Wall Street has a million ways to tell you the sky is falling. You’ve got the VIX screaming, the 10-year yield spiking, and talking heads on CNBC looking like they’ve seen a ghost. But if you're trying to figure out when the selling actually stops, you've probably ended up looking at the put to call ratio SPY traders obsess over. It's one of those metrics that sounds fancy but is basically just a giant mood ring for the S&P 500.

Basically, it's a math problem. You take the number of put options (bets that the market goes down) and divide it by the number of call options (bets that it goes up). When the number gets high, everyone is terrified. When it's low, everyone is high-fiving.

But here’s the thing.

Most people use it wrong. They see a high ratio and think, "Oh, everyone is bearish, I should sell too." Honestly? That’s usually the exact moment you should be looking for a bounce. It’s a contrarian indicator, but like any tool in this weird 2026 market, it has some massive "gotchas" that can blow up your account if you aren't careful.

The Mechanics of the Put to Call Ratio SPY Traders Track

If you look at the CBOE (Chicago Board Options Exchange) data, you'll see two main flavors: the total put-call ratio and the equity-only ratio. For SPY—the SPDR S&P 500 ETF—the data is a bit noisier. Because SPY is the most liquid vehicle on the planet, it isn't just retail traders gambling on a "moon mission."

Big institutions use SPY puts as insurance. It’s like buying a homeowners policy. They aren't necessarily "bearish" in the sense that they think the world is ending; they just have billions of dollars in stocks and don't want to lose 10% in a week if a rogue inflation print hits the wires. This means the put to call ratio SPY often stays higher than individual stocks like Nvidia or Apple.

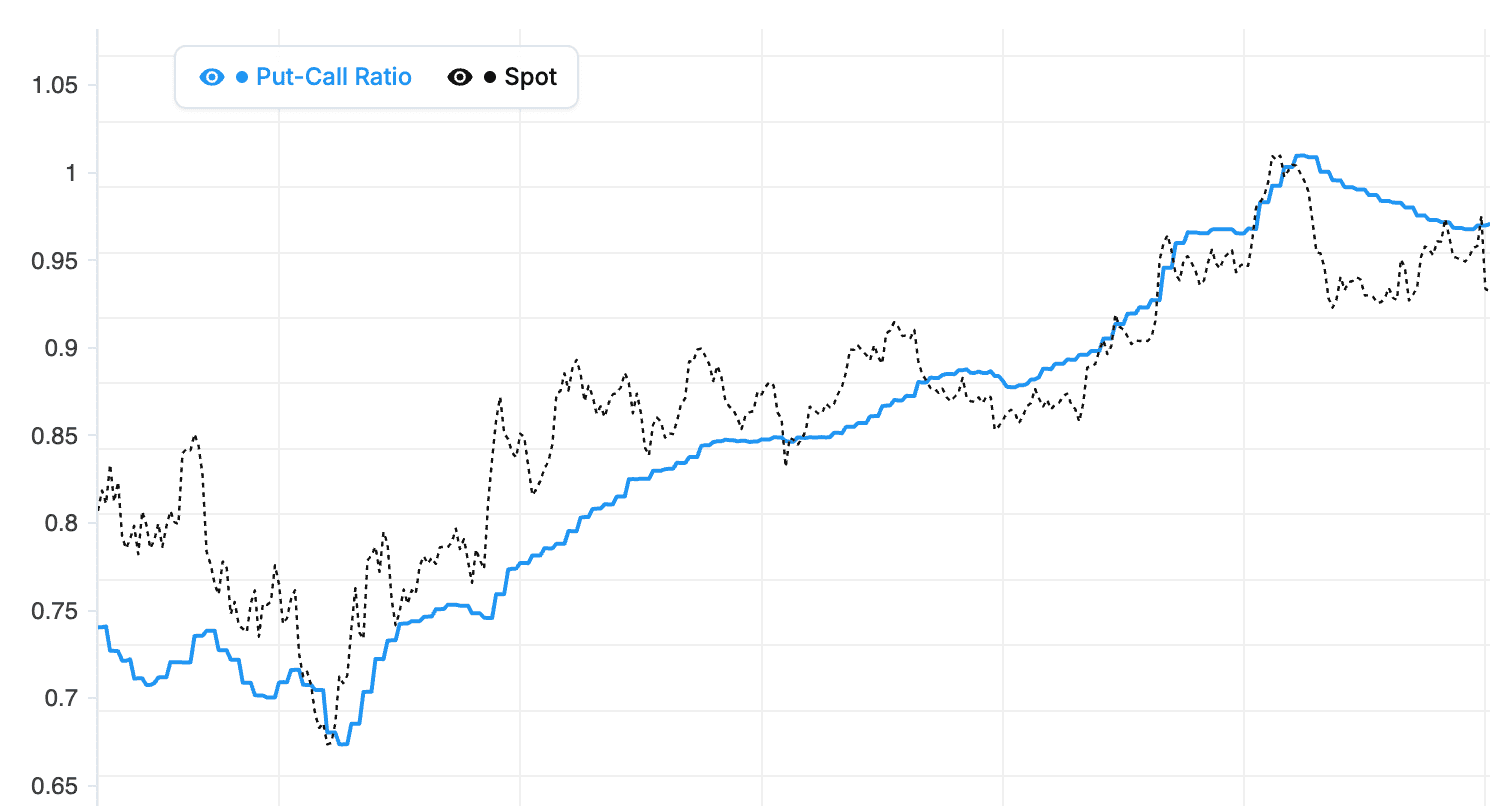

When the ratio hits 1.0, it means for every call being bought, there’s a put being bought. In a "normal" healthy market, the ratio usually hovers around 0.7 or 0.8. Why? Because humans are naturally optimistic (or greedy), and we like buying calls more than puts. When that number spikes toward 1.2 or 1.5, the "fear" is palpable.

✨ Don't miss: Les Wexner Net Worth: What the Billions Really Look Like in 2026

You’ve likely seen this happen during "black swan" events or even just nasty earnings seasons. The crowd piles into puts to protect themselves. But once everyone who wanted to buy protection has already bought it, who is left to sell? That's the "exhaustion" point. It’s a classic rubber band effect. The more you stretch it toward "extreme fear," the harder it snaps back toward the mean.

Why 2026 Trading Has Changed the "Standard" Readings

Everything changed with the explosion of 0DTE (zero days to expiration) options. Back in the day, a high put to call ratio SPY reading meant investors were hedging for the next month or quarter. It was a slow, heavy sentiment shift.

Now? Half the volume in SPY options expires in a few hours.

This creates "gamma flips" and insane intraday volatility that can make the put-call ratio look absolutely psychotic. You might see a massive spike in the morning because of a bad jobs report, only for the ratio to collapse by 2:00 PM as traders close out their hedges. If you’re just looking at a daily closing number, you’re missing the actual story of the tape.

Larry McMillan, a legend in the options world and author of Options as a Strategic Investment, often points out that you have to look at the moving averages of these ratios to get any real signal. A single day's spike is just noise. But if the 10-day moving average of the put-call ratio starts trending toward multi-year highs, that’s when you pay attention. It shows a persistent, systemic lack of confidence. And historically, that’s where the big money is made on the long side.

The Dangerous Trap of "Hedging" vs. "Speculating"

One thing I see people mess up constantly is failing to distinguish between the equity put-call ratio and the index ratio.

🔗 Read more: Left House LLC Austin: Why This Design-Forward Firm Keeps Popping Up

SPY is an index ETF. When you see the put to call ratio SPY data, you're seeing a lot of institutional "smart money" activity. This is different from the "equity-only" ratio, which reflects bets on individual stocks. If the equity ratio is low while the SPY ratio is high, it tells you that people are still bullish on their favorite stocks but are terrified of the "market" as a whole.

It’s a weird divergence.

Usually, you want to see both ratios confirm each other. If everyone is buying puts on everything, that’s a "puke phase" low. If they are only buying puts on SPY, it might just be a temporary hedge for a specific macro event, like a Fed meeting or a geopolitical flare-up.

Remember the 2022 bear market? We had multiple instances where the put-call ratio stayed elevated for months. If you had bought the first "spike" in the ratio, you would have been crushed. You need more than just one indicator. You need to see price action actually confirm the sentiment. As the old saying goes: "The market can stay irrational longer than you can stay solvent."

How to Actually Trade These Signals Without Getting Ripped

Stop looking at the absolute number. 1.0 doesn't mean the same thing today as it did five years ago.

Instead, look at the relative extremes. Is the ratio at a 52-week high? Is it higher than it was during the last three market pullbacks? That’s your context.

💡 You might also like: Joann Fabrics New Hartford: What Most People Get Wrong

I’ve found that using the put to call ratio SPY works best when paired with something like the RSI (Relative Strength Index) or a simple Bollinger Band on the SPY price chart. If SPY is hitting the bottom of its Bollinger Band and the put-call ratio is at a localized "extreme," the probability of a reversal is much higher than if you were just looking at the ratio in a vacuum.

Also, watch the "Call Side." Sometimes the ratio drops not because people stopped buying puts, but because they started FOMO-ing into calls. This is the "melt-up" scenario. When the ratio gets down to 0.5 or lower, the market is basically a tinderbox. Everyone is "all-in," and there's no one left to buy. That’s usually when a "nothing burger" news headline causes a 3% drop because there are no bids underneath.

Real-World Example: The "V-Bottom" Setup

Think back to some of the sharpest recoveries we've seen. Often, the put to call ratio SPY peaks before the price hits the absolute bottom.

Why? Because options are a leading indicator of sentiment.

By the time the price hits the final low, the smartest traders have already started covering their puts and buying calls. They’ve moved on to the next phase of the cycle while the "laggards" are still panic-buying protection at the worst possible prices. If you wait for the ratio to go back to "normal" before you buy, you’ve already missed the first 5% of the rally.

Misconceptions That Will Cost You Money

- "High P/C Ratio means the market MUST go up." No. It means sentiment is bearish. While that's often a contrarian buy signal, sentiment can stay bearish for a long time during a structural downtrend (think 2008 or 2000).

- "The ratio is manipulated." It’s not. It’s just data. However, market makers (the people who sell those options) have to hedge their own risk, which can create feedback loops that make the ratio look "fake."

- "It works the same for every stock." Absolutely not. Low-float tech stocks have wildly different options dynamics than a massive ETF like SPY.

The put to call ratio SPY is a tool, not a crystal ball. It’s a way to measure the "temperature" of the room. If the room is freezing (extreme fear), you might want to look for a coat. If it’s boiling (extreme greed), maybe it’s time to step outside.

Actionable Steps for Using Put-Call Data

If you want to incorporate this into your routine without losing your mind, keep it simple. Don't over-analyze every tick.

- Monitor the 10-day Moving Average (MA): Use a charting tool like TradingView or StockCharts to plot the $CPCE (Equity Put/Call Ratio) or $CPCI (Index Put/Call Ratio) with a 10-day MA. Look for levels above 0.8 for the equity ratio as a potential "buy zone" and levels below 0.5 as a "caution zone."

- Check for "Divergence": If the S&P 500 is making new lows but the put to call ratio SPY is making lower highs (meaning fewer people are buying puts despite the price drop), that is a classic bullish divergence. It suggests the selling pressure is drying up.

- Combine with Volatility: Watch the VIX alongside the ratio. If both are spiking to multi-month highs simultaneously, you are looking at a high-probability "capitulation" event.

- Ignore the "Noon Noise": Intraday spikes are often just institutional rebalancing or 0DTE madness. Use the closing data for a more reliable "signal."

- Look for the "Washout": The best signals come after a period of sustained selling where the ratio finally "moons" (spikes vertically). This usually indicates the last of the "weak hands" have finally panicked.

Trading is basically a game of figuring out what the majority is doing and then asking yourself if they are likely wrong. Most of the time, the majority is right during the middle of a trend but disastrously wrong at the turns. The put to call ratio SPY is your best window into exactly when those "turns" are most likely to happen. Just don't forget to check the actual price chart before you hit the "buy" button. Sentiment is a suggestion; price is the law.