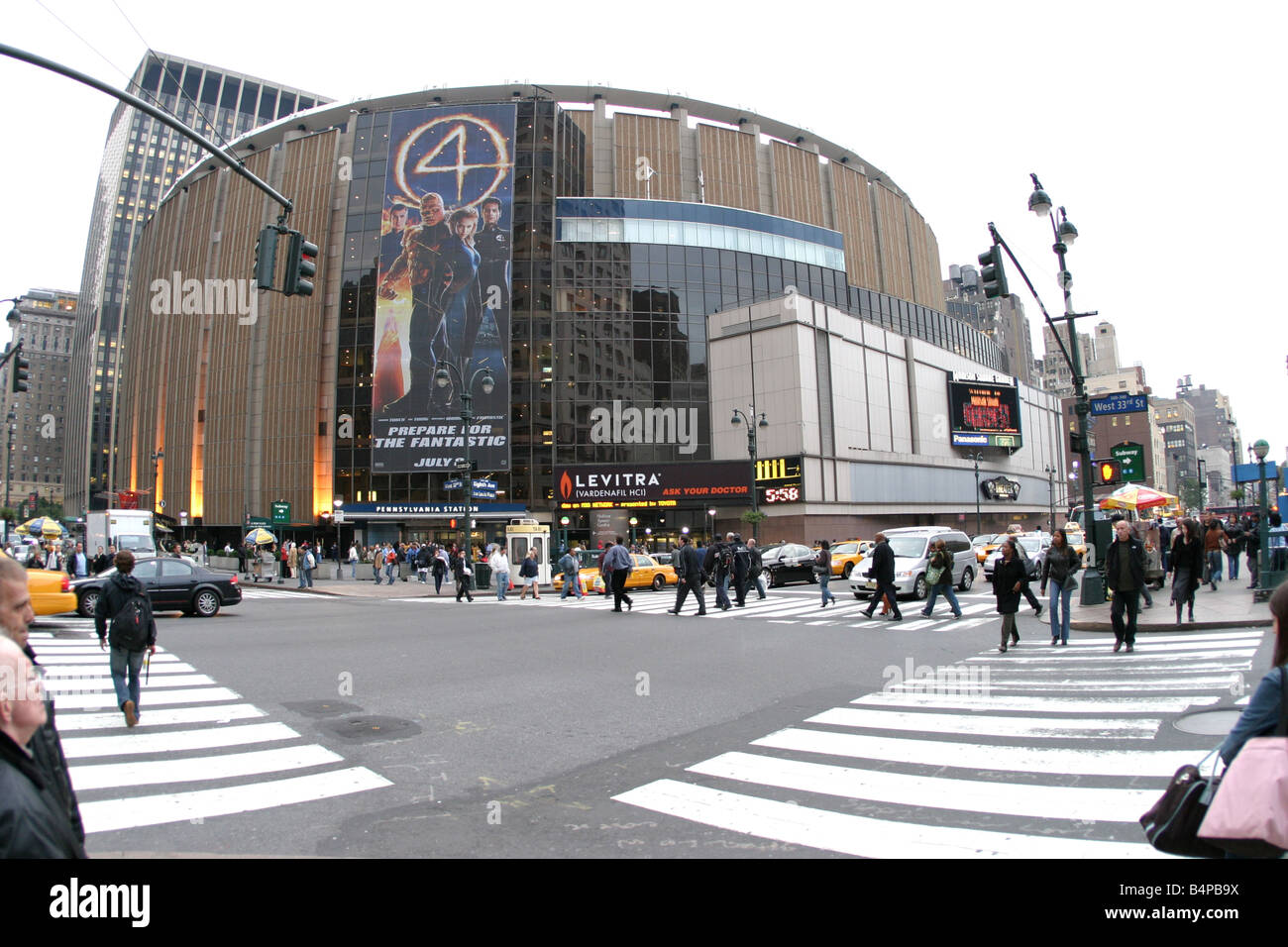

This is the one that actually owns the "bricks and mortar." If you want to own the physical Madison Square Garden Arena, Radio City Music Hall, and the Beacon Theatre, this is your ticker.

💡 You might also like: Do You Have to Have Receipts for Tax Deductions: What Most People Get Wrong

In the first quarter of fiscal 2026, MSGE reported revenues of $158.3 million, which was up about 14% from the year before. They’ve been aggressively buying back their own stock—about $205 million worth since they spun off in 2023. At a current price of roughly **$59.48**, it’s a much more affordable entry point than the sports stock, but it carries the heavy overhead of maintaining massive New York City real estate.

3. Sphere Entertainment Co. (SPHR)

This is the wild card. Formerly part of the MSG family, it’s now the entity that owns the Sphere in Las Vegas and MSG Networks. It’s high-risk, high-reward tech-heavy entertainment. If the Sphere concept goes global, this stock flies. If it stays a one-hit wonder in Vegas, it’s a different story.

Why the Sports Stock (MSGS) is Defying Gravity

It's kinda wild. MSGS is trading at nearly $290, yet the company actually reported a net loss of **$8.8 million** for the quarter ending September 30, 2025.

How does that work?

Investors in madison square garden stock (specifically the sports side) don't care about quarterly earnings as much as "Private Market Value." Basically, they’re betting that if the Knicks were sold tomorrow, they’d go for $7 billion or more.

- Scarcity: You can't just start a new NBA team in Manhattan.

- Media Rights: Even though local media deals are getting messy, the big national NBA and NHL TV contracts keep the floor very high.

- Betting Partnerships: In early 2026, the Rangers even named Polymarket as their "Official Prediction Market Partner." This kind of stuff was unheard of five years ago.

The "Dolan Discount" and Real Estate Risks

There is always a "but."

📖 Related: ¿Quién es el hombre más rico del mundo hoy? Lo que el ranking de Forbes no siempre te cuenta

For years, analysts have talked about the "Dolan Discount." This is the idea that the stock trades for less than its assets are worth because investors are wary of how James Dolan runs the show. He has total control through Class B shares, meaning regular shareholders have basically zero say in what happens.

Then there's the MSG Arena itself. MSGE owns it, but they don't have a permanent permit to stay there. The New York City Council only gave them a five-year operating permit back in 2023. Every few years, there’s a political fight about moving the arena to make way for a better Penn Station.

If you're holding MSGE, that permit uncertainty is a constant shadow.

What the Numbers Actually Say (Q1 2026 Data)

If you look at the fiscal 2026 first-quarter results, the "Entertainment" side (MSGE) is actually seeing a record number of concerts. People are spending like crazy on live experiences.

Food, beverage, and merchandise revenues jumped 20% to $22.8 million in a single quarter for the entertainment company. That's a lot of $15 beers and $50 t-shirts. On the sports side, ticket renewal rates for the Knicks and Rangers are sitting at a staggering 94%. People are locked in.

| Metric (MSGS) | Value (Approx. Jan 2026) |

|---|---|

| Current Price | $289.61 |

| 52-Week High | $289.65 |

| Market Cap | ~$6.94 Billion |

| Revenue (Q1 '26) | $39.5 Million |

Notice the revenue for the sports corp looks low? That's because the NBA/NHL seasons haven't fully ramped up their revenue reporting in the summer/early fall quarter. It’s a seasonal business.

👉 See also: Philippine Peso to USD Explained: Why the Exchange Rate is Acting So Weird Lately

Is it a Buy or a "Wait and See"?

Honestly, it depends on what you're looking for.

If you want a safe haven for wealth, MSGS (Sports) behaves almost like a piece of fine art or a gold bar. It’s a luxury asset. It rarely goes on sale, and it usually trends upward because the value of sports franchises has historically outperformed the S&P 500.

If you’re looking for a recovery play, MSGE (Entertainment) is the one. They are the ones benefiting from the "experience economy." As long as people keep wanting to see Billy Joel or the Rockettes at Radio City, they have a steady stream of cash. They even added more performances of the Christmas Spectacular this year—215 shows compared to 200 last year.

The biggest mistake? Buying madison square garden stock without realizing you’re actually buying a specific slice of the pie.

Actionable Insights for Investors:

- Check the Ticker Twice: Make sure you aren't buying SPHR if you actually want the Knicks. They are separate companies now.

- Watch the Debt: MSGS recently updated its credit facilities for the Knicks and Rangers, providing up to $425 million in liquidity. They have the cash to survive, but interest rates still matter.

- Monitor the Penn Station Situation: Any news about "MSG relocation" will tank the MSGE stock price, even if a move is a decade away.

- Look at the "Sum of Parts": Many experts believe if you added up the value of the teams and the buildings, the stocks should be trading 20-30% higher than they are today. The "gap" is your potential profit—or your risk.

Invest with your head, not just because you’re a fan of the team. Owning the stock won't get you better seats at the game, but if the Knicks finally win a ring, the market might just give you a very nice payout.