You're standing in a kitchen with outdated linoleum, but you see the potential. Or maybe you're looking at a 50-unit apartment complex in a part of town that's just starting to turn around. You want it. But you aren't ready to drop a fifty-page legally binding contract on the seller's desk quite yet. That's where the letter of intent to purchase real estate comes in. Honestly, it’s the "first date" of property deals. It’s a way to say, "Hey, I’m serious, here’s what I’m thinking, are we on the same page?" without getting married to the deal before you’ve checked the plumbing or the rent rolls.

Most people treat an LOI like a formality. Big mistake. Huge. If you mess up the phrasing, you might accidentally find yourself in a legally binding nightmare, or worse, you leave a massive loophole that lets a better-funded buyer swoop in and steal the deal from under you.

Why the Letter of Intent to Purchase Real Estate Isn't Just "Paperwork"

In the fast-moving world of commercial and residential investing, speed is everything. A letter of intent to purchase real estate allows you to move fast. It’s a roadmap. It lays out the price, the timeline, and the "outs." Think about it this way: if you try to negotiate every single tiny detail of a Purchase and Sale Agreement (PSA) right out of the gate, the deal will die of exhaustion. Lawyers cost money. Lots of it. You don't want to spend $5,000 in legal fees for a contract on a property the seller won't even sell at your price point.

The LOI is a filter.

It weeds out the tire kickers from the actual players. When a seller sees a well-drafted letter of intent to purchase real estate, they know you've done your homework. They see a price. They see a closing date. They see your "due diligence" period. It gives them enough confidence to stop taking other calls—at least for a few days—and focus on you.

Is it actually binding?

Well, it depends. This is where people get tripped up. Most LOIs are intended to be non-binding, meaning you can walk away if you find a cracked foundation or if your bank laughs at your loan application. But, and this is a big but, certain clauses should be binding. The "Exclusivity" or "No-Shop" clause is the big one. You want the seller to agree that they won't talk to other buyers while you're spending money on inspections. If that part isn't binding, you're just a backup plan while they look for a better offer.

The Anatomy of a Deal-Winning LOI

Don't just use a generic template you found on a random blog from 2012. Every deal is weird in its own way. You need to address the specifics.

👉 See also: Share Market Today Closed: Why the Benchmarks Slipped and What You Should Do Now

First, you’ve got the Purchase Price. This is the headline. Don't play too many games here. If the property is worth $2 million and you offer $1.2 million "just to see," expect the LOI to end up in the trash.

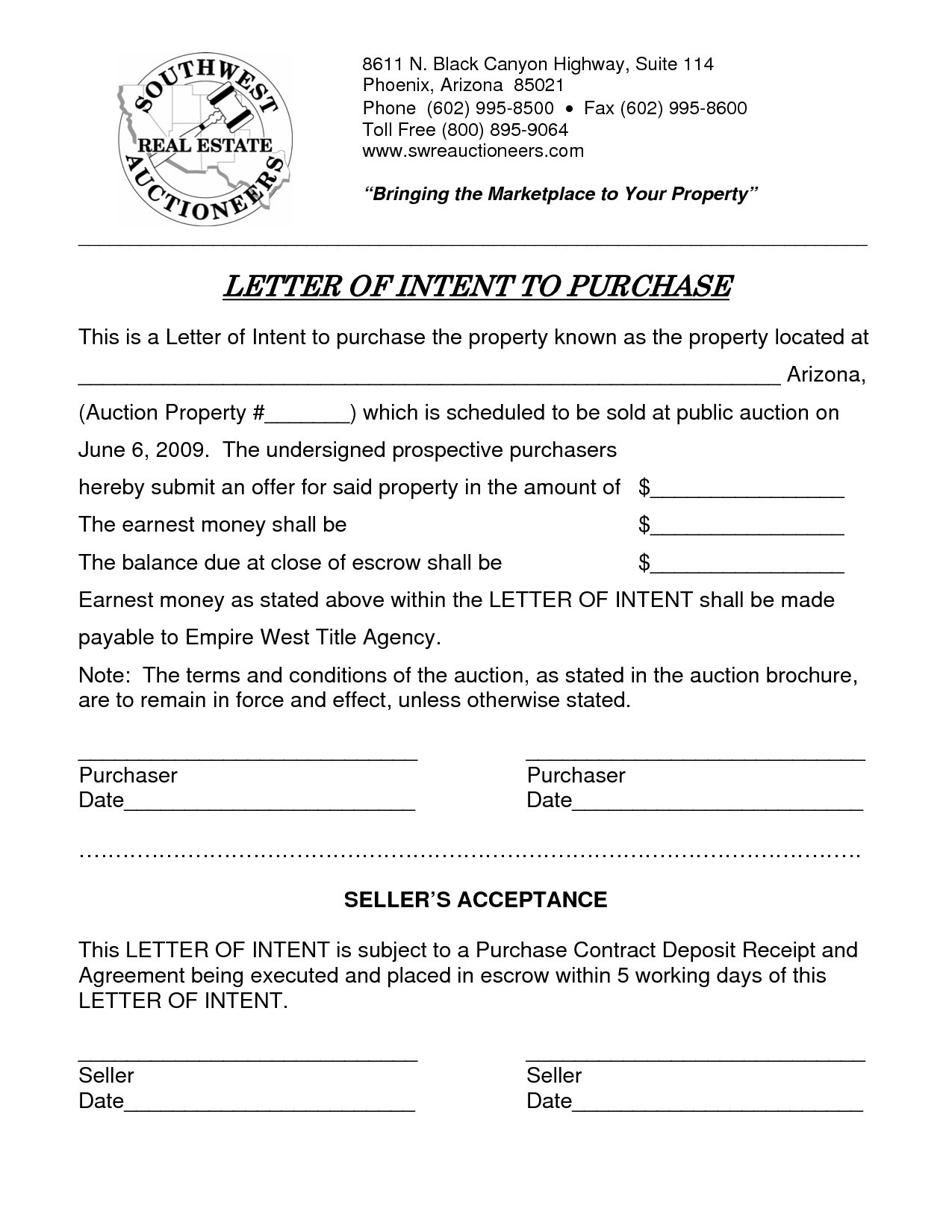

Next, the Earnest Money Deposit. This is your "skin in the game." In a letter of intent to purchase real estate, you’ll specify how much you’re putting down and when it becomes "hard" (non-refundable). Sellers love seeing money go hard early, but as a buyer, you want to keep that cash refundable until you’re 100% sure the roof isn't caving in.

The Due Diligence Period

This is your "look under the hood" time. Usually, it's 30 to 60 days. You're checking titles, environmental reports, and zoning laws. If you're buying a commercial building, you're looking at every single lease to make sure the tenants aren't all planning to move out next month.

- Inspection Period: How long do you have to poke around?

- Closing Date: When does the money actually change hands?

- Financing Contingency: What happens if the bank says no?

- Seller Disclosures: What does the seller have to tell you?

You also need to talk about Closing Costs. Who pays for the title insurance? Who pays the transfer taxes? In some states, it’s customary for the seller to pay; in others, it’s the buyer. Don’t let a $20,000 tax bill surprise you at the finish line because you didn't mention it in the LOI.

The "No-Shop" Clause: Your Secret Weapon

Imagine you spend $3,000 on a structural engineer and $2,000 on a lawyer to draft the final contract. Then, the seller calls you and says, "Sorry, someone else offered $10k more. We're going with them."

You'd be livid.

✨ Don't miss: Where Did Dow Close Today: Why the Market is Stalling Near 50,000

That's why a binding exclusivity period in your letter of intent to purchase real estate is non-negotiable for serious investors. You’re basically asking the seller to take the property off the market for 15, 30, or 45 days. It gives you the "quiet" you need to do your work without looking over your shoulder. If a seller refuses to sign a no-shop clause, they aren't serious about selling to you. They're just using your offer to bait someone else.

Common Pitfalls That Kill Deals

Kinda crazy how many people forget to include the "Expiration Date." An LOI shouldn't hang out there forever. Give the seller 48 or 72 hours to respond. It creates urgency. If you leave it open-ended, they'll just sit on it while they wait for other offers to roll in.

Another big one: being too vague about "Financing."

If you just say "subject to financing," the seller might worry you don't even have a pre-approval letter. Be specific. Say "Buyer shall obtain a commitment for a loan of at least 70% of the purchase price within 30 days." It shows you actually know how the banking world works.

Watch Out for "Subjective" Language

Avoid words like "satisfactory" without defining what that means. To you, a "satisfactory" roof might mean it doesn't leak. To a seller, "satisfactory" might mean "the shingles are still mostly there."

The Difference Between Commercial and Residential LOIs

In residential real estate, especially for single-family homes, the letter of intent to purchase real estate is less common because most agents use standardized state-specific forms. However, in "off-market" deals—where you're approaching a homeowner directly—an LOI is a great, low-pressure way to start the conversation. It feels less like a legal threat and more like a proposal.

🔗 Read more: Reading a Crude Oil Barrel Price Chart Without Losing Your Mind

In the commercial world (retail, office, industrial, multi-family), the LOI is the absolute standard. No one starts with a full contract. It’s too complex. You might have 20 different tenants with 20 different estoppel certificates. You need the LOI to get the broad strokes down before the lawyers start their "redlining" war.

How to Present Your LOI to Win

Don't just email a PDF.

If you can, have your broker call the listing agent and talk through the highlights first. Or, if you're dealing directly with a seller, send a brief, professional cover letter. Explain why you want the property. Maybe you grew up in the neighborhood. Maybe you have a track record of renovating historic buildings. Sellers are humans. They often care about the "legacy" of the property, especially if they've owned it for decades.

A little bit of rapport goes a long way.

Honestly, I’ve seen lower offers get accepted over higher ones simply because the buyer seemed more "certain" to close and had a better story. The letter of intent to purchase real estate is your chance to tell that story.

Actionable Steps to Take Right Now

If you're looking at a property and you're ready to move, don't wait for the "perfect" moment.

- Verify the Legal Description: Make sure you aren't just using the street address. Get the parcel number (APN) or the "Lot and Block" description from the county records. You want to be sure you're buying exactly what you think you're buying.

- Define Your "Outs": Be crystal clear on what allows you to walk away with your deposit intact. Usually, this is "sole and absolute discretion" during the due diligence period.

- Set a Hard Deadline: Give the seller a reason to say "yes" today. "This offer expires Thursday at 5:00 PM."

- Consult a Pro: Even though an LOI is usually non-binding regarding the purchase, the language can still create "implied contracts." Have a real estate attorney look at your template once. Just once. It’s worth the few hundred bucks to ensure your "non-binding" letter doesn't accidentally become a "binding" disaster.

- Check Your Proof of Funds: If you're claiming to have $500k for a down payment, have the bank statement ready (with account numbers blacked out). Attach it to the LOI. It makes you look like a pro.

Real estate is a game of clarity. The more clear you are in your letter of intent to purchase real estate, the smoother the rest of the transaction will go. You aren't just trying to buy a building; you're trying to build a relationship that leads to a successful closing.

Get the LOI right, and the rest of the deal usually follows suit. Mess it up, and you’ll be fighting over "what we meant" for the next six months while the property sits empty. Move fast, be clear, and always protect your deposit.