Moving to a new state just to save a buck on taxes sounds like a dream, doesn't it? You pack the U-Haul, head for the border, and suddenly your paycheck looks a whole lot fatter. But honestly, the reality of low state income tax states is way messier than those viral TikToks make it seem. People obsess over the headline number—that beautiful 0% or a tiny flat rate—without looking at the "hidden" ways states actually keep the lights on.

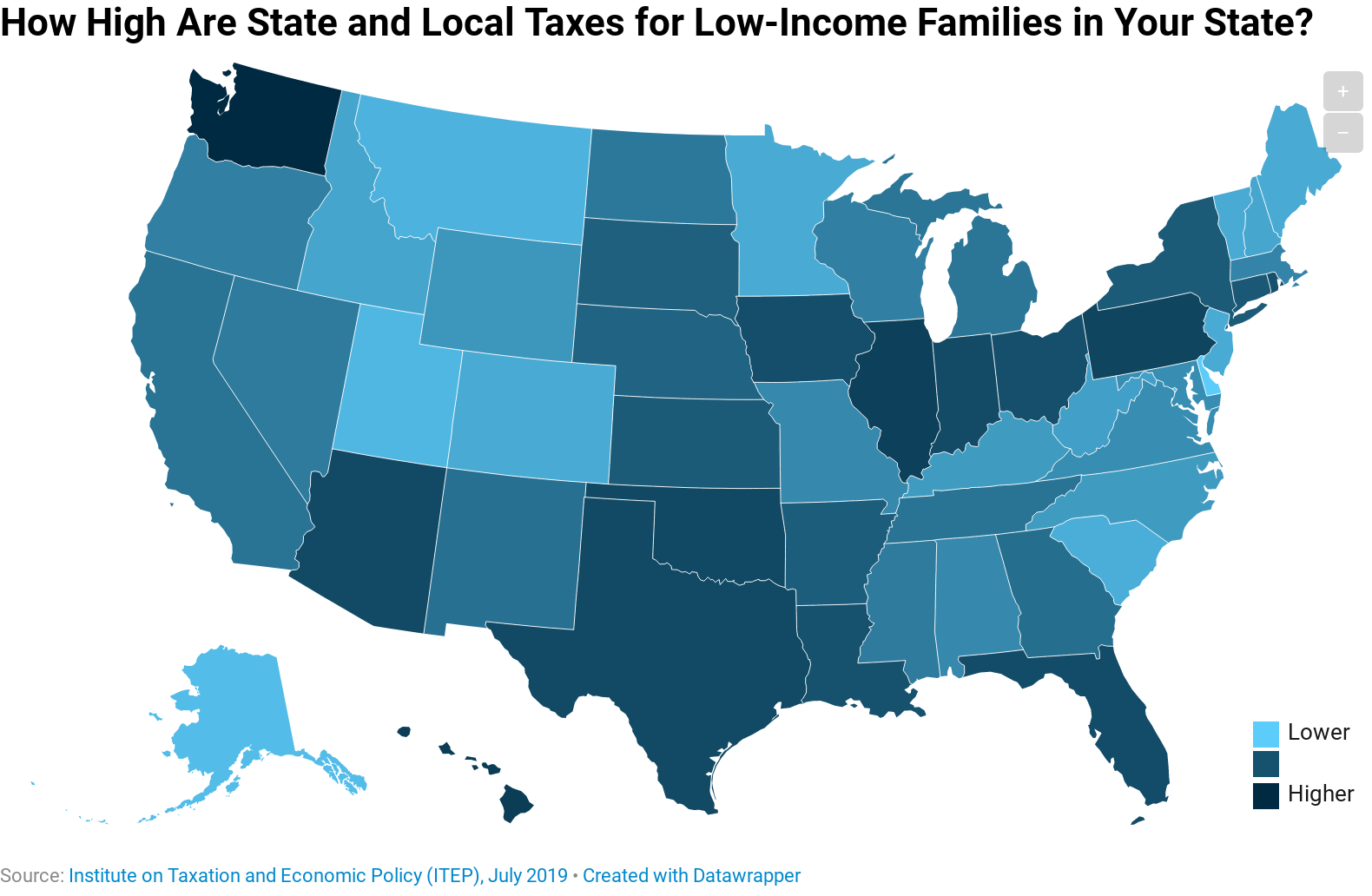

The truth is, Uncle Sam isn't the only one with his hand in your pocket. States that don't tax your income still need to pay for roads, schools, and police. They just get creative about it. If you aren't careful, you might trade a 5% income tax for a 10% sales tax or property taxes that make your eyes water.

The "Big Nine" and why they aren't all equal

Most people looking for low state income tax states immediately point to the heavy hitters. You know the ones: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming. New Hampshire joined the club recently too, as they've been phasing out their tax on interest and dividends.

Texas is a classic example of the "tax swap" phenomenon. Sure, you’ll see exactly zero dollars taken out of your paycheck for the state. That feels amazing on payday. But then you buy a house. According to the Tax Foundation, Texas has some of the highest effective property tax rates in the entire country. You aren't really "escaping" taxes; you're just paying them to the county assessor instead of the Department of Revenue.

Then there’s Washington. No income tax there either, but they have a hefty sales tax and a recently implemented capital gains tax that hit high earners. It’s a specialized ecosystem.

💡 You might also like: Cooper City FL Zip Codes: What Moving Here Is Actually Like

Alaska is the true outlier. It’s basically the only state that's actually "cheap" across the board because of its massive oil wealth. They don’t have a state income tax or a state sales tax, though some local municipalities might grab a few percent at the register. They even pay you to live there via the Permanent Fund Dividend. But, you know, you have to be okay with minus 40-degree winters and paying $8 for a gallon of milk in Juneau. There’s always a trade-off.

The rise of the "Flat Tax" states

If you can't get to zero, the next best thing is a flat tax. This is where things are getting interesting in 2026. States like Arizona, Idaho, and Mississippi have shifted toward a single-rate system to compete with the "no-tax" states.

- Arizona moved to a 2.5% flat tax, which is incredibly low compared to neighbors like California.

- North Carolina has been aggressively cutting its rate, aiming for a floor that makes it a magnet for businesses leaving the Northeast.

- Indiana stays steady around 3.05%, though local county taxes can bump that up a bit.

Don't ignore the "Cost of Living" trap

You’ve got to look at the math. A 0% tax rate in Florida might look better than a 4% rate in Ohio, but if your home insurance in Florida just tripled because of hurricane risk, you're actually deeper in the red.

I’ve seen people move from New York to Tennessee thinking they’d save a fortune. They did save on income tax, but they forgot to account for the fact that Tennessee has the highest combined state and local sales tax in the nation, often hitting nearly 10%. Every time you buy a car, a laptop, or even a bag of chips, you’re paying the state its "income tax" in installments.

📖 Related: Why People That Died on Their Birthday Are More Common Than You Think

Lifestyle matters here. If you’re a high-earner who spends very little, a state with no income tax and high sales tax is a goldmine for you. You keep the cash and avoid the "consumption" tax. But if you're a family of five buying tons of groceries and clothes, a state with a modest income tax but no sales tax—like Oregon—might actually leave more money in your bank account at the end of the month.

Why retirees see things differently

Retirees are the primary hunters of low state income tax states, but their checklist is different. Many states that do have an income tax actually exempt Social Security or pension income.

- Pennsylvania is a weird one. They have a flat income tax, but they don't tax retirement distributions or Social Security at all.

- Illinois—often dragged for its high taxes—actually doesn't tax most retirement income.

- Florida remains the king for retirees, not just because of the 0% tax, but because they have "homestead" exemptions that cap how much your property taxes can rise each year once you’re settled in.

The remote work "Nexus" nightmare

If you're a remote worker trying to move to a low-tax state, listen closely: it’s not always about where you sleep. It’s about where your employer is located.

New York, for instance, has a "convenience of the employer" rule. If you work for a company based in Manhattan but you decide to move to a beach in Florida to "save on taxes," New York might still try to tax every cent of your income unless your employer requires you to be in Florida.

👉 See also: Marie Kondo The Life Changing Magic of Tidying Up: What Most People Get Wrong

This has led to some massive legal battles. Most states follow the "physical presence" rule, meaning you pay tax where your feet are on the ground. But before you move to Wyoming to escape California's 13.3% top bracket, make sure your HR department knows how to handle the "nexus" of your employment. Otherwise, you might end up owing money to two different states, which is a paperwork nightmare no one deserves.

What you should actually do before moving

Don't just look at a map and pick a state with a 0% label. You need a "Total Tax Burden" calculation. This includes:

- Effective Property Tax: Look at the actual rate per $1,000 of home value, not just the percentage.

- Sales Tax Exemptions: Does the state tax groceries? Prescription meds? This makes a huge difference for your monthly budget.

- Fuel Taxes: If you have a 40-minute commute in a state like Pennsylvania or California, the gas tax will eat you alive.

- Insurance Costs: Low-tax states in the South often have higher insurance premiums for homeowners and autos due to weather risks.

Check out the "Tax Burden by State" reports from the Tax Foundation or the Federation of Tax Administrators. They rank states by the percentage of total income that goes to all state and local taxes. Often, you'll find that "middle-of-the-road" states like Wyoming or Nevada actually offer a better deal than "zero-tax" states with high hidden costs.

Final Checkpoint

Before you sign a lease or a mortgage, run your specific numbers. Take your gross income, your expected spending on taxable goods, and the value of the home you want to buy. Plug them into a calculator that accounts for local levies.

The goal isn't just to find low state income tax states; it's to find the lowest cost of existence for the lifestyle you actually want to live. Sometimes, paying a 3% income tax is the cheaper option if it means your car registration isn't $800 a year and your home insurance is affordable.

Actionable Next Steps:

- Calculate your current "Total Tax": Add up what you paid in state income tax, property tax, and estimated sales tax over the last 12 months.

- Verify your "Employer Nexus": Ask your HR department if they have a physical presence in your target state and how they handle out-of-state withholding.

- Audit the "Hidden" fees: Look up the cost of vehicle registration and the average homeowners insurance premium in the specific zip code you're eyeing.

- Consult a Multi-State Tax Pro: If you earn over $150k or have complex investments, pay a CPA for a one-hour consultation to model your specific move. It’s cheaper than a surprise tax bill from your old state.