You’re standing at the ATM. You need cash for the weekend, or maybe you're trying to clear a wire transfer before the 5:00 PM cutoff. Then it hits you—the lights are off, the doors are locked, and there’s a little taped sign on the glass. Is today a bank holiday in the USA? It’s a question that usually comes with a side of mild panic, especially when your rent is due or you’ve got a closing on a house.

The short answer depends entirely on the calendar, but the long answer is actually kinda complicated because "bank holiday" doesn't mean the same thing for everyone anymore.

Back in the day, if the Federal Reserve closed, everything stopped. Period. Now? We live in this weird gray area where your mobile app works, but your "instant" Zelle transfer might be stuck in limbo because some clerk in a basement in D.C. isn't at their desk. It’s frustrating.

What’s Actually Happening Today?

To figure out if today is a bank holiday in the USA, you have to look at the Federal Reserve Schedule. Banks almost always follow the lead of the "Fed." If the Fed is closed, the plumbing of the American financial system—the ACH (Automated Clearing House) and the FedWire—basically goes on break.

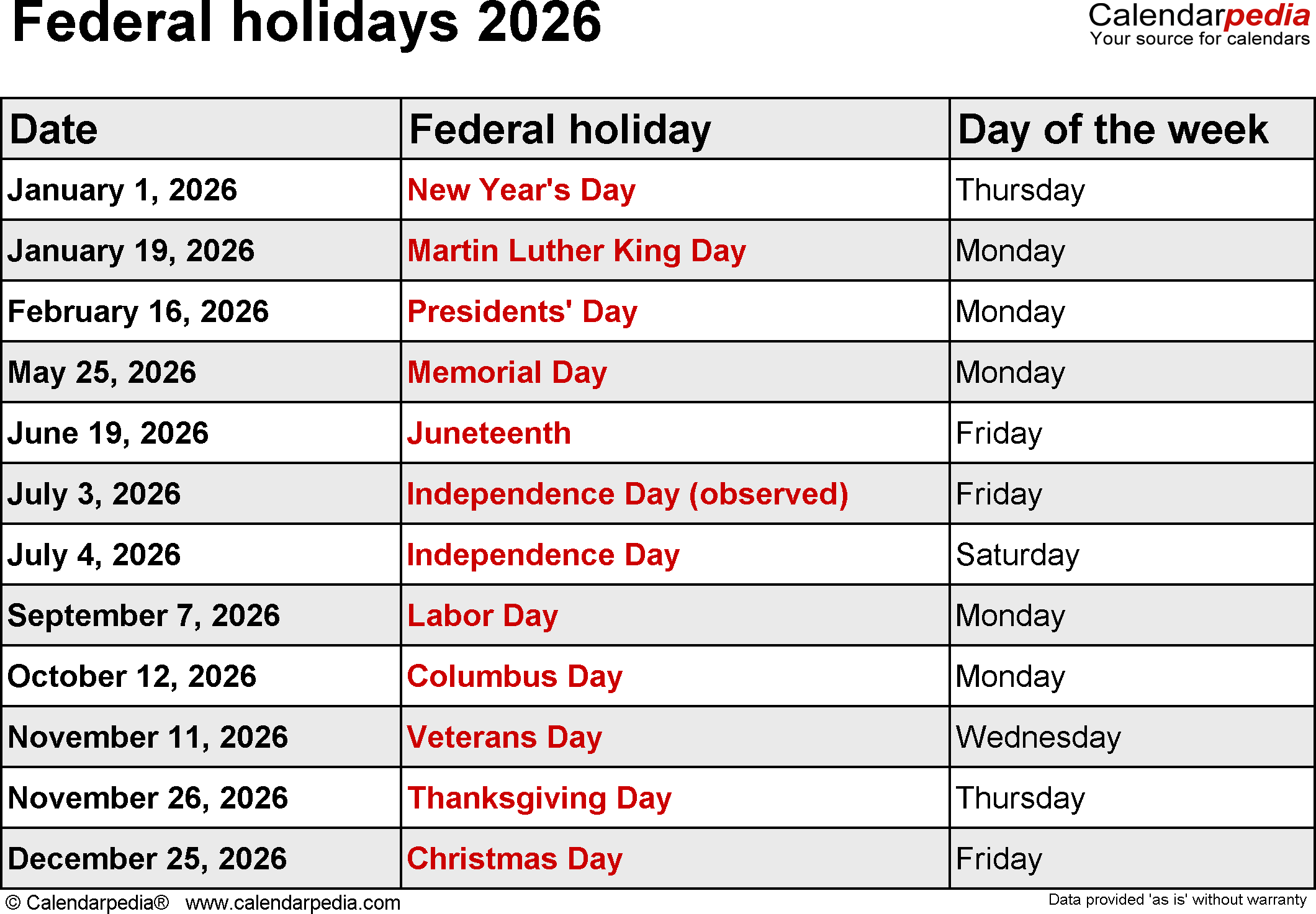

Right now, in 2026, we follow the standard slate of 11 federal holidays. If today is New Year’s Day, MLK Jr. Day, Washington’s Birthday (Presidents Day), Memorial Day, Juneteenth, the Fourth of July, Labor Day, Indigenous Peoples' Day (Columbus Day), Veterans Day, Thanksgiving, or Christmas, then yeah, the banks are shuttered.

But wait. There’s a catch.

If a holiday falls on a Sunday, the banks usually close on the following Monday. If it falls on a Saturday, the Federal Reserve Bank and its branches stay open on the preceding Friday, but many retail bank branches—the ones you actually walk into—might decide to close anyway. It’s a mess of "maybe."

✨ Don't miss: Economics Related News Articles: What the 2026 Headlines Actually Mean for Your Wallet

The "Big Eleven" List

Here is what the standard federal schedule looks like. Don't expect these to change much, though Juneteenth was the first "new" one we've seen in decades.

- New Year’s Day (January 1)

- Martin Luther King, Jr. Day (Third Monday in January)

- Washington’s Birthday (Third Monday in February)

- Memorial Day (Last Monday in May)

- Juneteenth National Independence Day (June 19)

- Independence Day (July 4)

- Labor Day (First Monday in September)

- Columbus Day / Indigenous Peoples' Day (Second Monday in October)

- Veterans Day (November 11)

- Thanksgiving Day (Fourth Thursday in November)

- Christmas Day (December 25)

Honestly, Columbus Day and Veterans Day are the ones that trip people up the most. The post office is closed, and the banks are closed, but your boss probably still expects you at your desk. It feels like a "fake" holiday until you realize you can't get a cashier's check.

Why "Is Today a Bank Holiday in the USA" Matters for Your Money

If you’re just trying to buy a latte, it doesn't matter. But if you are doing "real" banking, a holiday is a massive roadblock.

Think about the ACH system. This is the backbone of how most people get paid. If you’re expecting a direct deposit on a Friday, and that Friday happens to be a bank holiday, that money might not hit your account until Monday or Tuesday. It’s not that the money is "gone," it’s just that the digital handshakes required to move it aren't happening. The Fed’s computers are basically on "Do Not Disturb" mode.

Real estate is where this gets truly ugly. I've seen people sitting in moving trucks with all their furniture, unable to get the keys to their new house because a wire transfer didn't clear before a bank holiday. The title company can’t confirm the funds, so they can’t legally hand over the keys. You end up paying for an extra three days of truck rental because of a holiday you didn't even know existed.

The Rise of "Zombie" Banking

We are currently living through the era of "Zombie" banking. This is when your bank’s website is up, your balance is showing, and you can move money between your own accounts, but nothing outside the bank is moving.

🔗 Read more: Why a Man Hits Girl for Bullying Incidents Go Viral and What They Reveal About Our Breaking Point

Digital-only banks like Ally or Chime don't have physical branches to close, but they are still tethered to the Federal Reserve. Even if their customer service chat is open 24/7, they can't force an outgoing wire through if the Fed is dark. You’re basically driving a Ferrari on a road that’s been boarded up.

Stock Markets vs. Banks: The Great Confusion

One of the biggest misconceptions is that if the New York Stock Exchange (NYSE) is open, the banks must be open. Nope. Not true.

The NYSE and the banks don't always share a calendar. For example, the stock market stays open on Veterans Day and Columbus Day/Indigenous Peoples' Day. You can trade Apple stock all day long, but you can’t walk into a Chase branch and get a document notarized. It’s a weird quirk of American capitalism where the traders stay at their terminals while the tellers stay home.

On the flip side, the markets close for Good Friday, but banks are generally open. If you're trying to figure out "is today a bank holiday in the USA," checking the ticker on CNBC might actually give you the wrong answer.

State Holidays: The Curveball You Didn't See Coming

If you live in Massachusetts or Maine, you’ve got Patriots' Day in April. In Texas, there’s Texas Independence Day. While these aren't federal holidays, some local credit unions or smaller regional banks might decide to observe them.

Usually, the big national players like Bank of America, Wells Fargo, and Citibank stay open on state-specific holidays to keep things consistent across the country. But if you bank with a local "Main Street" credit union, you might find the doors locked on a random Tuesday in April because of a local tradition.

💡 You might also like: Why are US flags at half staff today and who actually makes that call?

What to Do If the Banks Are Closed

So, you’ve confirmed the worst: it is a bank holiday. Now what?

Most people think they’re totally stuck, but there are workarounds.

- Surcharge-Free ATMs: Most big banks have agreements with retailers like CVS or Walgreens. Even if the bank branch is closed, you can usually pull cash at these locations without getting hit with a $5 fee.

- Mobile Check Deposit: This still "works," but it won't "clear." You can take the photo and the bank will acknowledge it, but the funds usually won't be available until the next business day.

- Zelle and Venmo: These are generally your best bet for immediate needs, but remember that the "transfer to bank" feature will be delayed by the holiday. Keep the money in the "app" if you need to pay someone else who uses that app.

- The "Post-Office" Rule: If the post office is closed, the bank is almost certainly closed. They are the two pillars of federal downtime.

Looking Ahead to 2026 and Beyond

As we move further into 2026, the definition of a "bank holiday" is starting to blur even more. With the rollout of FedNow, the Federal Reserve’s new instant payment service, we are supposed to be moving toward a 24/7/365 financial system.

The goal of FedNow is to make bank holidays irrelevant for transfers. In theory, a wire sent on Christmas Day should arrive in seconds. However, the rollout has been slow. Most smaller banks haven't fully integrated it yet, and many big banks are dragging their feet because they like the "float" money they make while your funds are sitting in limbo during a long weekend.

Until FedNow is the universal standard, "is today a bank holiday in the USA" will remain a vital question for anyone trying to manage a budget.

Practical Steps to Avoid Holiday Headaches

Don't let a random Monday in October ruin your financial life.

- Audit your "Auto-Pay": If your mortgage or car payment is set to go out on the 1st of the month, and the 1st is a holiday, check your bank's policy. Some will pull the money the Friday before, which can trigger an overdraft if you aren't ready.

- Buffer your "Cash-Outs": If you’re a freelancer or gig worker using platforms like Uber or Upwork, don't wait until Thursday to "Instant Pay" your earnings if Friday is a holiday. Those systems often glitch or slow down during federal breaks.

- Check the "Observed" Dates: Always look at a calendar that specifically lists "Federal Observed Holidays." These are the real killers—the Mondays following a Sunday holiday that feel like regular days but act like Sundays.

If you’re currently staring at a closed bank door, your best bet is to use the mobile app for everything it's worth and wait for the 9:00 AM Tuesday morning rush. The digital world never sleeps, but the people who move the big money still do.

Actionable Insights for Today:

- Check the App First: Most banking apps now display a banner if it’s a federal holiday.

- Verify the Fed: Look at the Federal Reserve’s official holiday list for 2026 to see if "observed" rules apply to today.

- Use Retail ATMs: If you need cash, skip the bank branch and head to a 7-Eleven or a drug store that participates in your bank’s network.

- Delay Major Transfers: If you're sending more than $5,000, wait until the first non-holiday Tuesday to ensure it doesn't get "stuck" in a manual review queue over a long weekend.