You’ve probably seen those massive, sprawling complexes of pipes and smoke stacks while driving along the Gulf Coast or through the industrial stretches of New Jersey. They look like steel cities. Honestly, most people don't think about them until gas prices spike, but the list of oil refineries in the us is basically the circulatory system of the American economy. If they stop, everything stops.

The U.S. is actually sitting on a massive refining engine. As of early 2026, we’re looking at around 130 operable refineries. That number sounds high, but it’s actually shrinking. We're in a weird spot where the refineries that stay open are getting bigger and more complex, while the smaller, older ones are throwing in the towel. It's a game of "survival of the biggest."

Why the List of Oil Refineries in the US Is Changing Right Now

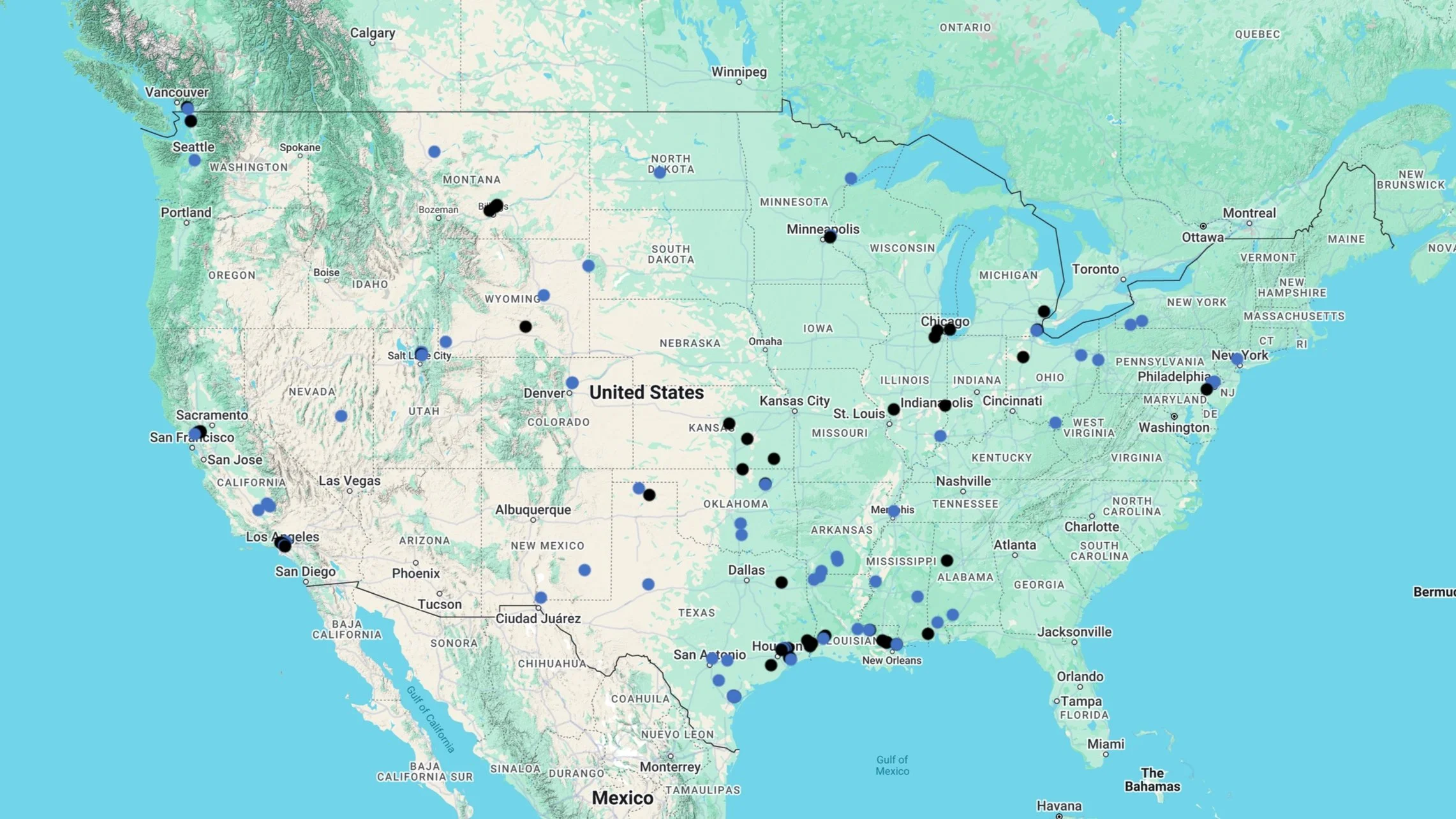

If you looked at a map of these facilities five years ago, it would look pretty different from today. We're seeing a massive geographic shift. Most of the action is moving toward the Gulf Coast. Texas and Louisiana are the undisputed heavyweights here.

Why? Because that’s where the infrastructure is.

But it's not all growth. California is currently the "canary in the coal mine" for the refining industry. Just this month, in January 2026, we’ve been watching the drama with Valero’s Benicia refinery. They’re planning to idle the facility by April 2026. This follows the closure of the Phillips 66 Los Angeles refinery at the end of 2025. When these West Coast plants close, it doesn't just affect locals; it changes how the whole country moves fuel.

The Heavy Hitters: Top 10 Refineries by Capacity

When we talk about "capacity," we’re talking about barrels per calendar day (b/cd). This is the amount of crude oil the plant can actually process into stuff we use, like gasoline or jet fuel.

📖 Related: August 2028: Why This Date Is Already Changing Your Financial Strategy

The biggest of the big is the Galveston Bay Refinery in Texas City. It’s owned by Marathon Petroleum and can handle a staggering 631,000 barrels every single day. To put that in perspective, that’s enough to fill up millions of cars.

Right on its heels is the Port Arthur Refinery, owned by Motiva (which is basically Saudi Aramco). It sits at about 626,000 b/cd. These two are the titans of the Texas coast.

ExxonMobil’s Beaumont facility recently jumped up to the number three spot. They did a massive expansion in 2023, and by early 2024, they were hitting over 609,000 b/cd. Then you have Marathon’s Garyville plant in Louisiana at roughly 597,000 b/cd.

The rest of the top tier is dominated by familiar names:

ExxonMobil has a massive presence in Baytown, Texas, and Baton Rouge, Louisiana. Citgo runs a huge operation in Lake Charles. BP’s Whiting refinery in Indiana is a bit of an outlier because it’s in the Midwest, but it’s a beast, processing about 435,000 barrels daily.

The Mid-Continent and the West Coast Struggle

The Midwest refineries, like the one in Whiting or the Koch-owned Flint Hills plant in Minnesota, have it a bit different. They mostly process "heavy" crude coming down from Canada. It’s thick, like molasses.

Over on the West Coast, things are getting tight.

Marathon’s Los Angeles Refinery is now the primary powerhouse for California, especially with other plants closing down. It’s a complex site that actually combined two older refineries (Carson and Wilmington) into one massive entity.

✨ Don't miss: 555 17th Street Denver: Why This Iconic Tower Is Changing the Way We Think About Office Space

Honestly, the "refined product" market in California is becoming an island. Because they have such specific environmental rules, they can't easily "borrow" gas from Nevada or Arizona. If one of these refineries has a fire—like the PBF Martinez refinery did in early 2025—prices at the pump go nuts almost instantly. PBF is actually still working on getting Martinez back to 100% capacity right now, aiming for full steam by March 2026.

What Most People Get Wrong About These Facilities

A common myth is that we’re building new refineries all the time. Nope.

The last "major" refinery built from the ground up in the U.S. was Marathon’s Garyville plant, and that was back in 1977. Every "new" capacity we see today is just an expansion of an existing footprint. It’s much easier to add a new unit to a 50-year-old plant than it is to get a permit for a brand-new one.

Another thing? Not all oil is the same.

The U.S. produces a ton of "light, sweet" crude from places like the Permian Basin. But many of the biggest refineries on our list were actually built to "eat" heavy, "sour" crude from places like Venezuela or Mexico. This creates a weird paradox: we export our own high-quality oil and import the "junkier" heavy oil because our refineries are specifically designed to handle the heavy stuff. It's like having a car that only runs on premium, but you're a diesel mechanic—you have to trade.

Real-World Impact of the 2026 Closures

The Energy Information Administration (EIA) recently noted that U.S. refining capacity might actually dip below 18 million barrels per day this year. That hasn't happened in a while.

With LyondellBasell shutting its Houston complex and the West Coast closures, the remaining refineries have to work harder. This is why you'll see "utilization rates" staying above 90%. When these machines run that hard for that long, they need more maintenance, which leads to "turnarounds."

A "turnaround" is basically a scheduled pit stop where they shut the whole thing down to fix the pipes. We’re expecting a lighter turnaround season in early 2026 because the industry went so hard on maintenance in late 2025. That might keep gas prices from jumping too high this spring, but it's a delicate balance.

The Move Toward "Renewable Diesel"

You can't talk about the list of oil refineries in the us without mentioning the "green" shift.

✨ Don't miss: Myers Briggs Type Indicator MBTI Certification: Why It Costs So Much and What You Actually Learn

Several refineries that used to process crude oil have converted to making renewable diesel from soybean oil or used cooking grease. The Phillips 66 Rodeo refinery in California is a prime example. It’s no longer a "traditional" refinery. This is great for the carbon footprint, but it removes "fossil fuel" capacity from the grid, which is one reason why the total number of traditional oil refineries is dropping.

Moving Forward: What You Should Watch

If you're tracking the energy market or just curious about why your local gas station is charging what it is, keep an eye on these three things:

- West Coast Imports: Watch if California starts bringing in more refined gas from Asia. Since they're losing local refineries, they'll have to buy it from somewhere else, and that adds shipping costs.

- Gulf Coast Expansions: See if Exxon or Chevron announce more "de-bottlenecking" projects. This is how they sneakily increase capacity without building new plants.

- The Venezuela Factor: With shifts in trade policy in early 2026, more heavy Venezuelan crude might start flowing into the Gulf refineries again. This could actually help lower production costs for diesel and jet fuel because those plants are hungry for that specific type of oil.

The U.S. refining landscape is becoming more concentrated. The "Big Three" states—Texas, Louisiana, and California—still hold the keys, but the balance is tipping heavily toward the South. Understanding this list isn't just about names and numbers; it's about seeing where the energy map of the country is being redrawn in real-time.