Money at the very top isn't just growing; it's behaving like a runaway train. If you look at a list of billionaires in america today, you’re not just seeing rich people. You’re seeing a total decoupling from what we used to think was "wealthy."

Elon Musk has basically broken the scale. As of early 2026, he’s sitting on a fortune that has hovered between $680 billion and $720 billion depending on the day's market swings. Honestly, that’s not even "money" anymore. It’s the GDP of a medium-sized country. While most of us are checking the price of eggs, Musk’s net worth is jumping by the equivalent of a mid-sized corporation’s valuation just because SpaceX hit a new internal milestone or Tesla stock breathed the wrong way.

The 2026 Heavy Hitters

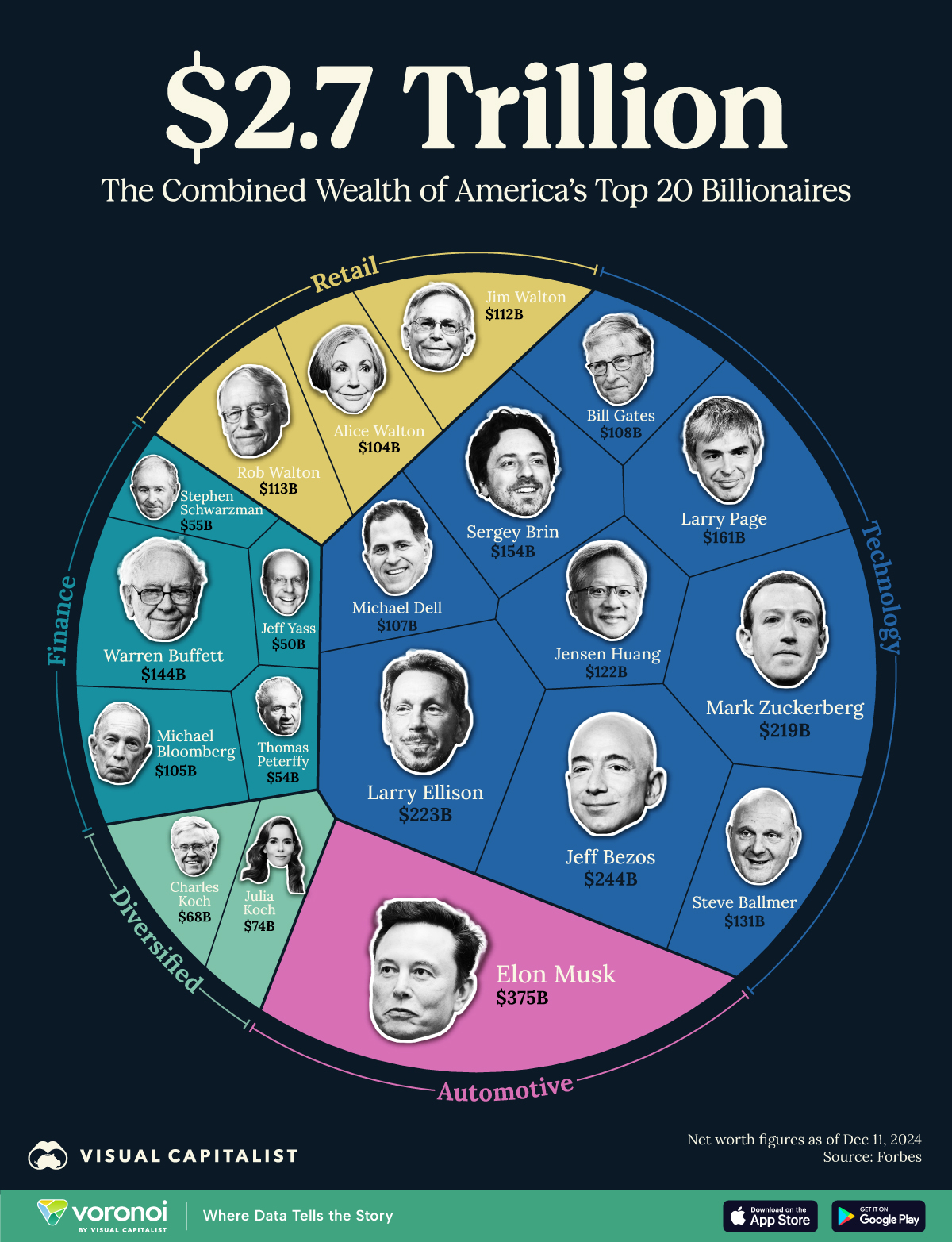

The names at the top of the list of billionaires in america haven't changed much in terms of who they are, but the gap between number one and everyone else is getting weird.

For a long time, Jeff Bezos and Musk were neck-and-neck. Not anymore. Musk is way out in front, largely because SpaceX is being valued at nearly $1.5 trillion as it eyes a potential IPO. Bezos is still doing just fine—don't feel bad for him—with a net worth around $240 billion to $255 billion. He’s been selling off Amazon stock to fund Blue Origin and buy high-end real estate, but he remains a permanent fixture in the top five.

Then you have the Google guys. Larry Page and Sergey Brin are basically the silent winners of the AI boom. Alphabet stock has been on a tear, pushing Page to around $260 billion and Brin to about $240 billion. They don't do the flashy interviews or the constant social media posting, but their bank accounts are doing the talking for them.

Larry Ellison is another one. The Oracle founder is 81 years old and still climbing the ranks, recently hitting the $245 billion mark. He owns 98% of the island of Lanai in Hawaii. That’s the kind of wealth we’re talking about here. It’s not just a big house; it’s an entire ecosystem.

🔗 Read more: Social Security Payment June 25: Why This Date Matters for Your Wallet

The New Wealth Drivers

What’s actually pushing these numbers so high?

- Artificial Intelligence: This is the big one. If your company has "AI" in its mission statement and actually produces chips or software, your net worth probably doubled in the last 24 months.

- Space Infrastructure: We’ve moved past the "rocket hobby" phase. SpaceX and its Starlink satellites are now core global infrastructure.

- The Inheritance Wave: We're starting to see the "Great Wealth Transfer." The Waltons (Walmart) and the Koch family still hold massive chunks of the list, but they are increasingly joined by younger heirs.

The Jensen Huang Phenomenon

You can't talk about the list of billionaires in america in 2026 without mentioning Jensen Huang. The Nvidia CEO is the poster child for the current era. In 2020, he was "only" worth about $4.7 billion. Fast forward to now, and he’s sitting at roughly $162 billion.

That is a 3,400% increase in six years.

Nvidia’s chips are the oxygen for the AI revolution. Every time a company like Meta or Microsoft announces a new data center, Huang gets richer. It’s a classic "picks and shovels" story, except the shovels are made of high-end silicon and cost $30,000 each.

Why the List Still Matters

Some people think obsessing over billionaire lists is just celebrity worship for nerds. But these numbers actually tell us where the world is going. When you see names like Michael Dell (now around $129 billion) or Steve Ballmer ($153 billion) continuing to rise, it shows that the old-guard tech foundations are still incredibly lucrative even as new AI startups try to disrupt them.

✨ Don't miss: 45 000 baht to usd: What Most People Get Wrong

Warren Buffett is still there, too. At 95, the "Oracle of Omaha" is worth about $150 billion. He’s the exception to the rule—the one guy who didn't get rich off a software company or a rocket ship. He just bought boring businesses and sat on them for half a century.

The Concentration Problem

There’s a flip side to this. The top 15 people on the list of billionaires in america now hold about $3.2 trillion combined. To put that in perspective, that’s more than the GDP of almost every country on Earth except for the top six or seven.

Critics like the Institute for Policy Studies point out that this wealth is growing way faster than the actual economy. While the S&P 500 might go up 15% or 16% in a good year, the top billionaires are seeing their assets surge by 30% or more.

Behind the Figures: What People Get Wrong

People often think these billionaires have billions of dollars in a checking account. They don't. Most of this wealth is "paper wealth."

If Elon Musk tried to sell all his Tesla and SpaceX stock tomorrow to buy a literal mountain of cash, the stock price would collapse, and he wouldn’t be worth $700 billion anymore. They live off massive loans taken out against their stock, which is a clever way to avoid paying income tax while still having enough liquidity to buy superyachts or social media platforms.

🔗 Read more: Rhode Island Nurseries Inc: Why Wholesale Trees Are Changing the East Coast Landscape

Actionable Insights for the Non-Billionaire

You might not be aiming for the top 400, but there are things to learn from how these fortunes are built:

Equity is the only way to real wealth. None of these people got rich on a salary. They own the means of production. Whether it's stock options at your job or starting a side business, you need to own something that grows while you sleep.

Concentration vs. Diversification. The biggest fortunes (Musk, Zuckerberg, Huang) came from being "all in" on one company for a long time. Once they became centi-billionaires, then they started diversifying.

Follow the infrastructure. The biggest gains right now aren't in the apps we use; they're in the chips, the satellites, and the data centers that make the apps possible.

If you're tracking the list of billionaires in america, keep an eye on the private valuations of companies like SpaceX and OpenAI. That’s where the next massive jumps will come from. The gap between the public markets and private "unicorn" valuations is where the real 2026 drama is happening.

To stay ahead, you should look into how "private equity" and "venture capital" are increasingly accessible to smaller investors through new fintech platforms. Understanding how the ultra-wealthy shield their assets through family offices—like Musk’s Excession LLC—can also give you ideas for your own long-term tax and estate planning, even on a much smaller scale.