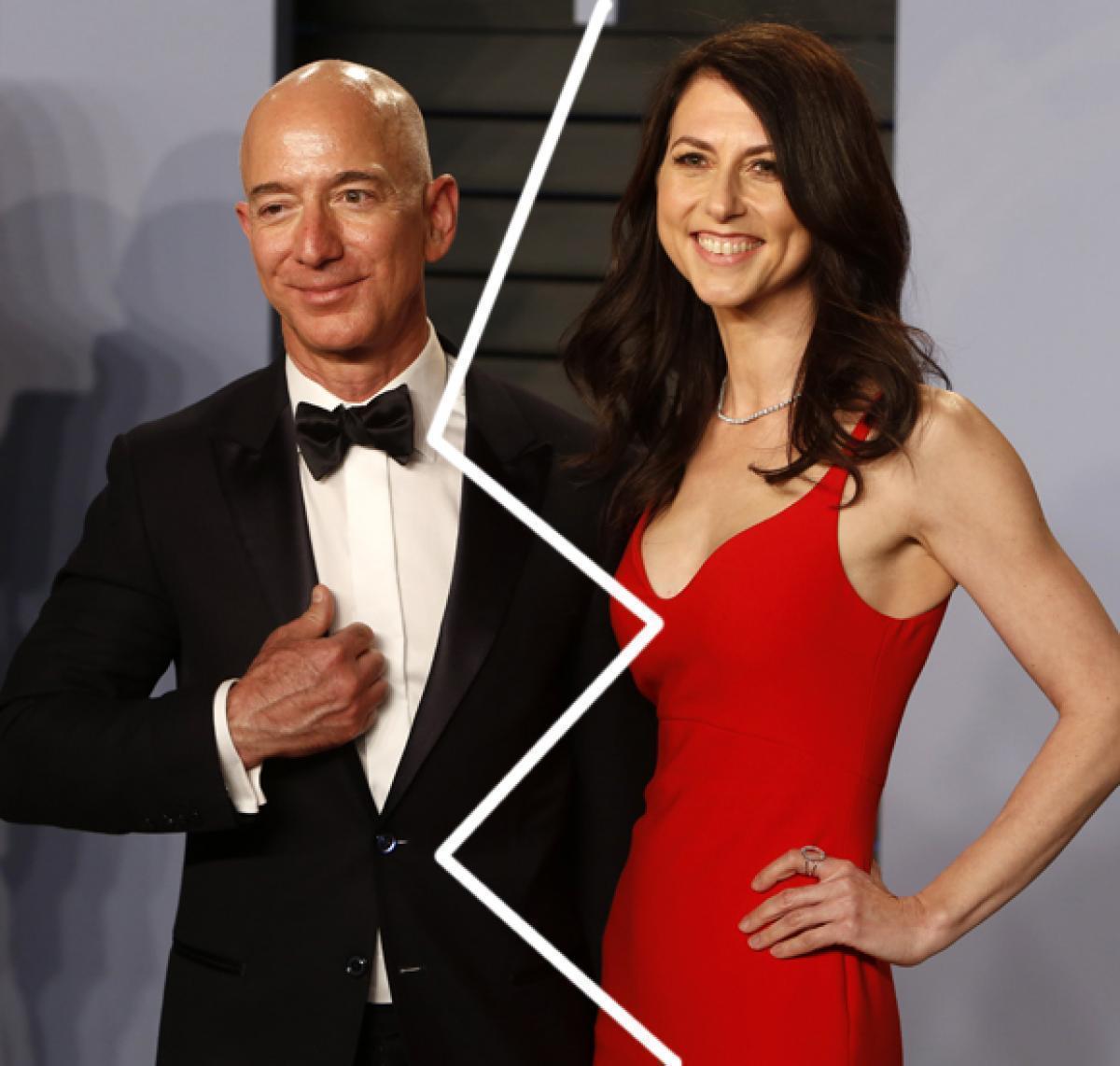

Seven years ago, a single tweet changed the financial landscape of the entire world. When Jeff Bezos and MacKenzie Scott announced they were splitting up after 25 years, the internet basically melted. Everyone expected a scorched-earth legal battle over the world’s largest fortune. Instead, we got a masterclass in strategic de-escalation.

Honestly, it's the most expensive breakup in history, yet it was handled with more grace than most suburban disputes over a lawnmower.

Most people see the jeff bezos divorce as a tabloid story about leaked texts or a $500 million yacht. But if you look closer, it was actually a high-stakes business maneuver that protected Amazon while creating the most aggressive philanthropic engine in modern history. We’re in 2026 now, and the ripples from that 2019 settlement are still reshaping how we think about wealth, power, and "fairness."

The "Fairness" Myth and the 25% Handshake

There’s this huge misconception that MacKenzie got "half."

She didn't.

Washington is a community property state, which usually means a 50/50 split of everything earned during the marriage. Since they started Amazon in a garage after they were already married, she technically had a claim to half of Jeff's 16% stake.

She took 4% instead.

Why? Because she isn't a chaotic person. If she had pushed for 8%, she might have destabilized the voting power of the company she helped build. By accepting a 25% share of their joint holdings—worth about $38 billion at the time—she allowed Jeff to keep 75% of the stock and, crucially, 100% of the voting control.

She also walked away from The Washington Post and Blue Origin. Entirely.

It was a tactical retreat that made her one of the richest women on Earth while ensuring Amazon’s stock didn't crater due to "founder instability."

Why the Jeff Bezos Divorce Still Matters in 2026

If you think this is just old news, you haven't been paying attention to the "Yield Giving" database. MacKenzie Scott didn't just take the money and hide in a mansion. Since the jeff bezos divorce, she has become a literal force of nature in philanthropy.

As of early 2026, she has given away over $26 billion.

Just yesterday, news broke that she dropped $45 million on The Trevor Project. That is her style: huge, "no-strings-attached" grants that show up in a nonprofit's bank account like a lottery win. While other billionaires spend decades setting up committees to decide where a few million goes, MacKenzie is cashing out Amazon shares at a record pace.

In late 2025, she sold another $12.6 billion worth of stock.

She is effectively "de-billionairing" herself in real-time. Meanwhile, Jeff has moved into a new era. He married Lauren Sánchez in a lavish Venice ceremony in June 2025. They’re co-chairing the Bezos Earth Fund and sponsoring the Met Gala.

It’s a total shift in vibes.

Jeff went from the "abnormally normal" guy in cargo shorts to a global celebrity socialite. MacKenzie went from the quiet co-founder to the most influential, low-profile donor in history.

The Logistics of a $150 Billion Breakup

How do you actually divide that much money without a prenup?

👉 See also: Why Did the Gas Go Up? What Most People Get Wrong About Your Local Pump

- Valuation: Since Amazon is public, they didn't have to argue about what the "business" was worth. The market told them every second.

- Voting Proxies: This was the genius part. MacKenzie kept the economic value of her shares but gave Jeff the right to vote them. This prevented a "hostile" board situation.

- Privacy: They used private mediators. By the time the public knew they were divorcing, the deal was basically done.

Most business owners freak out about divorce because they think they’ll lose their company. The Bezos model showed that you can trade "equity" for "control." Jeff kept the steering wheel; MacKenzie took the fuel.

The Real Takeaway for the Rest of Us

You probably don't have $150 billion. (If you do, hey, thanks for reading). But the lessons here are weirdly relatable.

First off, keep the business out of the courtroom. If Jeff and MacKenzie had let a judge decide their fate, the legal fees alone would have funded a small country. They settled in three months. That’s insane speed for a marriage of that length.

Second, your "team" matters. They both credited their support networks for getting them through it. Even with all that money, divorce is a grind.

Finally, look at the "afterlife" of the marriage. Jeff is leaning into his passions with Blue Origin and the Bezos Earth Fund. MacKenzie is reinventing how giving works. The jeff bezos divorce wasn't an ending; it was a massive reallocation of resources.

Actionable Insights for Business Owners:

- Draft a Buy-Sell Agreement: Even if you're happily married, define what happens to shares in a split.

- Focus on Voting Rights: If you have to give up equity to a spouse, try to retain the voting proxy to keep the business stable.

- Value Your "Sweat Equity": MacKenzie was Amazon's first accountant. She wasn't just a "spouse"; she was a founder. Acknowledge that contribution early to avoid resentment later.

The Bezos split proved that even the most complex, high-asset separations don't have to be a disaster if both parties prioritize the "health of the asset" over the "ego of the individual."