You’ve probably heard the noise. Everyone wants a piece of the mid-cap pie because, let’s be honest, that’s where the multi-baggers live. But finding a fund that doesn't crumble when the market catches a cold is a whole different ballgame. Enter the Kotak Emerging Equity Fund. It’s basically the veteran in a room full of hyperactive teenagers. While newer funds chase the latest "shiny object" stocks, this one has been quietly compounding wealth for over a decade.

It's massive. With an Asset Under Management (AUM) crossing the ₹45,000 crore mark, it's one of the largest mid-cap funds in India. Some people worry that being "too big" makes a fund sluggish. They think it can’t move fast enough to grab small opportunities. But Harsha Upadhyaya, the man who has been steering this ship for years, seems to have a different philosophy. He isn't trying to day-trade the volatility; he’s looking for companies that will survive the next five business cycles.

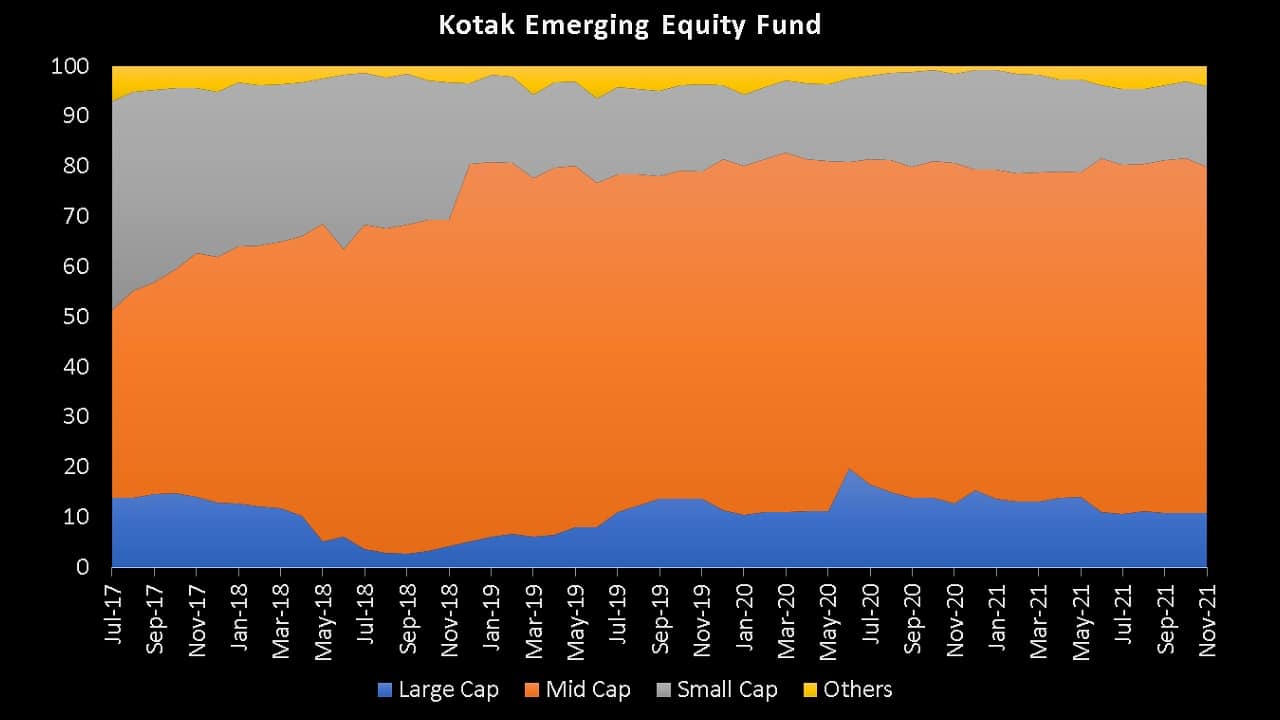

What Kotak Emerging Equity Fund Really Does Differently

Most mid-cap funds are like high-stakes poker players. They bet big on a few sectors and hope for the best. Kotak Emerging Equity Fund? Not so much. It’s diversified. Like, really diversified. We are talking about a portfolio that often holds 70 to 80 stocks.

📖 Related: SEK to USD Conversion: Why Your Bank Is Probably Ripping You Off

If one stock tanks 20% tomorrow because of a bad earnings report, the fund barely feels it. That's the secret sauce. It’s built for resilience. It focuses on the "Midcap 150" universe but filtered through a very specific lens: the "BMV" framework. That stands for Business, Management, and Valuation.

They don't just buy a company because it's growing at 30%. They buy it if the management isn't sketchy and the price isn't astronomical. Honestly, in a market where "valuation" often feels like a forgotten word, this discipline is refreshing. You won't find them chasing momentum stocks at any price. They’d rather sit out a rally than overpay for a mediocre business.

The Myth of the "Too Large" AUM

There is this constant debate in the investing world about whether a large AUM kills performance. It's a valid concern. When you have ₹40,000+ crore to deploy, you can't just buy a tiny company without moving the stock price yourself.

However, Kotak manages this by sticking to the upper end of the mid-cap spectrum. They lean into "quality" mid-caps—companies that are leaders in their niche but haven't quite reached the "Blue Chip" status of the Nifty 50 yet. Think of sectors like Industrial Products, Chemicals, and Consumer Durables. These aren't just fly-by-night operations; they are the backbone of the Indian manufacturing story.

Performance: Is It Still Delivering?

Let's look at the cold, hard numbers. If you look at the 5-year or 10-year CAGR (Compound Annual Growth Rate), the fund has consistently outperformed its benchmark, the Nifty Midcap 150 TRI.

But here is the kicker: it doesn't always top the charts during a crazy bull run.

In a year where the market is up 40%, a more aggressive, concentrated fund might give you 50%. The Kotak Emerging Equity Fund might "only" give you 42%. But—and this is a huge but—when the market drops 20%, this fund usually drops much less. It’s a "low beta" strategy. It’s for the investor who wants to sleep at night without checking their portfolio every ten minutes.

Many investors made the mistake of exiting in 2018-2019 when mid-caps were struggling. Those who stayed saw the fund bounce back spectacularly during the post-pandemic recovery. It’s a marathon runner, not a sprinter.

A Peek Into the Portfolio

The fund has a heavy tilt towards Capital Goods and Financials. It’s a bet on India’s capex cycle. If factories are being built and infrastructure is expanding, companies in this portfolio win. Names like Supreme Industries, Cummins India, and Schaeffler India have been long-term staples.

They also hold a decent chunk in private sector banks and non-banking financial companies (NBFCs). Why? Because mid-sized companies need credit to grow. By owning the lenders, the fund captures the growth of the entire ecosystem. It's clever. It’s also risky if the economy stalls, which is why the "Management" part of their BMV filter is so important. They want lenders with clean balance sheets, not the ones hiding bad loans under the rug.

The Downside No One Mentions

Nothing is perfect. The expense ratio for the Direct Plan is usually around 0.4% to 0.5%, which is fair. But the Regular Plan is significantly higher. If you’re still invested through a distributor, you’re bleeding a lot of potential returns over 10 years.

Also, the sheer size of the fund means it will likely never be the #1 performer in any single year. It’s too broad for that. If you are looking for 100% returns in 12 months, this isn't your fund. You’d be better off gambling on a thematic micro-cap fund (and probably losing your shirt in the process). This fund is for serious wealth creation over a decade or more.

Risk Management as a Priority

One thing you'll notice is the cash levels. Sometimes, the fund sits on 5% or 7% cash. Some investors hate this. "Why aren't you fully invested?" they ask.

The reason is simple: optionality. When the market goes into a panic and everyone is selling, Harsha and his team want the cash to buy high-quality stocks at a discount. That’s how you generate alpha (excess returns). It’s about being greedy when others are fearful, but you can only do that if you have some "dry powder" ready to go.

How to Actually Invest in This Fund

If you’re thinking about jumping in, don't just dump a massive lump sum today. The mid-cap space is notoriously volatile.

🔗 Read more: Kids Coffee Shark Tank: What Really Happened to the Company That Made Caffeine for Toddlers

The best way—kinda the only way for most people—is a Systematic Investment Plan (SIP). If you start a SIP, you buy more units when the market is down and fewer when it’s up. Over time, your cost averages out.

- Check your time horizon: If you need the money in 3 years, stay away. Mid-caps need at least 5 to 7 years to breathe.

- Portfolio fit: If your portfolio is already 80% mid-caps, adding more Kotak Emerging Equity won't help you. It should ideally be the "growth" engine of a diversified portfolio that also includes large-caps and maybe some debt.

- Taxation: Remember, since this is an equity fund, long-term capital gains (LTCG) over ₹1.25 lakh are taxed at 12.5% (as per the latest 2024 budget rules). Short-term gains (less than a year) are taxed at 20%.

The Indian economy is on a path to becoming a $5 trillion and then a $7 trillion economy. The companies that will drive this aren't just the huge conglomerates we already know. It’s the mid-sized players that are becoming leaders in specialized fields. Kotak Emerging Equity Fund is essentially a diversified bet on those future leaders. It’s not flashy. It’s not "get rich quick." It’s just solid, process-driven investing that has stood the test of time.

Actionable Steps for Your Portfolio

Stop looking at the 1-year return. It's a trap. Instead, look at the rolling returns over 3 and 5 years to see how the fund handles different market cycles. If you decide to invest, automate it. Set up a SIP for a date right after your salary hits.

Most importantly, keep an eye on the fund manager. While the "Kotak process" is robust, Harsha Upadhyaya’s experience is a big part of the value here. If there’s ever a major change in leadership, that’s when you re-evaluate. For now, it remains one of the most reliable vehicles for mid-cap exposure in India.

🔗 Read more: Oklahoma State Income Tax: What Most People Get Wrong

Review your existing equity allocations. If you lack exposure to the "mid-cap" segment—specifically the manufacturing and industrial side of India—this fund fills that gap effectively. Open your investment platform, compare the "Direct" plan performance against your current holdings, and consider a staggered entry to mitigate the risk of a market correction.