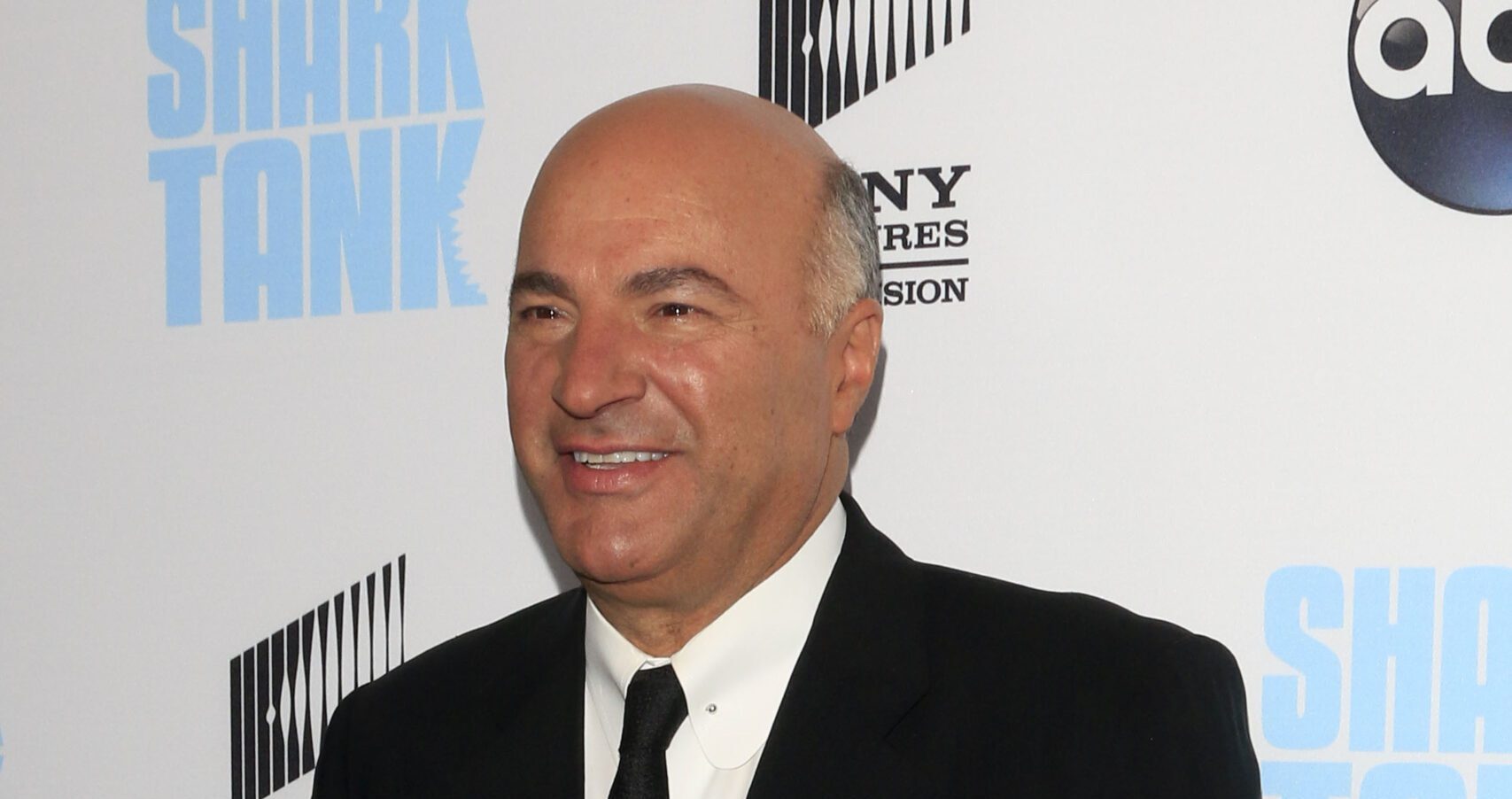

You see him every Friday night, perched in that leather chair with a smirk that says he knows exactly how much your "life's work" is actually worth. He’s the guy who tells a crying entrepreneur that their business is a "nothing-burger" and then offers a loan at 15% interest. But behind the "Mr. Wonderful" persona—the one that loves royalties and hates losing money—there’s a massive pile of cash that didn’t just appear out of nowhere. Honestly, if you've ever wondered about Kevin O’Leary’s net worth, you’re not alone. The guy basically makes a living talking about his own wealth.

As of early 2026, most credible estimates place the total value of the O'Leary empire at approximately $400 million.

It’s a staggering number, sure. But it’s also a number that feels a bit "light" compared to some of his Shark Tank colleagues like Mark Cuban, who sits in the multi-billionaire club. Why the gap? Well, Kevin plays a different game. He isn't out here trying to own the Dallas Mavericks or build the next Amazon. He’s the ultimate "yield" guy. He wants his money to have "babies," as he often says, through dividends, royalties, and structured debt.

How Kevin O’Leary’s Net Worth Actually Broke Out

The foundation of the whole thing started back in the 80s. You might know the story of SoftKey International. He started it in a basement with a $10,000 loan from his mother. Eventually, that little software company went on an acquisition tear, buying up competitors like The Learning Company and Broderbund.

The big payday? 1999.

Mattel bought The Learning Company for roughly $3.7 billion. Now, Kevin didn't pocket all of that—he was the CEO and a major shareholder, not the sole owner—but it was the "liquidity event" that changed his life forever. Even though the merger famously went south for Mattel shortly after, Kevin walked away with his fortune intact and his reputation as a ruthless dealmaker cemented.

The Storage and Wine Pivot

He didn't just sit on that Mattel money. By 2003, he co-founded Storage Now, a company that specialized in climate-controlled storage facilities for tech and pharmaceutical companies. They grew it fast and sold it in 2007 for about $110 million.

Then there’s the lifestyle stuff. O’Leary Fine Wines, his various book deals, and his massive public speaking fees—often reaching six figures per appearance—all add layers to that $400 million pile. He’s essentially turned his name into a brand that prints money regardless of what the stock market is doing today.

The Shark Tank Portfolio and the Royalties Obsession

If you watch the show, you know Kevin loves a royalty. While other Sharks fight for equity, Kevin often asks for a dollar for every unit sold until he gets his money back (plus interest). This strategy has paid off massively with companies like Wicked Good Cupcakes, which reportedly generated over $1 million in royalties for him before being acquired.

He’s also got big wins in companies like PRx Performance. He snagged 20% of that business for $80,000, and it’s now one of the top-performing companies in the show’s history with hundreds of millions in lifetime sales.

What He’s Holding in 2026

If you looked at his brokerage account right now, you wouldn't see a bunch of "moonshot" tech stocks. His OUSA (O’Shares U.S. Quality Dividend ETF) philosophy tells the whole story. He focuses on giant, boring, cash-flow-positive companies. His top holdings usually include:

- Apple (AAPL): Because even Mr. Wonderful can't ignore the iPhone's ecosystem.

- Microsoft (MSFT): A classic play on enterprise software dominance.

- Johnson & Johnson (JNJ): Pure stability and consistent dividends.

- Exxon Mobil (XOM): He’s a big believer in the energy sector’s cash flow.

He’s famously said he won't own a stock that doesn't pay him to own it. That's why his net worth doesn't swing as wildly as a tech mogul's. It's built on a bedrock of quarterly checks.

The Crypto Rollercoaster: A Hard Lesson

We have to talk about the FTX thing. It’s the elephant in the room. Kevin was a paid spokesperson and an investor, and he took a massive hit when the exchange collapsed. He’s been very open about losing nearly $15 million in that debacle.

However, by late 2025 and into 2026, he’s changed his tune on digital assets. He recently purged almost all his "altcoins," keeping only Bitcoin (BTC) and Ethereum (ETH). He’s waiting for the U.S. CLARITY Act to fully pass, believing that once the regulations are solid, institutional money will pour in and drive those two assets much higher. He’s still a believer, just a much more cautious one.

The "Milton Rockwell" Era: A Hollywood Pivot?

Surprisingly, one of the newest contributors to his brand value isn't a stock at all. Kevin recently took a role in the A24 film Marty Supreme, playing a wealthy 1950s socialite named Milton Rockwell. While the acting paycheck probably didn't move the needle on a $400 million net worth, it keeps him in the cultural zeitgeist.

✨ Don't miss: Jung-Chin Shen at York University: What Most People Get Wrong About Organizational Strategy

And in Kevin's world, being relevant is the same as being profitable. The more people know who "Mr. Wonderful" is, the higher his speaking fees go, and the more users sign up for his investment apps like Beanstox.

Why $400 Million is Probably an Underestimate

Estimating a celebrity's wealth is always a bit of a guessing game because we can't see their private bank accounts. Most experts agree that the $400 million figure is a "conservative" floor.

Think about it. He owns high-end real estate in Toronto, Geneva, and the United States. He has a world-class collection of rare watches—including pieces from Patek Philippe and Rolex that have appreciated significantly in value. He’s also an owner in WonderFi, one of Canada's largest regulated crypto platforms. When you add up the private equity, the physical assets, and the brand equity, the real number could easily be higher.

But Kevin doesn't care about being the "richest." He cares about "freedom." To him, $400 million is just the number that ensures no one can ever tell him what to do again.

✨ Don't miss: Did Jeff Bezos Support Trump? What Really Happened with that Washington Post Mess

Actionable Takeaways from the O’Leary Method

If you want to build a "Wonderful" portfolio, you don't need millions to start. You just need his discipline.

First, stop chasing the "next big thing" and start looking for companies that actually make a profit. If they don't pay a dividend, they shouldn't be the core of your wealth. Second, diversify. Kevin never puts more than 5% of his wealth into one stock and never more than 20% into one sector. It’s about surviving the bad years so you can thrive in the good ones.

Finally, treat your money like employees. If they aren't working for you and bringing back more money, they’re fired. It’s a cold way to look at a bank account, but it’s exactly how you end up with a net worth that stays solid regardless of the headlines.

To truly apply these principles, start by auditing your current holdings for "yield." Identify which of your assets are actually producing cash flow versus those that are simply sitting there hoping for a price increase. Shifting even 10% of a stagnant portfolio into high-quality dividend-paying stocks or automated investment tools can be the first step toward building a self-sustaining financial engine.