The days of snagging a $5 sundress without a second thought are getting a whole lot more complicated. If you've opened the Shein app lately, you might have noticed things look a little different—or rather, the prices do. People are asking one big question: is Shein affected by tariffs, or is this just corporate greed?

Honestly, the answer is a massive "yes," but the way it’s happening is way more technical than just a simple tax. It’s a total overhaul of how stuff enters the United States.

The Death of the $800 Loophole

For years, Shein (and its rival Temu) basically had a cheat code for the U.S. market. It was called the de minimis exemption. Basically, any package worth less than $800 could slide into the country duty-free. No taxes, no heavy paperwork, no nothing.

That changed.

Starting in early 2025, the U.S. government effectively killed that loophole for Chinese imports. President Trump signed an executive order that hit Shein’s business model right where it hurts. By May 2025, the de minimis exemption for China and Hong Kong was gone.

Now, every single little package—even that one $3 set of hair clips—is subject to scrutiny and, more importantly, tariffs ranging from 10% to 50%. In some specific categories like beauty and personal care, the hit is even more brutal. Some shipments were slammed with a **$200 flat fee** or a 120% tariff depending on the entry point.

Why Your Cart Is Getting Expensive

You’ve probably seen the warnings on the site. Shein actually sent out letters to customers in April 2025 admitting that "operating expenses have gone up." That's code for "we can't eat these taxes anymore."

Data from Bloomberg showed that some items on Shein’s U.S. site spiked by as much as 377% overnight. A pack of dishcloths that used to be $1.28 suddenly cost over $6. It’s not just a few cents; it’s a fundamental shift.

- Women’s Clothing: Averaging about an 8% increase.

- Beauty Products: Rising by an average of 51%.

- Home & Kitchen: Up roughly 30%.

These aren't random numbers. They reflect the literal cost of the new tariffs being passed directly to you, the shopper.

The Supreme Court Showdown of 2026

Here is where it gets kinda wild. As of right now, in early 2026, the legality of these tariffs is actually sitting in front of the Supreme Court.

The argument? Critics say the executive branch might have overstepped its constitutional authority by unilaterally ending the de minimis rule. If the court rules against the administration later this year, we could see a massive wave of refunds for consumers who paid these taxes. But for now, you’re paying the "tariffed" price at checkout.

💡 You might also like: Why I Do It For You Is Changing How We Think About Delegation

Is Shein Leaving China?

Shein isn't just sitting there taking the hit. They are currently scrambling to move production out of China to avoid these specific "China-only" tariffs.

Factory owners in the "Shein villages" of Panyu, Guangzhou, are reportedly seeing orders drop by half. Why? Because Shein is moving that work to Vietnam, Cambodia, and Brazil. If a shirt is made in Vietnam and shipped to the U.S., it might still qualify for some exemptions—at least until the trade rules change again.

They are also trying a "local fulfillment model." You’ll start seeing more items labeled as "shipped from U.S. warehouse." By bringing goods in by the boatload (and paying the bulk tariffs upfront), they can sometimes keep the individual price lower than if they mailed it to you directly from an overseas factory.

What This Actually Means for You

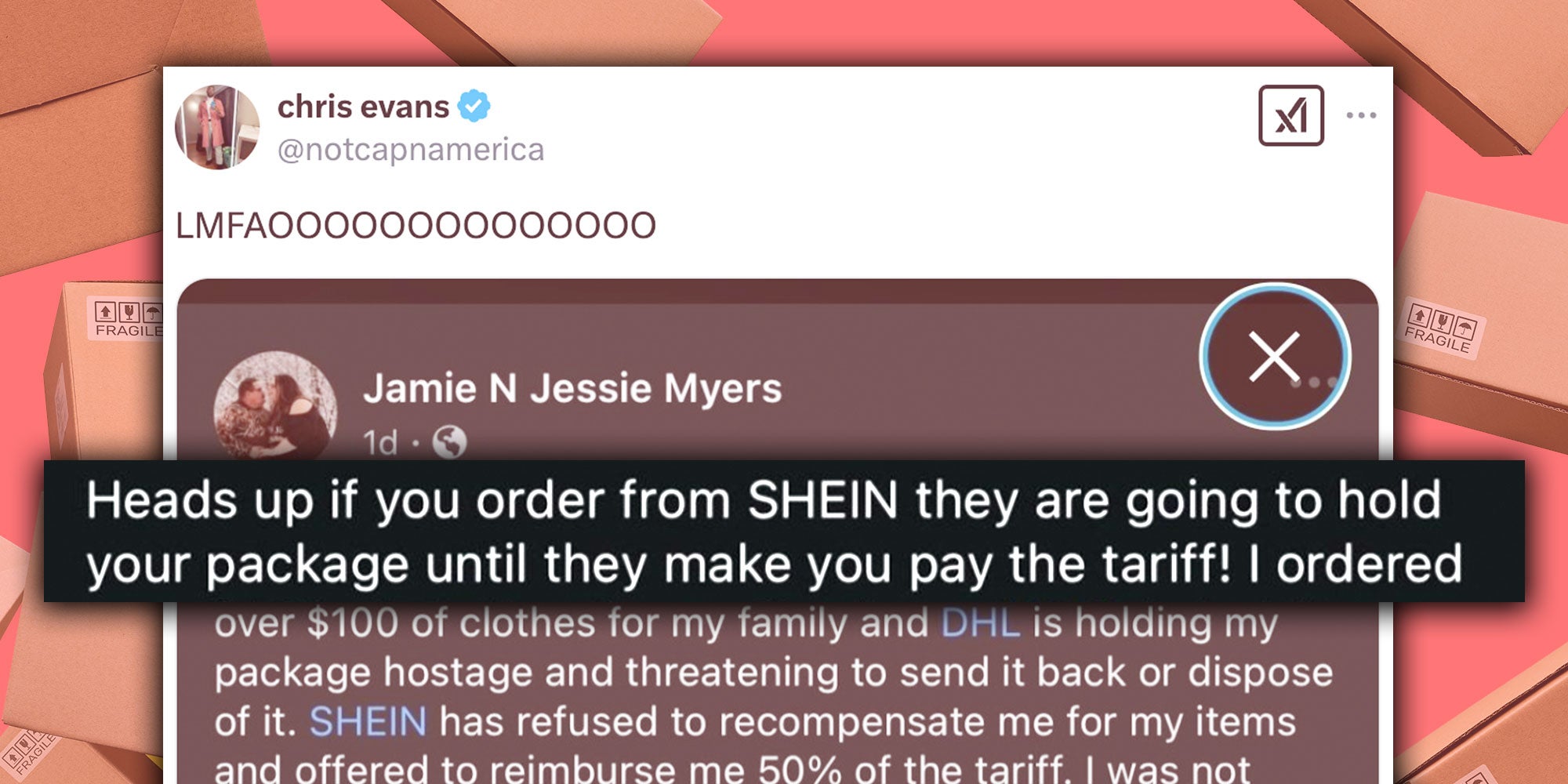

If you’re a regular shopper, the "golden era" of ultra-cheap fast fashion is effectively over. The prices are higher, and shipping is slower. Customs officials are now checking millions of individual parcels that they used to just wave through. This causes massive backlogs at ports and postal hubs.

Actionable Insights for Shoppers:

- Check the Shipping Origin: Items shipping from "Local" or "U.S. Warehouse" usually have the tariff already baked into the price, meaning no surprise fees later.

- Watch the "Flat Fees": Be careful with beauty and personal care items; these are currently the most heavily taxed categories under the new 2026 rules.

- Keep Your Receipts: If the Supreme Court strikes down the tariff authority mid-2026, there might be a mechanism to claim a refund on the duties you've paid.

- Consolidate Orders: While the $800 limit is gone, shipping one large package is often cheaper for the retailer than ten small ones, which might help you qualify for "free shipping" offsets.

The reality is that Shein is no longer the "untouchable" giant of cheap retail. They are now playing by the same expensive rules as everyone else, and your wallet is the one feeling the friction.

Next Steps for Staying Ahead:

To navigate these changes, you should regularly check the "Tax & Duty" section of the Shein checkout page, as rates are currently fluctuating based on the ongoing trade negotiations. Additionally, consider looking for "QuickShip" items already located in domestic warehouses to avoid the potential for carrier-collected duties at your doorstep.