Texas is doing that thing again. You know, the one where it finds a massive energy fortune right under its boots just when everyone thinks the old era is fading. Honestly, if you look at a lithium deposits in Texas map today, it looks less like a geology chart and more like a high-stakes treasure map. We aren't talking about giant open-pit mines that look like craters from space. We’re talking about "white gold" dissolved in the salty, nasty water that oil companies have been pumping out and throwing away for a century.

Texas is basically sitting on a battery revolution.

The Smackover Formation: The Billion-Dollar Brine

The real action is happening in the northeast corner of the state. If you trace the lithium deposits in Texas map through Cass, Franklin, and Titus counties, you’re looking at the Smackover Formation. This is a geological relic of an ancient Jurassic sea. For decades, it was just a place to find oil and bromine. Now? It’s the hottest lithium prospect in North America.

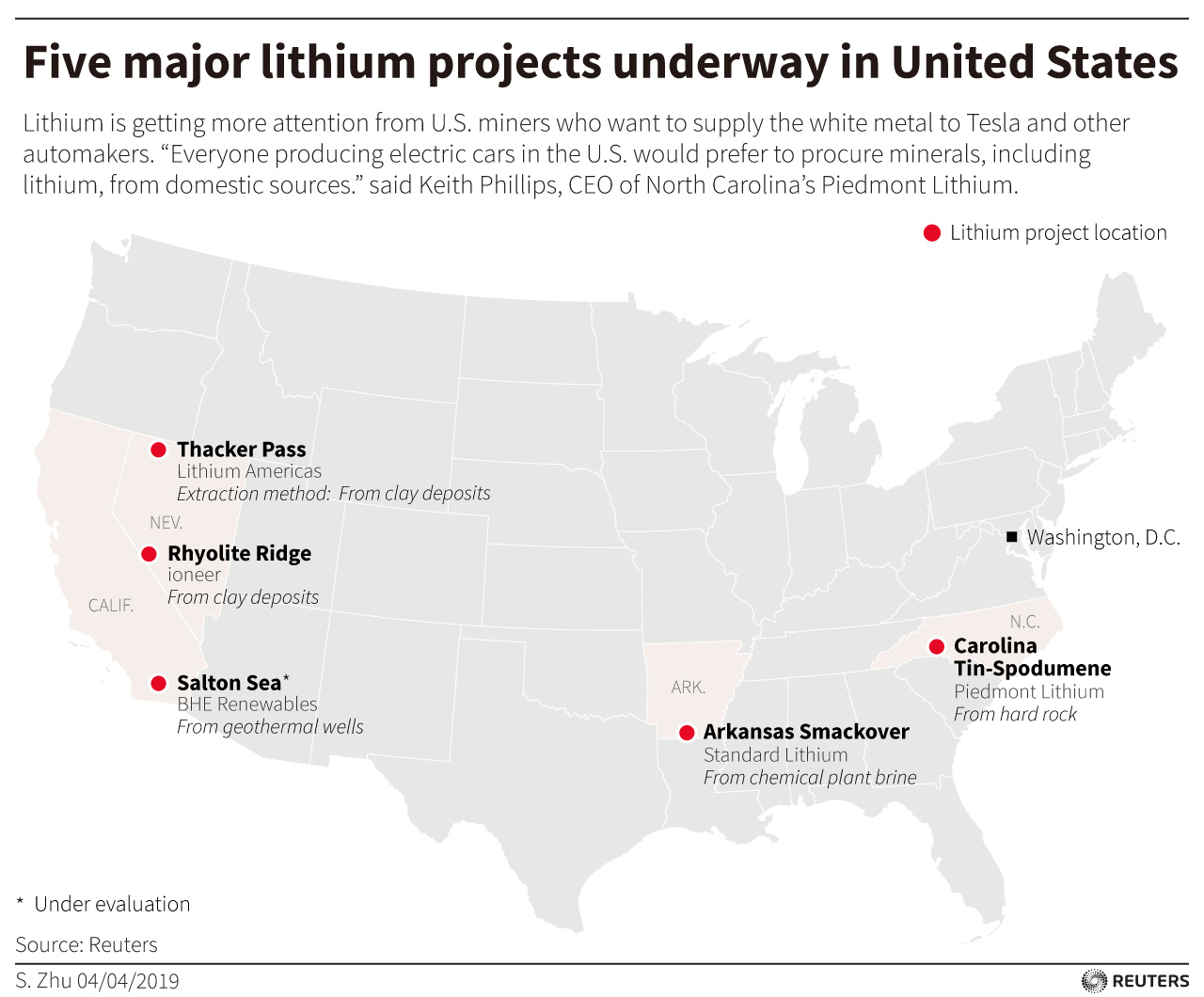

Standard Lithium recently reported some of the highest lithium-in-brine grades ever seen on the continent. We’re talking concentrations around 668 mg/L to 806 mg/L in parts of East Texas. To put that in perspective, most other US projects are happy to see half of that. Companies like GeoFrame Energy and Standard Lithium (partnered with Equinor) are snatching up tens of thousands of acres. They aren't digging holes; they’re drilling wells.

Tesla and the Corpus Christi Connection

While the mining is happening up north, the processing is hitting the coast. You’ve probably heard about Tesla’s massive refinery in Robstown, just outside Corpus Christi. As of early 2026, this place is officially running rock. It’s the first of its kind in North America, designed to skip the nasty acid-leaching process used in China.

Instead of creating mountains of toxic waste, Tesla’s "acid-free" route produces a byproduct called anhydrite. It’s basically sand and limestone. They’re literally planning to sell their "waste" to construction companies to make concrete. It’s a clever move. It turns a massive environmental liability into a secondary revenue stream.

Why the Permian Basin is a Wildcard

You can't talk about a lithium deposits in Texas map without mentioning the Permian Basin out west. This is the heart of Texas oil. Every day, the Permian produces billions of gallons of "produced water." It’s salty, mineral-rich, and usually a massive headache to dispose of.

The problem? The lithium concentrations out west are... kinda meh.

While East Texas has those 600+ mg/L "hotspots," the Permian usually hovers between 1 and 30 ppm. It’s low. But—and this is a big but—the sheer volume of water is so high that even low concentrations could theoretically produce massive amounts of lithium if the technology gets cheap enough. Right now, it’s a scale game.

🔗 Read more: iPhone 15 Pro Max Battery mAh: Why the Number Doesn't Tell the Whole Story

The Tech Making This Possible: DLE

None of this works without Direct Lithium Extraction (DLE). Traditional lithium mining involves sitting brine in giant ponds for a year and letting the sun evaporate the water. Texas doesn't have the space or the patience for that. Plus, it rains too much in East Texas for evaporation ponds to work.

DLE is basically a high-tech Brita filter for lithium.

- Step 1: Pump the brine up from 10,000 feet down.

- Step 2: Use specialized beads or solvents to "grab" only the lithium atoms.

- Step 3: Shoot the "dead" brine back into the ground where it came from.

This process takes hours, not months. It uses a fraction of the land. It keeps the local water table safe. Honestly, it’s the only way a lithium industry survives the strict environmental scrutiny of the mid-2020s.

The Legal Mess Nobody Mentions

Here is the awkward part: who actually owns the lithium? In Texas, mineral rights are a labyrinth. If you own the "oil and gas" rights, do you own the lithium in the water? Or does that belong to the surface owner?

Texas lawmakers are still scrambling to figure this out. Right now, we’re in a bit of a "Wild West" phase where leases are being signed, but the legal precedent is thin. This uncertainty is the biggest thing holding back a total explosion of the lithium deposits in Texas map. Investors hate lawsuits more than they hate low lithium prices.

Real Numbers: What’s Actually There?

Let's look at the Franklin Project in East Texas. The latest resource estimates suggest over 2.1 million tonnes of Lithium Carbonate Equivalent (LCE) sitting in that one project area alone. That is enough to power millions of EVs. And that's just one spot on the map.

ExxonMobil is also in the game. While they started their big lithium push just across the border in Arkansas, they’ve been quietly leasing acreage and surveying the Texas side of the Smackover. When a company with Exxon’s balance sheet starts pivoting to brine, you know the geological data is solid.

What This Means for the Local Economy

For towns like Mount Vernon or Marshall, this is a second act. These communities already have the infrastructure. They have the pipe-fitters, the drillers, and the geologists.

A single lithium plant can bring in hundreds of high-paying jobs and triple a small town's tax base. We're seeing "Lithium Valley" vibes starting to form in the piney woods. It’s a weird mix of old-school oil rigs and new-school green tech.

Your Next Steps to Track the Texas Lithium Boom

If you’re looking to get a piece of this or just want to stay informed, here is how you actually track it:

- Watch the RRC Filings: The Railroad Commission of Texas (RRC) handles drilling permits. Look for "Brine Mining" or "Geothermal" permits in Cass and Franklin counties. That’s where the real maps are being drawn.

- Follow the DLE Pilots: Standard Lithium’s performance at their demonstration plants is the "canary in the coal mine." If their recovery rates stay above 90% at scale, the Texas lithium map will double in size overnight.

- Check the Tesla Feedstocks: Keep an eye on where Tesla is getting its raw spodumene. While they refine it in Corpus Christi, the goal is to eventually process local Texas brine. When that switch happens, the midstream infrastructure (pipelines) will be the next big investment play.

- Monitor Legislative Sessions: Keep an ear out for any bills regarding "Mineral Ownership of Brine." Once that law is settled, the "land grab" will turn into a full-scale construction boom.

Texas is no longer just an oil state. It’s becoming a battery state. The map is changing, and for once, the treasure is hidden in the water we used to throw away.