Banking used to be a chore involving physical pens on chains and waiting for a teller named Linda to verify your signature. Now, it's just a slab of glass in your pocket. Honestly, most people downloading the app for capital one bank just want to check if their paycheck cleared or if that 2:00 AM taco run finally posted to their statement. But there is a lot more going on under the hood of this specific piece of software than just a balance checker.

It’s fast. That’s the first thing you notice.

While some legacy bank apps feel like they’re running on a dial-up connection from 1998, Capital One has spent a ridiculous amount of money making sure their interface doesn't lag. They’ve consistently ranked high in J.D. Power satisfaction studies for a reason. They aren't just a bank; they're basically a tech company that happens to lend money. If you've ever dealt with a clunky credit union app that crashes when you try to deposit a check, the fluid motion of the Capital One interface feels like a relief.

What the app for capital one bank does differently

Most banking apps are reactive. You go in, you look at what happened, you leave. Capital One tries to be a bit more proactive, which is a double-edged sword depending on how much you like your phone talking to you.

The biggest standout is Eno. Think of Eno as a digital watchdog that’s significantly smarter than your average chatbot. It tracks your spending patterns and actually alerts you if something looks wonky. Not just "hey, someone bought a laptop in Romania" wonky, but "hey, you tipped 200% at a restaurant by mistake" or "your Amazon Prime subscription just went up in price." It’s that level of granular detail that makes the app for capital one bank feel less like a ledger and more like an assistant.

Another weirdly useful feature is the virtual card numbers.

🔗 Read more: Gold Today Per Ounce: Why The Price Is Acting So Weird Right Now

If you're sketches out by a random website where you're buying a niche car part or a subscription you know you’ll forget to cancel, you can generate a unique card number right in the app. If the site gets hacked, your real credit card info is safe. It’s a layer of security that should be standard everywhere, but Capital One is one of the few big players that makes it easy to do on the fly.

Then there’s the CreditWise integration. Most banks give you a free FICO score once a month. This is different. It’s a full-on simulator. You can literally toggle sliders to see what would happen to your score if you paid off $5,000 in debt or if you applied for a new mortgage. It’s addictive in a "watching the numbers go up" kind of way, but it’s also genuinely educational for people trying to climb out of a credit hole.

The dark side of digital-first banking

It isn't all sunshine and seamless transfers.

The biggest gripe? If the app goes down, you are essentially locked out of your financial life if you don't carry physical cards. While Capital One does have "Cafés" (which are basically Blue Bottle Coffee shops that happen to have ATMs and bankers), they don't have the massive branch footprint of a Chase or a Bank of America. If the app for capital one bank has a server hiccup, you might find yourself unable to move money between your 360 Savings and your checking account right when you're at the register.

Also, the mobile check deposit can be finicky. It requires perfect lighting. If your check has a slight crease or the lighting in your kitchen is a bit yellow, the app might reject it three times before finally accepting the image. It’s a common industry problem, but for a "tech-forward" bank, you’d think they’d have solved the shadow-on-the-check issue by 2026.

Security stuff that actually matters

We have to talk about biometrics because nobody wants to type a 16-character password every time they want to see if they can afford dinner. The app handles FaceID and fingerprint sensors natively. But the real security is in the "Instant Purchase Notifications."

The millisecond your card is swiped, your phone buzzes.

This is arguably better than any fraud department. You are the fraud department. If you’re sitting on your couch and your phone says your card was just used at a gas station in Ohio, you can hit a single button in the app for capital one bank to "Lock" the card instantly. No calling a 1-800 number. No waiting on hold for twenty minutes listening to smooth jazz. You just kill the card's ability to spend money until you figure out what happened.

- Card Lock: One-tap disable for lost or stolen cards.

- Identity Alerts: Real-time monitoring of your SSN on the dark web.

- Travel Notices: You actually don't need to set these anymore; the app uses your location data (if you let it) to realize you're in London and not being defrauded.

Dealing with the "360" Ecosystem

Capital One 360 accounts are their bread and butter. They offer high-yield savings that actually compete with online-only banks like Ally or Marcus. The app makes managing these "buckets" of money pretty simple. You can create multiple savings accounts and nickname them things like "New Car Fund" or "Emergency Pizza Fund."

Moving money between them is a drag-and-drop affair.

The interest rates are visible right there on the home screen, which is a nice bit of transparency. Some banks hide your APY deep in a PDF statement you have to download. Here, it’s front and center. It’s a subtle psychological nudge to save more, seeing that percentage every time you log in.

Is the app for capital one bank accessible?

Accessibility is a huge deal that gets ignored. The app supports screen readers well, and the high-contrast modes are actually readable. They’ve clearly put effort into making sure that if you have visual impairments, you aren't locked out of your finances. The buttons are large enough for "fat-finger" errors, and the navigation doesn't require complex gestures.

Technical hiccups and "The Glitch" factor

No software is perfect. Sometimes the app will show a "restricted" status on an account for no apparent reason, usually during late-night maintenance windows on Sundays. If you're a night owl trying to do your bookkeeping at 3:00 AM, you might run into some "Service Unavailable" messages.

And let's talk about the Zelle integration.

Zelle is built into the app for capital one bank, which is great for paying back a friend for coffee. But Zelle is also a magnet for scammers. Capital One puts up a few warnings, but it’s still very easy to send money to the wrong person if you mistype a phone number. Once that money is gone, it’s basically gone. The app doesn't have a "cancel" button for Zelle once the recipient is notified, which is a stressful reality of modern instant-pay systems.

Real-world utility for travelers

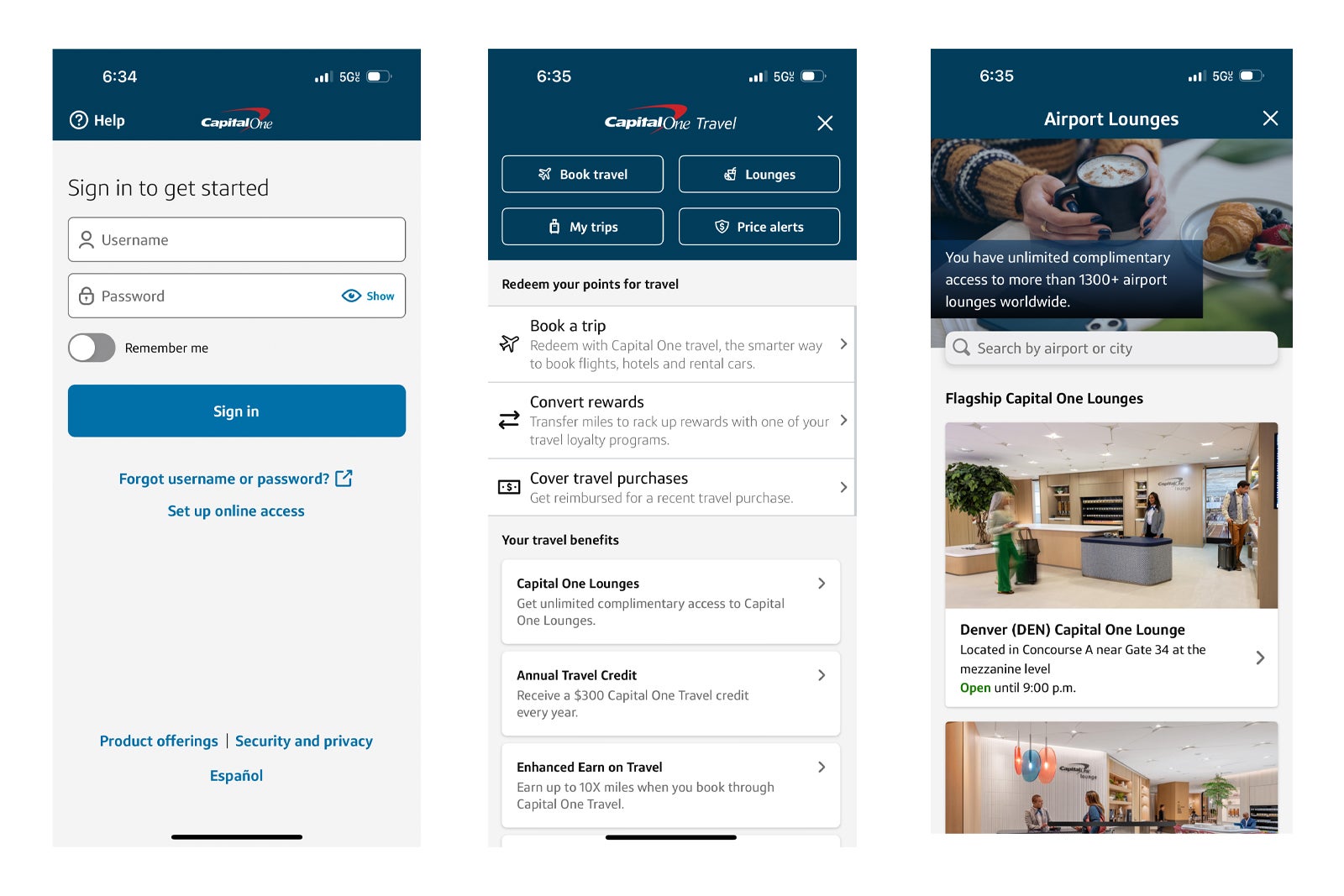

If you’re using one of the Venture cards, the app becomes a travel portal. You can book flights, hotels, and car rentals directly through the app using your miles. They use Hopper’s technology to predict whether flight prices will go up or down.

It’ll literally tell you: "Wait to buy, we think this flight to Tokyo will drop by $200 next week."

🔗 Read more: Chilean Peso to US Dollar: What Most People Get Wrong About the 2026 Rate

That’s a level of integration that feels genuinely helpful. Most bank travel portals are clunky web-wrappers that feel like they were designed in the early 2000s. This feels like a modern travel app. Plus, the ability to see your lounge access (like the Capital One Lounges in DFW or Dulles) and get a QR code for entry makes the airport experience slightly less miserable.

How to actually optimize your use of the app

If you're just using it to check your balance, you're missing out on the tools that actually save you money.

- Turn on the "Second Look" notifications. This is where Eno tells you if you’ve been double-charged. It happens more often than you think, especially at grocery stores or with digital subscriptions.

- Use the "Autosave" rules. You can set the app to pull $5 every time you spend money, or just $20 every payday. It’s the "set it and forget it" mentality that actually builds a cushion.

- Clean up your merchant list. The app shows you exactly which recurring subscriptions are hitting your card. If you see "Paramount+" and realize you haven't watched it in six months, you can use the info there to go cancel it.

- Download your statements as CSVs. If you’re a data nerd and want to run your own budget in Excel, the app lets you export data easily rather than forcing you to use their proprietary "Spending Analysis" tool.

The Verdict on the app for capital one bank

It’s one of the few banking apps that doesn't feel like a chore to use. It’s fast, the security features like virtual cards are legitimately useful, and it bridges the gap between a traditional bank and a fintech startup quite well.

You should probably spend ten minutes going through the "Profile" settings and turning off the marketing notifications while keeping the "Transaction" alerts on. That’s the sweet spot for a quiet phone and a secure bank account.

Actionable Next Steps

- Check your "Subscription" tab inside the app today. You’ll likely find at least one $9.99/month charge for something you forgot existed.

- Generate a virtual card number the next time you shop at a new online store to keep your primary card data off their servers.

- Set up a "Lock" shortcut. Get familiar with where that button is so if you lose your wallet at a bar, you can freeze the card before the person who found it buys a round of shots.

- Enable biometrics but ensure you have a "Legacy Contact" or a way for your family to access accounts in an emergency, as digital-only access can be a nightmare for estate planning.