Money makes people nervous. Especially when the government starts talking about taking a bigger slice of your "paper wealth." If you’ve been doom-scrolling through financial news lately, you’ve probably seen the headlines about the Kamala Harris capital gains tax proposals. Some say it's the end of the American dream; others say it's just a way to make the ultra-wealthy pay for the coffee.

The truth? It’s kind of in the middle, and it definitely isn't as simple as a single number.

Basically, what we’re looking at is a pivot. During the lead-up to the recent elections and into the 2026 policy cycle, Harris has staked out a position that is notably different from the one President Biden originally floated. While Biden was eyeing a top rate that pushed toward 40%, Harris has settled on a 28% figure for long-term gains.

Why does this matter? Because for someone sitting on a massive portfolio, that 12% difference is enough to buy a small island. Or at least a very nice fleet of cars.

The 28% Threshold: Who Actually Pays?

Let's get the big scary number out of the way first. The proposed Kamala Harris capital gains tax rate is 28%.

Currently, the top rate for long-term capital gains is 20%. If you add the Net Investment Income Tax (NIIT) of 3.8%, the real top rate for the "rich" is 23.8%. Harris wants to bump that base 20% up to 28%. If the NIIT also goes up—which has been discussed as part of the broader Medicare funding plan—the total "all-in" rate for the highest earners could hit around 33%.

But here’s the kicker: this doesn't apply to everyone.

You aren't going to get hit with a 28% tax because you sold $5,000 worth of Apple stock to fix your roof. This proposal specifically targets households making more than **$1 million per year**.

Honestly, for about 99% of Americans, the long-term capital gains tax rate would stay exactly where it is. If you’re in the middle class, you’re likely still looking at the 0%, 15%, or 20% brackets depending on your income.

👉 See also: Why 425 Market Street San Francisco California 94105 Stays Relevant in a Remote World

The strategy here is a "Goldilocks" approach. It’s higher than the current rate to satisfy those who want more revenue from the top 1%, but it’s lower than the 39.6% rate Biden proposed, which many feared would freeze the markets and stop people from ever selling their assets.

The "Billionaire Minimum Tax" and Unrealized Gains

Now, this is where things get spicy. You might have heard people panicking about a "tax on money you haven't even made yet."

They’re talking about unrealized gains.

Under current law, you only pay tax when you sell something. If you bought Bitcoin for $10 and it’s now worth $60,000, you don't owe the IRS a dime until you hit that "sell" button. The Harris proposal (echoing a Biden-era idea) suggests a 25% minimum tax on the total income—including those "paper profits"—for people with a net worth over **$100 million**.

How it works (theoretically)

- You have $200 million in net worth.

- Your stock portfolio goes up by $10 million this year.

- You didn't sell any of it.

- Under this plan, you’d still owe a "pre-payment" on that $10 million gain.

It’s a massive shift in how America thinks about wealth. Critics like the Cato Institute argue this is "economically destructive" because it forces people to sell assets just to pay the tax. Imagine owning a family business worth $150 million. If the "value" goes up, but you don't have $5 million in cash sitting in a bank account, you might have to sell part of your company just to cover the IRS bill.

On the flip side, supporters like the ITEP (Institute on Taxation and Economic Policy) argue that the ultra-wealthy use these unrealized gains as collateral for low-interest loans, effectively living off their wealth without ever paying income tax. This proposal is designed to close that "Buy, Borrow, Die" loophole.

Death, Taxes, and the "Step-Up" in Basis

There is another piece to the Kamala Harris capital gains tax puzzle that doesn't get enough airtime: what happens when you die.

Right now, we have something called a "step-up in basis." If your grandpa bought a house for $20,000 in 1960 and it’s worth $1 million when he passes away, you inherit it at the $1 million value. If you sell it the next day, you pay $0 in capital gains tax. The $980,000 in profit basically vanishes for tax purposes.

✨ Don't miss: Is Today a Holiday for the Stock Market? What You Need to Know Before the Opening Bell

Harris has signaled support for taxing these gains at death, though with significant exemptions. We’re talking about a $5 million exemption for individuals and $10 million for couples.

This means the average family farm or suburban home is still safe. But for the massive estates? The taxman is coming for the appreciation that happened during the previous owner's lifetime. It’s a move that the Committee for a Responsible Federal Budget (CRFB) estimates could raise about $150 billion over a decade.

The Economic Ripple Effect

What happens to the actual economy if this goes through?

It depends on which economist you ask. The Tax Foundation, which tends to be more conservative, thinks the Kamala Harris capital gains tax and associated hikes could reduce the long-run GDP by about 2%. Their logic is that if you tax investment more, people invest less. Less investment means fewer jobs and slower wage growth.

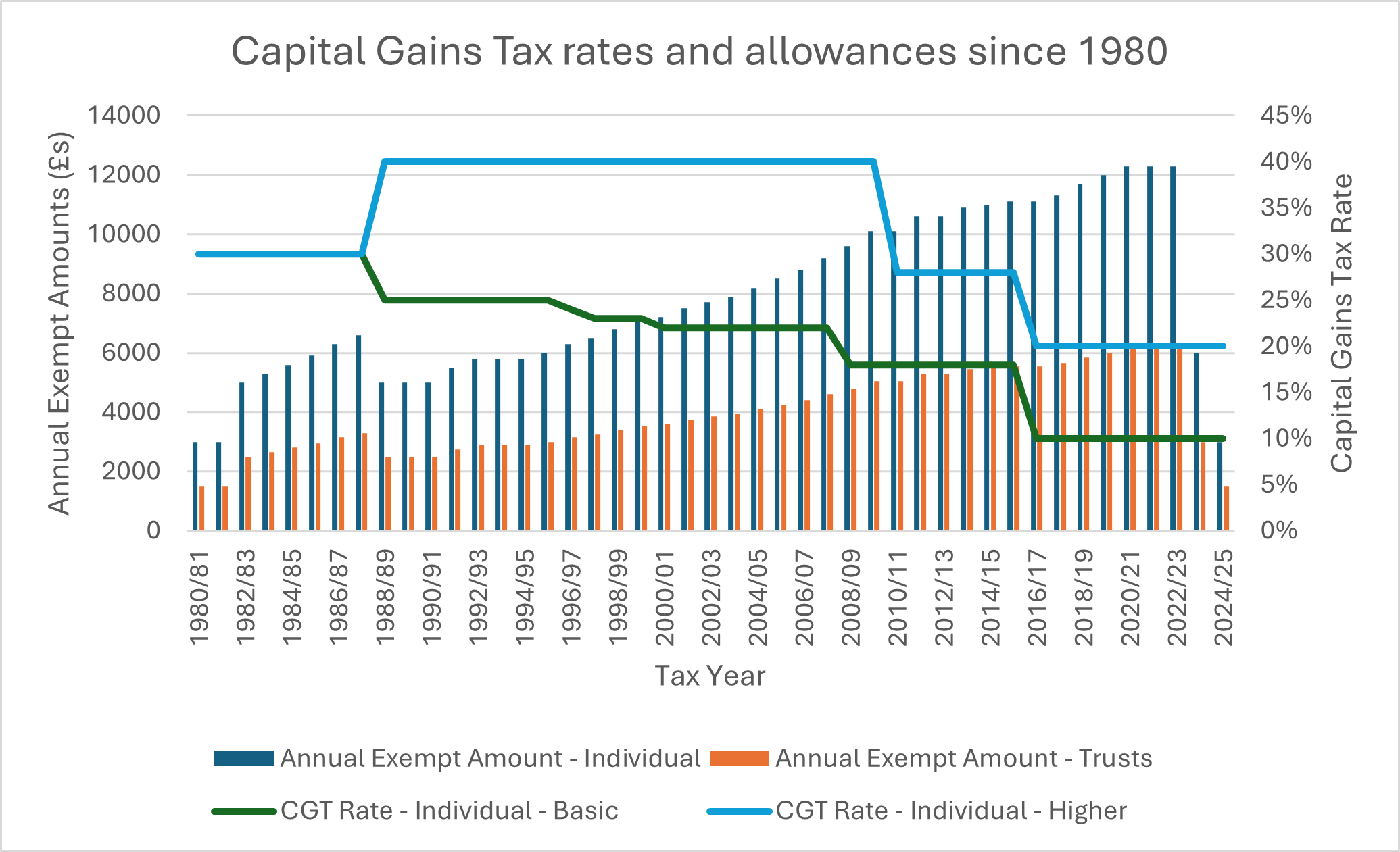

However, many "Main Street" economists argue the impact is overblown. They point out that even at 28%, the rate is still lower than it was during much of the 1970s and 80s, and the world didn't end then.

There's also the "lock-in" effect. If taxes are too high, people just stop selling. They sit on their assets forever, which makes the market less efficient. By choosing 28% instead of nearly 40%, the Harris team is trying to find that "sweet spot" where the government gets more money but investors still feel like it's worth it to trade.

Actionable Steps for Investors

So, what should you actually do? You shouldn't panic-sell your portfolio, but you should probably be smarter about how you hold things.

1. Maximize your "tax-advantaged" buckets.

If these rates go up, your 401(k), IRA, and Roth IRA become even more valuable. Taxes inside those accounts don't care about the capital gains rate. If you aren't maxing these out, start there.

🔗 Read more: Olin Corporation Stock Price: What Most People Get Wrong

2. Look into Tax-Loss Harvesting.

This is basically the art of using your "losers" to offset your "winners." If you sell a stock that went down, you can use that loss to cancel out the tax you’d owe on a stock that went up. It’s a classic move, but in a higher-tax environment, it becomes a necessity.

3. Consider the 1031 Exchange (while it lasts).

If you’re in real estate, the 1031 exchange allows you to defer capital gains by rolling the profit from one property into another. There have been talks about capping this at $500,000 in gains, so if you’re sitting on a massive real estate profit, you might want to look at your exit strategy sooner rather than later.

4. Watch the Income Threshold.

Remember, that 28% rate is for those making over $1 million. If you're retired and selling off assets to live, you can often control your "income" by only selling what you need. Keeping your taxable income below the million-dollar mark keeps you in the lower brackets.

5. Don't let the "tax tail" wag the "investment dog."

The worst thing you can do is hold a bad investment just because you’re afraid of the tax. If a stock is overvalued and likely to drop 20%, pay the 28% tax and keep your 72% profit. It’s better than holding it and watching the whole thing disappear.

Ultimately, tax laws are always a bit of a moving target. What is proposed today might be negotiated into something completely different by the time it hits the House floor. But the trend is clear: the era of historically low capital gains taxes for the ultra-wealthy is likely facing a sunset.

Stay informed, keep your records clean, and maybe talk to a professional if your "paper wealth" is starting to look like a target.

Next Steps for You:

- Review your current portfolio to identify any massive unrealized gains that might put you near the $1 million income threshold if sold.

- Consult with a tax professional specifically about "basis tracking" for inherited assets, as the rules around death and taxes are the most likely to shift.

- Audit your retirement contributions to ensure you are shielding as much growth as possible from future rate hikes.