If you’ve ever walked into a small-town bank or a local credit union, there’s a massive chance that the software keeping that place alive isn't coming from a Silicon Valley startup. It’s coming from Monett, Missouri. That’s the home of Jack Henry & Associates.

People usually overlook the "boring" stuff in fintech. They want the flashy AI apps or the latest crypto exchange. But if you're watching the jack henry and associates stock price, you know boring is actually where the money is. As of January 12, 2026, the stock is trading around $190.25. It’s been a wild ride lately. Just a few months ago, it was hovering in the mid-140s.

Why the sudden jump? Honestly, it’s about a "beat-and-raise" culture that finally caught the market's attention.

What’s Actually Driving the Jack Henry and Associates Stock Price?

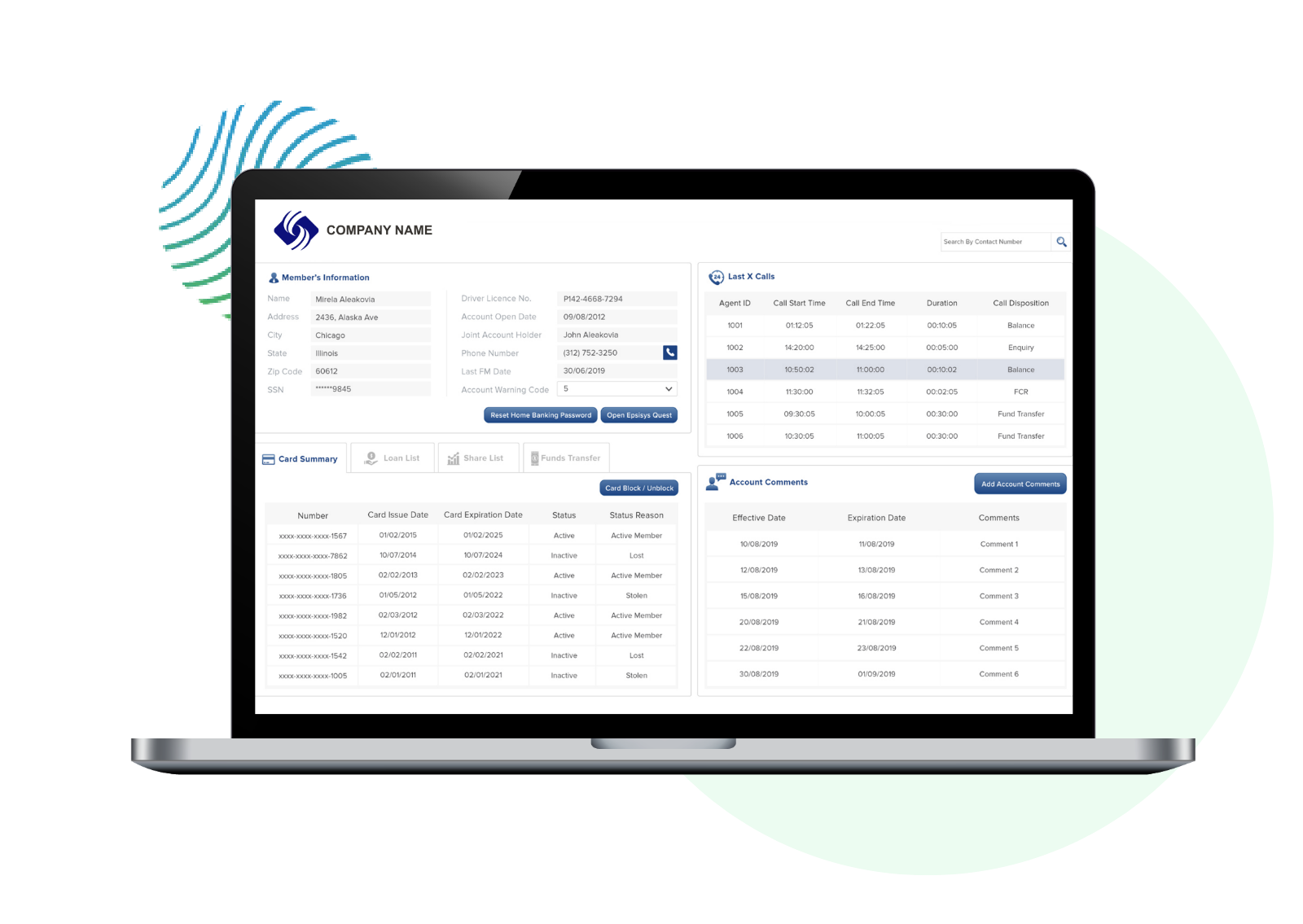

Investors aren't just buying a name; they're buying a moat. Jack Henry (JKHY) doesn't just provide "an app." They provide the "core." In banking terms, the core is the central nervous system. It handles the ledgers, the transactions, and the security. Switching a bank's core is like trying to swap out an airplane engine while you're at 30,000 feet. Nobody wants to do it unless they absolutely have to.

This creates a level of "stickiness" that most software companies would kill for.

🔗 Read more: The Stock Market Since Trump: What Most People Get Wrong

Recent earnings for fiscal Q1 2026 (ended September 2025) were a wake-up call for the skeptics. Revenue hit $644.7 million, which was a healthy 7.3% jump. But the real story was the earnings per share (EPS). They posted $1.97. Wall Street was only expecting around $1.70. When you beat expectations by nearly 30 cents, people notice.

The Competitive Dislocation Theory

RBC Capital recently upgraded the stock with a $210 price target. Why? Because their biggest competitors—FIS and Fiserv—are going through some identity crises. Fiserv is neck-deep in a massive core platform transition.

Whenever a giant competitor stumbles or forces their clients to migrate to new systems, those clients start looking for the exit. Jack Henry is standing there with the door open. Analysts are betting that Jack Henry could pick up over 100 new core wins in the next few years. Normally, they only get about 50 a year. That’s a potential doubling of their win rate simply because the "other guys" are making things difficult for their customers.

Is the Current Valuation Too High?

Kinda. It depends on who you ask.

💡 You might also like: Target Town Hall Live: What Really Happens Behind the Scenes

With a P/E ratio sitting near 29, it’s definitely not a "value" play in the traditional sense. You’re paying for quality. If you look at the 52-week range—$144.13 to $196.00—we are clearly closer to the top than the bottom.

- The Bull Case: Wolfe Research just slapped a $220 target on it. They see a sustainable 7-8% revenue growth through 2026. They love the "Piotroski Score" of 9—basically a fancy way of saying the company's balance sheet is incredibly healthy.

- The Bear Case: Some DCF (Discounted Cash Flow) models suggest a fair value closer to $160. If the economy takes a massive dump and regional banks stop spending on tech, that $190 price tag starts to look a bit heavy.

But here's the thing about regional banks: they have to spend. They are currently in a death match with mega-banks like JP Morgan and BofA. If a small bank can’t offer a sleek mobile app or real-time payments, they lose. Jack Henry sells the "arms" for that "war."

Understanding the Revenue Segments

It’s not just one big pile of money. Jack Henry breaks it down into four main buckets. This is where you see where the jack henry and associates stock price gets its support.

- Core Segment: This is the bread and butter. It grew about 6.3% on an adjusted basis recently. It’s slow, steady, and very hard to lose.

- Payments Segment: This is the growth engine. Think card processing and digital transactions. It jumped 8.3% lately. As people move away from cash, this segment thrives.

- Complementary: These are the "add-ons"—fraud detection, lending tools, etc. It grew nearly 10%.

- Corporate/Other: A smaller piece, but it saw a massive 31.5% jump recently, partly due to the timing of their Connect conference.

One weird detail you might see in the filings is "deconversion revenue." This is basically the "breakup fee" a bank pays Jack Henry when they get bought out by another bank. In Q1 2026, they pulled in $8.6 million just from banks leaving. It’s a bittersweet revenue stream—you get the cash, but you lose the customer.

📖 Related: Les Wexner Net Worth: What the Billions Really Look Like in 2026

The Fintech Integration Network (FIN)

Jack Henry is doing something smart. They aren't trying to build every single feature themselves. They created the Fintech Integration Network.

Basically, they let other fintech startups plug directly into their core. If a bank wants a specific niche AI tool for lending, Jack Henry makes it easy to "plug and play." This prevents the bank from feeling trapped and actually makes them more likely to stay. It’s a platform play, not just a software play.

What Should You Watch Next?

If you're tracking the jack henry and associates stock price, circle February 3, 2026, on your calendar. That’s the next big earnings date.

The consensus estimate is around $1.40 EPS. If they beat that again, we might actually see that $220 price target become a reality. If they miss, or if management sounds worried about regional bank consolidation, we could see a retreat back to the $175 level.

Actionable Insights for Investors

- Check the Dividends: They recently paid out $0.58 per share. It’s a 1.2% yield. Not enough to live on, but it shows they are disciplined with cash.

- Monitor Competition: Keep an eye on Fiserv’s migration issues. If Fiserv fixes their problems, Jack Henry’s "easy wins" might dry up.

- Watch Interest Rates: High rates usually mean banks have more money to spend on tech, but if rates drop too fast, their margins might squeeze, and they might cut their IT budgets.

Honestly, Jack Henry is a classic "sleep well at night" stock. It won't 10x in a week like a meme coin, but it’s anchored to the very foundation of the American banking system. As long as small and mid-sized banks exist, Jack Henry has a job to do.

Next Steps for You:

If you're considering a position, look at the jack henry and associates stock price relative to its 50-day moving average. It has a habit of "cooling off" after these big 20% runs. Setting a limit order near the $180 support level might be a smarter entry than chasing it at $190. Always read the 10-Q filings yourself—the "Services and Support" revenue line is the best indicator of their long-term health.