You’ve probably seen the headlines. The US is still on top, China is breathing down its neck, and India is charging up the leaderboard like a runner who just found a second wind. But if you actually dig into the data for the largest economies in the world 2024, you'll realize that the "biggest" doesn't always mean the "richest" or the "strongest." Honestly, looking at nominal GDP alone is sorta like judging a book by its cover—you get the gist, but you miss all the good parts.

The Heavyweights: Who’s Actually Leading the Pack?

The United States finished 2024 with a nominal GDP of roughly $29.18 trillion. It’s a massive number. To put that in perspective, California alone has an economy worth about $4.1 trillion, which would make it the fifth-largest "country" if it ever decided to go rogue. The US economy is basically a giant service machine, with finance, healthcare, and tech doing the heavy lifting.

China, the perennial runner-up, hit about $18.7 trillion (World Bank estimates) or $19.4 trillion depending on whose data you trust more. They grew by 5% in 2024. That’s slower than their "glory days," but when your economy is that big, 5% is still an absolute mountain of new money.

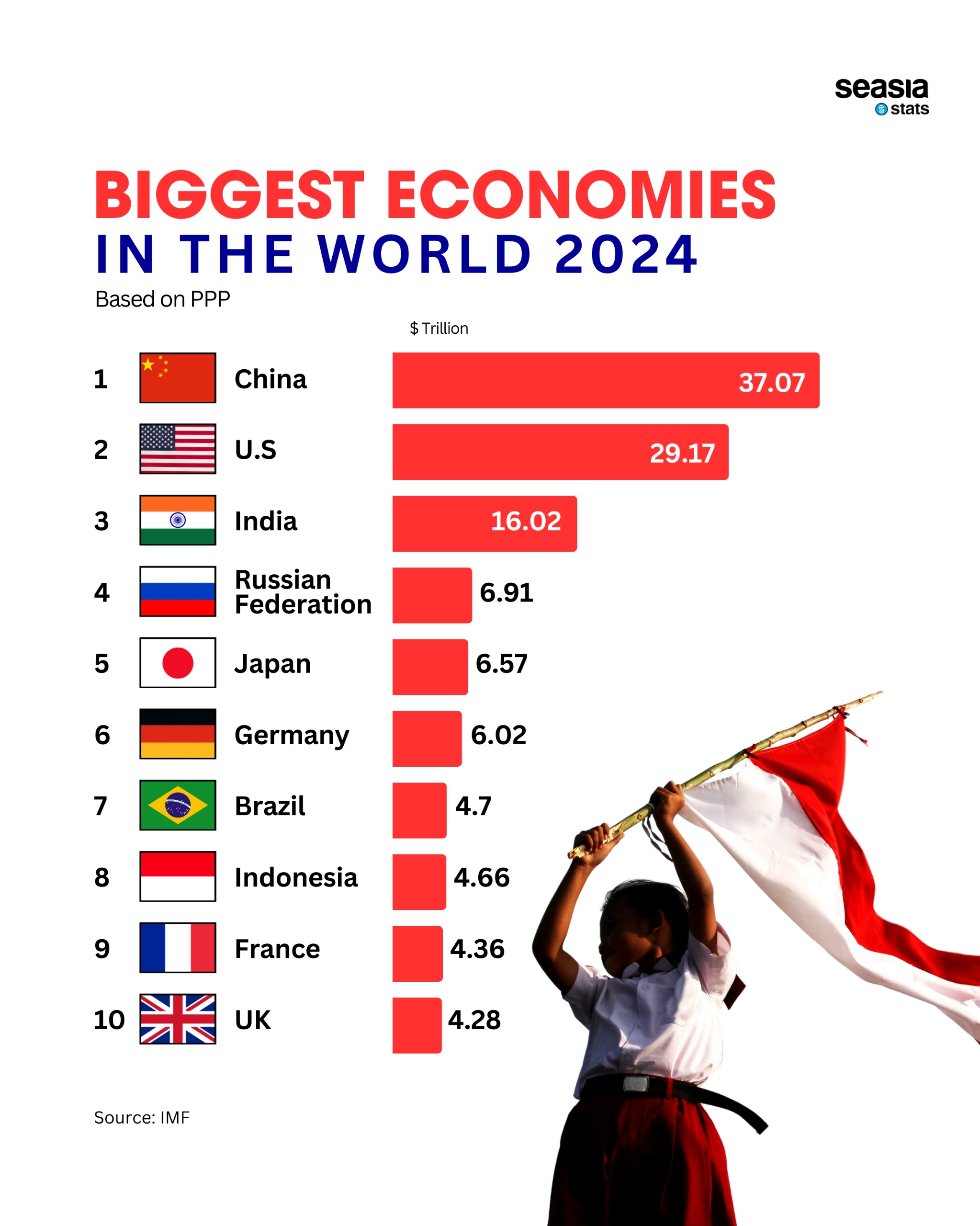

But here’s the kicker: if you switch to Purchasing Power Parity (PPP)—which adjusts for the fact that a dollar buys way more in Beijing than in Boston—China has actually been the world’s largest economy for years. In PPP terms, China’s 2024 output was over $35 trillion. It makes you wonder why we still obsess over nominal rates, doesn't it?

The Great Swap: Germany, Japan, and the Rise of India

2024 was a bit of a weird year for the mid-table giants. For the first time in ages, Germany officially overtook Japan to become the world’s third-largest economy.

Was it because Germany had a stellar year? Not really. In fact, Germany’s economy was pretty sluggish, growing at a measly 0.2%. Japan, on the other hand, got hit by a weakening Yen that made its economy look smaller when converted into US dollars. It’s a classic case of currency fluctuations messing with the "official" rankings.

🔗 Read more: Is The Housing Market About To Crash? What Most People Get Wrong

Then you’ve got India.

India is the one everyone is watching. It’s currently sitting at number five with a GDP of around $3.9 trillion. But while Germany and Japan are basically flatlining, India grew at a blistering 7% to 8.2% depending on the quarter. Experts like those at the IMF expect India to leapfrog both Germany and Japan by 2027. If you're a business looking for growth, India is basically the only game in town right now.

Why GDP Doesn't Tell the Whole Story

Honestly, GDP is a flawed metric. It measures "stuff" produced, but it doesn't measure how people are actually living.

Take a look at Ireland. On paper, Ireland has one of the highest GDPs per capita in the world (over $100,000). But if you ask a local in Dublin, they’ll tell you about the housing crisis and the cost of living. Much of that "GDP" is just accounting magic from tech giants like Google and Apple parking their intellectual property there for tax reasons.

The Top 10 List (The Nominal Reality)

Instead of a boring table, let's just look at how the 2024 landscape settled:

💡 You might also like: Neiman Marcus in Manhattan New York: What Really Happened to the Hudson Yards Giant

The United States stayed dominant at nearly $30 trillion. China followed, though dealing with a massive property market headache. Germany took the bronze at roughly $4.6 trillion, mostly because Japan ($4.0 trillion) saw its currency dive. India ($3.9 trillion) is the rising star, followed by the United Kingdom ($3.7 trillion) which is still trying to find its feet post-Brexit. France ($3.1 trillion), Brazil ($2.18 trillion), Italy ($2.38 trillion), and Canada ($2.24 trillion) rounded out the top tier.

The "Silent" Power of the Emerging Markets

While we focus on the Top 10, the real drama is happening further down. Countries like Indonesia and Brazil are becoming massive players. Indonesia, in particular, is a manufacturing powerhouse in the making.

And then there's Russia. Despite all the sanctions and being cut off from Western markets, Russia’s nominal GDP stayed around $2.1 to $2.5 trillion. Why? Mostly because of oil and a pivot toward trade with China and India. It’s a reminder that the "world economy" is no longer just a Western club.

What Most People Get Wrong About 2024

A common mistake is thinking that a high GDP means a strong currency. It doesn't.

Japan is the perfect example. They have world-class companies like Toyota and Sony, but the Yen was so weak in 2024 that their global "rank" dropped. Does a Japanese person feel poorer because their country dropped to #4? Maybe a little when they travel abroad, but at home, the stores are still full and the trains still run on time.

📖 Related: Rough Tax Return Calculator: How to Estimate Your Refund Without Losing Your Mind

Also, don't confuse GDP with wealth. GDP is what you make this year. Wealth is what you have. The US has massive accumulated wealth in its stock market and real estate, which gives it a cushion that younger economies like India don't have yet.

What’s Coming Next?

If you're trying to make sense of all this for your own life or business, here’s the "so what":

- Watch the Middle Class: The real power shift isn't just about government spending. It's about where the new middle class is. By 2030, the majority of the world's middle-class consumers will be in Asia, not Europe or North America.

- Currency is King (or a Villain): If you're investing, remember that a country's GDP can grow while its currency shrinks. Always look at local growth rates, not just the USD conversion.

- Diversification: 2024 proved that "stable" economies (like Germany) can stall. Having exposure to "high-beta" markets like India or Southeast Asia is no longer a luxury—it's a necessity.

The global economy is currently in a "sticky spot," as the IMF puts it. Inflation is cooling, but interest rates are still high, and debt is a ticking time bomb for many developing nations.

Actionable Steps to Use This Knowledge

Don't just read these numbers and move on. Use them to guide your next move:

- Audit your investments: Are you too heavily weighted in "slow-growth" regions like the EU? It might be time to look at Emerging Market ETFs that focus on India or Indonesia.

- Business expansion: If you're a small business owner, look at the "digital export" potential to the rising middle classes in the East.

- Stay skeptical of rankings: Whenever you see a "Largest Economies" list, immediately check if it's Nominal or PPP. If it's Nominal, you're looking at a map of currency strength. If it's PPP, you're looking at a map of actual production.

The world is changing fast. The 2024 rankings are just a snapshot of a race that never really ends.

Next Steps for You:

- Research the difference between GNI (Gross National Income) and GDP to see how much money actually stays in a country.

- Check the latest IMF World Economic Outlook updates, as they revise these numbers every few months based on new inflation data.

- Look into the MSCI Emerging Markets Index if you want to see how these economic rankings translate into stock market performance.