Let's be honest. Opening that envelope from the Kane County Treasurer is never exactly a "highlight of the week" kind of moment. You see the total, maybe feel a slight spike in blood pressure, and then wonder how on earth the number got that high. It’s basically a rite of passage for homeowners in Geneva, Aurora, or Elgin. But here’s the thing: most people just look at the bottom line and grumble, without actually understanding what the Kane County property tax bill is telling them.

If you’re staring at your 2026 bill (or prepping for the next one), you need to know that these numbers aren’t just pulled out of thin air. They are a complex cocktail of your township assessor’s opinion, local school board spending, and whether or not you actually remembered to file for that homestead exemption.

Decoding the Math Behind Your Kane County Property Tax Bill

Most folks think the county just picks a percentage and charges it. Nope. Not even close. In Illinois, and specifically here in Kane, your bill is a product of Equalized Assessed Value (EAV).

Basically, the law says your property should be assessed at roughly 33.33% of its fair market value. If the "market" thinks your house is worth $300,000, your EAV should hover around $100,000. But then the state throws in a "multiplier" to make sure every county is playing fair. It’s a mess.

Why your neighbors might pay less

You ever talk to a friend a few blocks over and realize they’re paying $1,000 less than you? It’s probably not because the county likes them more. It’s usually because of exemptions.

For 2026, there have been some actual, meaningful changes to the Low-Income Senior Citizen Assessment Freeze. Governor Pritzker signed Senate Bill 642, which bumped the maximum household income for that freeze to $75,000 for the 2026 tax year (payable in 2027). If you’ve been hovering just over the old limit, this is a big deal. It doesn't mean your taxes won't go up at all, but it freezes the valuation of your home so you aren't penalized when the housing market in St. Charles goes nuts.

The Calendar: Dates You Actually Need to Circle

Missing a deadline in Kane County is expensive. Like, 1.5% per month expensive. That interest adds up faster than you’d think.

Typically, the Treasurer’s office, currently headed by Chris Lauzen, sticks to a pretty rigid schedule. You aren't paying for the current year; you’re paying for the previous one. So, in 2026, you are actually paying your 2025 taxes.

- First Installment: Usually due right around June 1st.

- Second Installment: Generally falls on September 1st.

If you're the type to forget, sign up for the Treasurer’s E-Notifications. Seriously. It’s better than finding a red notice on your door in October. By the time the last Friday in October rolls around, the county is done being patient. That’s when the annual tax sale happens, and you do not want to be on that list.

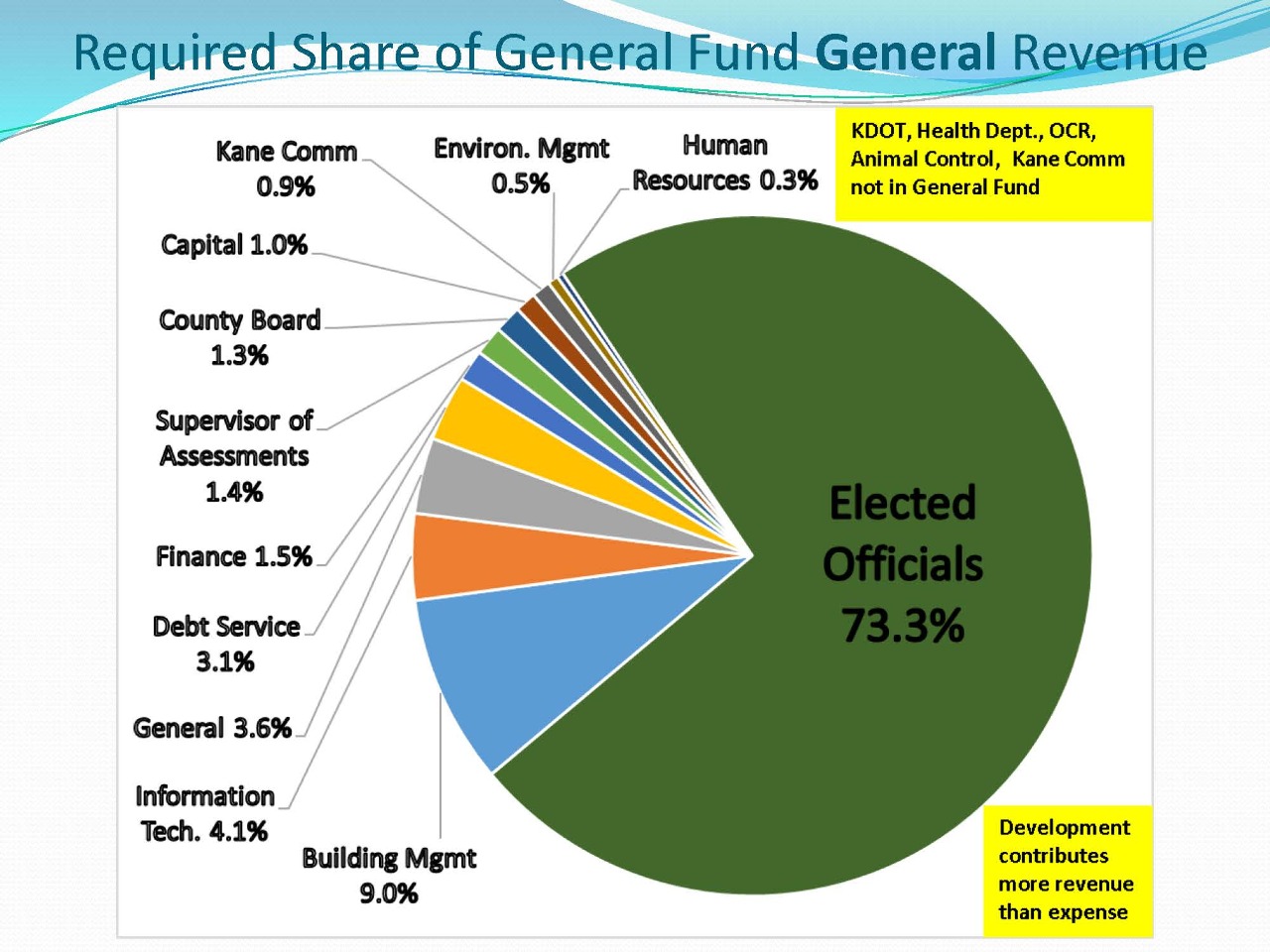

Where the Money Actually Goes

It’s easy to blame the county board, but they only take a slice. If you look at the "Taxing Body" section of your Kane County property tax bill, you’ll see the real culprits. Usually, 60% to 70% of your money is heading straight to your local school district.

The rest is a "choose your own adventure" of:

- Fire protection districts

- Library boards

- Forest preserve funds

- Township road and bridge funds

Each of these groups holds a "levy" meeting. If you really want to lower your taxes, those are the meetings you actually need to attend. Once the Clerk’s office calculates the rates based on those levies, the bill is basically set in stone.

Common Mistakes When Paying

Kinda surprisingly, the most common mistake isn't paying late—it's double paying.

💡 You might also like: Intel Foundry Business Cuts: Why Pat Gelsinger Is Breaking Up the Empire

If you have a mortgage, your lender is probably escrowing your taxes. They pay it for you. But every year, hundreds of Kane County residents see their bill in the mail, panic, and send a check anyway. The Treasurer’s website (treasurer.kanecountyil.gov) has a lookup tool. Use it. If it says "Bank/Mortgage Company" in the status, keep your checkbook in the drawer.

Also, don't try to send a partial payment. The office won't take it. They aren't a "payment plan" kind of establishment. It's either the full installment or nothing. If you're struggling, you're better off looking into the Senior Citizen Real Estate Tax Deferral Program, which is a whole different ballgame involving the State of Illinois.

How to Fight Back (The Appeal Process)

Think your assessment is total garbage? You can't appeal the tax bill itself, but you can appeal the assessment.

This happens way before the bill arrives. You usually have a 30-day window after the assessment notices are mailed out (typically in the late summer or fall) to file a complaint with the Kane County Board of Review.

You'll need evidence. "My taxes are too high" isn't evidence. "My neighbor's identical house is assessed at $50k less" or "An appraiser says my house is worth way less than the county thinks" is what gets results. Mark Armstrong, the Supervisor of Assessments, has the forms on his site, but you've gotta be fast. Once that window shuts, you’re stuck with that value for the year.

Actionable Next Steps

- Check your exemptions: If you turned 65 recently, or if you’re a veteran with a disability, make sure those codes (like E01 for General Homestead) are on your bill. It’s literally free money.

- Verify your income for the Senior Freeze: With the new $75,000 limit for 2026, more people qualify than ever before. Get your 2025 tax returns ready to prove it.

- Search your parcel online: Go to the Kane County Treasurer’s "Property Tax Inquiry" page. Check the payment history to ensure your mortgage company actually sent the money.

- Mark the June 1st deadline: Even if you haven't received the paper bill yet, assume the first installment is due then. If you don't get a bill by May, call the office at 630-232-3565. Not receiving a bill isn't a legal excuse for not paying it.

Your property tax bill doesn't have to be a total mystery. It’s just a matter of knowing which levers to pull and when to pull them. Stay on top of the assessment dates, and you might actually find a way to keep a few more bucks in your own pocket next year.