You’ve probably seen the headlines. Your phone pings with a notification from CNBC or Bloomberg, and suddenly everyone at the office is talking about "blue chips" and "record territory." But if you look at your own portfolio, it might not feel like a party. Is the stock market at an all time high? Honestly, the answer depends entirely on which day you ask and which specific "market" you’re looking at.

When people ask this, they’re usually talking about the S&P 500 or the Dow Jones Industrial Average. As of early 2026, we’ve seen some massive runs. We’ve also seen some gut-wrenching dips. It's a rollercoaster. You can't just look at a single number and assume everything is expensive. Some sectors are screaming toward the moon while others are basically stuck in the basement.

Markets are weird. They don't move in straight lines.

The psychology of the peak

Psychologically, hitting an all-time high feels scary. It’s like standing on the edge of a cliff. You keep waiting for the wind to blow you off. Investors start worrying about a "bubble." They think, "If it's never been higher than this, it has to go down, right?"

Actually, history says otherwise.

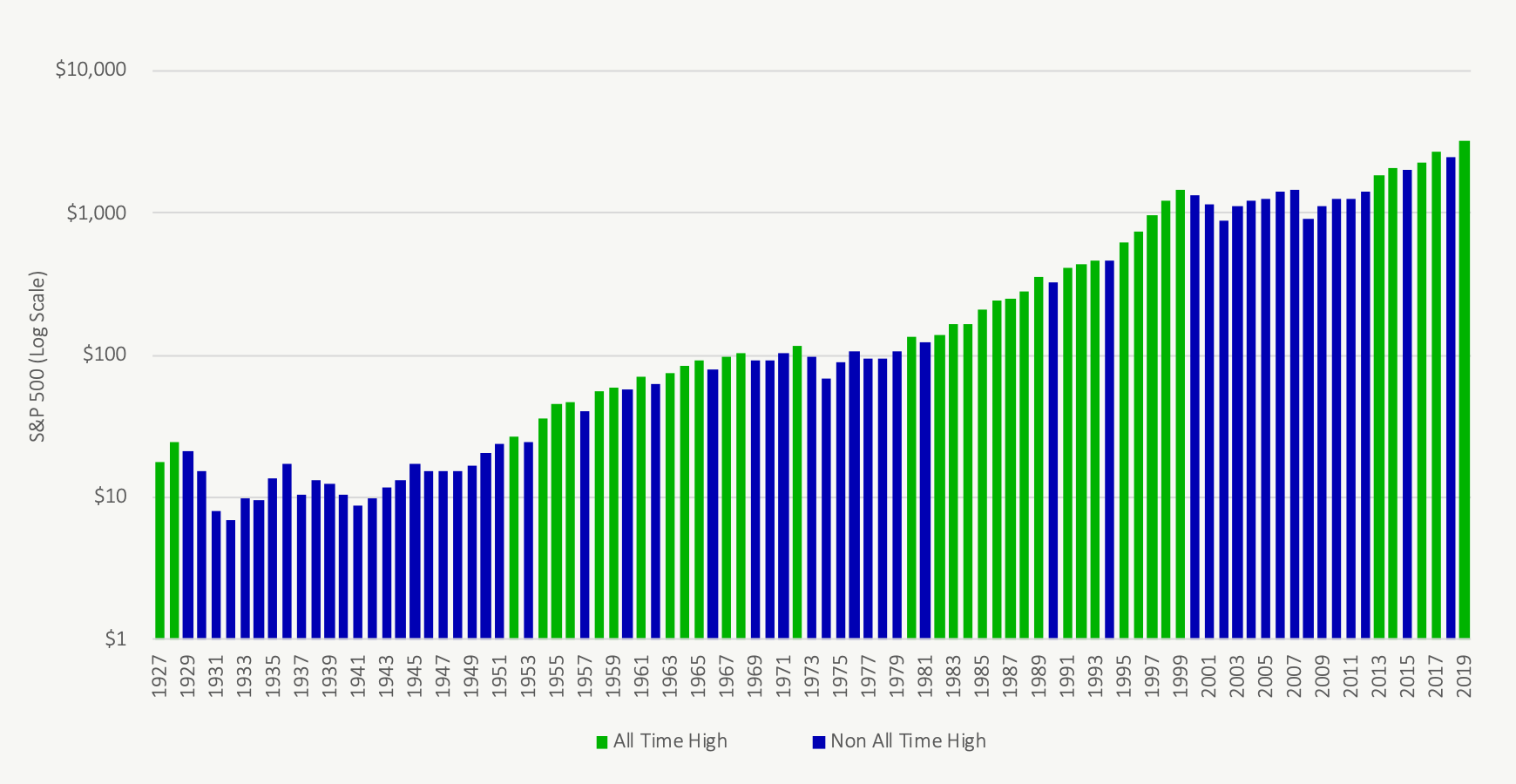

Research from firms like J.P. Morgan Asset Management has shown that investing at an all-time high has historically produced solid returns over the following year. It sounds counterintuitive. You’re taught to "buy low and sell high." But in a growing economy, the market is supposed to hit new highs regularly. If it didn't, we’d all be in a lot of trouble. It’s a sign of expansion. It’s the sound of corporate earnings growing.

Take a look at the mid-2010s or even the post-2020 recovery. We hit "all-time highs" hundreds of times. If you sold every time the market broke a record, you would have missed out on one of the greatest wealth-building periods in human history. That’s the trap.

Why it feels different this time

There is a huge disconnect right now. We have high interest rates—at least compared to the "free money" era of 2010-2021—and yet the indexes keep pushing upward. Why?

Concentration. That is the word of the year. A handful of massive tech companies, often nicknamed the "Magnificent Seven" (though the roster changes as companies like Nvidia explode and others like Tesla face hurdles), represent a giant chunk of the market’s total value. If those five or six companies do well, the whole index looks like it’s at an all-time high, even if the "average" stock in the index is actually down for the year.

🔗 Read more: US Stock Futures Now: Why the Market is Ignoring the Noise

It’s an illusion. Sorta.

If you own an equal-weighted index fund, you might be seeing very different results than someone holding the standard market-cap-weighted S&P 500. This is why you’ll hear analysts like Ed Yardeni talk about "rolling recessions." Different parts of the economy take turns being miserable while others thrive.

Looking under the hood of the current rally

Let’s get specific. When we ask is the stock market at an all time high, we have to look at the catalysts. In 2026, the biggest driver is undeniably Artificial Intelligence integration. We’ve moved past the "hype" phase and into the "show me the money" phase. Companies are actually showing improved margins because of automated workflows and advanced predictive modeling.

But there’s a flip side.

- Consumer Debt: Credit card balances are at record levels.

- Commercial Real Estate: There are still massive "zombie" office buildings in major cities.

- Geopolitics: Trade tensions haven't exactly cooled off.

So, you have this tug-of-war. Innovation is pulling the market up to new highs, while debt and global instability are trying to anchor it down.

Valuation vs. Price

Price is what you pay; value is what you get. Warren Buffett said that. It’s still true. Just because the price is at an all-time high doesn't mean the market is "expensive."

If a company earns $10 and the stock is $100, the P/E ratio is 10. If the company grows its earnings to $20 and the stock goes to $180, the stock is at an all-time high price, but it’s actually cheaper relative to its earnings (a P/E of 9).

This is what most people get wrong. They see a big number and get spooked. They don't look at the earnings supporting that number. In 2026, corporate earnings have remained surprisingly resilient despite the higher cost of borrowing. Companies got lean. They cut the fat. Now, they are reaping the rewards of efficiency.

💡 You might also like: TCPA Shadow Creek Ranch: What Homeowners and Marketers Keep Missing

What should you actually do?

Stop trying to time it. Seriously.

If you’re waiting for a 20% drop to get in, you might wait three years. By the time that 20% drop happens, the market might have already gone up 50%. You’d be buying in at a price higher than the one you’re afraid of today. It’s a loser’s game.

The most successful investors I know—the ones who actually have seven-figure brokerage accounts—don't care if the market is at an all-time high. They care about "time in the market."

The "All-Time High" Strategy

If you are genuinely nervous about putting a large lump sum into a record-breaking market, use Dollar Cost Averaging. Take that $10,000 or $100,000 and break it into ten pieces. Move it in over ten months. If the market keeps going up, you’re glad you started. If it crashes, you’re buying the dip with your remaining cash. It's a win-win for your mental health.

Another thing to watch is the VIX, or the "fear index." When the market is at highs and the VIX is very low (under 12 or 13), it usually means investors are getting complacent. That’s usually when a "healthy correction" of 5-10% happens. It’s not the end of the world; it’s just the market taking a breath.

Real-world risks to watch in 2026

We can't talk about record highs without talking about what could break them.

The Federal Reserve is the main character in this story. If inflation stays "sticky"—meaning it won't drop down to that 2% target—the Fed might keep rates high for much longer than the market wants. The market hates high rates because they make future profits less valuable today.

Then there’s the labor market. We’ve seen a shift from "we can't find enough workers" to "we are selectively hiring." If unemployment starts to creep up toward 5%, consumer spending will crater. Since the US economy is driven by people buying stuff they don't necessarily need, that's a huge red flag.

📖 Related: Starting Pay for Target: What Most People Get Wrong

Is the stock market at an all time high?

Yes, for several major indexes, we are hovering at or near historic peaks. But don't let the "high" label paralyze you. The market spent about 30% of the time between 1926 and 2023 within 5% of its all-time high. Being at the top is actually a very normal state of affairs for a healthy capitalist system.

The danger isn't the high price. The danger is your reaction to it.

Investors who panicked in 2007, 2013, 2017, and 2021 because "the market is too high" all share one thing in common: they missed out on life-changing gains.

Actionable Steps for Today's Market

Instead of staring at the charts and worrying, take these concrete steps to protect your downside while staying positioned for growth.

- Rebalance your winners. If your tech stocks have grown so much that they now make up 80% of your portfolio, sell a little bit. Move that money into "boring" areas like healthcare or utilities. These usually hold up better if the market decides to take a dive.

- Check your cash reserves. You shouldn't be investing money you need for rent or a mortgage in the next two years. If you have a solid "emergency fund" in a high-yield savings account (which are still paying great rates in 2026), you won't be forced to sell your stocks at a loss if the market hits a rough patch.

- Audit your fees. When the market is going up 15% a year, nobody notices a 1% management fee. When the market flattens out, that 1% eats your lunch. Look for low-cost ETFs from providers like Vanguard or Schwab.

- Ignore the "Doom-Porn." There is a whole industry of YouTubers and newsletter writers who predict a "total collapse" every single week. They only have to be right once every ten years to look like geniuses. Don't let them scare you out of your long-term plan.

The reality is that is the stock market at an all time high is a headline, not a strategy. The market is a machine designed to reflect human progress and corporate greed. As long as humans keep inventing things and companies keep trying to make a profit, the long-term trajectory of the market will be up.

Stay invested, stay diversified, and keep your emotions in check. That’s how you actually win.

Immediate Next Steps:

- Review your asset allocation: Log into your brokerage account and see if your "risky" assets have grown to represent a larger percentage of your wealth than you're comfortable with.

- Set up an automatic contribution: If you aren't already, automate your investing so you buy every month regardless of whether the market is at a high or a low.

- Evaluate your "yield": With rates where they are, make sure your "safe" money is actually earning interest in a money market fund or short-term Treasuries.