Jersey City is changing. Fast. If you’ve walked down Newark Avenue or looked at the soaring glass towers in Paulus Hook lately, you know it’s not the same town it was twenty years ago. But for homeowners, that "Gold Coast" glow-up comes with a massive, recurring headache: the tax bill. Honestly, Jersey City property tax has become the single biggest topic of conversation at backyard BBQs and neighborhood association meetings from the Heights to Bergen-Lafayette. It’s a mess of revaluations, school funding battles, and shifting municipal budgets that can leave even a math whiz feeling lightheaded.

Understanding your tax bill isn't just about looking at the final number. It’s about knowing why that number exists.

The Revaluation Hangover That Never Really Left

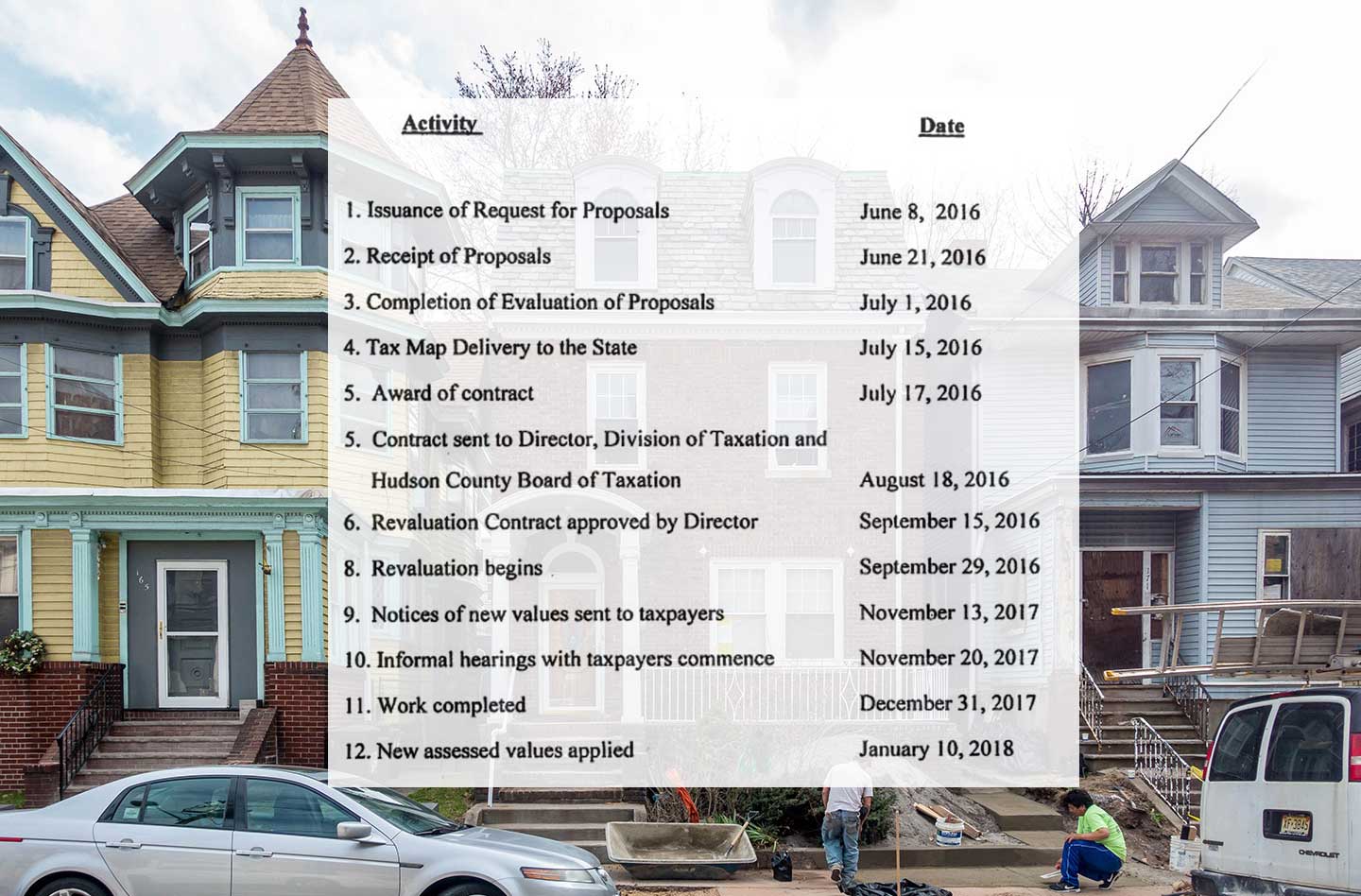

For decades, Jersey City didn't touch its property assessments. It was a political third rail. By the time 2018 rolled around, the city hadn't done a full revaluation since 1988. Think about that. Thirty years of growth, gentrification, and neighborhood shifts were being ignored by the tax office. People in multimillion-dollar brownstones were paying taxes based on 1980s values, while long-time residents in declining areas were effectively overpaying.

Then came the "Reval."

It was a shock. Some people saw their bills double overnight. Others saw them drop. But the ripple effect of that 2018 correction is still being felt today because it set a new baseline for how the city calculates your "fair share." When the city says your house is worth $800,000, but you think it’s worth $600,000, that’s where the friction starts. The tax rate—which is basically just a multiplier—gets applied to that assessed value. If the assessment is wrong, everything else is wrong.

Breaking Down the "Big Three" Portions of Your Bill

Your tax bill isn't a monolith. It’s a Frankenstein’s monster of three different taxing authorities.

First, you’ve got the Municipal Tax. This pays for the police, the fire department, trash pickup, and City Hall. This is the part Mayor Steven Fulop and the City Council argue over every budget season. Then there’s the County Tax. Hudson County takes a slice to pay for county roads, the jail, and various regional services. Usually, this is the smallest piece, but it’s the one most people forget to track.

💡 You might also like: Dealing With the IRS San Diego CA Office Without Losing Your Mind

The real kicker? The School Tax.

For years, Jersey City schools were heavily subsidized by the state of New Jersey through something called "Abbott District" funding. But the state started clawing that money back under the S2 funding formula. The logic was simple: Jersey City is rich now, so it should pay for its own schools. This created a massive hole in the Jersey City Board of Education (BOE) budget. To fill it, the BOE has had to hike the school portion of the property tax significantly. We are talking hundreds of millions of dollars shifted onto the backs of local property owners in a very short window of time.

Why "Abatements" Are the Local Villain

Talk to anyone who has lived in Downtown for more than a decade and they will eventually complain about tax abatements, or PILOTs (Payments in Lieu of Taxes).

Developers get these deals to build big towers. Instead of paying traditional property taxes, they pay a set fee directly to the city. Here’s the catch: PILOT money stays mostly with the city government. It doesn't get shared with the school district in the same way regular property taxes do. This makes people angry. The perception is that the guy in the luxury penthouse is getting a break while the family in a 2-family home in Greenville is subsidizing the local elementary school.

The city argues these deals are necessary to spur development and build affordable housing units. Critics say the city is addicted to the revenue and leaving the school district out in the cold. It’s a complicated, messy debate that directly affects what you see on your quarterly tax statement.

How to Actually Appeal Your Assessment

You don't have to just take it. If you think your Jersey City property tax assessment is higher than what your house could actually sell for, you can appeal. But you have to be fast.

📖 Related: Sands Casino Long Island: What Actually Happens Next at the Old Coliseum Site

The window for filing an appeal with the Hudson County Board of Taxation usually closes on April 1st of each year (or 45 days after the assessment postcards are mailed). You can't just show up and say "taxes are too high." The board doesn't care about your budget. They only care about market value.

- Find "Comps": You need at least three or four recent sales of similar homes in your neighborhood. "Similar" means same bedroom count, similar square footage, and similar condition.

- The 15% Rule: New Jersey uses something called Chapter 123. There’s a "common level range." Basically, if your assessment is within 15% of the actual market value, the court likely won't change it. You have to prove the assessment is significantly out of whack.

- Hire an Expert?: For a single-family home, you can do it yourself. For a multi-family or commercial property, get a lawyer. It’s worth the fee if they save you $3,000 a year for the next five years.

The Hidden Impact of Short-Term Rentals

Jersey City cracked down on Airbnbs a few years ago. You might think that has nothing to do with taxes, but it does. When the city lost some of that hotel tax revenue from short-term rentals, it had to find that money elsewhere. Plus, investors who bought up properties to use as de facto hotels drove up prices. Higher sales prices in your neighborhood lead to higher assessments for everyone. It’s all connected.

The market is cooling slightly in some areas, but in Jersey City, "cooling" just means prices are staying flat instead of jumping 10% a year. That’s cold comfort when your tax bill is already at an all-time high.

What to Watch Out For in 2026

Keep an eye on the state house in Trenton. There are constantly rumors of new "Stay NJ" senior tax credit programs or changes to how school funding is calculated. Locally, the municipal budget is always a battleground. If the city decides to hire 50 more police officers or build a new park, that money has to come from somewhere.

Also, look at the "Equalization Ratio." This is a weird technical number that the state uses to ensure everyone is paying their fair share relative to true market value. If the ratio drops too low, it usually triggers another city-wide revaluation. We aren't there yet, but with the way prices have moved since 2018, the "fairness" of the current assessments is starting to look a bit shaky again.

Concrete Steps for Jersey City Homeowners

If you’re feeling the squeeze, you need to be proactive.

👉 See also: Is The Housing Market About To Crash? What Most People Get Wrong

First, verify your exemptions. Are you a senior citizen? A veteran? There are modest but helpful deductions available ($250 usually) that some people forget to claim. They won't pay for a vacation, but they'll cover a few grocery runs.

Second, check the ANCHOR program. The state’s ANCHOR (Affordable New Jersey Communities for Homeowners and Renters) program has replaced the old Homestead Rebate. Depending on your income, you could get a check back for $1,000 to $1,500. It doesn't lower your tax bill directly, but it acts as a much-needed offset.

Third, participate in the process. Go to the Board of Education budget hearings. That is where the largest chunk of your tax increases is born. When the BOE proposes a 2% or 4% increase, they are required to hold public comment sessions. Most people don't go. Be the person who goes.

Finally, document everything. If you’re planning an appeal, start taking photos of any issues with your property that might lower its value—a cracked foundation, an ancient roof, or proximity to a noisy industrial site. The tax assessor assumes your house is in "average" condition. If it’s not, show them.

Jersey City is an incredible place to live, with a culture and energy that rival any city in the world. But that energy isn't free. Staying informed about the mechanics of your property taxes is the only way to ensure you can afford to keep calling this city home. Check your assessment postcard the moment it arrives in February. That’s your starting gun. If the number looks wrong, don't wait until April 2nd to complain. By then, it’s already too late.