If you’ve been watching the Kaveri Seed Company stock price lately, you’ve probably noticed the vibe is a little... tense.

As of January 15, 2026, the stock is hovering around ₹885.30. Just to give you some perspective, this is a far cry from the ₹1,602 peak we saw earlier in the year. Honestly, it’s been a rough ride for anyone holding the bag. Over the last six months, the price has tumbled by more than 20%.

Why? It’s not just one thing. It's a messy cocktail of illegal seeds, production costs, and a quarterly report that looked like it had been through a paper shredder. But if you look under the hood, the company is still one of India's biggest seed giants.

The Numbers Nobody Likes to Talk About

Let’s get the ugly stuff out of the way first. In the quarter ending September 2025 (Q2 FY26), Kaveri Seed reported a net loss of ₹15.05 crore.

Compare that to the massive profit of ₹316.50 crore they pulled in during Q1, and you can see why the market got spooked. The revenue for that same quarter dropped a staggering 74.1% on a quarter-on-quarter basis.

That’s a huge swing.

👉 See also: Sands Casino Long Island: What Actually Happens Next at the Old Coliseum Site

Investors hate volatility like that. However, farming is seasonal. You can't judge a seed company by one quarter in the same way you wouldn't judge an ice cream shop by its January sales. Even with that dip, the consolidated revenue for the first half of the year (H1 FY26) was up 14.54%, reaching ₹1,077.43 crore.

Basically, they are selling more, but it’s getting more expensive to make the stuff.

The Real Reason for the Slump

If you ask an analyst why the Kaveri Seed Company stock price is struggling, they’ll probably point to the "illegal seed" problem.

It sounds like a movie plot, but it’s a real headache for the industry. In the cotton segment, volumes dropped by about 15-20%. Why? Because farmers are increasingly using illegal, unapproved seeds (specifically BG-II RRF seeds).

When the market is flooded with grey-market products, the big, legitimate players like Kaveri lose out.

✨ Don't miss: Is The Housing Market About To Crash? What Most People Get Wrong

On top of that, production costs for cotton seeds have spiked. Usually, companies just pass those costs to the customer. But in the agri-world, you can't always do that without losing your shirt—or your farmers.

Where the Money Is Actually Moving

It’s not all doom and gloom. If you’re looking at this as a long-term play, you have to look at the non-cotton segments.

- Maize: Revenue grew by a massive 56.76% in the first half of the year.

- Vegetables: This is the high-margin goldmine. Revenues jumped 31.06%.

- Hybrid Rice: Growing steadily, with revenue up over 21%.

Kaveri is trying to pivot. They know cotton is a mess right now. That’s why they are dumping around ₹60 crore a year into R&D. They are betting big on climate-resilient seeds and new vegetable hybrids like okra, chili, and tomato.

They also recently declared an interim dividend of ₹5 per share (250% of the face value). For a stock trading under ₹900, that’s a decent little kickback for staying loyal.

Is it Underpriced?

Most analysts seem to think so. While the current price is near its 52-week low of ₹867.45, the average 1-year price target is sitting around ₹1,144 to ₹1,170.

🔗 Read more: Neiman Marcus in Manhattan New York: What Really Happened to the Hudson Yards Giant

That is some significant upside.

The company is debt-free. That’s a rarity in today’s market. They have a cash balance of about ₹363 crore on the books. While that’s down from last year (mostly because of inventory build-up), it’s still a very healthy cushion.

The Price-to-Earnings (P/E) ratio is roughly 15.15, which is way lower than the industry average of over 50. In simple terms? It looks cheap.

But "cheap" can sometimes be a trap if the growth doesn't return.

What to Watch Next

Keep an eye on the Union Budget 2026. There is a lot of chatter about the government pushing for digital agriculture and better irrigation. If that happens, quality seed companies are the first to benefit.

Also, watch the export numbers. Kaveri is eyeing markets like Bangladesh, Vietnam, and Tanzania. They are projecting export growth of 30-40% this year. If they can nail that, the dependence on the volatile Indian cotton market becomes less of a problem.

Actionable Next Steps for Investors:

- Monitor the Cotton Recovery: Check if the government takes a harder stance on illegal seeds. If the "grey market" shrinks, Kaveri’s volumes will bounce back instantly.

- Evaluate the Rabi Season: The extended monsoon in late 2025 has left the soil with great moisture. This is prime for the Rabi (winter) crop, especially maize. Strong Q3 and Q4 results could be the catalyst the stock needs to break its downward trend.

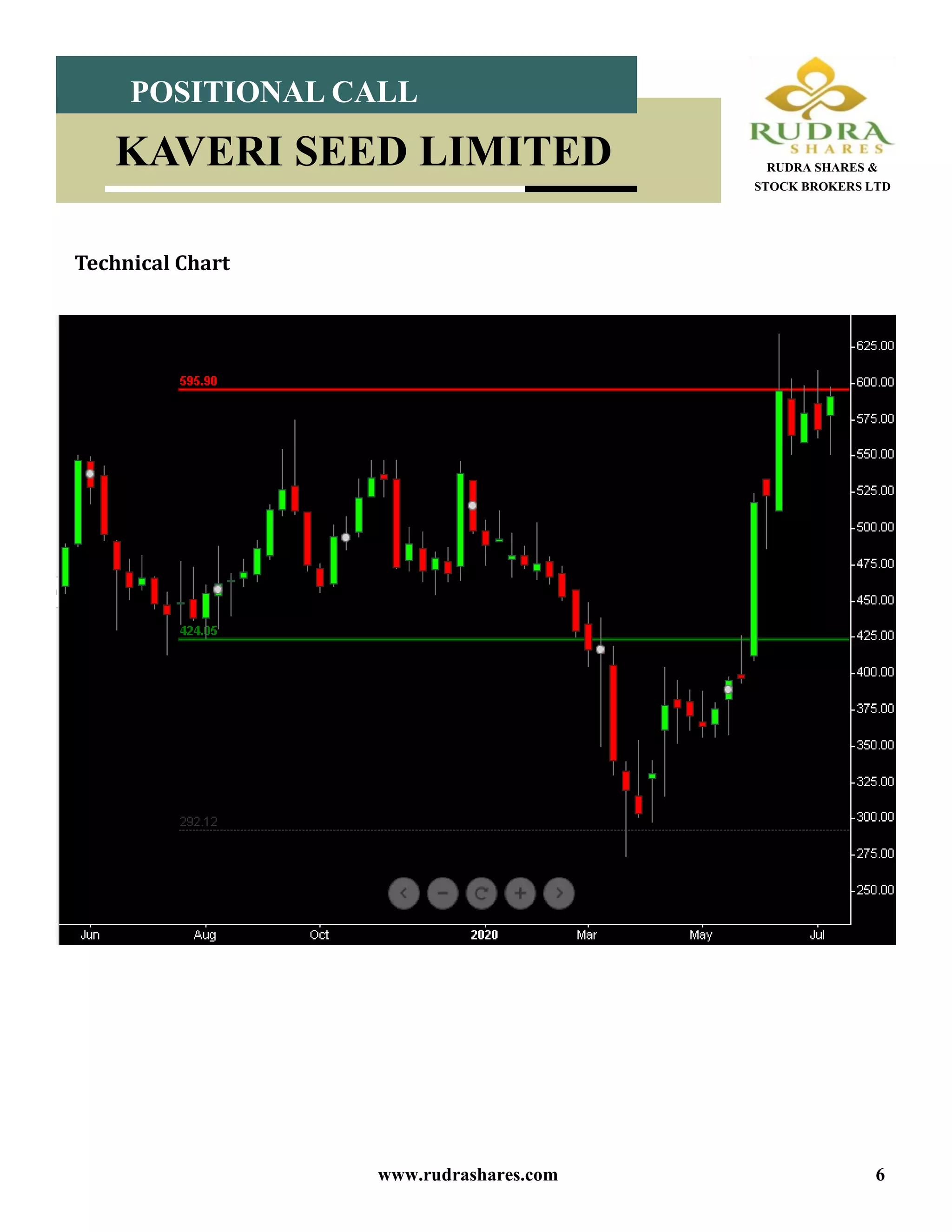

- Check Technical Support: The stock is currently trading below its 200-day EMA (Exponential Moving Average). For a safe entry, most technical traders wait for the price to stabilize and cross back above the 50-day EMA, which is currently around ₹978.

- Assess Portfolio Diversification: If you already hold agri-stocks like Dhanuka or Godrej Agrovet, Kaveri’s current valuation makes it an interesting "value" play, but don't over-concentrate until the profit margins stabilize.

The Kaveri Seed Company stock price is in a classic "wait and watch" zone. It has the fundamentals of a winner, but it's currently fighting a tough macro environment.