Money was scarce on the American frontier in the 1830s. People were desperate. If you walked into a general store in Ohio back then, you weren't pulling out a crisp twenty-dollar bill issued by the federal government. You were probably handing over a handful of mismatched notes from private banks that might or might not be worth their face value by the time the sun went down. This chaotic financial backdrop is where the story of the Kirtland Safety Society begins. It wasn't just a footnote in religious history; it was a full-blown economic crisis that still fuels debates today. When people look for kirtland safety society history essays, they’re usually trying to figure out if this was a genuine attempt at community building or a naive financial blunder that spiraled out of control.

It failed. Spectacularly.

Within months of opening its doors in Kirtland, Ohio, the institution collapsed, leaving early members of The Church of Jesus Christ of Latter-day Saints in financial ruin and sparking a wave of apostasy that nearly tore the movement apart.

The Wild West of Banking

To understand why the Kirtland Safety Society happened, you have to understand the era of "Wildcat Banking." President Andrew Jackson had a massive vendetta against the Second Bank of the United States. He killed it. This left a vacuum. Suddenly, everyone and their cousin thought they could start a bank. In Ohio, the state legislature was stingy with bank charters, often favoring political allies.

Joseph Smith and other church leaders applied for a charter in late 1836. They were rejected.

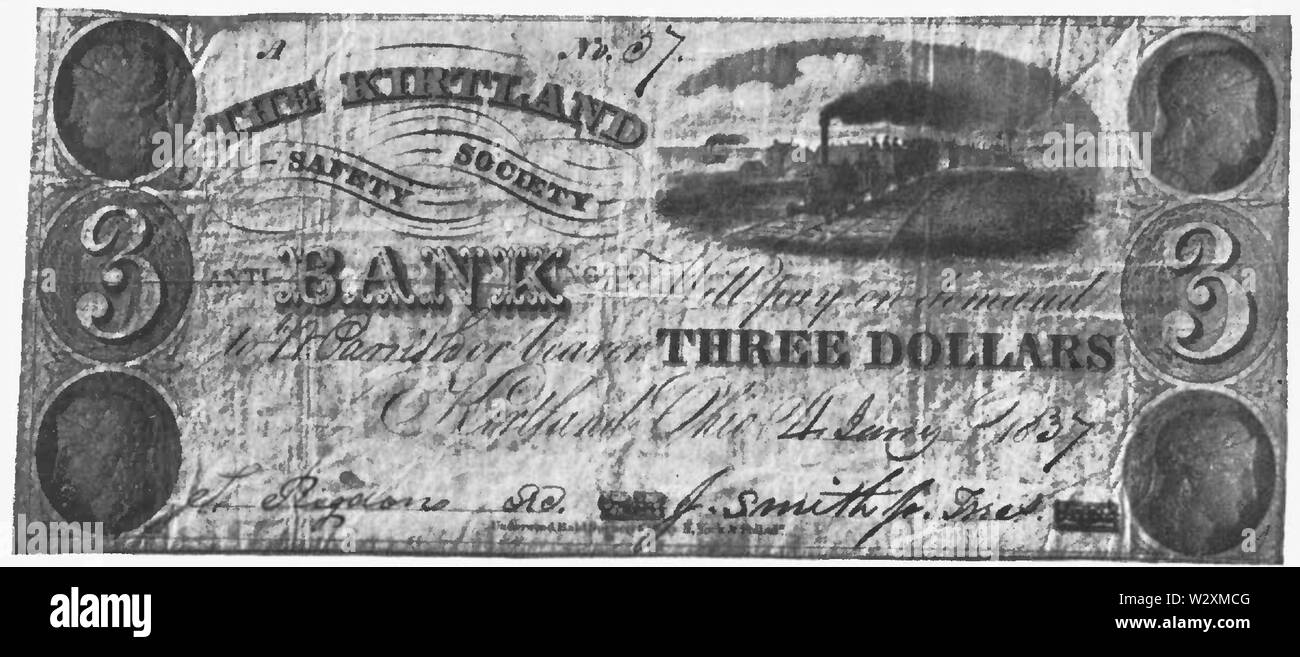

Most people would have stopped there. They didn't. Instead, they pivoted and formed a "joint-stock company" called the Kirtland Safety Society Anti-Banking Company. It’s a bit of a linguistic joke—calling yourself an "anti-bank" to get around the fact that you don't have a banking license. They even took their printed banknotes and physically stamped "Anti" before "Bank" and "ing" after "Bank" to technically comply with the law. You can still see these stamped notes in museums today. They look hurried.

Why Kirtland Safety Society History Essays Matter Today

Historians like Mark Stuy and Scott Sommerdorf have spent years digging through the ledgers. What they found wasn't a simple case of fraud, though critics at the time certainly shouted that from the rooftops. It was more a case of extreme over-leverage and bad timing.

👉 See also: Statesville NC Record and Landmark Obituaries: Finding What You Need

The Panic of 1837 was brewing.

This wasn't just a Kirtland problem; it was a global one. Cotton prices in New Orleans plummeted. Banks in New York stopped redeeming notes for gold. The entire American economy hit a brick wall right as the Kirtland Safety Society was trying to find its footing. If you're writing or researching kirtland safety society history essays, the Panic of 1837 is your primary context. Without it, the story is incomplete.

The society had very little "specie"—that’s gold and silver coin. They had a lot of land. But land is illiquid. You can't give a guy a square inch of a farm to pay for a loaf of bread. When people started getting nervous and demanded gold for their paper notes, the vault was essentially empty.

The Internal Friction

Imagine being a convert who had moved your entire life to Ohio because you believed in a prophetic calling, only to lose your life savings because the prophet’s bank went bust. It was brutal.

Parley P. Pratt, who later became a prominent apostle, was briefly among the loudest critics. He felt betrayed. He wasn't alone. Grandison Newell, a local antagonist, started buying up Kirtland notes at a massive discount and then taking them to the bank to demand gold, knowing they didn't have it. It was a targeted "run on the bank" designed to break the institution. It worked.

By the summer of 1837, the bank was dead. Joseph Smith and Sidney Rigdon were eventually fined for illegal banking. The fallout was a sieve that filtered the church membership. Those who stayed had to reconcile their faith with the very human, very messy financial failure of their leaders.

✨ Don't miss: St. Joseph MO Weather Forecast: What Most People Get Wrong About Northwest Missouri Winters

Myths and Misconceptions

One common story you'll find in older kirtland safety society history essays is the "hidden drawers" legend. The story goes that Joseph Smith filled crates with sand and stones, covering them with a thin layer of gold coins to fool investors. Modern scholarship, particularly from the Joseph Smith Papers Project, hasn't found contemporary evidence to support this as a coordinated scam. It’s more likely a bit of folklore that grew in the telling.

The real tragedy wasn't a secret box of sand; it was the sincere belief that God would sustain the bank regardless of the economic math.

The math won.

The Numbers Game

- Initial Capital: They claimed a huge amount on paper, but actual liquid assets were likely under $20,000.

- Notes Issued: Roughly $100,000 in paper currency was put into circulation.

- Lifespan: Active operations lasted barely seven months.

Lessons from the Rubble

So, what do we actually learn from this? Honestly, it’s a masterclass in the dangers of mixing religious zeal with speculative real estate. The Kirtland era was defined by a gathering of people. Thousands arrived with no place to live. The church bought land on credit to house them. They expected the land values to keep rising forever. They didn't.

When the bubble popped, it didn't just pop—it disintegrated.

If you are looking to synthesize this into your own research, you have to look at the legal side too. The "Anti-Banking" loophole was clever, but it wasn't a shield. The Ohio courts didn't care about the wordplay. They saw an entity performing banking functions without a license.

🔗 Read more: Snow This Weekend Boston: Why the Forecast Is Making Meteorologists Nervous

How to Analyze the Primary Sources

When you dive into the archives, don't just look at the polemics. Look at the balance sheets. The Joseph Smith Papers provide digitized versions of the Kirtland Safety Society ledger book. It’s a dry read, but it tells the truth. You can see the names of people who deposited their last few dollars. You can see the massive loans given to church leaders to buy more land.

It shows a community trying to build a city out of thin air.

- Step 1: Compare the Kirtland Safety Society's failure rate to other banks in 1837. You'll find they weren't the only ones failing, but they were certainly among the most vulnerable.

- Step 2: Read the personal journals of Wilford Woodruff. He was a staunch supporter who recorded both the excitement and the crushing disappointment. His perspective provides the emotional weight that ledgers lack.

- Step 3: Examine the specific charges brought against Smith and Rigdon in the Geauga County court records. Understanding the exact legal violations helps strip away the hyperbole from both sides.

The Kirtland Safety Society wasn't a vacuum. It was a microcosm of a young, chaotic America trying to figure out what money was actually worth. It remains one of the most complex chapters in religious history because it forces a confrontation between spiritual conviction and the cold, hard reality of a balance sheet.

To get a full handle on the subject, track the movement of the keys. When the bank failed, the keys to the temple were still held, but the keys to the city's economy were lost. This led directly to the exodus to Missouri, a move prompted as much by debt and legal threats as by revelation. Understanding that transition is the "secret sauce" for any high-level analysis of this period. Focus on the transition from Kirtland to Far West to see the long-term scars left by the "Anti-Bank" experiment.

Actionable Insights for Researchers:

- Contextualize with the Panic of 1837: Never write about the Kirtland Safety Society as an isolated event. It was part of a national contagion.

- Use the Joseph Smith Papers: This is the gold standard for factual accuracy. Avoid secondary sources written more than 50 years ago, as they often rely on hearsay rather than the actual ledger books.

- Differentiate between the 'Society' and the 'Bank': Technically, they are the same, but the name change to "Anti-Banking" is a critical legal detail that shows the intent to bypass state restrictions.

- Track the Apostasy Rates: Use the 1837-1838 period to see how financial failure directly correlates with leadership turnover in the early church. It provides a data-driven look at how material loss affects spiritual affiliation.