Money, power, and the "Art of the Deal"—or, as New York Attorney General Letitia James puts it, the "art of the steal." It’s 2026, and the legal echoes of the massive civil fraud case against Donald Trump are still bouncing around the courtrooms of New York. You’ve probably seen the headlines: a nearly half-billion-dollar judgment, talk of seizing skyscrapers, and a high-stakes appeal that’s basically turned into a marathon.

But what actually happened? And why is everyone still talking about it?

Honestly, it’s a bit of a mess. At its core, this wasn't about a single "mortgage fraud" in the way a homeowner might lie on an application. It was about a decade-long pattern of allegedly inflating asset values to get better deals from banks and insurers. We’re talking about "ghost" acres, tripled square footage, and price tags that seemed to change depending on who was asking.

The $450 Million Hammer

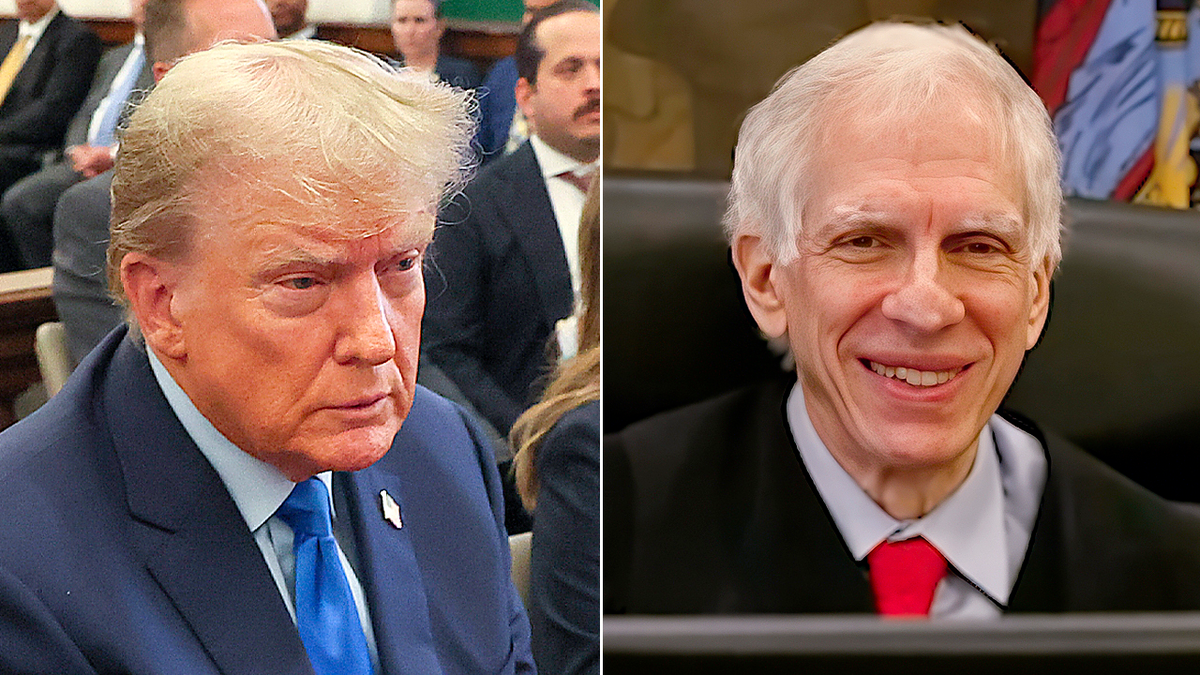

Back in February 2024, Judge Arthur Engoron dropped the hammer. He didn't just find that Trump had committed fraud; he ordered him and his co-defendants to pay more than $450 million. That number included interest that was ticking up at a staggering rate of about $112,000 every single day.

The judge’s 92-page decision was blistering. He basically said the defendants were "incapable of admitting the error of their ways" and noted a "complete lack of contrition" that he found borderline pathological.

✨ Don't miss: Carlos De Castro Pretelt: The Army Vet Challenging Arlington's Status Quo

Trump, naturally, called it a witch hunt. He argued that the banks made money, no one was a victim, and that "disclaimers" in his financial statements told everyone to do their own homework. But the court wasn't buying it. In New York, the Attorney General can sue for "persistent fraud" even if no one lost money, simply to protect the "integrity of the marketplace."

The "Triplex" and Other Wild Numbers

If you want to understand why James won the initial round, you have to look at the Trump Tower Triplex. For years, Trump’s financial statements claimed his penthouse was 30,000 square feet.

In reality? It was 10,996 square feet.

That’s not a rounding error. That’s claiming your apartment is three times bigger than it actually is to add $200 million to your net worth. Then there was Mar-a-Lago. The state argued Trump valued it as a private residence worth up to $739 million, even though he’d signed away the right to use it as anything other than a social club, which dropped its value significantly.

🔗 Read more: Blanket Primary Explained: Why This Voting System Is So Controversial

The trial featured a "who's who" of the Trump Organization.

- Michael Cohen testified about being told to "increase the total assets" to a number Trump had already picked.

- Donald Trump Jr. and Eric Trump tried to distance themselves from the math, claiming they relied on accountants.

- Allen Weisselberg, the former CFO, ended up in jail (again) for perjury related to his testimony in this very case.

The 2025-2026 Twist: Appeals and Indictments

Here’s where it gets really wild. By August 2025, the Appellate Division in New York made a move that shocked people on both sides. They affirmed that Trump was indeed liable for fraud—meaning they agreed he lied—but they voided the massive $450 million penalty. They called the fine "excessive" under the circumstances.

Right now, in early 2026, the case is in a weird kind of limbo.

- Letitia James is fighting to get that money back.

- Trump’s team is pushing for the whole thing to be tossed based on "presidential immunity" or just plain old bias.

Adding more fuel to the fire, James herself became the target of a federal investigation. In late 2025, she was actually indicted on charges related to her own mortgage applications and bank fraud. She’s called it "political retribution" from a weaponized DOJ, and a federal judge recently dismissed those charges, but the political fallout has been massive. It’s created this bizarre mirror-image situation where the person who sued Trump for mortgage-related fraud was then accused of the same thing.

💡 You might also like: Asiana Flight 214: What Really Happened During the South Korean Air Crash in San Francisco

What This Means for Business Owners

If you’re watching this and thinking, "Can the government do this to me?" the answer is... maybe, but probably not. This case relied on Executive Law § 63(12), a New York powerhouse law that gives the AG massive reach.

However, the case teaches some pretty clear lessons about "funny money" in business:

- Consistency is King: You can't tell the IRS a property is worth $10 million for taxes and tell a bank it's worth $100 million for a loan.

- Accountants Aren't Shields: You can’t just say "my accountant did it" if the raw data you gave the accountant was fake.

- Disclaimers Have Limits: Those "worthless clauses" that tell banks not to trust the numbers? Judge Engoron famously called them "worthless" in a literal sense.

What Happens Next?

We’re waiting on the New York Court of Appeals (the state's highest court) to decide if the money stays gone or if Trump has to pay up. If the penalty is reinstated, it could still bankrupt parts of his empire or force a fire sale of famous properties like 40 Wall Street.

Keep an eye on the Independent Monitor, Barbara Jones. She’s been sitting inside the Trump Organization for years now, watching every dollar that moves. As long as she’s there, the "Art of the Deal" has a very strict babysitter.

If you're following this for your own business or just for the drama, stay focused on the Appellate Division filings. That's where the real power is right now. The trial is over, the shouting is mostly done, and now it’s just a high-stakes math problem for the highest judges in the state.

Next Steps for You:

Check the New York Unified Court System website for the latest "Notice of Entry" in the case People of the State of New York v. Donald J. Trump (Index No. 452564/2022) to see if a final payout date has been set.