You’re staring at your trading dashboard, maybe looking to catch a dip or rebalance some tech heavyweights, and then it hits you—it’s Juneteenth. If you’re asking is the stock market open on june 19th, the short answer is no. Not even a little bit.

In 2026, June 19th falls on a Friday. This means you’re looking at a long weekend. The New York Stock Exchange (NYSE) and the Nasdaq are both keeping their doors locked. It’s a full market holiday.

Honestly, it’s still a relatively "new" thing for the financial world. While Juneteenth has been celebrated for over a century, it didn't become a federal holiday until 2021. The markets followed suit shortly after. Now, it’s as standard as Christmas or the Fourth of July.

Why the June 19th Market Closure Matters

You might think, "Big deal, I’ll just trade on the 20th." Well, that’s a Saturday. You’re actually waiting until Monday, June 22nd, before a single ticker moves again.

When the market closes for Juneteenth, it’s not just the guys in suits on the floor taking a breather. The entire plumbing of the U.S. financial system pauses.

💡 You might also like: New Zealand currency to AUD: Why the exchange rate is shifting in 2026

- No Regular Trading: From 9:30 a.m. to 4:00 p.m. ET, nothing happens.

- No Pre-market or After-hours: Those 4 a.m. early birds? They’re sleeping in.

- Bond Markets: SIFMA, the group that basically runs the bond world, also recommends a full close. You won't be moving Treasuries.

There's this weird thing that happens with settlement, too. Because June 19, 2026, is a Friday, any trades you wrap up on Thursday, June 18, won't technically "settle" until the following week. Usually, we’re on a $T+1$ settlement cycle now. But holidays throw a wrench in that. Your money might feel like it's in limbo for an extra day or two.

Is Everything Closed?

Kinda, but not quite.

If you’re a crypto junkie, you already know the drill. Bitcoin doesn’t care about federal holidays. Ethereum doesn’t take a day off for emancipation. Those markets stay wide open 24/7/365. Just be careful—liquidity can get a bit wonky when the "big money" institutional desks are closed for the holiday.

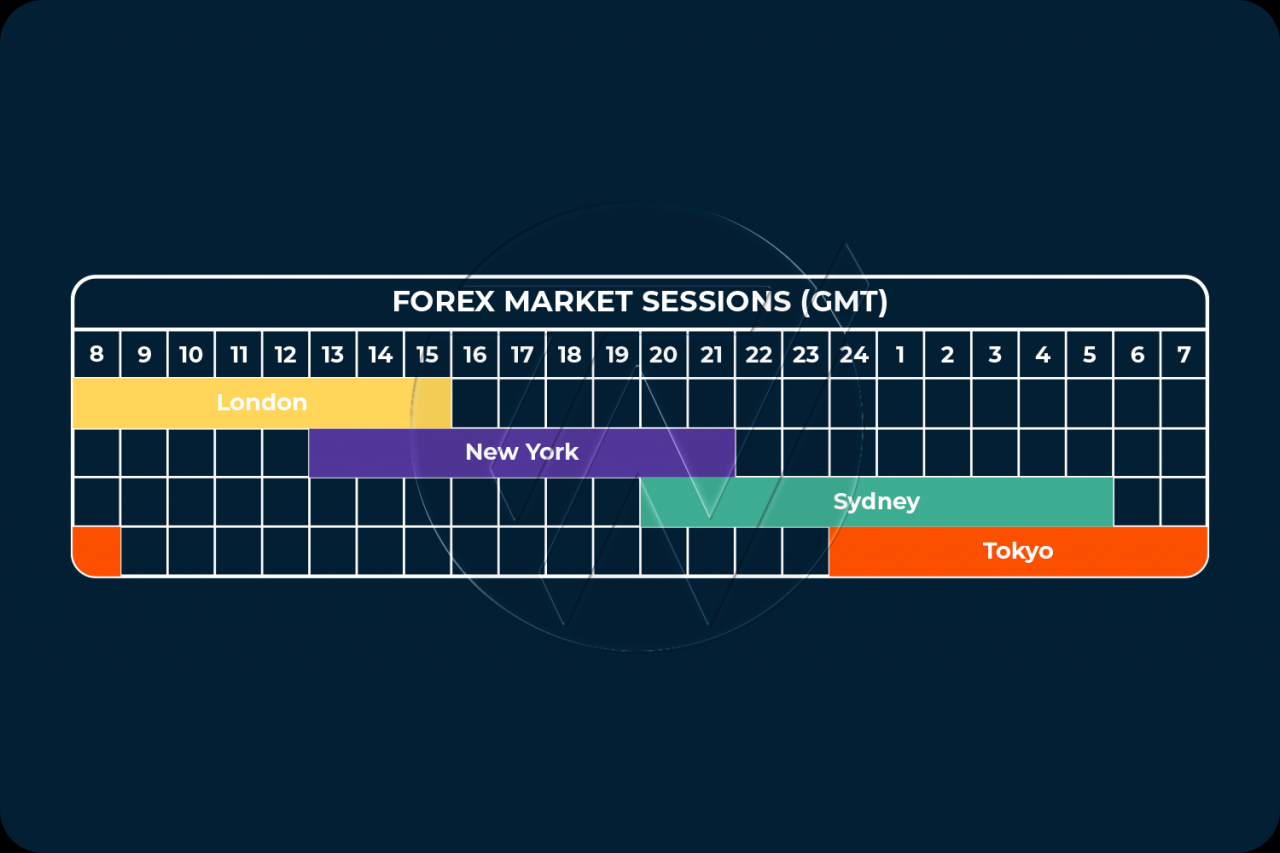

International markets are another story. The London Stock Exchange (LSE) or the Tokyo Exchange? They’re open. It’s a U.S. federal holiday, not a global one. If you have international holdings, you might see your portfolio value fluctuate even while the NYSE is dark. It’s a bit jarring to see your total balance move when you can't actually sell anything.

📖 Related: How Much Do Chick fil A Operators Make: What Most People Get Wrong

The Bond Market Twist

The bond market is usually the most boring part of finance, but on holidays, it’s the most specific. While the stock market is a hard "no," the bond market sometimes does "early closes."

For Juneteenth 2026, SIFMA has recommended a full close for Friday the 19th. However, they often suggest an early 2:00 p.m. ET close on the day before a major holiday. If you're heavy into fixed income, keep an eye on Thursday, June 18th.

Strategy for the Long Weekend

Most people just treat this as a day to grill or head to the beach. But if you’re active in the markets, the "holiday effect" is a real thing.

Historically, the days leading up to a long summer weekend like this see lower volume. Big institutional traders often head out early. This can lead to some "thin" trading—where a small move can have a weirdly outsized impact on a stock's price because there aren't as many buyers and sellers to smooth things out.

👉 See also: ROST Stock Price History: What Most People Get Wrong

I’ve seen plenty of traders get caught in a "gap" on Monday morning. If some massive news breaks over the weekend while the is the stock market open on june 19th answer is still "no," the market will "gap" up or down when it opens Monday. You can’t set a stop-loss to protect you during a holiday. If the market opens $5$ dollars lower than it closed on Thursday, your stop-loss triggers at that lower price. It sucks, but that’s the risk of holding through a long weekend.

What to Do Next

Don't panic-sell on June 18th just because the market is closed for a day. That’s usually a recipe for regret. Instead, treat the closure as a forced "sanity check."

- Check your margins: If you're trading on margin, remember that interest still accrues even when the market is closed. Those extra days can add up.

- Update your calendar: Put a big red "X" on June 19th. Don't be the person calling their broker wondering why the app isn't working.

- Review your "GTC" orders: Good 'Til Canceled orders stay in the system. If you have a buy limit set for a stock, it will still be sitting there waiting for Monday morning's bell.

Basically, the stock market being closed is a great excuse to actually observe the holiday. Juneteenth is about freedom and reflection. Maybe take the day to look at your long-term goals instead of the 1-minute candle charts. Your portfolio will still be there on Monday.

The most important thing is simply knowing the schedule. Markets will resume their usual chaotic 9:30 a.m. ET start on Monday, June 22, 2026. Until then, the tickers are frozen.