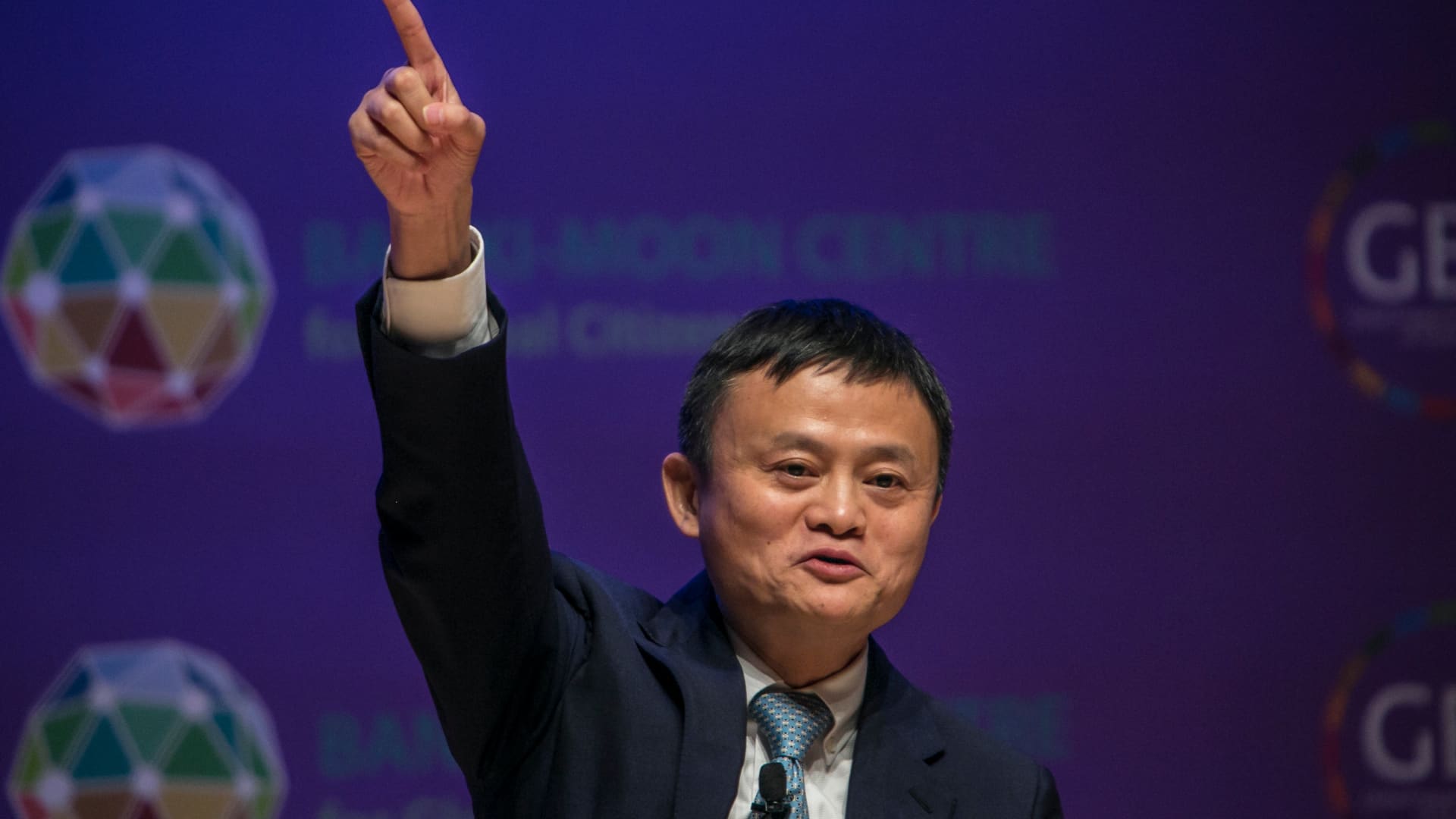

He was everywhere. If you followed tech or global finance between 2014 and 2020, you couldn't escape the face of Jack Ma. He was the diminutive English teacher from Hangzhou who somehow built a $500 billion empire. People obsessed over Jack Ma who is arguably the most famous face of Chinese capitalism. He danced like Michael Jackson at company anniversaries. He sat with presidents. He lectured at Davos. Then, he basically vanished.

The shift was jarring.

One day he’s criticizing global regulators in Shanghai; the next, he’s a ghost. For nearly three years, the world asked: Where is he? Is he in jail? Is he even alive? The story of Jack Ma isn't just a corporate biography. It’s a cautionary tale about what happens when a private individual’s shadow becomes longer than the state's.

The Teacher Who Built an Empire

Jack Ma (Ma Yun) didn't start with a computer science degree. He failed his university entrance exams twice. He was the only person out of 24 applicants rejected from a job at KFC. Honestly, his early life sounds like a series of "no's" that would have crushed most people. But in 1995, he went to the US, saw the internet for the first time, and searched for "beer." No results for Chinese beer popped up.

That was the "aha" moment.

He started Alibaba in his apartment with 17 friends in 1999. They didn't have money. They had a vision of connecting Chinese manufacturers with the world. It was called "The Iron Triangle"—e-commerce, logistics, and payments. By the time Alibaba went public on the New York Stock Exchange in 2014, it was the largest IPO in history.

Most people think of Alibaba as "The Amazon of China," but that’s not quite right. Amazon is a retailer; Alibaba is a marketplace. It’s more like eBay on steroids, mixed with a bank (Ant Group) and a delivery network.

✨ Don't miss: Funny Team Work Images: Why Your Office Slack Channel Is Obsessed With Them

The Speech That Changed Everything

If you want to understand the downfall, you have to look at October 2020. This is the "Before and After" moment.

Ma stood on a stage at the Bund Summit in Shanghai. High-ranking officials were in the audience. He didn't play it safe. He called Chinese banks "pawnshops" and claimed the global financial system—the Basel Accords—was an "old people's club." He was pushing for his fintech giant, Ant Group, to be regulated differently than traditional banks. He wanted disruption.

He got it, but not the kind he wanted.

Within days, the $37 billion Ant Group IPO—the most anticipated in history—was pulled. Regulators descended. Ant was ordered to restructure. Alibaba was hit with a record $2.8 billion antitrust fine. And Jack Ma? He stopped tweeting. He stopped appearing in public. The charismatic showman went silent.

Life After the Limelight: Where is Jack Ma Now?

So, Jack Ma who is no longer the face of Alibaba—what’s he actually doing?

For a while, he was spotted in Tokyo, living a quiet life focused on watercolor painting and sushi. He popped up in Thailand watching Muay Thai matches. He spent time in Europe looking at agricultural technology. This is the "New Jack." He’s traded the boardroom for the greenhouse.

🔗 Read more: Mississippi Taxpayer Access Point: How to Use TAP Without the Headache

In 2023, he took up a position as a visiting professor at Tokyo College, part of the University of Tokyo. He’s also a professor at the University of Hong Kong. He’s gone back to his roots: teaching. It’s a full-circle moment, even if it was forced by political gravity.

Why the Chinese Government Reigned Him In

It wasn't just one speech. It was a systemic shift in Chinese policy called "Common Prosperity." The era of "move fast and break things" in China ended abruptly. The CCP wanted to signal that no tech mogul—no matter how rich—is bigger than the Party.

- Data Sovereignty: Ant Group held data on nearly a billion people.

- Financial Risk: The government feared Ant's lending practices could cause a systemic collapse.

- Income Inequality: The optics of billionaire "celebrity" CEOs didn't fit the new socialist narrative.

The Reality of the "Disappearance"

Let's clear something up. He wasn't "missing" in the sense of being in a dungeon. He was "laying low." In China, this is a known survival strategy. When you're in the crosshairs, you become invisible.

During his absence, Alibaba’s stock price cratered. It lost more than 70% of its value from its peak. Investors who bet on Ma's "magic touch" learned a hard lesson about geopolitical risk. The company has since split into six different business units to satisfy regulators and try to spark growth again, but the spark feels different now. It’s more corporate, less "Jack."

What Most People Get Wrong About Ma

People think he was a tech genius. He wasn't. He famously admitted he didn't know how to code and barely understood the tech behind his platform.

His real genius was trust.

💡 You might also like: 60 Pounds to USD: Why the Rate You See Isn't Always the Rate You Get

In 1990s China, nobody trusted buying things online. How do you pay someone you’ve never met? He created Alipay, which held money in escrow until the buyer was happy. That single move unlocked the entire Chinese middle class. He didn't build a website; he built an ecosystem of trust in a low-trust environment.

Moving Forward: Actionable Insights for Investors and Entrepreneurs

If you're looking at the story of Jack Ma and wondering what it means for the future of tech and global business, here are the real takeaways:

1. Founder Risk is Real

When a brand is inextricably tied to one person’s personality, the company is vulnerable to that person’s mistakes. If you are investing in companies with "celebrity CEOs," always discount the valuation for the risk of a "Ma-style" exit.

2. Regulatory Alignment

Innovation can only outrun regulation for so long. Eventually, the "pawnshops" catch up. If you are building in a highly regulated space (finance, healthcare, AI), fighting the regulators publicly is rarely a winning strategy. Collaborative disruption works; aggressive defiance usually ends in a "restructuring."

3. The Pivot to "Essential" Tech

Notice what Ma is studying now: Agriculture. Sustainable fishing. Food tech. The world of "pure software" is being eclipsed by "hard tech." If you’re looking for the next big wave, it’s in things that solve physical world problems—water, food, and energy.

4. Diversify Your Presence

For entrepreneurs, Ma’s story teaches us not to put all our political or social capital in one basket. He became the sole target because he was the sole face. Building a deep bench of leadership isn't just good management; it’s a defense mechanism.

Jack Ma is still wealthy. He’s still influential in his own way. But the era of the "Rockstar Chinese CEO" is over. We’ve moved into an era of quiet compliance and technical specialization. Ma hasn't really changed—he's still the teacher. It's just that now, his most important lesson is one he never intended to teach: the price of speaking truth to power in a system that values stability over everything else.

To stay updated on his latest academic papers or his ventures into "1.8 Meters Marine Technology" (his new food venture), watch the agricultural tech space in Zhejiang. That’s where the next chapter is being written. Keep an eye on the University of Tokyo’s public lecture schedule as well; that's where he's actually speaking these days.