You've probably seen the headlines. Maybe you’ve noticed your vacation fund doesn’t go quite as far as it used to, or perhaps you're just tracking the DXY index and seeing those red numbers pile up. It’s a weird time for the greenback. Honestly, after years of the dollar being the undisputed king of the hill, things are feeling a bit shaky.

Is the US dollar weakening? The short answer is yes, but it’s not a straight line down. It’s more of a jagged, frustrating slide.

In 2025, the dollar took a massive hit, dropping about 9.4% on a DXY basis—the worst performance we’ve seen in nearly a decade. Now that we’re into 2026, the big question is whether this is a temporary dip or the start of something more permanent. Experts at Morgan Stanley and Bank of America are looking at the data and seeing a "bear regime" that might stick around until at least the middle of this year.

Why the US dollar weakening isn't just a rumor

Markets don't just move on vibes. There are specific, heavy-duty economic levers being pulled right now that are dragging the dollar down.

First, let's talk about interest rates. For a long time, the Federal Reserve kept rates high while the rest of the world was cutting. That made the dollar a "high-yield" currency—everyone wanted to park their cash in US Treasuries to earn that sweet, sweet interest. But that gap is closing. As the Fed cuts rates—forecasted to hit around 3% to 3.25% by June 2026—the "US exceptionalism" trade is losing its luster.

Then there's the fiscal side of things. Have you heard of the "One Big Beautiful Bill" (OBBBA)? It’s a massive fiscal package with a $4.1 trillion price tag that’s currently blowing a hole in the US budget. When a country spends way more than it brings in, investors start to get twitchy. We call this the "twin deficit"—a growing budget deficit combined with a record trade imbalance.

The Mar-a-Lago Accord and Policy Chaos

There’s also a lot of "noise" coming from Washington that’s actually moving the needle. In late 2025, analysts started floating the idea of a "Mar-a-Lago Accord"—a modern version of the 1985 Plaza Accord where countries basically agree to weaken the dollar on purpose to help exports. Even though nothing official has been signed, the mere suggestion that the administration wants a weaker dollar is enough to make traders sell.

And let's not forget the drama around Fed Chair Jerome Powell. Every time there’s a headline about potentially firing him or undermining the Fed's independence, the dollar drops. It happened on July 16, 2025, when a rumor about his dismissal caused a 1.2% flash crash in the dollar within an hour.

Trust is the currency of currencies. If people start doubting the rules of the game in the US, they look elsewhere.

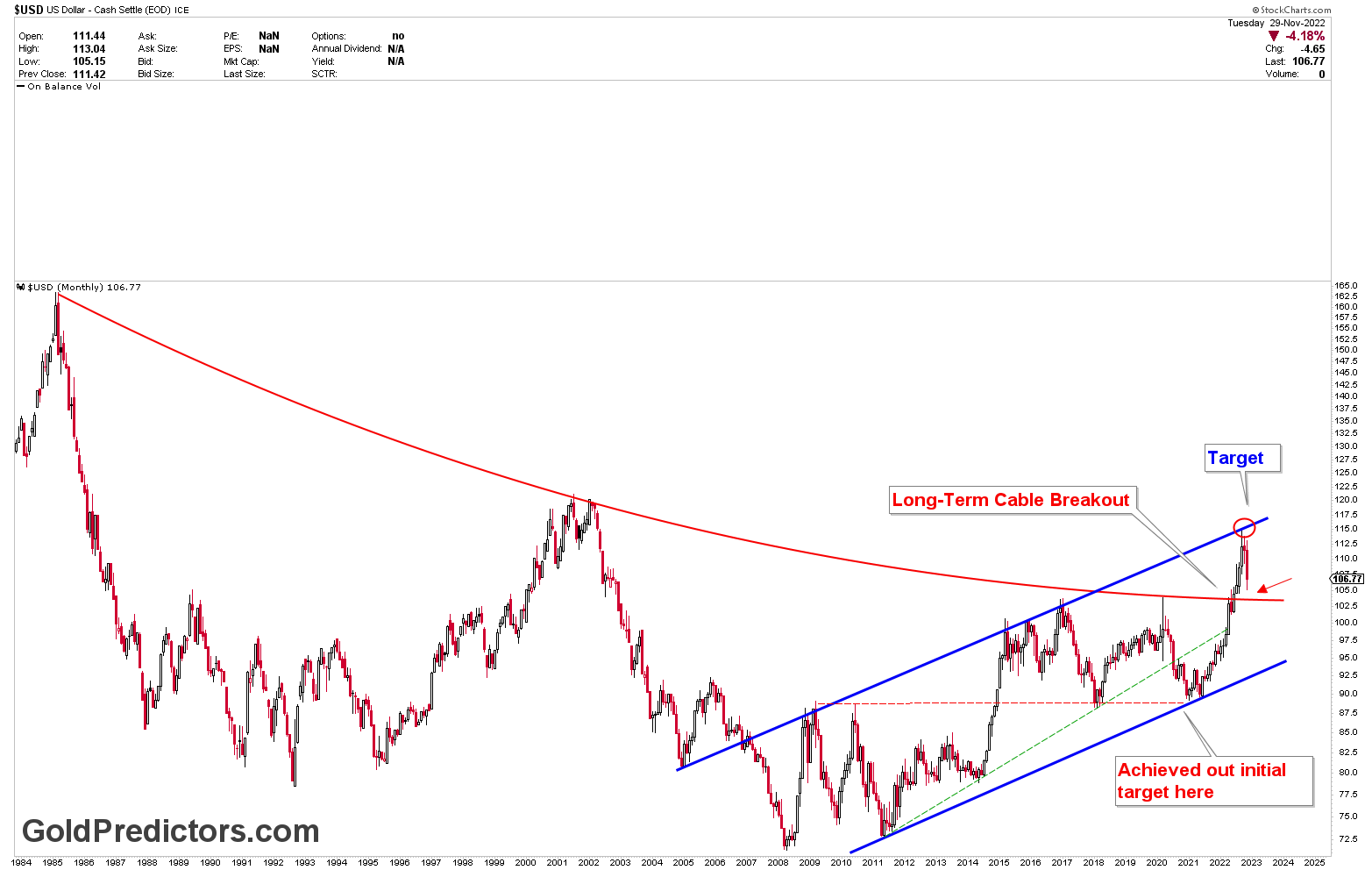

Is the DXY headed for 94?

The DXY (US Dollar Index) is basically the dollar's scorecard against a basket of other big players like the Euro and the Yen. Right now, it’s hovering around 99, but many analysts think it has further to fall.

✨ Don't miss: What’s Actually Happening at 1 Dell Parkway Nashville TN These Days

- Morgan Stanley predicts the DXY could bottom out at 94 in the second quarter of 2026.

- Bank of America is even more aggressive, suggesting an 8% decline this year if historical trends from 1995 repeat.

- MUFG Research is projecting the DXY could slide to 93.41 by the end of Q4 2026.

But here’s the twist: it’s not a total collapse. While the dollar is definitely weakening against the Euro—which some see breaking above 1.2000 this year—it’s still the world’s reserve currency. Nobody is actually replacing it yet. It’s just becoming "less special."

Real-world impact: What this means for your wallet

If you're a US-based investor, a weakening dollar is actually a bit of a double-edged sword. On one hand, it makes your European or Japanese stocks worth more when you convert them back to USD. On the other hand, it makes imported goods more expensive, which feeds into that "sticky inflation" everyone is worried about.

Preston Caldwell from Morningstar recently noted that inflation might tick back up to 2.7% as those higher import costs hit consumers. It’s a bit of a cycle: a weak dollar helps exports but hurts the person buying a new TV or a tank of gas.

What about the "Safe Haven" status?

Usually, when the world goes crazy, people buy dollars. It’s the ultimate "safe haven." But lately, that hasn’t been working. During the "tariff shocks" and geopolitical tensions early in 2025, the dollar didn't spike like it used to. In fact, it fell. This suggests that the US is currently the source of the uncertainty, rather than the refuge from it.

💡 You might also like: Lerners New York Credit Card: What Really Happened to Your Account

When the house is on fire, you don't run into it for safety.

Actionable insights for a weak dollar environment

So, what do you actually do with this information? Sitting around watching the DXY tick down isn't a strategy.

- Diversify into non-USD assets. If the dollar is sliding, holding assets in Euro, Yen, or even Emerging Markets (EM) can act as a natural hedge. J.P. Morgan is currently bullish on global equities for 2026, forecasting double-digit gains.

- Watch the Fed, not the headlines. While political noise causes short-term spikes, the long-term trend is driven by interest rate differentials. If the Fed pauses its cuts while the ECB keeps cutting, the dollar might actually find a floor sooner than expected.

- Hedge your bets. Many large institutional investors have started hedging their US exposure for the first time in years. If you have a significant portfolio, it might be worth looking into currency-hedged ETFs to protect against further depreciation.

- Keep an eye on the second half of 2026. Most forecasts see a "choppy path" followed by a recovery late in the year. Morgan Stanley thinks the dollar could claw its way back to 100 by December 2026 as US growth reaccelerates to 1.8%.

The era of "dollar dominance at any cost" is taking a breather. We’re moving into a more balanced, multi-polar currency world. It’s not the end of the greenback, but it’s certainly a wake-up call for anyone who thought it only goes up.

Stay flexible. The data is moving fast, and in 2026, the only thing that's certain is volatility. Keep your eyes on the inflation prints and the Fed's next move—that's where the real story is written.

Practical Next Steps

- Review your international exposure: Check if your portfolio is over-weighted in US-only assets.

- Monitor the 10-year Treasury yield: If it stays around 4.2%, it might provide some support for the dollar.

- Follow the FOMC meetings in March and June: These will be the "pivot points" for the dollar's direction this year.