Ever looked at your 401(k) during a red week and wished you could just hit a "pause" button on the volatility? That's basically the vibe of a Lincoln stable value account. It isn't a flashy tech stock. It definitely isn't Bitcoin. Instead, it's that quiet, reliable corner of a retirement plan that keeps your principal intact while everyone else is stressing over the latest Fed meeting or a sudden dip in the S&P 500. Honestly, most people ignore these accounts until the market takes a nose-dive, and then suddenly, everyone is asking their HR rep how to move money into one.

The Reality Behind the Lincoln Stable Value Account

A Lincoln stable value account is essentially a portfolio of high-quality, intermediate-term bonds wrapped in an insurance contract. It's unique. You won't find this in a standard brokerage account; it’s a creature of the employer-sponsored retirement world, like 401(k)s or 403(b)s. The goal is simple: provide a higher interest rate than a money market fund while keeping the price of your shares at a steady $1.00.

🔗 Read more: Why that Big Can of Arizona Iced Tea is Still 99 Cents (Mostly)

Think of it as a middle ground. Money markets are safe but often pay peanuts. Bond funds can lose value when interest rates rise. The stable value account uses "benefit responsive" wrap contracts, usually provided by institutions like Lincoln Financial Group, to smooth out those price fluctuations. Even if the underlying bonds drop in value because interest rates spiked, the contract ensures you can still withdraw your money at your "book value" (what you put in plus interest).

How the Interest Rate Gets Set

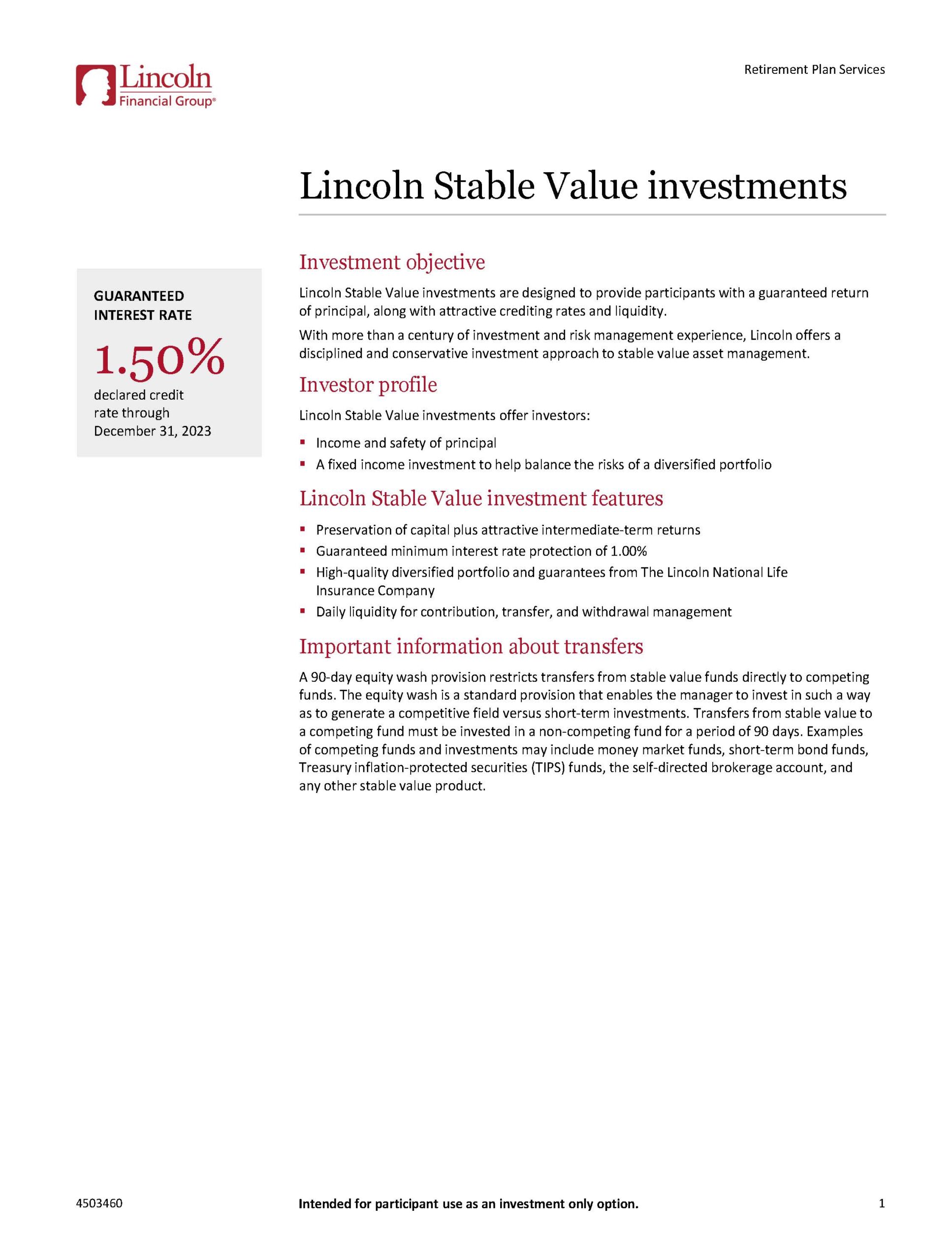

You aren't going to get a fixed rate for life here. Lincoln generally resets the "crediting rate" on a quarterly or semi-annual basis. They look at the yield of the bonds they’re holding, subtract their fees, and then look at the "market-to-book" ratio of the fund. If the bonds are doing great, your rate might creep up. If the market is struggling, it might lag.

It’s a slow-moving ship. That’s the point.

Why Stable Value Isn’t Just a "Cash" Alternative

People often lump stable value in with cash, but that’s technically wrong. In a money market fund, you’re usually holding very short-term debt—think weeks or months. Because the duration is so short, the risk is tiny, but so is the reward.

Lincoln's stable value approach involves slightly longer-term bonds. We're talking two to five years. Because they are holding longer-term debt, they can capture higher yields. The "insurance wrap" is the magic sauce that lets you ignore the fact that those 5-year bonds are bouncing around in price every day.

💡 You might also like: Ashok Mandava and Hopewell Junction: The Reality of Local Community Impact

The Benefit Responsive Wrap

The wrap contract is the backbone of the Lincoln stable value account. It’s a promise. Lincoln (or whoever the wrap provider is) says, "Even if the bonds in this pool are technically worth 95 cents on the dollar today, we will let your employees take their money out at 100 cents."

This is huge during a liquidity crisis. While other investors are selling at a loss to get cash, you’re just clicking "transfer" and moving your money at full value. But remember, this protection usually only applies to you as an individual participant. If your entire company decided to drop Lincoln and move the whole plan to a different provider, that's a different story.

The "Equity Wash" Rule and Other Nuances

You can't just jump in and out of a Lincoln stable value account whenever you feel like gaming the system. There’s a catch called the "Equity Wash."

If you want to move money out of your stable value fund, most plans won’t let you move it directly into a "competing" fund, like a money market or a short-term bond fund. They usually make you park that money in a stock fund or a long-term bond fund for 90 days first. Why? Because they don't want people arbitrage-hopping between safe havens. It protects the stability of the fund for everyone else.

Credit Risk vs. Interest Rate Risk

Usually, bond investors worry about interest rates. When rates go up, bond prices go down. In a stable value account, Lincoln absorbs that volatility. But you are trading interest rate risk for credit risk.

💡 You might also like: David Rubenstein Net Worth: What Most People Get Wrong

You are relying on the financial strength of Lincoln Financial Group. If the insurance company providing the wrap goes bust, that $1.00 share price isn't guaranteed anymore. Now, Lincoln is a massive, highly regulated entity, but it’s a distinction worth knowing. You aren't backed by the FDIC like a bank account. You're backed by the claims-paying ability of an insurance giant.

Is This Right for Your Portfolio?

It depends on where you are in life. If you’re 22 and just started your first job, having 50% of your money in a Lincoln stable value account is probably a mistake. You need growth, and stable value won't give you that. It barely beats inflation over the long haul.

However, if you're five years from retirement, this is a godsend. It's a "safe bucket." When the stock market has a "correction" (which is just a polite way of saying it fell off a cliff), your stable value money stays put. It gives you the psychological breathing room to let your stocks recover without selling them at the bottom just to pay your bills.

The Fee Factor

Everything has a price. You won't see a monthly bill for your stable value account, but Lincoln takes their cut before they announce the crediting rate. These fees cover the cost of the insurance wrap and the management of the bonds.

Generally, these fees are opaque. You have to dig into the Fact Sheet or the Summary Plan Description (SPD) to see what the "spread" is. If the underlying bonds are yielding 4% and your account is paying 3.2%, that 0.8% difference is going toward expenses and the wrap fee. It's usually a fair trade for the lack of volatility, but it’s something to keep an eye on.

Real-World Performance During Market Stress

Look at 2022. It was a nightmare year where both stocks and bonds crashed simultaneously. Usually, bonds go up when stocks go down, but inflation changed the math. Total Bond Market funds were down double digits.

During that time, people in a Lincoln stable value account were fine. Their balance didn't move—except for the interest added every month. While their neighbors were seeing 15% losses in "safe" bond funds, stable value holders were earning a steady 2% or 3%. That is the specific scenario where this asset class shines. It decouples you from the broader market's bad mood.

Common Misconceptions to Clear Up

- "It’s a savings account." No. It's an investment contract within a retirement plan. You can't go to a Lincoln branch and withdraw cash.

- "The rate is guaranteed forever." Nope. The rate changes. Lincoln tries to keep it steady, but if the economy shifts, your yield will too.

- "I can't lose money." Technically, you could if the wrap providers fail or if there is a catastrophic "run on the fund" that exceeds the contract's terms. It’s extremely rare, but in finance, "never" is a dangerous word.

Actionable Steps for Plan Participants

If you're staring at your investment options and seeing the Lincoln stable value account, don't just click "buy" or "ignore." Do a little detective work first.

- Check the current crediting rate. Compare it to the current yield on 3-month Treasury bills. If the stable value account is paying significantly less, it might be lagging behind the market too much.

- Read the Equity Wash provision. Know exactly where you can't move your money if you decide to sell. If you have a lot of "competing" funds in your 401(k), your liquidity might be more limited than you think.

- Assess your "Safe Bucket." Most financial advisors suggest keeping 3-6 months of expenses in true cash (savings/checking). The stable value account should be part of your investment allocation, not your emergency fund.

- Look at the Wrap Providers. Often, these funds are "multi-wrapped," meaning Lincoln might be the lead, but other companies share the risk. This is actually a good thing—it diversifies the credit risk.

- Evaluate your timeline. If you need this money in 12 months, stable value is great. If you need it in 20 years, use it sparingly.

Stable value is one of the few "free lunches" in the retirement world because it offers bond-like returns with money-market-like stability. It isn't perfect, and it isn't exciting, but when the market gets messy, it's often the most valuable tool in your 401(k) toolkit. Check your plan's specific "Fact Sheet" for the Lincoln stable value account to see the exact expense ratio and current yield before making your move.