Money on the island is a bit of a moving target. If you've ever stood at a cambio in New Kingston or checked your banking app from a beach in Negril, you know the feeling. One day your jamaica dollar to USD conversion looks great, and the next, it's shifted just enough to make you rethink that extra plate of oxtail. Honestly, the exchange rate here isn't just a number on a screen; it’s the heartbeat of the local economy.

It’s personal.

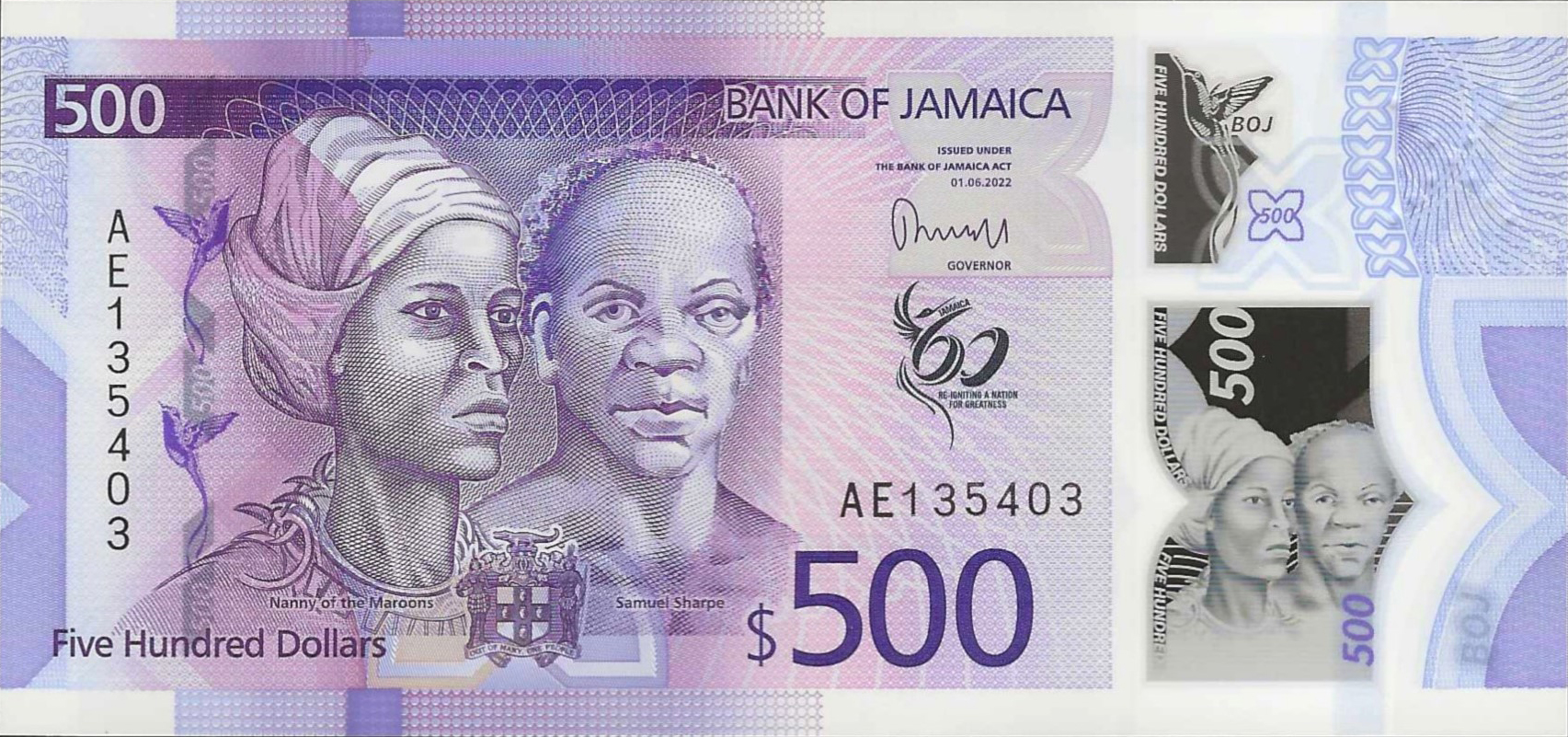

Right now, as we move through January 2026, the rate is hovering around 157.94 to 158.20 Jamaican dollars for every 1 US dollar. But that’s just the "official" window dressing. If you’re actually trying to buy greenbacks, you’re likely seeing prices a few cents higher at the counter. It’s a delicate dance between the Bank of Jamaica (BOJ) trying to keep things steady and the raw demand from importers who need US cash to bring in everything from car parts to cornflakes.

Why the Jamaica dollar to USD rate feels like a roller coaster

Most people think the rate just "goes up" because of bad luck. It’s actually way more calculated than that. Take the last few months of 2025. We had Hurricane Melissa roll through in late October, which basically threw a wrench into the works. When a storm hits, tourism takes a temporary dive. Fewer tourists mean fewer US dollars flowing into the hotels and craft markets. When the supply of USD dries up, the price of the remaining dollars goes up. Simple math, really.

Then there’s the holiday hangover. Every December, the BOJ pumps out billions in local currency—about $13.1 billion in net new cash just this past month—to handle the Christmas spending spree. People are buying gifts, painting houses, and throwing parties. By the time January 18, 2026, rolls around, the central bank is usually trying to suck that cash back out of the system to prevent inflation from spiraling.

👉 See also: Why Amazon Stock is Down Today: What Most People Get Wrong

The BOJ is currently holding their policy interest rate at 5.75%. They’re trying to find that "sweet spot" where they can keep inflation between 4% and 6% without making it too expensive for businesses to borrow money. It's a tough gig. If they lower rates too fast, everyone sells their Jamaican dollars to buy US assets, and the exchange rate tanks. If they keep them too high, the economy stalls.

The B-FXITT factor: How the BOJ "fixes" the rate

You might have heard the term "B-FXITT" mentioned on the evening news. It sounds like a workout program, but it’s actually the Bank of Jamaica Foreign Exchange Intervention Trading Tool. Basically, when the jamaica dollar to USD rate starts sliding too fast, the BOJ steps in like a referee.

On January 9, 2026, the Bank held a standard auction and sold US$35 million into the market. Why? Because the demand from companies was hitting a boiling point. By dumping US dollars into the system, they satisfy that hunger and keep the rate from jumping to 160 or 165 overnight. Big players like National Commercial Bank (NCB) and JMMB are usually the ones snatching up these millions to pass on to their corporate clients.

Remittances and the "Hidden" Support System

If you’re living in the diaspora—maybe in New York, Toronto, or London—you are the unsung hero of the Jamaican dollar. Remittances are massive. In fact, they’ve been one of the few things keeping the currency stable after the recent hurricanes. When you send money home via Western Union or GraceKennedy, you are providing the foreign exchange the country desperately needs.

✨ Don't miss: Stock Market Today Hours: Why Timing Your Trade Is Harder Than You Think

Interestingly, when the Jamaican dollar gets "stronger" (meaning the rate goes down to, say, 155), people receiving remittances actually get less bang for their buck. They’ve got fewer JMD to spend at the supermarket. It’s a weird paradox. A "strong" currency sounds good for national pride, but if you're a hotel worker getting tipped in USD or a grandma living on a monthly wire transfer, you actually want the rate to stay a bit higher.

Practical things you should know about exchanging money

- Avoid the Airport: This is the golden rule. The rates at Sangster International or Norman Manley are historically terrible. You'll lose 5-10% just for the convenience.

- Use Authorized Cambios: Look for names like FX Trader (GraceKennedy) or JMMB. They usually offer better rates than the big commercial banks for small-to-medium transactions.

- Check the BOJ Daily Rate: Before you head out, check the Bank of Jamaica website. It gives you the weighted average selling rate. If a cambio is offering you something significantly worse, walk away.

- The "Spread" Matters: The difference between the buying and selling price is where the banks make their money. In early 2026, this spread has been relatively tight, but it can widen quickly if there's a whiff of economic instability.

Looking ahead: Will the Jamaican dollar slide further?

Predicting currency is a fool's errand, but we can look at the breadcrumbs. The IMF recently stepped in with about $415 million in aid following Hurricane Melissa. This provides a massive cushion for Jamaica's international reserves. When the country has a big "rainy day fund" of US dollars, speculators are less likely to bet against the Jamaican dollar.

However, we are also seeing some shifts in the US Federal Reserve's policies. If the US keeps interest rates high, investors will keep their money in the States, putting pressure on the jamaica dollar to USD pairing. Locally, the government is projecting a bit of a contraction for the early part of 2026 as the island continues to repair infrastructure.

Expect the rate to stay "volatile but managed." The BOJ has shown they aren't afraid to spend their reserves to prevent a freefall. For most of us, that means the days of seeing 100:1 are long gone, but we likely won't see a sudden crash to 200:1 anytime soon either.

🔗 Read more: Kimberly Clark Stock Dividend: What Most People Get Wrong

Actionable steps for managing your money

If you're a business owner or someone who travels frequently, you've gotta be proactive. Don't wait until the day you need USD to go looking for it. Since the market can get "tight" (meaning banks claim they don't have any US cash to sell), it’s smarter to buy small amounts over time when the rate dips.

Also, keep an eye on the tourism numbers. The "high season" in Jamaica usually runs from December to April. This is when the most US dollars enter the system. Usually, the rate is a bit more stable during these months. If you have big US dollar obligations, trying to settle them during the peak of the tourist season can sometimes save you a few cents on the dollar compared to the "lean" months of September or October.

Ultimately, the Jamaican dollar is a reflection of the island's resilience. Despite two hurricanes in two years and global inflation, the currency hasn't crumbled. It's tough, a bit unpredictable, and always a topic of conversation—kinda like Jamaica itself. Keep your eyes on the BOJ's next interest rate announcement on February 23, 2026, as that will be the next big signal for where the money is headed.

Monitor the weighted average selling rate daily through the BOJ’s official portal to ensure you aren't overpaying at local cambios. If you are holding significant Jamaican dollars and worried about devaluation, consider diversifying into short-term JMD instruments like 30-day Certificates of Deposit, which currently offer competitive yields to offset currency fluctuations.

Stay informed on the quarterly monetary policy reports; these documents, while dense, contain the exact roadmaps the central bank uses to decide when to intervene in the market. Understanding these cycles is the best way to protect your purchasing power in an environment where the exchange rate never truly stands still.