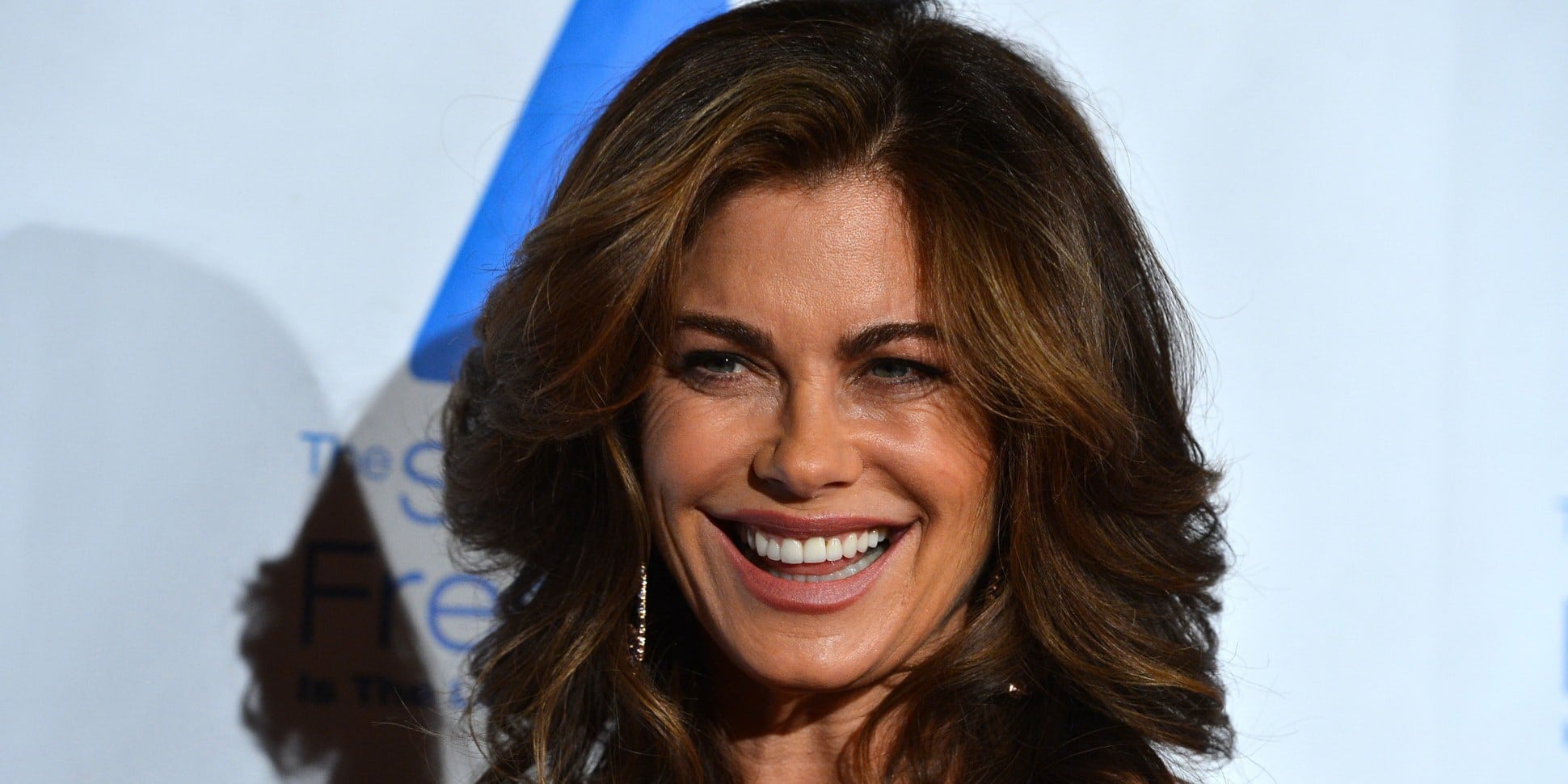

You probably remember the poster. Most people do. In 1989, Kathy Ireland graced the cover of the Sports Illustrated Swimsuit Issue in a yellow bikini, an image that eventually became the best-selling cover in the magazine's history. It was the kind of fame that usually expires. For most models, the "shelf life" is brutal—you’re a face for a decade, then a trivia question for the rest of your life.

But Kathy Ireland net worth isn’t a relic of the eighties. It’s a modern case study in how to build a billion-dollar empire without ever needing to walk another runway.

Today, she isn't just a "former model." She is the Chair and CEO of kathy ireland Worldwide (kiWW), a private licensing powerhouse that moves billions in retail sales every year. Honestly, if you’ve bought a ceiling fan, a rug, or a pair of socks recently, there’s a decent chance you’ve contributed to her bank account.

The Shocking Numbers Behind Kathy Ireland Net Worth

Let’s get the big question out of the way. How much is she actually worth? As of early 2026, most credible financial analysts and wealth trackers place Kathy Ireland net worth at approximately $500 million.

Some estimates vary. You might see numbers as high as $540 million or as "low" as $360 million depending on how you value her privately held company. Because kiWW isn’t traded on the stock market, she doesn’t have to open her books to the public. But here is the kicker: her company generates over **$3.1 billion in annual retail sales**.

That is more than double what Martha Stewart’s empire was producing at its peak.

Think about that for a second. We’re talking about a woman who was once told she was just a "pretty face" now out-earning the world’s most famous homemaker. It’s a staggering level of success that stays mostly under the radar because she’s not chasing tabloid headlines. She’s chasing market share in "un-glamorous" categories like office furniture, window treatments, and insurance.

📖 Related: Yangshan Deep Water Port: The Engineering Gamble That Keeps Global Shipping From Collapsing

It All Started With a Pair of Socks

In 1993, Kathy was pregnant and looking for a way out of the modeling industry before it kicked her out. Most agencies wanted her to launch a swimwear line. It made sense, right? She was the swimsuit queen. But she said no.

She wanted to sell socks.

People thought she was crazy. Why would the most famous model in the world care about footwear for busy moms? But she had a theory: if she could earn a woman’s trust with a $5 pair of socks, she could eventually sell her a $2,000 sofa.

She partnered with Moretz Mills in North Carolina. They didn’t just put her name on a package; she actually worked on the design and the marketing. They sold 100 million pairs. That wasn't just a fluke. It was a proof of concept.

The Warren Buffett Connection

You don't get to a half-billion-dollar net worth without some heavy-hitting advice. Kathy famously counts Warren Buffett as a mentor. On his suggestion, she pivoted heavily into home furnishings. Buffett told her that the "home" category was far more stable than the fickle world of fashion.

She listened.

👉 See also: Why the Tractor Supply Company Survey Actually Matters for Your Next Visit

Today, her brand covers more than 17,000 products. We aren't just talking about clothes. We're talking about:

- Amini Innovation Corp (AICO): High-end furniture that looks like it belongs in a mansion but sells at Nebraska Furniture Mart.

- Fintech: She even has a credit card processing arm called Ireland Pay.

- Real Estate: Her "Weddings by Kathy Ireland" resorts span from Fiji to Greece.

- Pet Products: Because even dogs need the Kathy Ireland touch.

Why She’s the Richest Supermodel (And It’s Not Even Close)

When people talk about wealthy models, they usually bring up Gisele Bündchen or Cindy Crawford. Gisele is incredibly wealthy, with a net worth hovering around $400 million. But Gisele’s wealth still feels tied to the "glamour" industry.

Kathy is different. She is a "model-preneur" who built a licensing juggernaut.

Licensing is the secret sauce. She doesn't own the factories. She doesn't deal with the shipping logistics of 17,000 items. Instead, she licenses her name, her designs, and her brand "solutions" to manufacturers who do the heavy lifting. She gets a cut of every single sale. It’s a high-margin, low-overhead business model that has allowed her to scale to a level her peers can't touch.

Lessons from the $500 Million Empire

If you’re looking at Kathy Ireland net worth and wondering how to replicate even a fraction of that success, there are a few "Kathy-isms" that actually matter.

First, she under-promises and over-delivers. Her dad was a labor union organizer who taught her to always put the newspaper on the porch, not just in the driveway. She still runs her business that way.

✨ Don't miss: Why the Elon Musk Doge Treasury Block Injunction is Shaking Up Washington

Second, she isn't afraid of "no." She often tells stories about the hundreds of meetings where she was laughed out of the room. Business guys in suits didn't think a girl from Sports Illustrated could understand supply chains or manufacturing. She let them think that—and then she outworked them.

Third, she owns 100% of her company. By staying private, she doesn't have to answer to Wall Street. She can make long-term bets that might look "bad" on a quarterly report but pay off big over a decade.

What’s Next for kiWW?

She isn't slowing down. Recently, she’s been moving into the "age-tech" and "tele-health" spaces. She’s looking at how to help the aging population live better, which is a massive market.

She’s also a massive philanthropist. A huge chunk of her time (and money) goes toward ending human trafficking and supporting veteran families. For her, the money is just a tool to get things done.

To truly understand the Kathy Ireland net worth story, you have to look past the 1980s covers. She used her fame as a "seed" and planted it in the most boring, stable industries she could find. It turns out, selling ceiling fans is a lot more lucrative than selling calendars.

Practical steps to take from Kathy's career:

- Diversify your income streams: Don't rely on your "main" talent; look for ways to license your expertise or brand.

- Prioritize trust over trends: Build a brand that solves a problem for a specific audience (like her "busy moms" focus).

- Seek mentorship early: Find people like Warren Buffett who have seen market cycles and can guide your long-term strategy.

- Keep your equity: If possible, maintain ownership so you can make the decisions that matter for your future.

The most important takeaway? Never let people define your limits based on your first job. Kathy Ireland went from a "paper girl" to a "cover girl" to a "business mogul." She’s still just getting started.