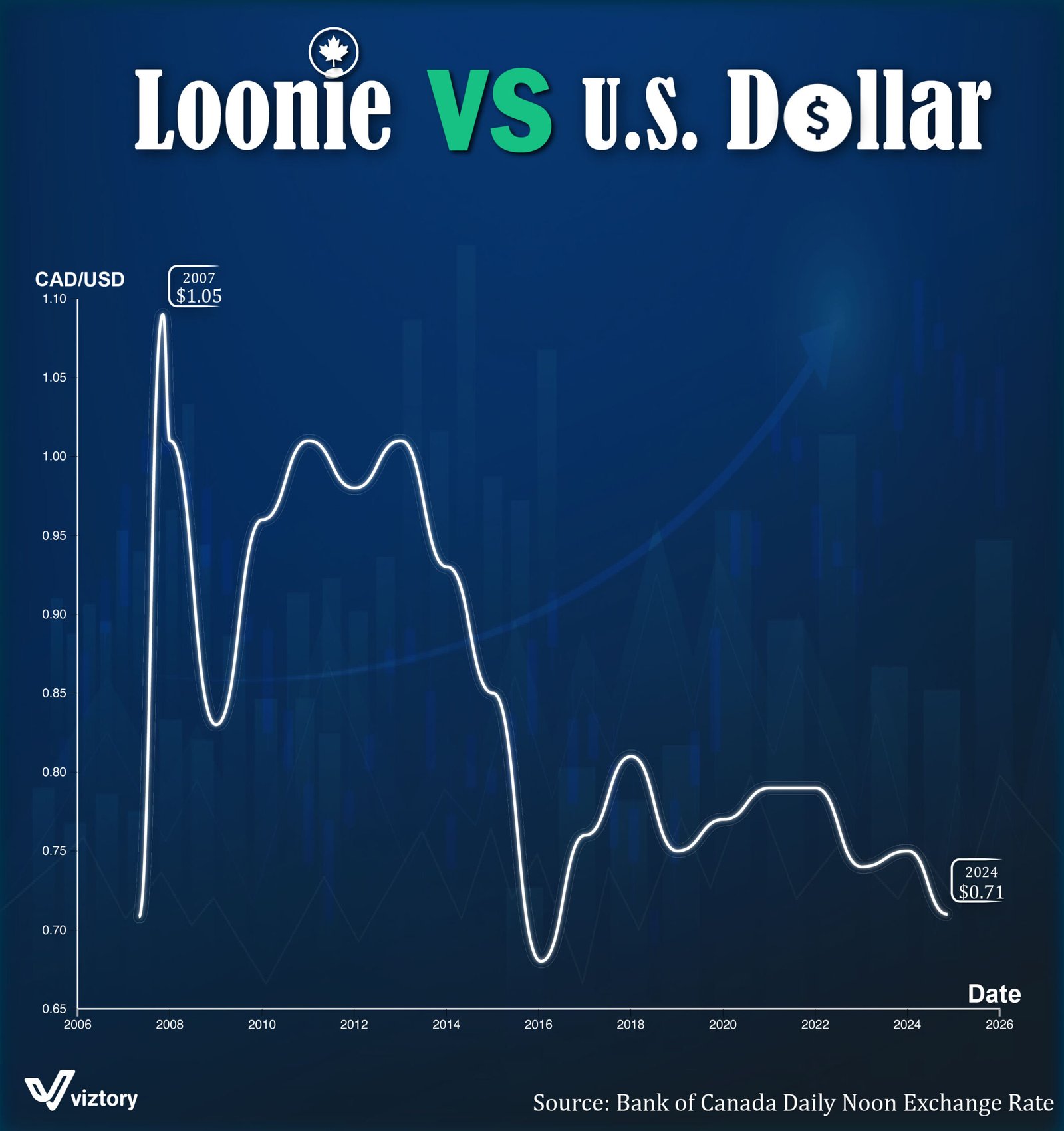

If you’ve looked at the exchange rate lately, you’ve probably felt that familiar sting. Seeing the loonie hover around the 72-cent mark isn't exactly a thrill for anyone planning a Disney trip or ordering parts from across the border. Honestly, it’s been a rough ride. As of January 13, 2026, the loonie vs us dollar battle is basically a tug-of-war between a resilient U.S. economy and a Canadian landscape that’s trying to find its footing amidst some pretty serious trade drama.

But here’s the thing. Most people look at the headline number and assume Canada is just falling behind. It’s way more complicated than that. You’ve got a massive CUSMA review looming in July, oil prices that can't seem to stay in a groove, and two central banks—the Bank of Canada and the Fed—playing a very high-stakes game of chicken with interest rates.

The CUSMA Cloud and the "Trump Effect"

Let’s be real: the 800-pound gorilla in the room is trade. We’re officially in the year of the CUSMA review. Back in late 2025, U.S. tariffs on Canadian goods like steel, aluminum, and even lumber started putting a serious dent in the loonie’s value. By October 2025, the average tariff on Canadian exports had jumped from basically nothing to 5.9%.

That hurts. It’s not just a number on a spreadsheet; it’s a direct tax on the Canadian economy.

President Trump has been pretty vocal about wanting more concessions from Ottawa. He’s complained about dairy supply management—again—and suggested the U.S. doesn't really "need" anything from Canada. Harsh? Yeah. Effective at scaring investors? Absolutely. When people are worried about the "backbone" of North American trade being dismantled, they don't exactly rush to buy Canadian dollars.

"Canada is dealing with the heavy cloud of US trade uncertainty, a cloud that is very unlikely to disperse anytime soon," noted Douglas Porter, chief economist at BMO Economics.

He’s right. This isn’t a quick fix. We’re looking at months of posturing before the formal review starts in July. This uncertainty is acting like a lead weight on the loonie, keeping it from making any real gains even when other economic data looks okay.

👉 See also: Why Toys R Us is Actually Making a Massive Comeback Right Now

Why the Bank of Canada is Staying Put (For Now)

For a while there, everyone thought the Bank of Canada (BoC) would just keep cutting rates. We saw 275 basis points of cuts starting back in mid-2024. But now? Governor Macklem and the team have hit the pause button.

The BoC's policy rate is sitting at 2.25%, and most experts think it’s going to stay there for the rest of 2026.

Why? Because inflation is being stubborn. Even though the economy feels sluggish, the prices of essential goods are still creeping up faster than the 2% target. Plus, Mark Carney—who’s back in the mix as Prime Minister—just passed a budget focused on infrastructure and defense. That kind of government spending usually means interest rates have to stay higher for longer to prevent the economy from overheating.

Meanwhile, the U.S. Federal Reserve just cut their rates to a range of 3.5% to 3.75% in December.

Notice the gap?

Usually, when Canadian rates are lower than U.S. rates, the loonie drops. Investors want the higher return they get in the States. But if the Fed keeps cutting and the BoC stays steady, that gap narrows. That’s actually a good thing for the loonie. Some analysts, like Sarah Ying at CIBC Capital Markets, actually think the loonie could climb back toward C$1.35 (74 cents USD) by the end of the year because of this narrowing spread.

✨ Don't miss: Price of Tesla Stock Today: Why Everyone is Watching January 28

The Oil Factor: Mid-$50s is the New Normal

If you want to know where the loonie is going, you usually just look at a chart of WTI crude oil.

Right now, it’s not a pretty picture. WTI is stuck in the mid-$50s per barrel. We’re talking $56 to $58. That’s about 20% lower than where it was this time last year. There’s a global supply glut, and China’s demand for energy is… well, lackluster is a nice way to put it.

There’s also a weird new competitive threat: Venezuela.

With the U.S. potentially ramping up imports of Venezuelan crude, Canadian producers in the Gulf Coast market are looking over their shoulders. Canadian oil is still competitive, but more supply on the market generally means lower prices.

Wait, there's a silver lining. The Trans Mountain Pipeline expansion has actually helped. It allowed Alberta producers to send more oil to Asia, which kept the "spread" (the price difference) between Canadian heavy oil and U.S. light oil from getting too wide. Without that, the loonie would probably be in much worse shape right now.

What Most People Get Wrong About the Exchange Rate

People love to say "the loonie is weak."

🔗 Read more: GA 30084 from Georgia Ports Authority: The Truth Behind the Zip Code

Actually, the U.S. dollar is just incredibly strong. It’s the "safe haven" currency. When the world feels chaotic—and with midterms coming up in the U.S. and trade wars brewing—everyone runs to the greenback.

It’s not necessarily that Canada is doing a bad job. It’s that the U.S. economy is a powerhouse that won’t quit. Their GDP growth is projected at 2.3% for 2026, while Canada is struggling to hit 1.4%. When you’re the smaller neighbor, you’re always going to feel that gravity.

Real-World Impacts You’re Seeing Right Now

- Gas Prices: Have you noticed they’re up even though oil is down? That’s the weak loonie at work. Since oil is priced in USD, we pay a "currency tax" at the pump.

- Grocery Bills: A huge chunk of our winter produce comes from the States. Every time the loonie drops a cent, your strawberries get more expensive.

- Tech and Cars: Most of this stuff is priced in USD. If you’re eyeing a new MacBook or a truck, you’re effectively paying a premium because our dollar doesn't go as far.

The Path Forward: What Happens Next?

So, where do we go from here?

If you're waiting for an 80-cent loonie, don't hold your breath for 2026. The combination of trade uncertainty and lackluster oil prices makes that a tough climb. However, there’s a real chance of a modest recovery in the second half of the year.

Once the CUSMA review gets moving and we get some clarity on the rules of the game, some of that "fear premium" might leave the market. If the Fed continues to slow-walk their rates down while the BoC stays firm at 2.25%, the loonie could realistically claw its way back to the 74 or 75-cent range.

It’s going to be a bumpy ride. Expect volatility.

If you're a business owner, now is the time to look at currency hedging. If you're a traveler, maybe consider exploring more of Canada this summer—or look at destinations where the loonie still has some muscle, like parts of Southeast Asia or South America.

Actionable Steps for Navigating the Loonie’s Fluctuations:

- Lock in rates for big purchases: If you know you have a major U.S. expense coming up in six months, talk to your bank about a forward contract. Don't gamble on the "hope" of a 78-cent loonie.

- Watch the July CUSMA Review: This is the pivot point. Any positive news from these negotiations will likely trigger a quick jump in the CAD.

- Diversify your investments: If all your assets are in CAD, you're at the mercy of the oil market and U.S. trade policy. Holding some USD-denominated assets can act as a natural hedge.

- Monitor the 10-year yield spread: If the gap between U.S. and Canadian 10-year bonds starts to narrow significantly, it’s a strong signal that the loonie is about to rally.

The loonie vs us dollar story for 2026 isn't about a collapse; it's about a slow, grinding adjustment to a new trade reality. Canada’s economy is fundamentally resetting. It’s not always pretty to watch, but the underlying resilience—especially in the labor market and new trade ties with Asia—suggests that the loonie isn't done fighting yet.