Mid-cap stocks are kind of the "Goldilocks" of the investing world. They aren't the slow-moving blue-chip giants that barely budge, but they also aren't the tiny, fragile startups that could go bankrupt if the wind blows the wrong way. They're just right. Or at least, that's the theory. If you've been looking at the T. Rowe Price Mid-Cap Growth Fund (RPMGX), you're looking at a fund that has spent decades trying to prove that theory correct. It’s a massive fund, honestly. We’re talking about tens of billions of dollars under management, which is a lot of weight to throw around in the mid-cap space.

But here is the thing.

Size can be a double-edged sword. When a fund gets this big, it starts to look a lot like the index it's trying to beat. Brian Berghuis, the longtime manager who really built the reputation of T. Rowe Price Mid-Cap Growth, handed over the reins to Don Easley a few years back. Transitioning from a legendary manager is always a "hold your breath" moment for investors. So far, the strategy hasn't pivoted into some unrecognizable beast, but the market environment for growth stocks has become, well, let's call it "volatile" to be polite.

Why T. Rowe Price Mid-Cap Growth actually matters right now

Growth investing isn't just about picking companies that have a cool logo or a tech-heavy pitch deck. It's about finding companies that are growing their earnings faster than the rest of the market. For this specific fund, that usually means hunting in the $2 billion to $15 billion market cap range, though they’ll hold onto winners as they graduate into large-cap territory.

Why do people care? Because mid-caps historically outperform large-caps over very long horizons. But—and this is a big "but"—they come with more stomach-churning drops. The T. Rowe Price Mid-Cap Growth strategy tries to mitigate this by focusing on "durable" growth. They aren't usually chasing the hottest, profitless meme stock. They want companies with established business models that are just hitting their stride.

The "Berghuis Legacy" vs. Current Reality

For nearly 30 years, Brian Berghuis was the face of this fund. He had this uncanny ability to find companies like Microchip Technology or Amphenol and just ride them for years. It was a low-turnover approach. He wasn't trading like a day trader; he was acting like an owner.

When Don Easley took over as the sole pilot in 2021, the skeptics came out of the woodwork. It's natural. You've got a strategy that worked for decades, and then the guy who wrote the playbook leaves. However, Easley wasn't a random hire. He’d been with T. Rowe for ages and worked alongside Berghuis for years. The philosophy remains largely the same: look for high barriers to entry and strong free cash flow. If a company can't generate cash, it's probably not going to end up in this portfolio.

✨ Don't miss: Starting Pay for Target: What Most People Get Wrong

The valuation trap

Let's be real for a second. Growth stocks have been expensive. For a while, people stopped caring about price-to-earnings (P/E) ratios and started caring about "vibes." That ended poorly in 2022. T. Rowe Price Mid-Cap Growth took a hit then, just like everyone else in the growth space.

What's interesting is how they've navigated the recovery. They tend to lean into sectors like Information Technology and Health Care. You won't find much in the way of Utilities or Consumer Staples here. It’s a bet on innovation. If you think the "old economy" is going to dominate the next decade, this fund is absolutely not for you.

What's actually inside the portfolio?

You can't talk about this fund without looking at the concentration. Despite having a huge asset base, they don't just buy everything. They are selective. Some of their long-term holdings have included names like Hologic or Agilent Technologies. These aren't exactly household names like Apple or Amazon, but they are dominant in their specific niches.

- Technology: Usually the biggest slice of the pie. They look for software-as-a-service (SaaS) models because recurring revenue is the holy grail of growth investing.

- Health Care: Specifically medical devices and life sciences. These companies often have "moats" because switching costs for hospitals are incredibly high.

- Industrials: But not your grandpa's tractor company. Think high-tech aerospace or specialized electronics.

One nuance that many people miss is the "style drift." Because the fund is so big, it can be hard for them to buy enough shares of a $2 billion company to move the needle without owning 20% of the company (which creates all sorts of legal and liquidity headaches). As a result, the fund has naturally skewed toward the larger end of the mid-cap spectrum. Some critics argue it’s basically a "Large-Cap Growth Lite" fund at this point.

The Fee Situation (It's complicated)

Investment costs matter. A lot. T. Rowe Price Mid-Cap Growth usually carries an expense ratio around 0.70% to 0.80% for the Investor class (RPMGX). Is that cheap? No. You can buy a mid-cap growth ETF for 0.04%.

So, why pay the premium? You're paying for the research. T. Rowe Price has one of the biggest armies of analysts on Wall Street. They visit the factories, talk to the suppliers, and grill the CEOs. In the mid-cap space, where information isn't always as perfect as it is for the S&P 500, that "boots on the ground" research can actually find things the algorithms miss. Whether that research is worth 70 basis points a year is the $64,000 question.

🔗 Read more: Why the Old Spice Deodorant Advert Still Wins Over a Decade Later

Performance vs. The Benchmark

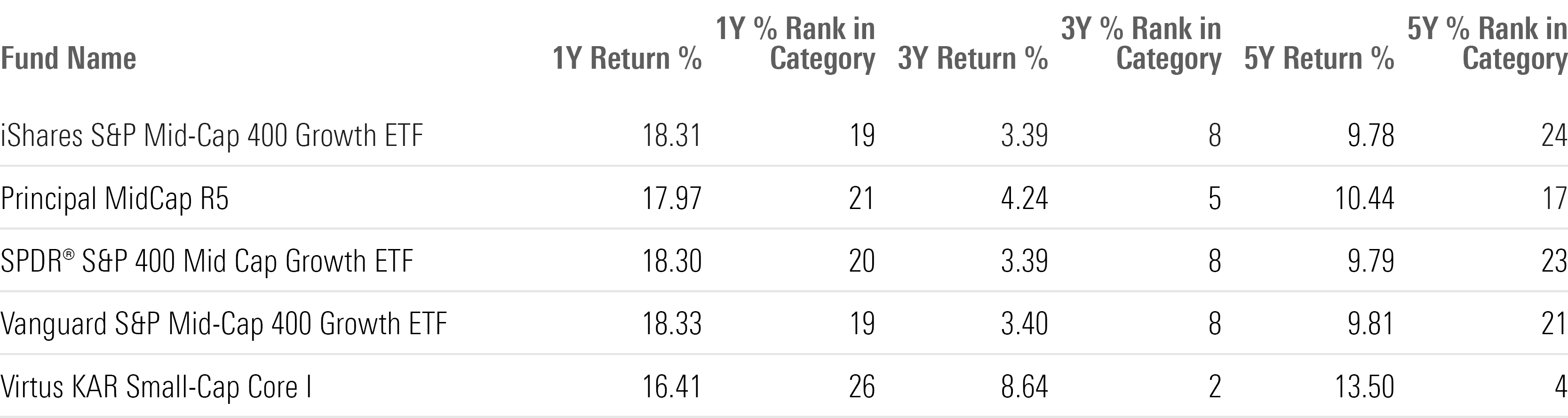

If you look at the 10-year or 15-year charts, the fund has historically outperformed the Russell Midcap Growth Index. That's the benchmark. But in shorter windows—like the last 3 to 5 years—it has been a fight. The rise of passive indexing has made it hard for active managers to keep up, especially when a few "mega-cap" tech stocks are doing all the heavy lifting for the broader market.

The fund's "alpha" (that extra return above the index) has been harder to come by lately. A lot of that is due to the macro environment. When interest rates rise, growth stocks get hit because their future earnings are worth less in today's dollars. It’s basic math, but it feels like a punch in the gut when your portfolio drops 20% in a year.

Is it right for your portfolio?

Honestly, it depends on what else you own. If your 401k is already 100% in an S&P 500 index fund, adding T. Rowe Price Mid-Cap Growth might actually give you some much-needed diversification. Why? Because the S&P 500 is incredibly top-heavy right now. It's dominated by five or six tech giants. This fund moves you down the market cap scale into the companies that are trying to become the next tech giants.

However, if you're nearing retirement and can't handle a 25% swing in your account balance over a few months, stay away. This is a long-term play. It's for the person who has at least a 5-to-10-year horizon. It’s for people who believe that active management—actually having a human being pick the stocks—still works.

Risks no one talks about

Everyone talks about market risk, but "capacity risk" is the real monster here. If too much money flows into the fund, the manager can't find enough good ideas to put that money to work. T. Rowe Price has closed this fund to new investors in the past to protect existing shareholders. That's actually a good sign. It shows they care more about performance than just vacuuming up fees. If it closes again, it's usually a signal that they think the mid-cap market is getting picked over.

Practical Steps for Interested Investors

If you're thinking about jumping in, don't just dump all your cash in on a Tuesday.

💡 You might also like: Palantir Alex Karp Stock Sale: Why the CEO is Actually Selling Now

First, check your current exposure. Use a tool like Morningstar’s "Instant X-Ray" to see if you already own these stocks through other funds. You might be surprised how much overlap there is.

Second, consider the "I-Class" shares if you have access through a workplace retirement plan. They are much cheaper because they don't have the marketing and distribution fees tacked on.

Third, look at the turnover rate. T. Rowe Price Mid-Cap Growth typically keeps turnover low, which is great for taxes if you hold this in a regular brokerage account. If a fund is constantly buying and selling, you get hit with capital gains distributions even if you didn't sell a single share.

Finally, watch the "active share" metric. This tells you how much the fund differs from its index. You want a reasonably high active share. If you're paying for active management, you don't want a "closet indexer" who just mimics the Russell 2000 and charges you ten times the price.

Investors should periodically review the fund's top ten holdings. If you start seeing names like Microsoft or Nvidia in there, it’s no longer a mid-cap fund. It’s a large-cap fund in disguise. As of now, they’ve stayed pretty true to their mandate, but in the world of finance, things change fast. Stay skeptical, stay diversified, and don't let a "five-star" rating from three years ago be your only reason for buying.