So you're heading to the Rock, or maybe you're just trying to figure out how much those Jamaican dollars in your drawer are actually worth now. Honestly, looking at the exchange rate for Jamaica currency to US can feel like watching a slow-motion roller coaster. One day you think you’ve got the math down, and the next, the Bank of Jamaica (BOJ) drops a new intervention that shifts the ground under your feet.

It’s not just about a number on a screen.

Right now, as of mid-January 2026, the Jamaican Dollar (JMD) is hovering around $0.0063 USD. To put that in terms people actually use: $1 USD gets you roughly $158 JMD. But if you just rely on that flat number, you’re going to lose money. Real talk.

The Post-Hurricane Melissa Reality

Why is the rate doing what it's doing? We can't talk about Jamaican money in 2026 without talking about Hurricane Melissa. When that storm ripped through in late 2025, it didn't just mess up the infrastructure; it sent the local economy into a tailspin. Agriculture got hit hard. When the yams and bananas aren't growing, prices go up.

When prices go up, everyone wants cash.

In December 2025 alone, the BOJ had to pump about $21 billion JMD into the system just to keep up with people wanting physical notes. A lot of that was "precautionary demand." Basically, people were scared and wanted to hold onto "real" money. Interestingly, a huge chunk of the support for the Jamaican dollar right now is coming from remittances. Jamaicans abroad are sending home record amounts of US dollars to help with rebuilding. This influx of Greenbacks is actually the only thing keeping the JMD from sliding even further against the US dollar.

🔗 Read more: 620 Eighth Avenue NY NY: Why This Building Is Actually the Center of Global News

Understanding the BOJ "Invisible Hand"

The Bank of Jamaica doesn't just let the currency float entirely free. They use a tool called B-FXITT. It sounds like a workout program, but it’s actually how they auction off US dollars to big banks to make sure the exchange rate doesn't just collapse overnight.

Just last week, the BOJ threw $40 million USD into the market through one of these auctions. They do this specifically to "preserve relative stability." If they didn't, the cost of importing fuel and food would skyrocket, and your vacation—or your cousin's grocery bill in Kingston—would become unaffordable.

Where You’ll Lose Money (The Tourist Trap)

If you are traveling, the "official" rate is almost a lie. Not because it’s fake, but because you’ll never actually see it.

The biggest mistake? Changing money at Sangster International Airport in Montego Bay.

Look, the convenience is great, but the spread is predatory. While the market rate might be 158:1, the airport booth might offer you 140:1. On a $500 USD exchange, you’re basically handing them $50 USD for free. Just don't do it. Use an ATM instead. Jamaican ATMs (like NCB or Scotiabank) usually give you a much fairer shake, even with the $5 or $10 fee your home bank might grab.

Pro Tip: When a merchant asks if you want to pay in "Local Currency" or "US Dollars" on the credit card machine, always pick Local Currency. If you pick USD, the merchant's bank chooses the exchange rate, and they never choose one that favors you.

Why the JMD is a "Heavy" Currency

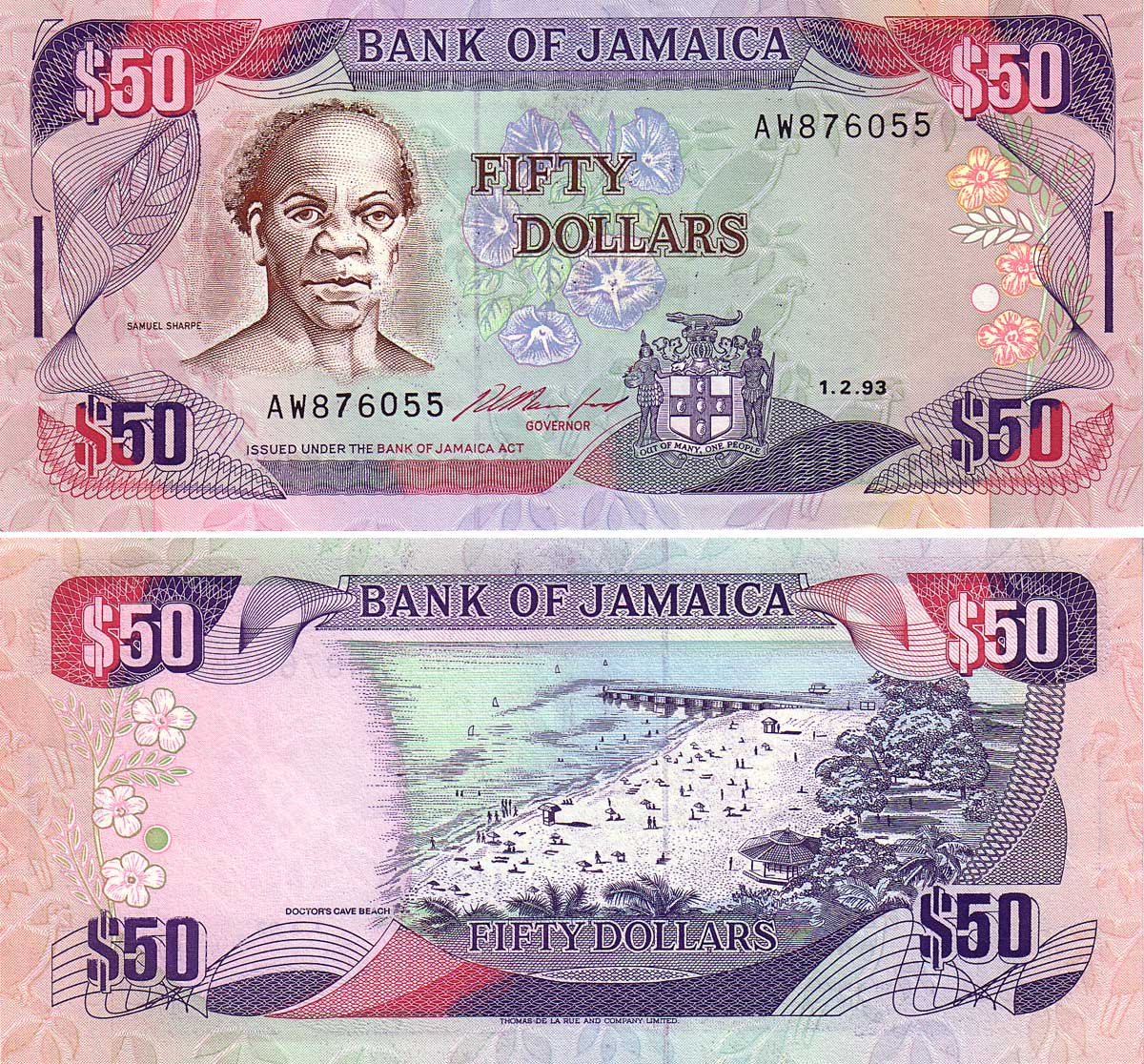

Jamaican money is weirdly bulky. Since the 2023 introduction of the new polymer notes—the ones with the shiny bits and the late Bob Marley and Marcus Garvey—the bills last longer, but you need a lot of them.

Because the exchange rate is so wide, carrying $50,000 JMD (which is only about $315 USD) feels like you’re carrying a thick brick of cash. It’s colorful, it’s pretty, and it smells like fresh plastic, but it’s a lot to manage. Most locals in 2026 are leaning heavily into digital transfers (Lynk is huge there now), but for the small jerk chicken stands in Portland or a route taxi in Ocho Rios, cash is still the undisputed king.

The 2026 Economic Outlook

The BOJ is keeping the policy interest rate at 5.75%. They are trying to fight inflation, which is currently sitting around 4.5%. They want to keep it between 4% and 6%. If inflation stays in that "sweet spot," the exchange rate usually stays predictable.

But there’s a catch.

Jamaica is expecting a GDP contraction of about -4.0% to -6.0% for this fiscal year because of the hurricane damage. Usually, when an economy shrinks, the currency weakens. The only reason the Jamaica currency to US rate isn't crashing is that the central bank has decent "Net International Reserves" (NIR). They have a war chest of US dollars they use to defend the JMD.

Actionable Steps for Handling Your Money

Don't just wing it. If you're dealing with JMD to USD or vice versa, follow this checklist to keep your margins tight:

- Check the BOJ Daily Weighted Average: Before you change a single cent, go to the Bank of Jamaica website. Look for the "Weighted Average Spot Selling Rate." This is the true market price. Anything more than 2-3% away from this number is a rip-off.

- Use Cambios, Not Banks: If you have physical cash, look for "Cambios" (authorized money exchangers) in town centers. Places like FX Trader or Western Union often have better rates than the big commercial banks, which have long lines and more paperwork.

- The "Double Currency" Strategy: Carry a mix. Use US dollars for big things like hotel bills, tours, or car rentals. Use Jamaican dollars for "roadside" expenses. Locals will often give you a terrible exchange rate (like 140:1 or even 100:1) if you try to pay for a $300 JMD coconut with a US dollar bill.

- Download a Converter App: Use an app like XE or Oanda that works offline. It’s easy to get confused when you’re three Red Stripes deep and trying to figure out if a shirt is $4,000 JMD or $40,000 JMD.

- Notify Your Bank: This is old school but vital. In 2026, fraud detection is aggressive. If your card suddenly pings in a Kingston ATM, it will get blocked faster than you can say "Jah Provide." Call them before you leave.

The Jamaican dollar is resilient, just like the people. It’s been through devaluations, hurricanes, and global shifts, but it’s holding its own. Just remember: in the world of foreign exchange, information is literally money. Keep an eye on that BOJ rate, stay away from the airport booths, and always pay in JMD when you're off the resort.