So, you’re thinking about starting an LLC state of Texas? Honestly, you aren't alone. It feels like every time I look at the news, another major tech giant or a tiny boutique craft shop is filing paperwork with the Texas Secretary of State. There is a reason for the stampede. Texas has built a reputation for being "open for business," but if you think it's just about having no state income tax, you're only seeing half the picture.

The reality of running a Texas LLC is a mix of incredibly simple paperwork and some surprisingly annoying recurring requirements that can trip you up if you aren't paying attention.

The No-Income-Tax Myth (And the Reality)

Let's address the elephant in the room. People flock here because Texas doesn't have a personal income tax. That’s huge. If your LLC is a pass-through entity—which most are—the profits flow directly to you without the state taking a bite out of your personal paycheck. It's a massive win compared to places like California or New York.

But wait.

Texas still needs to keep the lights on. Instead of an income tax, the state uses something called the Franchise Tax. For a long time, this was a massive headache for small business owners. However, things changed recently. As of 2024, the "no tax due" threshold was raised significantly. Most small businesses making under $2.47 million in total revenue don't actually have to pay the tax, though you still have to file a report. It’s a bit of a "gotcha" because even if you owe zero dollars, failing to file that paperwork can lead to your LLC being administratively dissolved. I've seen it happen. A business owner forgets the May 15th deadline, and suddenly their "Limited Liability" status is in jeopardy.

Why Texas and Not Delaware?

If you spend any time on business forums, you’ll hear people shouting about Delaware. Sure, Delaware has the Chancery Court and pro-corporate laws, but for a small to mid-sized business actually operating in Houston, Dallas, or Austin, a Delaware LLC is often a waste of money. You’d end up paying filing fees in two states.

Texas offers something called the Series LLC. This is a niche but powerful tool. Think of it like a parent ship with little shuttle crafts. You can have one main LLC and then "series" underneath it that hold different assets—like separate rental properties—without having to file a whole new LLC for each one. Not every state allows this. Texas does. It's one of the most flexible frameworks in the country for real estate investors.

Filing Your LLC State of Texas: The Nitty Gritty

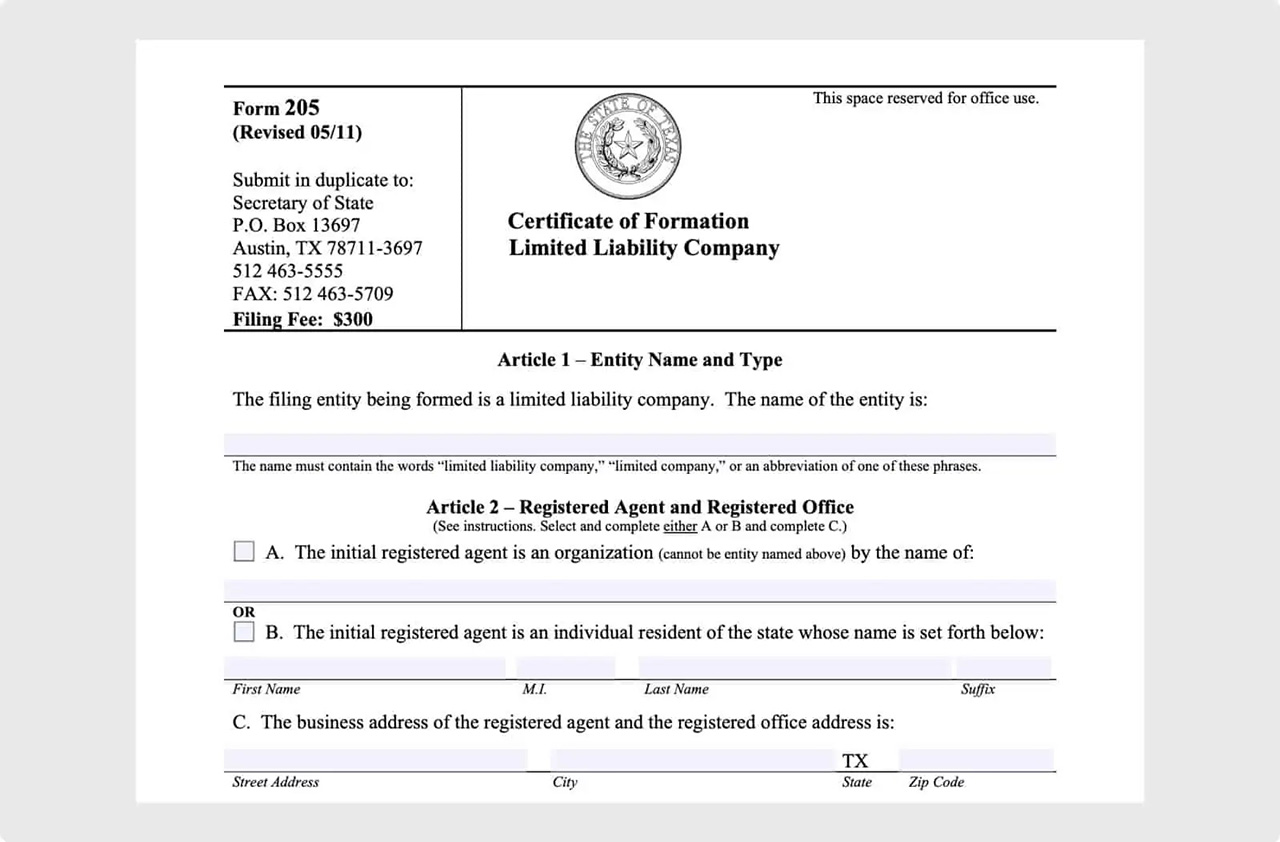

You don't need a lawyer to start an LLC here. You really don't. You go to the SOSDirect website, which looks like it hasn't been updated since 2004, and you file your Certificate of Formation (Form 205).

The cost? A flat $300.

✨ Don't miss: Jerry Jones 19.2 Billion Net Worth: Why Everyone is Getting the Math Wrong

It’s a one-time fee. Compare that to some states that charge you hundreds of dollars every single year just to exist. Texas is a "pay to play" entry state, but once you're in, the maintenance is relatively low-cost.

The Registered Agent Trap

You have to name a registered agent. This is just a person or a company that agrees to accept legal papers if you get sued. You can be your own agent. It's free. But here's the catch: your address becomes public record.

If you value your privacy or run a business out of your spare bedroom, don't use your home address. There are dozens of services in cities like Austin or San Antonio that will act as your agent for about $50 to $100 a year. It keeps your front door off the state’s searchable database. Worth every penny.

Governance and the "Handshake" Mistake

Texas is big on contract freedom. The state basically says, "We don't care how you run your business, as long as you write it down." This is your Company Agreement (often called an Operating Agreement in other states).

Texas law doesn't technically require you to have a written Company Agreement. You could theoretically run your LLC on a handshake and a prayer.

Please don't do that.

If you have a partner and things go south—and let's be real, they often do—the Texas Business Organizations Code (BOC) acts as the "default" rulebook. The problem is that the BOC might not say what you want it to say regarding how profits are split or who gets to make decisions. Writing a solid agreement is the only way to override those defaults. It’s your shield.

Public Information Reports

Every year, you have to file a Public Information Report (PIR). This is tied to that Franchise Tax deadline I mentioned earlier (May 15th). It’s basically a roll call. The state just wants to know who the managers or members are and where you're located. It’s a simple form, but it's the number one reason LLCs in Texas lose their "Good Standing" status.

🔗 Read more: Missouri Paycheck Tax Calculator: What Most People Get Wrong

Being in "Good Standing" matters because you can't get a bank loan or sell your business without a Certificate of Fact from the Secretary of State proving you aren't delinquent.

The Reality of Asset Protection

One thing people get wrong about an LLC state of Texas is thinking it’s an invisible cloak. It’s not.

If you use your business bank account to buy groceries or pay your personal mortgage, you are "commingling" funds. In a Texas court, a creditor could argue for "piercing the corporate veil." This basically means they ask the judge to ignore the LLC because you treated it like your personal piggy bank. If they win, your personal assets—your car, your house, your savings—are back on the table.

Texas has very strong homestead laws that protect your primary residence from most creditors, but you still don't want to give a lawyer an easy path to your personal life. Keep the accounts separate. Seriously.

Moving an Existing Business to Texas

If you already have an LLC in another state and want to bring it to Texas, you have two main paths: Foreign Qualification or Statutory Conversion.

Foreign Qualification is like getting a visa. Your LLC stays a "citizen" of your home state (like Nevada), but you get permission to do business in Texas. You’ll pay the $750 filing fee—yes, it’s more expensive for "foreign" entities—and you’ll have to file reports in both states.

Conversion is more like moving and getting a new driver's license. You legally move the entity to Texas, and it becomes a Texas LLC. This is cleaner in the long run but requires more paperwork upfront, including a "Plan of Conversion."

What Most People Miss

The "Texas Margin Tax" is a weird beast. Unlike many states that tax net income (revenue minus expenses), Texas looks at your "margin." There are four different ways to calculate it, and you get to pick the one that results in the lowest tax.

💡 You might also like: Why Amazon Stock is Down Today: What Most People Get Wrong

- Total revenue minus cost of goods sold.

- Total revenue minus compensation.

- Total revenue times 70%.

- Total revenue minus $1 million.

For most small businesses, the $2.47 million exemption makes this irrelevant, but if you’re scaling fast, you need a CPA who actually understands the Texas tax code. It's unique. It's not like the federal system.

Naming Constraints

Texas is surprisingly picky about names. You can't use words like "Bank," "Trust," or "Insurance" without special permission. Also, the name must be "distinguishable" from every other entity on file. If "Taco Heaven LLC" exists, you probably can't have "Taco Heaven of Texas LLC." You can check name availability on the SOSDirect site or the Comptroller’s Taxable Entity Search.

Actionable Steps for Your Texas LLC

Ready to pull the trigger? Don't just wing it. Follow this sequence to make sure you're protected from day one.

1. Run a Taxable Entity Search Don't just check the Secretary of State. Check the Texas Comptroller’s website. Sometimes a name is "inactive" at the SOS but still has a tax hold at the Comptroller. You want a name that is clean on both sides.

2. Get a Federal EIN Immediately Once your Certificate of Formation is approved (usually takes 3-5 business days if filed online), go to the IRS website. It’s free. Do not pay a third-party service $200 to get an EIN for you. It takes ten minutes.

3. Separate Your Finances Open a business checking account the moment you have your EIN and your approved Certificate of Formation. Put your initial investment into that account. Use that account—and only that account—for every business expense, from web hosting to paperclips.

4. Mark May 15th on Your Calendar This is the most important date for a Texas business owner. This is when your Franchise Tax and Public Information Report are due. Even if you made zero dollars, you must file. Set a recurring reminder on your phone.

5. Draft a Simple Company Agreement Even if you are a single-member LLC, having an agreement that outlines how the business is managed helps reinforce the "separateness" of the entity. It proves to the world (and the courts) that this is a real business, not just an extension of your persona.

6. Register for Sales Tax if Necessary If you’re selling tangible goods in Texas, you need a Sales Tax Permit from the Comptroller. Texas is aggressive about sales tax collection. You can apply for this online through the eSystems portal.

Texas is a phenomenal place to build something. The regulatory burden is low, the talent pool is massive, and the "can-do" culture is infectious. Just remember that "low regulation" doesn't mean "no regulation." Keep your filings current, keep your bank accounts separate, and you'll be able to enjoy the benefits of the LLC state of Texas without the legal headaches that catch the unprepared.