If you walked into a boardroom in Marunouchi five years ago and brought up "private credit," you probably would’ve been met with polite, confused silence. Or a very firm "no thanks."

Japan was always the land of the mega-banks. For decades, companies just went to Mitsubishi UFJ or Mizuho and got a loan for basically zero interest. Why would anyone pay 7% or 8% to some foreign fund when the local bank would give it to you for 0.5%?

But things changed. Fast.

The latest japan private credit news coming out of early 2026 shows a market that has basically done a 180. We aren't just talking about niche players anymore. We are talking about $300 billion in M&A volume and a desperate need for the kind of "bespoke" money that old-school banks just don't know how to handle.

The BOJ Factor: Why 2026 is Different

The Bank of Japan finally did it. In late 2025, they hiked rates to 0.75%—the highest they’ve been since the mid-90s.

It sounds small. But it’s a psychological nuke.

Suddenly, the "free money" era is dead. When the base rate moves, bank loans get pricier, and more importantly, banks get pickier. They start looking at their balance sheets and realizing they can’t just fund every massive carve-out or risky tech transition on a handshake.

This is exactly where firms like Blackstone and KKR are swooping in. They aren't trying to compete with banks on a standard business loan. That’s a loser’s game. Instead, they are positioning themselves as the "gap fillers."

💡 You might also like: Replacement Walk In Cooler Doors: What Most People Get Wrong About Efficiency

Honestly, it’s about complexity. If a Japanese conglomerate wants to spin off a non-core chemical wing—a "carve-out"—they need money that behaves more like equity but sits like debt. Traditional banks hate that. Private credit loves it.

Goldman Sachs and the New "High-Grade" Play

David Dubner over at Goldman Sachs recently pointed out something pretty interesting. He’s seeing a surge in what they call "high-grade" private financing. This isn't the distressed, "loan-to-own" shark behavior people used to fear.

It’s about partnerships.

Take the $7.4 billion buyout of Air Lease Corp late last year. You had Sumitomo Corp and SMBC joining forces with Apollo and Brookfield. It’s a hybrid. You get the stability of the Japanese strategics and the aggressive, flexible capital from the private credit guys.

The AI and Data Center Hunger

Japan is currently obsessed with "Sanaenomics"—the pro-growth policies of Prime Minister Sanae Takaichi. A big part of that is the digital transition.

Every big tech firm in Tokyo is currently trying to figure out where to put their data centers. These projects are massive. They are capital-intensive. And they take years to actually generate cash.

- The Problem: Banks want immediate interest coverage.

- The Reality: A data center is a hole in the ground for the first 24 months.

- The Solution: Private credit.

Blackstone’s Mark Glengarry has been pretty vocal about this. He’s argued that Japan is at an "inflection point." After four years of "educating" Japanese CEOs, the message is finally sinking in: Private credit isn't a sign of weakness. It’s a tool for speed.

📖 Related: Share Market Today Closed: Why the Benchmarks Slipped and What You Should Do Now

If you want to build a ¥50 billion AI hub in Chiba, you don't want to wait six months for a bank committee to approve a vanilla loan. You want a fund that understands the tech and can structure a three-year "grace period" on the principal.

What Most People Get Wrong About the "Japanese Discount"

For years, the "conglomerate discount" was the bane of the Tokyo Stock Exchange. Giant companies holding onto random subsidiaries like a hoarder in a mansion.

But the TSE (Tokyo Stock Exchange) put their foot down. They’ve been shaming companies with low price-to-book ratios. This has triggered a wave of "management buyouts" (MBOs) and "take-privates."

Look at the Fuji Soft or Topcon deals. These weren't small fries. These were significant firms deciding that being public in Japan was more hassle than it was worth.

When a company goes private, they need a ton of debt. But they also need flexible debt. If the BOJ keeps hiking—and some analysts are whispering about 1.25% or even 1.75% by 2027—floating-rate private loans actually look more attractive because of the covenants and the relationship-heavy nature of the deal.

The Rise of the "Retail-ization"

One weird bit of japan private credit news is where the money is coming from. It’s not just pension funds anymore.

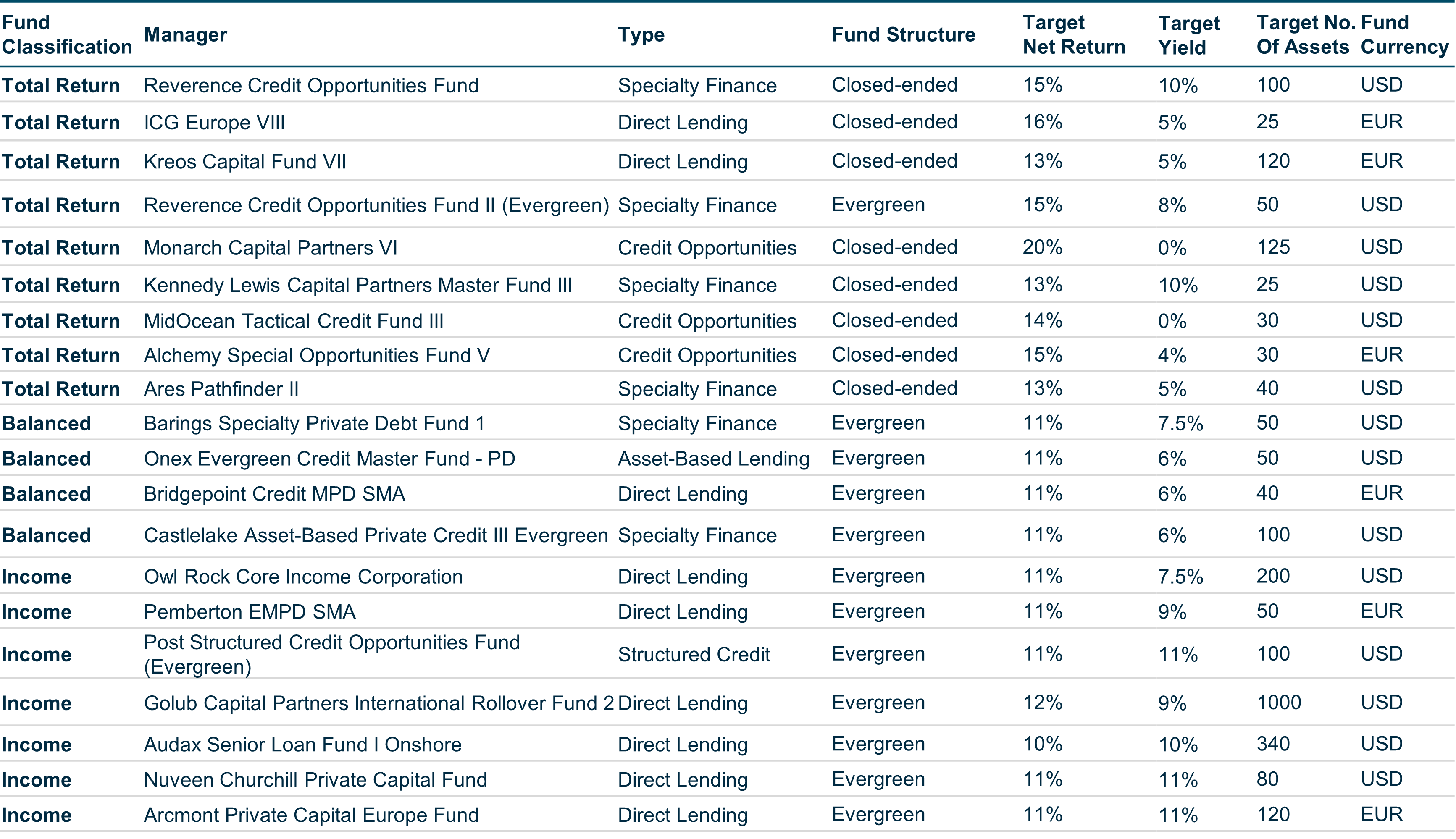

State Street’s 2025/2026 outlook noted that "democratization" is hitting the private markets. Basically, Japanese "Mrs. Watanabe" investors—the retail crowd—are getting bored of low-yield bonds. They are moving into semi-liquid "evergreen" funds.

👉 See also: Where Did Dow Close Today: Why the Market is Stalling Near 50,000

It’s a bit of a gamble.

If thousands of retail investors are suddenly the "lenders" to a Japanese mid-cap manufacturer, what happens if that manufacturer hits a wall? The transparency isn't always there. Unlike the public bond market, private credit happens in the shadows.

Is the Bubble About to Pop?

Not everyone is a fan.

Some critics argue that the "gold rush" into Japan is getting crowded. Ares Management and KKR are raising billions specifically for Asia credit. When too much money chases too few deals, terms get "covenant-lite." That’s fancy talk for "the lender has no protection if things go south."

Also, the "Yen Carry Trade" hasn't fully disappeared. If the Yen suddenly strengthens too much, some of these international funds might find their returns squeezed when they try to move their profits back into Dollars.

Actionable Insights for 2026

If you're looking at the Japanese market, here's how to actually play this:

- Watch the "Carve-outs": The real money is in the conglomerates. Keep an eye on the "Security of Everything" sectors—energy, semiconductors, and pharmaceuticals. These are the companies that will need massive, non-bank financing to reshore their supply chains.

- Monitor the Regional Banks: While the mega-banks are playing ball with private credit, the smaller regional banks are struggling. They might start selling off their own loan portfolios to private credit funds just to stay liquid. That’s a secondary market that is about to explode.

- Focus on "Asset-Based" Lending: It’s not just about corporate cash flow anymore. Financing backed by real estate or equipment (collateral-based) is becoming the "safe" way for private credit to enter Japan without taking on too much equity-like risk.

The era of the "Main Bank" system in Japan isn't dead yet. But it’s definitely sharing the bed with some new, much more aggressive partners. The next twelve months will decide if this is a sustainable boom or just a high-interest sugar high.