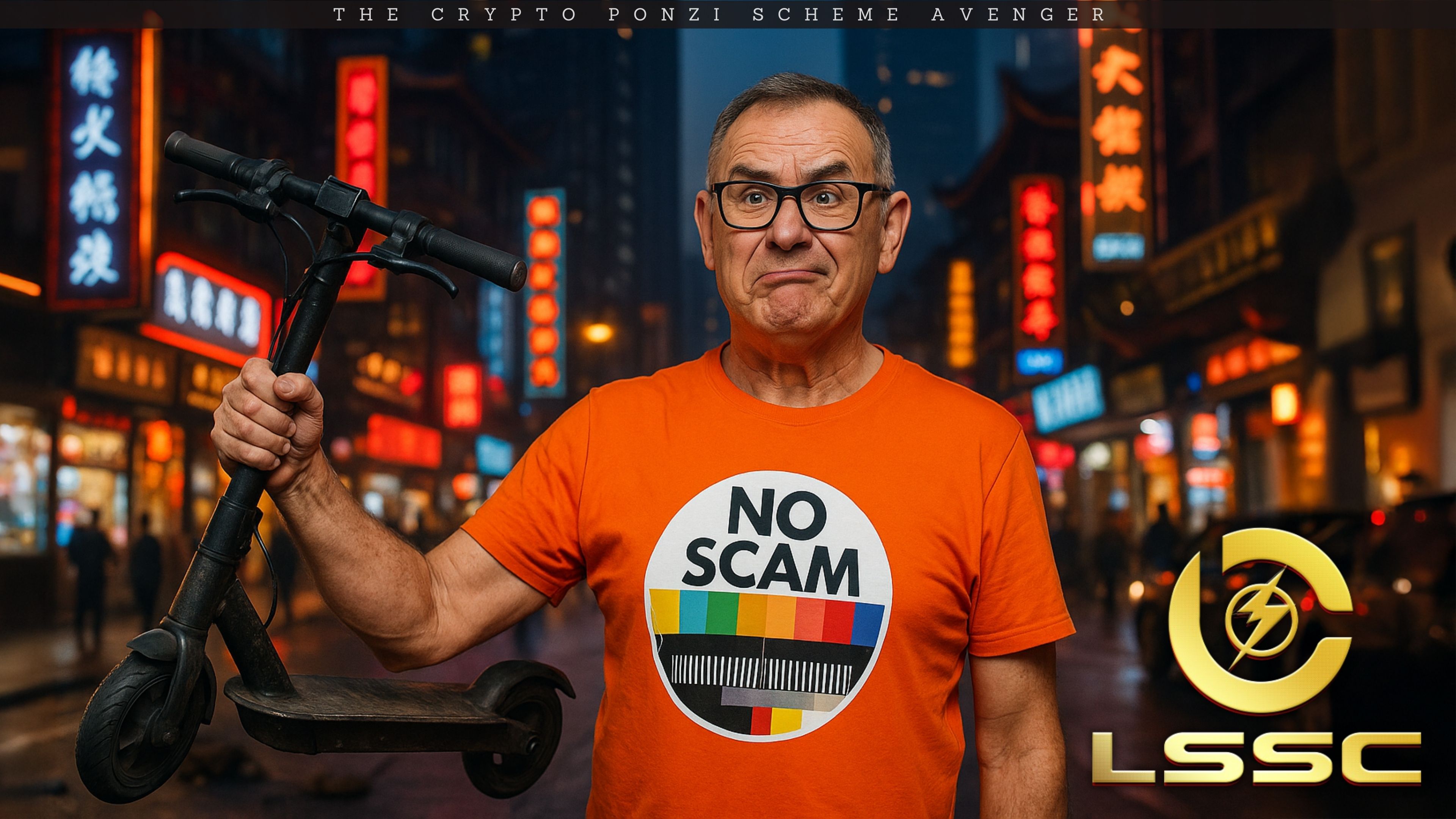

You've probably seen the videos on Instagram or TikTok. Someone is showing off a brand-new SUV or a stack of cash, thanking a company called Lightning Shared Scooter Co. (or LSSC for short). They talk about "passive income" and how easy it is to make money just by clicking a button in an app to "manage" a fleet of electric scooters. Honestly, it sounds like the dream side hustle for 2026.

But if you’re looking for a scooter to actually ride down the street, you’re going to be disappointed.

There is a massive difference between real micromobility companies like Lime or Bird and what’s happening with LSSC. While the name sounds like a standard tech startup, the reality is much more complicated—and significantly more dangerous for your wallet. Regulatory bodies across North America, including the Financial and Consumer Affairs Authority of Saskatchewan (FCAA) and the Autorité des marchés financiers (AMF) in Québec, have already issued urgent warnings.

What is Lightning Shared Scooter Co. exactly?

Basically, LSSC claims to be a platform where regular people can invest in electric scooters. The pitch is simple: you "buy" or "rent" a virtual scooter through their app, and then you earn a daily profit from the supposed rides that scooter takes in the real world. They call it a "click-to-earn" model.

It sounds like a modern version of a vending machine business.

The problem? Nobody has actually seen these scooters on the streets.

In a traditional business like Lime, you see the green scooters parked on sidewalks. You scan a QR code, you ride, and you pay. With Lightning Shared Scooter Co., the business happens entirely inside a closed app. Most of the transactions are handled via cryptocurrencies like USDC on the Polygon network or USDT.

📖 Related: Why 1 USD to TL Still Matters: The Real Story Behind the Exchange Rate

Why the Red Flags are Flying

Regulators haven't been shy about using the word "scam." In mid-2025, the Canadian Securities Administrators (CSA) added LSSC and its various entities—like LSSC Canada Inc. and LSSC Edmonton Ltd.—to their investor caution lists.

They aren't registered to sell securities. They aren't authorized to solicit investors.

If you look at the structure, it looks a lot like a classic Ponzi scheme. In these setups, the "profits" paid out to early members aren't coming from actual scooter rentals. Instead, they come from the deposits made by newer members. It works great for a few weeks, which is why you see those "success story" videos. But once the stream of new investors dries up, the whole thing tends to vanish overnight.

The Social Media Trap

LSSC has been pushed hard through what people call "dynamic income" strategies. Basically, members get huge commissions for bringing in friends and family. This creates a weird social pressure. You see someone you trust posting about their "stable income," and it feels legit.

Some reports even mention people being pressured to take out loans to open "LSSC stores" or "service centers" that don't actually exist in any physical capacity.

"It's literally at the push of a button," says one man in a promotional video.

This is a classic psychological trigger. We all want easy money. But real businesses—even high-growth tech startups—have overhead, maintenance, and actual physical assets you can touch.

How to Spot the Difference

If you're interested in the shared mobility space, you need to know how to tell a legitimate investment or business opportunity from a "click-to-earn" trap.

- Physical Presence: Does the company have a permit to operate in your city? Real scooter companies have to fight for years to get municipal licenses in places like New York, Toronto, or London.

- Payment Methods: Legitimate apps use standard credit card processors (Stripe, Apple Pay). If a company only wants crypto or "shady" third-party apps like Bonchat, be extremely careful.

- Guaranteed Returns: No real business guarantees a "static income" for three years. Markets fluctuate. Scooters break. Rain happens.

- The "Vibe" Check: If the marketing is more about "recruiting" than "riding," it’s probably not a transportation company.

The Impact on Real Micromobility

The tragedy here is that shared scooters are actually a great piece of urban infrastructure. Companies like Bird, Lime, and Voi are doing the hard work of reducing car trips and lowering carbon emissions. When a name like Lightning Shared Scooter Co. gets associated with financial warnings, it makes people cynical about the whole industry.

✨ Don't miss: US Historical Inflation Rates: What Most People Get Wrong

Real micromobility is a low-margin, operationally intense business. It involves charging crews, mechanics, and legal teams. It is definitely not as simple as "clicking a button" in an app to watch your money grow.

What to Do if You’ve Already Put Money In

If you’ve already deposited funds into an LSSC-linked wallet, you need to act fast.

- Stop Depositing: Do not "top up" your account to reach a withdrawal threshold. This is a common tactic to get even more money out of victims before the site goes dark.

- Attempt a Withdrawal: Try to pull your principal out immediately.

- Report It: Contact the Better Business Bureau (BBB) or your local securities commission. In Canada, that’s the CSA; in the US, you should look toward the SEC or your state’s financial regulator.

- Secure Your Accounts: If you gave the app access to your crypto wallet or personal info, change your passwords and consider moving your remaining assets to a new, "cold" wallet.

Kinda scary, right?

The reality is that 2026 has seen a massive surge in these types of "app-based" investment schemes. They dress themselves up in the language of the "sharing economy" and "green energy" to look modern and ethical. But at the end of the day, if it sounds too good to be true—like making a living by "turning on" virtual scooters from your couch—it almost certainly is.

Always check aretheyregistered.ca or the equivalent registration database in your country before sending crypto to anyone claiming to be a "shared mobility" partner. Your future self will thank you for being the "annoying" person who asks too many questions.

Actionable Next Steps:

Check the official Investor Caution List on your regional securities commission website to see if any new "mobility" startups you've seen on social media are flagged. If you're looking for legitimate ways to invest in the scooter industry, stick to publicly traded companies or established venture capital platforms rather than "click-to-earn" apps.