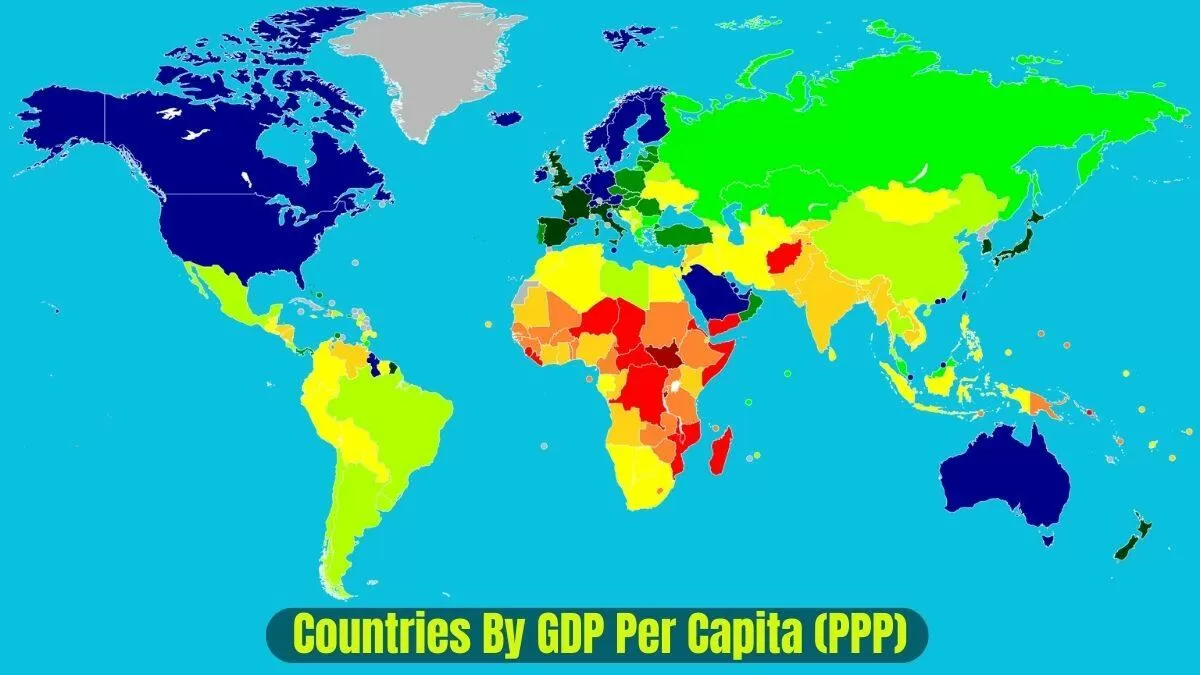

Ever looked at a list of the world's "richest" countries and felt like something was... off? You see the United States or China dominating the news, but then you look at a list of countries by gdp ppp per capita and suddenly Qatar and Luxembourg are running the show.

Honestly, it's kinda confusing. If China has the most "stuff," why are they often nowhere near the top of the per-person rankings?

The secret lies in those three little letters: PPP.

What Is This PPP Thing Anyway?

Basically, $100 in New York City doesn't buy you the same amount of life as $100 in Kuala Lumpur. In Manhattan, that might get you a decent dinner for two. In Malaysia, you’re eating like a king for a week.

Purchasing Power Parity (PPP) is the Great Equalizer. It’s an economic metric that adjusts for the cost of living and inflation rates. Instead of just looking at raw exchange rates—which bounce around like a tennis ball—economists use a "basket of goods" (bread, milk, rent, haircuts) to see what money actually buys you locally.

When we talk about the list of countries by gdp ppp per capita, we’re dividing that adjusted wealth by the number of people living there. It’s the closest thing we have to a "standard of living" scoreboard.

The Heavy Hitters: Who's Actually Winning in 2026?

If you're looking for the big names, you've gotta look at the small places. It’s a paradox of global economics: the smaller the country, the easier it is to make everyone look rich on paper.

👉 See also: Why Amazon Stock is Down Today: What Most People Get Wrong

1. Luxembourg: The Banking Fortress

Luxembourg almost always takes the gold. With a GDP PPP per capita often soaring past $140,000, they’re in a league of their own. Why? Because a massive chunk of their workforce lives in neighboring France or Germany. They come in, produce wealth, and then leave. The wealth stays in the numerator, but the people aren't in the denominator. Kinda feels like a cheat code, right?

2. Singapore: The Lion City

Singapore is the poster child for "started from the bottom, now we're here." Lacking natural resources, they turned themselves into a global financial hub. By 2026, their figures hover around the $135,000 - $150,000 mark depending on which IMF or World Bank report you trust more.

3. Ireland: The Multinational Magnet

Ireland's spot on the list is... controversial. You’ve probably heard of "Leprechaun Economics." Because so many tech giants (think Google, Apple, Meta) have their European headquarters there for tax reasons, their GDP looks inflated. Does the average person in Dublin feel like they have $130,000 in the bank? Ask them about their rent and you’ll get a very different answer.

4. Qatar & The UAE: The Energy Giants

These countries are the classic examples of resource wealth. Qatar, specifically, has a tiny population and the world's third-largest natural gas reserves. It’s a recipe for a massive per-capita number, usually sitting comfortably above $110,000.

Why the US Isn't Number One

You've probably noticed the United States is usually around 10th or 11th place. For 2026, the US sits around $85,000 to $90,000.

That’s actually incredibly impressive.

✨ Don't miss: Stock Market Today Hours: Why Timing Your Trade Is Harder Than You Think

Think about it. It’s easy for a city-state like Singapore or a tiny duchy like Luxembourg to have a high average. Maintaining that level of wealth across 340 million people and a massive geographic landmass is a totally different beast. The US remains the only "large" economy that consistently hangs out with the tiny tax havens and oil states at the top of the leaderboard.

The "Middle Class" of Nations

When you scroll down the list of countries by gdp ppp per capita, you find the European powerhouses.

- Norway: Often near the top ($95k+) thanks to their massive sovereign wealth fund.

- Switzerland: High wages, but man, those $25 Big Macs really eat into the PPP adjustment.

- Guyana: Here is a wild card. Because of massive offshore oil finds, Guyana has had some of the fastest-growing GDP in history lately. They've shot up the rankings faster than almost any country in the last 50 years.

Where Most People Get It Wrong

People often mistake this list for a "Happiness Index" or a "Quality of Life" chart. It’s not.

GDP PPP per capita doesn't care about income inequality. You could have one billionaire and 999 people living in poverty, and the "per capita" average would still look great. For a better look at how the average person lives, you'd want to look at Median Household Income, but that data is way harder to collect and often years out of date.

Also, PPP has its limits. If you’re buying a locally made loaf of bread, PPP is great. If you’re buying an iPhone or a Boeing 747, the "local cost of living" doesn't matter. The price is the price on the global market.

How to Use This Data

So, you’ve got the list. What do you do with it?

🔗 Read more: Kimberly Clark Stock Dividend: What Most People Get Wrong

- Business Expansion: If you’re a company looking to sell luxury goods, you look at the top of this list. High PPP means high discretionary income.

- Expat Planning: If you’re thinking of moving, don't just look at the salary. Look at the PPP. A $100k salary in Switzerland might feel like $50k in Texas.

- Investment: Rapidly climbing countries (like the recent surge in Southeast Asia or the aforementioned Guyana) often signal emerging market opportunities.

What’s Next?

The 2026 landscape is still shifting. We're seeing a trend where "knowledge economies" and "energy exporters" are pulling away from "manufacturing economies."

If you want to dive deeper, I'd suggest checking the IMF World Economic Outlook database. It’s updated twice a year and is basically the "bible" for this stuff. Just a heads-up: it’s a bit of a maze of spreadsheets.

Keep an eye on the gap between nominal GDP and PPP. In countries like India or Vietnam, the PPP GDP is often 3 to 4 times higher than the nominal version. That gap tells you exactly where the "cost of living" advantage is strongest.

The list of countries by gdp ppp per capita is a snapshot, not a destiny. It tells us where the money is moving and how much a dollar actually buys, but it doesn't tell the whole story of a nation's soul.

To get the most out of this data for your own planning, you should look up the specific IMF Data Mapper for your region of interest to see the five-year growth projections. That'll show you not just who is rich now, but who is going to be rich by 2030.