You’ve probably seen the headlines. Maybe you saw a frantic tweet or a TikTok breaking down how the government is coming for your house because its value went up. There is a lot of noise out there. Honestly, most of it is just plain wrong. When people talk about Kamala Harris unrealized gains proposals, they often skip the fine print, and that's where the actual story lives.

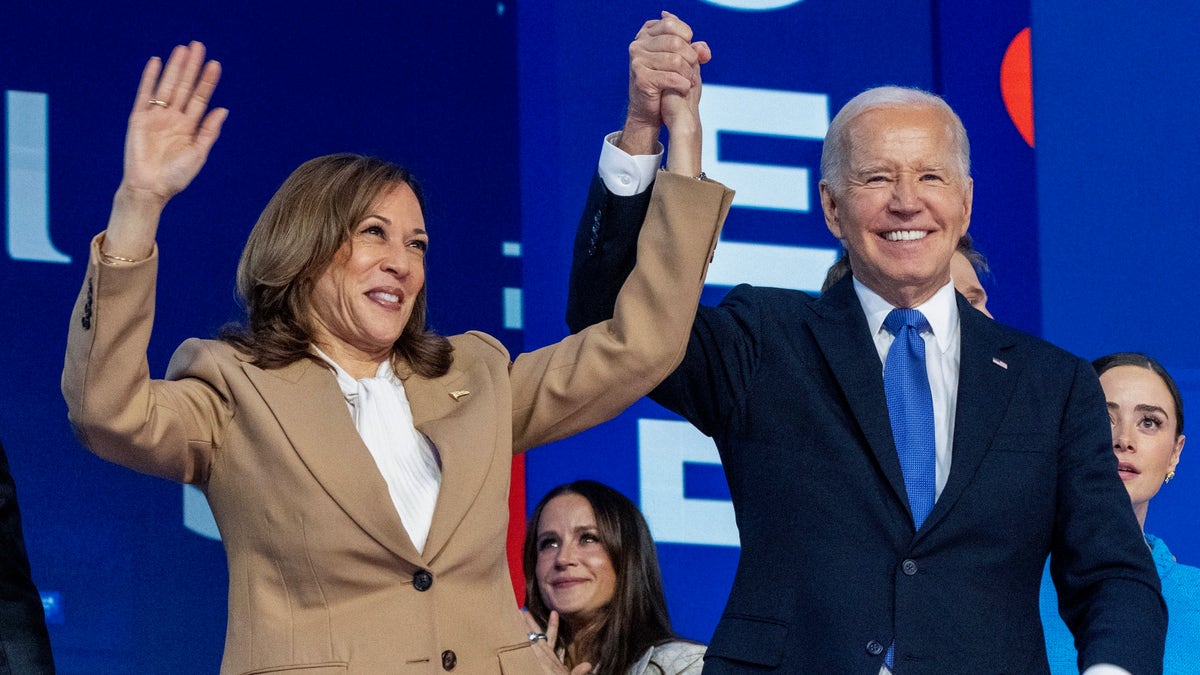

Basically, we are talking about a massive shift in how the United States thinks about wealth. For a century, the rule was simple: you don't pay taxes on an investment until you sell it. If you bought Apple stock in 2004 and held it, you were a genius on paper, but the IRS didn't see a dime. The new proposal—which Harris adopted from the Biden-Harris 2025 budget—wants to change that "wait and see" approach for the ultra-wealthy.

The $100 Million Threshold: Who Actually Pays?

Here is the thing. This isn't a tax on the average person. It’s not even a tax on the "rich" guy down the street with a nice boat.

The proposal specifically targets individuals with a net worth over $100 million. We are talking about the top 0.01% of households. If your net worth is $99 million, you’re still playing by the old rules. But once you cross that nine-figure line, the government wants a 25% minimum tax on your total income, and that includes unrealized capital gains.

Why? Well, the argument from the Vice President's side is about fairness. They see billionaires borrowing against their stocks to live a lavish lifestyle while technically reporting $0 in taxable income. By taxing the "paper gains"—the increase in value of stocks, real estate, or private companies—before they are sold, the government aims to close what they call the "buy, borrow, die" loophole.

How the Tax Actually Works (It's Kinda Complicated)

If you're worth $200 million and your tech startup’s valuation jumps by $10 million this year, you haven't actually "made" that money in cash. It's just a number on a screen. Under the Kamala Harris unrealized gains plan, you would owe a portion of that $10 million in taxes now, rather than ten years from now when you eventually sell the company.

- The Prepayment Rule: Any tax you pay on these gains is essentially a "down payment." When you finally do sell the asset, you don't get taxed twice. You just credit what you already paid against the final bill.

- The 9-Year Spread: To prevent people from having to fire-sale their companies just to pay the IRS, the proposal allows taxpayers to spread the initial tax payment over nine years. Future annual gains can be spread over five years.

- What if the Market Crashes? This is the big "what if." If you pay tax on a gain this year, but the stock market tanks next year and you lose that value, the proposal includes "refund" rules or credits that carry forward.

It sounds logical on paper, but in practice? It’s a logistical mountain. Imagine trying to value a private collection of rare Basquiat paintings or a niche software company every single year. The IRS would basically need to become a world-class appraisal firm overnight.

Why Silicon Valley is Freaking Out

If you talk to anyone in the venture capital world, they’ll tell you this is an "innovation killer." They aren't just being dramatic.

Startups are weird. A founder might own 20% of a company valued at $500 million, making them worth $100 million on paper. But that founder might only be taking a $150,000 salary. They are "paper rich" but "cash poor." If they suddenly owe $2 million in taxes because their company's valuation went up in a funding round, where does that cash come from?

They might have to sell their shares. If they sell their shares, they lose control of the company they built. Critics like Y Combinator’s Garry Tan have warned that this could force founders to sell out early to private equity firms, effectively ending the "garage startup" dream for anyone who actually succeeds.

The Constitutional Roadblock

There is also a huge legal shadow hanging over this whole thing. The 16th Amendment gives Congress the power to tax "incomes." Historically, the Supreme Court has defined "income" as something you’ve actually received or "realized."

In the 2024 case Moore v. United States, the Court danced around this issue. They upheld a specific tax on foreign earnings, but Justice Kavanaugh’s majority opinion was very careful. They didn't explicitly say the government can tax unrealized gains across the board. In fact, several justices hinted they might strike down a broad wealth tax or an unrealized gains tax if it ever landed on their desks.

So, even if Harris wins and Congress passes this, it’s going to spend years—maybe a decade—stuck in the court system.

📖 Related: Rite Aid in Lacey: What’s Actually Left and Where to Go Now

Practical Realities and Next Steps

Is this going to happen to you? Unless you are currently shopping for a private jet or a professional sports team, probably not. But it matters because it sets a precedent. Taxes that start at the "top" have a funny way of creeping down over the decades.

If you are a high-net-worth investor or an entrepreneur, the conversation around Kamala Harris unrealized gains should change how you look at your long-term exit strategy.

Here is what you should actually do:

- Audit your "Paper Wealth": Sit down with a CPA to see how close you actually are to that $100 million threshold when you factor in every illiquid asset, from real estate to intellectual property.

- Review Liquidity Provisions: If you are a founder, look at your shareholder agreements. Do you have the right to sell enough shares to cover potential tax liabilities? Many founders are currently "locked in" in ways that would make this tax impossible to pay without breaking contracts.

- Watch the "Step-Up in Basis": Another part of this proposal involves ending the "step-up" at death. Currently, if you die and leave stock to your kids, their "cost basis" resets to the current price, and the old gains are never taxed. Harris wants to end this. It’s time to look into Irrevocable Life Insurance Trusts (ILITs) or other estate planning tools that can provide cash for heirs to pay these taxes without selling the family business.

The debate isn't just about "taxing the rich." It's about whether we want to tax success as it happens, or wait until the money is actually in the bank. For now, it’s a proposal, but it’s one that could fundamentally rewrite the American financial playbook.

Key Takeaway: The proposed tax on Kamala Harris unrealized gains targets only those with $100 million+ in net worth, functioning as a "prepayment" of future taxes. However, it faces massive hurdles in the Supreme Court and fierce opposition from the tech and investment communities who fear it will drain liquidity from the American economy.

To stay ahead of these changes, you should consult with a specialized tax strategist to model how these potential "prepayments" would impact your portfolio's internal rate of return over a 10-year horizon.