You've seen the charts. Everyone has. For the last few years, Nvidia has felt less like a stock and more like a force of nature. It’s the engine room of the entire artificial intelligence era, and its ticker symbol, NVDA, has become shorthand for "generational wealth." But now that the dust of the initial AI explosion has settled, the question keeps coming back: is NVDA a buy right now, or are you just chasing a ghost?

Honestly, the answer isn't as simple as a "yes" or "no." It depends on whether you're looking at the hardware, the software moat, or the massive geopolitical chess game happening in the background.

We aren't in 2023 anymore. The days of buying just because "AI is cool" are over. Today, you have to look at the Blackwell architecture, the rise of sovereign AI, and the very real threat of "chip indigestion" among the big hyperscalers. If you're looking for a quick pump, you might be disappointed. But if you’re looking at the long-term plumbing of the global economy, the story gets a lot more interesting.

The Blackwell bottleneck and why it matters

Everyone talks about the H100s, but the real story right now is the Blackwell B200 and the GB200 NVL72 systems. These aren't just chips; they are essentially supercomputers in a rack. Nvidia CEO Jensen Huang has called the demand "insane," and for once, that's not just CEO hyperbole.

The complexity of these new systems is staggering. We're talking about liquid-cooled racks that consume massive amounts of power. This creates a weird dynamic for the stock. Even if demand is infinite, supply is constrained by the physical limits of packaging—specifically TSMC’s CoWoS (Chip on Wafer on Substrate) capacity. When you ask is NVDA a buy, you’re really asking if TSMC can keep up with Jensen's vision.

There's also the "air pocket" theory. Some analysts, like those at New Street Research, have occasionally voiced concerns about a lull in orders as customers wait for the next big thing. But so far, the big spenders—Microsoft, Meta, and Alphabet—haven't blinked. They're terrified of being left behind. In their world, overspending on AI infrastructure is a manageable mistake, but underspending is an existential threat.

The software moat nobody talks about

Nvidia isn't just a hardware company. It’s a software company that happens to sell silicon. This is the "CUDA" advantage.

CUDA is the software layer that developers use to talk to Nvidia GPUs. It has been around for nearly two decades. Every AI researcher, every data scientist, and every coder at OpenAI or Anthropic grew up on CUDA. Trying to switch to a competitor like AMD’s ROCm or Intel’s Gaudi is like trying to rewrite the entire internet in a new language overnight. It’s possible, but it’s a massive pain in the neck.

This creates a "lock-in" effect that is incredibly hard to break. When a company buys $10 billion worth of Nvidia chips, they aren't just buying the plastic and metal. They are buying into an ecosystem where everything already works. That software moat is a huge reason why the margins remain so high. Most hardware companies see their margins shrink as competition arrives. Nvidia has somehow managed to keep theirs north of 70%. That’s unheard of in manufacturing.

Is the valuation actually insane?

Critics love to point at the P/E ratio. They'll tell you it's a bubble. They'll compare it to Cisco in 2000.

But there’s a massive difference.

Cisco was trading at over 100 times earnings back then while the internet was still mostly dial-up and banner ads. Nvidia, despite its massive price run, has often seen its forward P/E ratio drop even as the stock price goes up. Why? Because the earnings are growing faster than the stock.

In the most recent quarters, Nvidia’s data center revenue hasn't just grown; it has exploded. We’re talking triple-digit year-over-year growth. If a company earns $1 one year and $5 the next, the stock price should naturally follow. The "bubble" argument falls apart when you look at the actual cash flowing into the bank account.

However, there is a catch.

✨ Don't miss: Why Unique Giveaways at Trade Shows Still Matter in a Digital World

The concentration of revenue is a real risk. A handful of companies (the "Magnificent Seven") account for a huge chunk of Nvidia’s sales. If Mark Zuckerberg or Satya Nadella decides to hit the brakes on capital expenditures, Nvidia’s stock will feel it instantly. You have to ask yourself: how long can these tech giants keep spending $40 billion a year on data centers before their own shareholders demand a return on that investment?

The "Sovereign AI" wild card

While everyone is focused on Silicon Valley, Jensen Huang is looking at France, Japan, and the UAE. This is what he calls "Sovereign AI."

Countries have realized that data is the new oil. They don't want to send their national data to a cloud server in Virginia or Dublin to be processed. They want their own AI infrastructure on their own soil. This creates a whole new category of buyers that didn't exist three years ago. When a nation-state decides it needs a supercomputer for national security or economic planning, they don't look for the cheapest option. They look for the best.

This sovereign demand acts as a buffer. If Big Tech slows down, Big Government might just pick up the slack. It's a diversifier that most people haven't fully baked into their "is NVDA a buy" thesis yet.

The risks that should keep you up at night

It’s not all sunshine and 400% gains. There are three big things that could wreck the party.

- China: The U.S. government is constantly tightening export controls. Nvidia has had to "neuter" its chips (like the H20) to meet these regulations. China represents a massive chunk of the global market. If the door slams shut entirely, that’s a multi-billion dollar hole in the balance sheet.

- Internal Competition: Google, Amazon, and Microsoft are all building their own AI chips (TPUs, Trainium, Maia). They want to reduce their dependence on Nvidia. While these chips aren't as versatile as Nvidia’s, they are "good enough" for specific tasks.

- Power Constraints: We are running out of electricity. AI chips are power-hungry. If utilities can’t bring enough power to the grid to support new data centers, it doesn't matter how many chips Nvidia can build—there will be nowhere to plug them in.

Technicals and market sentiment

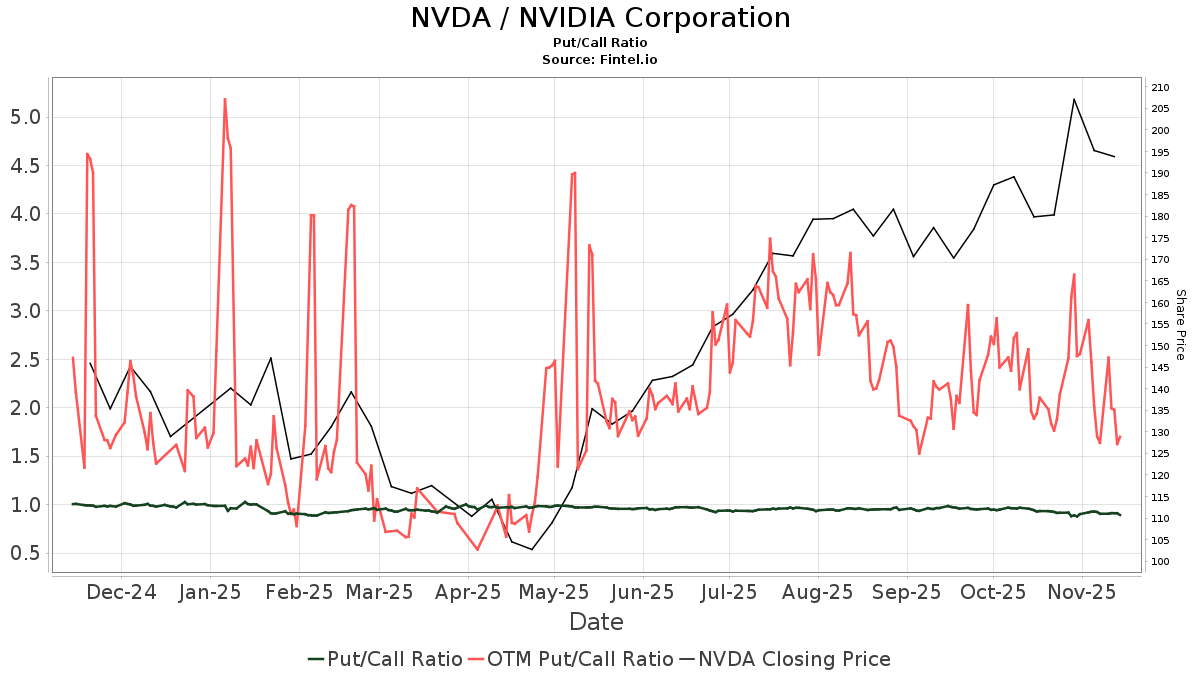

If you're a swing trader, the "is NVDA a buy" question is all about the 50-day moving average. The stock tends to be volatile. It can drop 10% in a week for no apparent reason, usually because of some macro fear or a random comment from a Fed official.

But for the long-term holder? The volatility is just noise.

Think about it this way: are we going to use less AI in five years? Probably not. Is there any company currently positioned to take the crown from Nvidia? Not yet. AMD is trying hard with the MI300X, and while it's a great chip, it doesn't have the software ecosystem to back it up.

Final verdict on the strategy

If you’re wondering is NVDA a buy, don’t think about it as a single "all-in" moment. The smartest way to play a stock this volatile is usually dollar-cost averaging.

The company is the undisputed king of the most important technology shift since the industrial revolution. They own the hardware, the software, and the developer's mindshare. But the "easy money" has definitely been made. From here, it's going to be a battle of execution and scaling.

Watch the quarterly "Data Center" revenue like a hawk. That is the only number that truly matters. As long as that number is growing, the bears are going to have a very hard time proving their case.

Actionable next steps for your portfolio

Don't just buy the hype. Do this instead:

- Check your concentration: If Nvidia already makes up 20% of your portfolio because of the recent gains, you might want to rebalance rather than buy more.

- Look at the "pick and shovel" plays: If Nvidia is too expensive for you, look at the companies that help them build. This means firms like Vertiv (cooling), ARM (architecture), or even the power utility companies that are fueling the data centers.

- Set a "stop-loss" in your mind: Decide now what price would make you lose faith in the story. If it drops 20%, is it a buying opportunity or a signal that the cycle is over? Having a plan before the volatility hits is what separates the pros from the amateurs.

- Monitor the big spenders: Keep an eye on the earnings calls of Microsoft and Meta. If they start talking about "optimizing" or "reducing" their AI spend, that is your cue to be cautious with NVDA.

Nvidia isn't a "set it and forget it" stock. It’s a high-performance machine that requires constant monitoring. It remains the best-in-class play for the AI era, but it’s no longer a secret. You're buying at the top of the world—just make sure you're comfortable with the view.