Texas is huge. I mean, we all know that, but it’s not just the landmass—it’s the sheer volume of people trying to plant a flag here. If you’re looking into an LLC state of Texas setup, you’ve probably heard the buzz about zero income tax and a "business-friendly" environment. But honestly? It’s a bit more nuanced than just saving a buck on your 1040. There’s a specific rhythm to how the Secretary of State handles things, and if you mess up the Certificate of Formation, you’re basically just tossing $300 into a digital void.

Setting up a limited liability company here is a rite of passage for entrepreneurs. You’re looking for that sweet spot where your personal assets—your house, your truck, your kid’s college fund—are shielded from the messiness of business lawsuits. Texas makes it relatively easy, but the state has some quirks that catch people off guard, especially when it comes to the Franchise Tax and the whole "Registered Agent" requirement.

What an LLC State of Texas Actually Does for You

Look, the core reason people flock to the Texas LLC structure is simple: protection. You’re creating a legal "person" that isn't you. If the business goes bust or gets sued because someone tripped on a rug, the LLC takes the hit. You don't. Texas is particularly protective of business owners. The state’s case law generally favors the "corporate veil," making it harder for creditors to "pierce" that shield compared to states like California or New York.

But let’s talk money. Texas has no personal state income tax. That’s the headline. You keep more of what you earn. However, the state has to get paid somehow, right? That’s where the Texas Franchise Tax comes in. For a long time, this was a massive headache for small shops. Thankfully, recent legislative changes (SB 3 from the 88th Legislature) mean that if your total revenue is under $2.47 million, you basically owe zero in franchise tax. You still have to file a "No Tax Due" report, which is a bit of a chore, but you aren't actually writing a check to the Comptroller.

The Nitty-Gritty of Filing

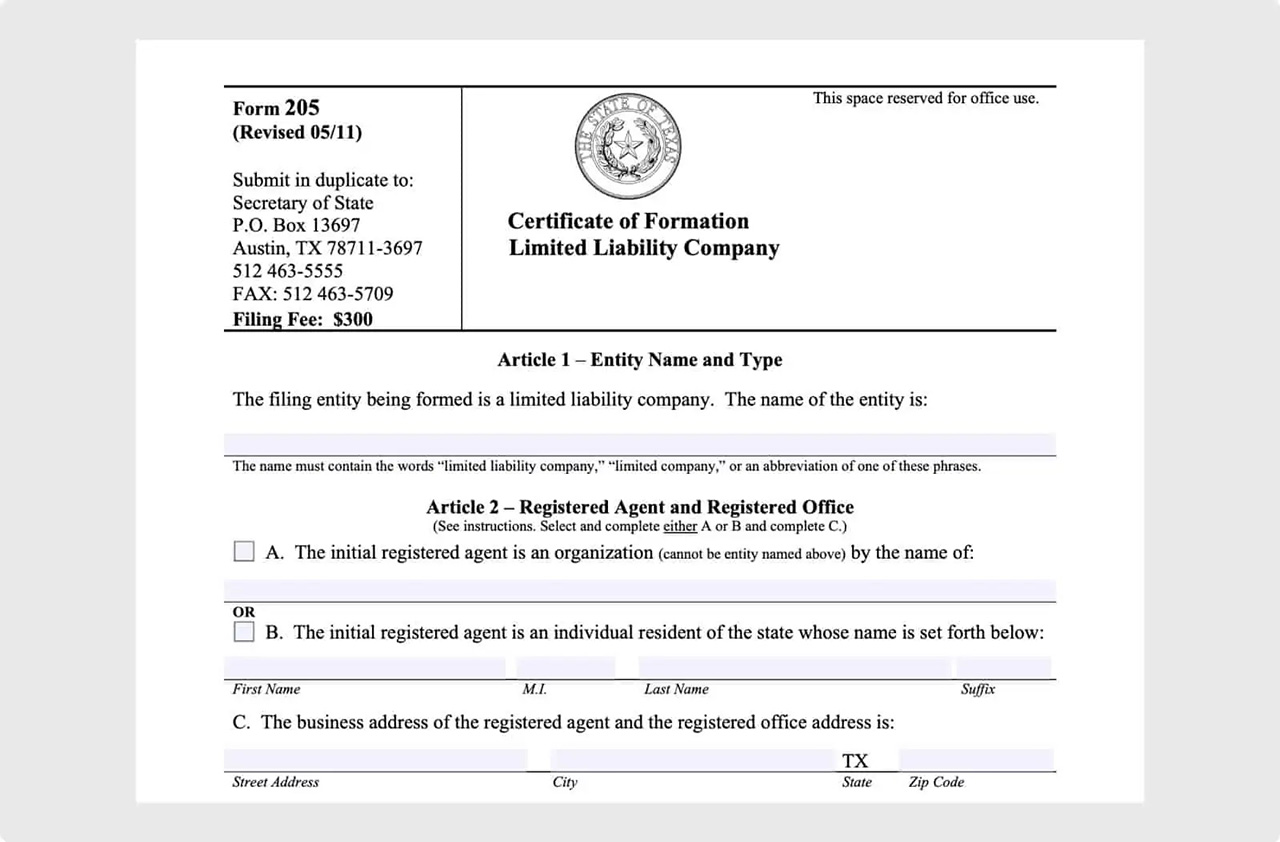

You don't need a lawyer to start an LLC state of Texas, though it doesn't hurt if your business is complicated. You’ll be dealing with Form 205. You can do this through SOSUpload or the SOSDirect portal. The portal looks like it was designed in 1998, but it works.

💡 You might also like: Business Model Canvas Explained: Why Your Strategic Plan is Probably Too Long

First, the name. It has to be "distinguishable." You can’t just name your company "Taco Shop" if there’s already a "Taco Shop LLC" in Austin. You need a suffix—LLC, L.L.C., or Limited Liability Company.

Then there’s the Registered Agent. This is a big one. You need someone with a physical address in Texas who is available during business hours to accept "service of process." Basically, if someone sues you, the state needs to know exactly where to drop the papers. You can be your own agent if you have a physical office or home in Texas, but many people hire a service for about $100 a year just to keep their home address off public records. Privacy is a luxury in the digital age.

The Certificate of Formation

This is your birth certificate. You’ll list whether the LLC is "member-managed" or "manager-managed." If it’s just you or a small group running the daily show, go with member-managed. If you’re bringing in outside investors who just want to provide cash but stay out of the kitchen, manager-managed is your best bet.

One thing people forget? The "Purpose." Most folks just write "any and all lawful purposes." Don't overthink it. You don't want to lock yourself into "selling hand-painted birdhouses" and then realize two years later you’d rather be a consultant.

📖 Related: Why Toys R Us is Actually Making a Massive Comeback Right Now

The Reality of Costs and Maintenance

It costs $300 to file. That’s a one-time fee to the Secretary of State. If you use a credit card, they tack on a small convenience fee. After that, your main obligation is the annual Public Information Report (PIR) and the Franchise Tax report. Both are due by May 15th every year.

Missing this deadline is the fastest way to get your LLC "forfeited." If that happens, you lose your liability protection. Suddenly, you’re just a person doing business, and your house is back on the table if things go sideways. Texas is unforgiving about this. They won't hunt you down; they'll just change your status to "Involuntary Dissolution" and wait for you to notice.

The Operating Agreement Secret

Texas law doesn’t actually require you to have an Operating Agreement. You can legally run an LLC without one. But—and this is a huge but—if you have partners, you are playing with fire if you don't have one. This document is where you decide who gets what if the business closes, what happens if a partner dies, or how you settle a tie-break vote. Without it, you’re at the mercy of the Texas Business Organizations Code (BOC), which might not rule in a way you like. Sorta like getting married without a prenup; everything is fine until it isn't.

Why Some People Regret the Texas Move

It’s not all sunshine and BBQ. Texas has some of the highest property taxes in the country. Since there’s no income tax, the state gets its pound of flesh from real estate. If your LLC state of Texas owns a warehouse or a storefront, be prepared for that annual appraisal hike.

👉 See also: Price of Tesla Stock Today: Why Everyone is Watching January 28

Also, the "Registered Office" cannot be a P.O. Box. It has to be a street address. This catches out-of-state "digital nomads" all the time. If you’re running a business from a beach in Bali but your LLC is in Texas, you better have a reliable Registered Agent service back in the States to catch your mail.

Real-World Nuance: The Series LLC

Texas is one of the few states that really leans into the "Series LLC" concept. Think of it like a mother ship with little escape pods. You have one filing fee ($300), but you can create "cells" or "series" under that umbrella. This is huge for real estate investors. You put one rental property in Series A, another in Series B. If a tenant in Series A sues you, the assets in Series B are (theoretically) protected. It’s a bit of a legal frontier—courts are still figuring out exactly how robust those walls are—but for certain industries, it's a massive cost-saver.

Actionable Steps to Get Started

If you are ready to pull the trigger, don't just wing it. Follow this sequence to make sure you aren't stuck in administrative limbo:

- Run a Name Search: Use the Texas SOSDirect "Taxable Entity Search." It's free and tells you if your dream name is taken. Check the Comptroller's site too, because sometimes a name is okay with the Secretary of State but has a tax lien from a previous owner.

- Get an EIN Immediately: Once the state sends back your stamped Certificate of Formation (usually takes 3-5 days via the portal), go straight to the IRS website. Get your Employer Identification Number. It's free. Do not pay a third-party site $200 to do this for you.

- Open a Dedicated Bank Account: Never, ever mix your personal grocery money with your business revenue. This is called "commingling," and it’s the easiest way for a lawyer to break your liability shield. Even if you're a solo-freelancer, get a separate checking account.

- File Your BOI Report: This is a new federal requirement as of 2024. The Financial Crimes Enforcement Network (FinCEN) wants to know who actually owns the company. You have 90 days from formation (if starting in 2024) or 30 days (starting in 2025) to file this "Beneficial Ownership Information" report. Failure to do so carries heavy daily fines.

- Set a Calendar Alert for May 15: This is your "Texas Tax Day." Even if you made $0, you must file your No Tax Due and Public Information Report. Mark it in red.

Starting an LLC state of Texas is a bold move toward independence. The state's economy is diversified—tech in Austin, energy in Houston, aerospace in DFW—making it a resilient place to build something. Just keep your paperwork clean, respect the May 15th deadline, and keep your business and personal finances strictly separated. That is how you actually protect what you've built.